It is possible to complete how to utah ifta without difficulty by using our PDFinity® PDF editor. The editor is consistently upgraded by our staff, acquiring new awesome features and growing to be better. It merely requires a few basic steps:

Step 1: Click the "Get Form" button above on this page to open our PDF tool.

Step 2: The editor provides you with the capability to work with the majority of PDF files in a variety of ways. Modify it by writing personalized text, adjust what is already in the document, and put in a signature - all at your fingertips!

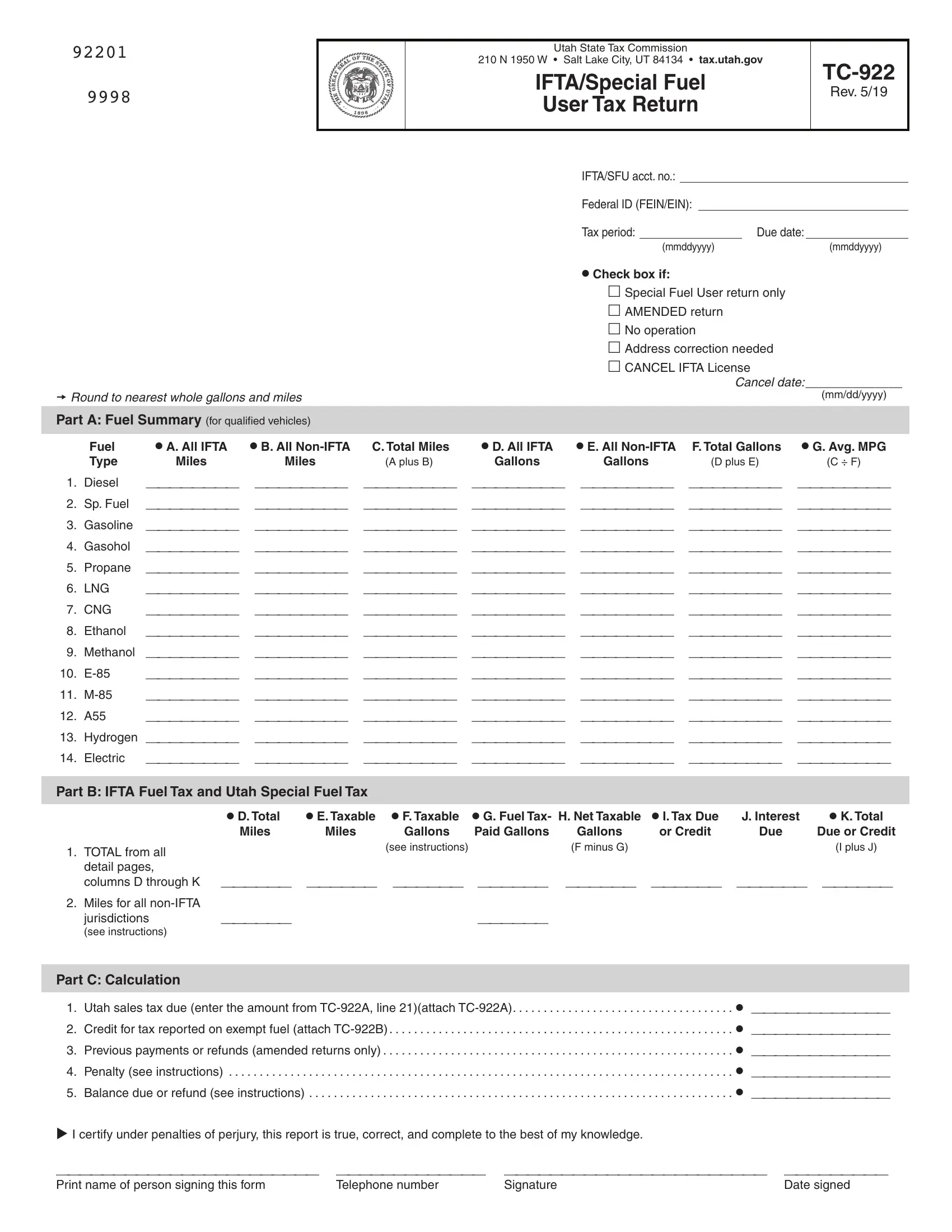

As for the blank fields of this particular form, here's what you should do:

1. To begin with, when filling out the how to utah ifta, begin with the page that features the following blanks:

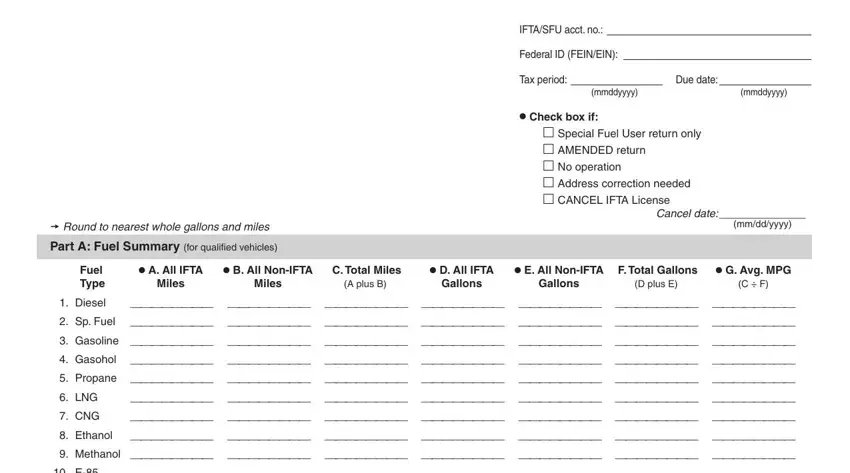

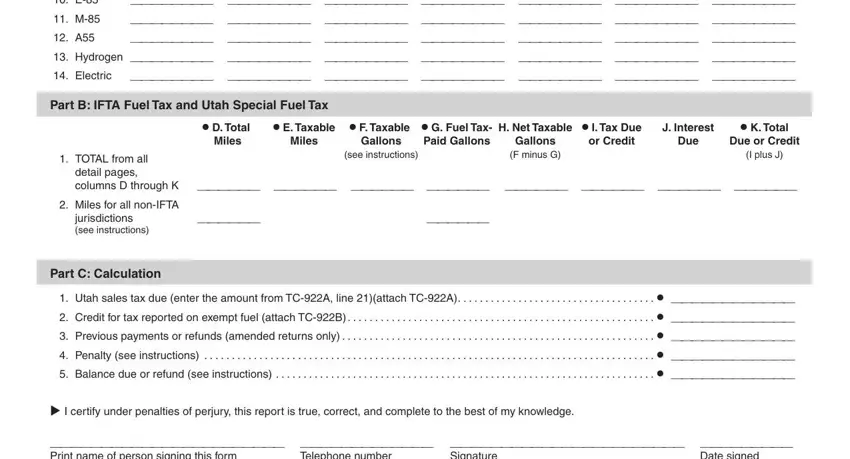

2. When the previous segment is finished, you're ready add the essential particulars in Hydrogen, Electric, Part B IFTA Fuel Tax and Utah, cid D Total, Miles, cid E Taxable cid F Taxable cid G, Paid Gallons, Gallons, Miles, see instructions, Gallons F minus G, J Interest, Due, cid K Total, and Due or Credit in order to progress to the third part.

It is easy to make a mistake when filling in your Gallons, so make sure that you reread it prior to when you send it in.

Step 3: Proofread all the information you've typed into the blanks and press the "Done" button. Go for a free trial plan with us and obtain immediate access to how to utah ifta - download, email, or change from your FormsPal cabinet. FormsPal guarantees risk-free document editor devoid of personal information recording or any sort of sharing. Feel at ease knowing that your details are safe with us!