Should you would like to fill out utah tc 675rs, you won't need to download and install any kind of applications - just try using our PDF tool. FormsPal team is constantly working to develop the tool and make it much faster for users with its cutting-edge functions. Bring your experience one step further with continuously improving and fantastic possibilities we provide! With a few easy steps, you can begin your PDF editing:

Step 1: First, open the tool by clicking the "Get Form Button" above on this page.

Step 2: The tool enables you to modify your PDF document in a range of ways. Change it with personalized text, adjust original content, and put in a signature - all when it's needed!

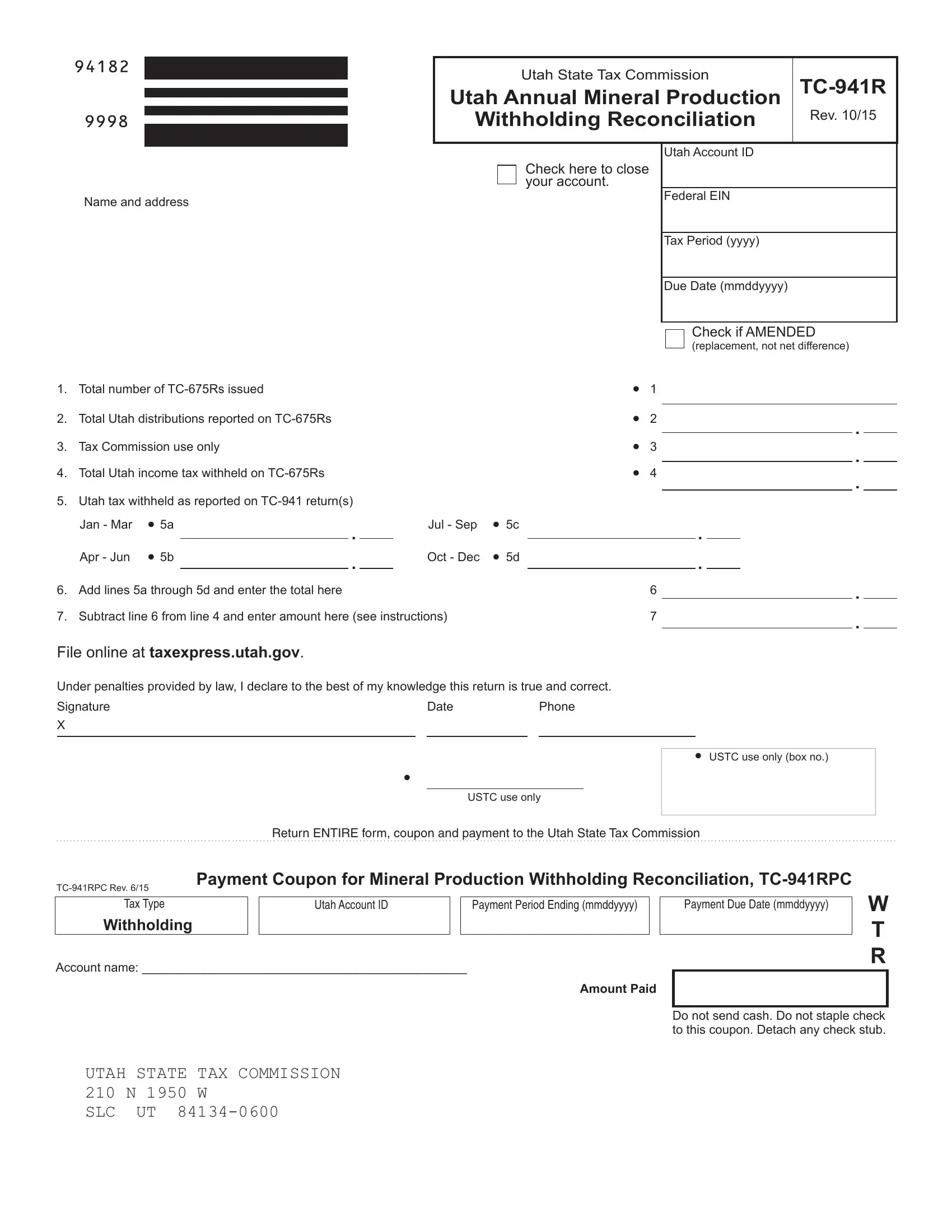

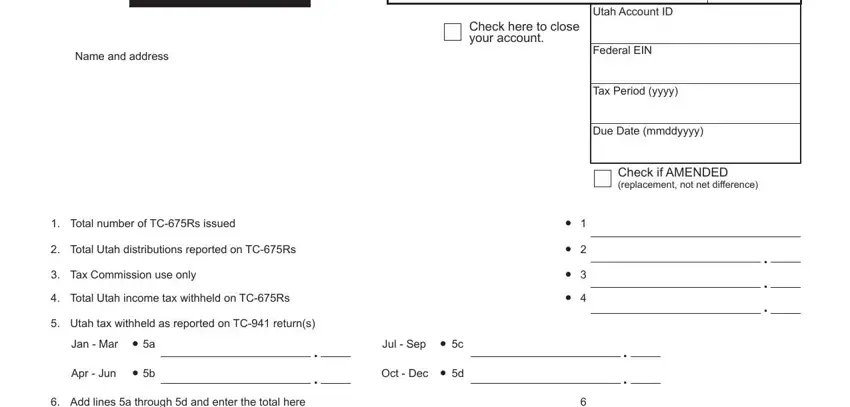

Filling out this form requires attentiveness. Make sure that all required blank fields are completed accurately.

1. Fill out the utah tc 675rs with a selection of essential fields. Get all of the necessary information and make sure nothing is overlooked!

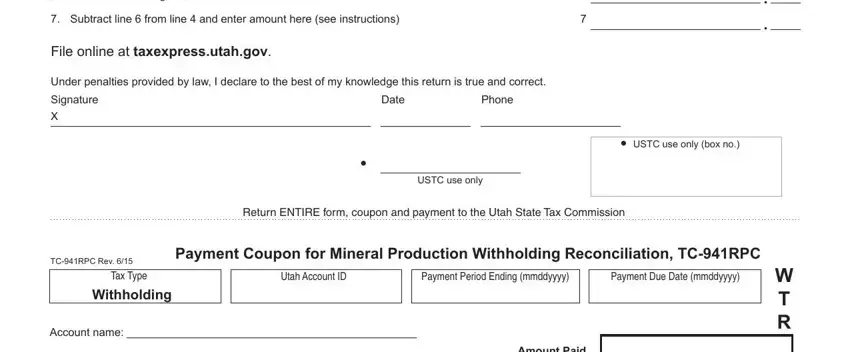

2. After the previous section is done, it's time to put in the required particulars in Add lines a through d and enter, Subtract line from line and, File online at taxexpressutahgov, Under penalties provided by law I, Signature, Date, Phone, cid, USTC use only, cid USTC use only box no, Return ENTIRE form coupon and, TCRPC Rev, Tax Type, Withholding, and Payment Coupon for Mineral so you're able to progress further.

Be very careful when filling out Signature and Withholding, since this is the part where many people make mistakes.

Step 3: Be certain that your information is accurate and click on "Done" to conclude the process. Create a free trial option with us and get direct access to utah tc 675rs - accessible in your FormsPal account. FormsPal guarantees safe document editor with no data recording or any type of sharing. Feel at ease knowing that your data is secure here!