Are you having difficulty understanding the Tc 95-1 form? Whether it's for your tax filing or other business affairs, accurate completion of this governmental form is essential. In this blog post, we will break down all the components of the Tc 95-1 to help demystify its use and make it more accessible for everyone. Get ready to learn about what document types require a Tc95-1, when usage is compulsory and how to fill out the form correctly in order ensure compliance with all applicable regulations.

| Question | Answer |

|---|---|

| Form Name | Tc 95 1 Form |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | kentucky transportation application, kentucky ky application, kentucky ky 1, kentucky trucking get |

|

|

|

|

|

|

|

|

|

|

|

|

|

TC |

|

|

|

|

|

|

|

|

|

|

|

|

KENTUCKY TRANSPORTATION CABINET |

Rev. 09/2021 |

|

|

|

|

|

|

|

|

|

|

|

|

Department of Vehicle Regulation |

Page 1 of 6 |

|

|

|

|

|

|

|

|

|

|

|

|

DIVISION OF MOTOR CARRIERS |

|

|

|

|

|

|

|

|

|

|

|

|

KENTUCKY TRUCKING APPLICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office Use Only |

|

|

|

|

Mail To: |

Overnight Deliveries: |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

KYU: |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|||||||

|

KIT: |

|

|

|

|

|

Kentucky Transportation Cabinet |

Kentucky Transportation Cabinet |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Division of Motor Carriers |

Division of Motor Carriers |

|

IFTA: |

|

|

|

|

|

|

PO Box 2007 |

200 Mero Street, 2nd floor |

||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

KY Intra |

|

|

|

|

Frankfort, KY |

Frankfort, KY 40622 |

||||||

|

KYTC#:_ |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

http://drive.ky.gov/ |

|||||

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructions: (Read instructions and use the checklist below before submitting an application.)

Type or print legibly and read all information carefully. NOTE: Original Application Accepted by Mail Only Please ensure that all federal and state licenses and/or credentials are active before submitting an application.

Data requested below must match the (FMCSA) Federal Motor Carrier Safety Administration’s data or the application will be returned. Incomplete applications or applications with required fields left blank will be sent back with an explanation letter.

Please allow

Carrier Checklist: (Check the box next to the credential(s) you are requesting.)

KYU (Kentucky Highway Use Tax) license (Complete sections 1, 2, 3, and 8 (NO FEES REQUIRED; all qualified carriers may apply)

IFTA (International Fuel Tax Agreement) (Complete sections 1, 2, 4, 6, and 8 (NO FEES REQUIRED; KY Interstate based carriers only) KIT (Kentucky Intra Fuel Tax) license (Complete sections 1, 2, 5, 6, and 8 (NO FEES REQUIRED; KY Intrastate carriers only) Kentucky Intrastate

Section 1: Carrier Information and Identification Numbers

USDOT Number: |

Tax Identification Number: |

|

||

(Visit FMCSA https://www.fmcsa.dot.gov/ for USDOT#.) |

(Provide FEIN (It must match FMCSA USDOT record.) |

|||

|

|

|

|

|

MC Number: |

²KYTC Number: |

|

||

(Visit FMCSA https://www.fmcsa.dot.gov/ for MC #.) |

(Visit Motor Carrier Portal to obtain for your KYTC number.) |

|||

|

|

|

|

|

Legal Name: |

|

|

|

|

|

|

|

|

|

DBA Name: |

|

|

|

|

(DBA must also be listed with FMCSA on your USDOT) |

|

|

|

|

Physical Address: |

|

|

|

|

|

|

|

|

|

City: |

|

|

State: |

ZIP Code: |

|

|

|

|

|

|

|

|

|

|

Is mailing address the Carrier’s or Third Party Provider? |

Company |

|

Third Party Provider |

|

|

|

|

|

|

Mailing Address: |

|

|

|

|

|

|

|

|

|

City: |

|

|

State: |

ZIP Code: |

|

|

|

|

|

Phone Number: |

|

|

FAX: |

|

(required) |

|

|

|

|

|

|

|

|

|

Contact Person: |

|

Email: |

|

|

(required) |

|

(required) |

|

|

|

|

|

|

|

|

TC |

KENTUCKY TRANSPORTATION CABINET |

09/2021 |

Department of Vehicle Regulation |

|

DIVISION OF MOTOR CARRIERS |

Page 2 of 6 |

|

|

|

|

KENTUCKY TRUCKING APPLICATION |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 2: Business Information |

|

|

|

|

|

Business Type (Check one) |

|

|

|

|

|

Individual |

¹Partnership |

¹Corporation or LLC |

||

(If business type is a Partnership, Corporation, or LLC, list the names and titles of corporate owners, partners, and officers for the company in the space provided below.)

Example: John Doe / |

President |

|

|

|

|

|

|

|||

1. |

|

|

/ |

2. |

|

/ |

||||

|

|

|

|

|

|

|

|

|

|

|

3. |

|

/ |

4. |

/ |

||||||

5. |

|

|

|

/ |

|

|

6. |

|

/ |

|

¹Kentucky- based Partnerships, Corporations, LLC’s, and Companies must be listed with the Kentucky Secretary of State. Register at http://www.sos.ky.gov/Pages/default.aspx

Operation Classification: (Check the one that matches your FMCSA USDOT data)

Private (Hauling your own goods)

²Leased (Leased to another carrier, KYTC Number Required to apply visit: Motor Carrier Portal.)

²If leased, provide the USDOT and/or the Motor Carrier Authority number you are leasing onto below.

USDOT Number:

MC Number:

•Federal Motor Carrier Safety Administration (FMCSA) requires all entities to have an active USDOT number for vehicles with a combined licensed weight of 10,001 lbs. or greater or vehicles used to transport hazardous materials.

•USDOT numbers are required to be updated every two years even if the company information has not changed and must be in good standing before applying for credentials with Kentucky.

•Interstate motor carriers that transport commodities

•Interstate motor carriers that transport commodities private and

•To receive all future important correspondence, make sure all contact information (mailing address, email, contact phone number, etc.) are updated on both federal and state levels.

•Visit drive.ky.gov to access the Motor Carrier Portal to view credential information, including statuses, with the KentuckyTransportation Cabinet.

|

TC |

KENTUCKY TRANSPORTATION CABINET |

09/2021 |

Department of Vehicle Regulation |

|

DIVISION OF MOTOR CARRIERS |

Page 3 of 6 |

|

KENTUCKY TRUCKING APPLICATION

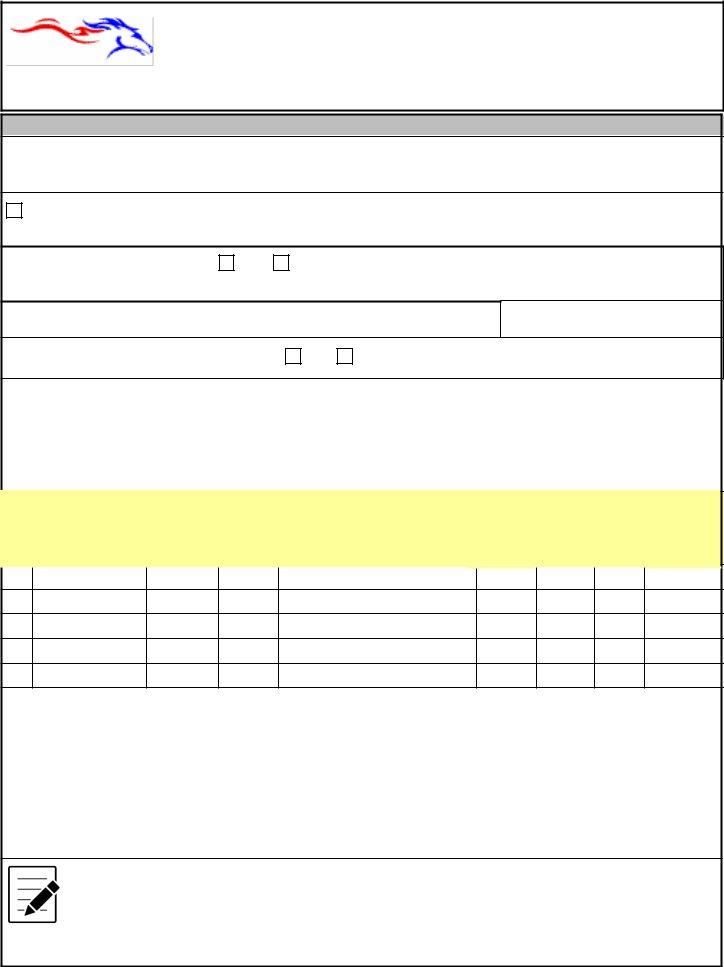

Section 3: Kentucky Highway Use Tax (KYU)

Instructions: This section is for all carriers regardless of base state. (No fees are required to apply for KYU.) To apply for a KYU number immediately, visit https://drive.ky.gov to register using the Motor Carrier Portal.

KYU License – Carriers operating in Kentucky with vehicles that have a combined licensed weight³ over 59,999 lbs. are subject to the weight distance tax.

Have you ever had a KYU license? |

No |

Yes |

(If yes, you are required to provide the name and number you operated under in the boxes below.)

Name:

KYU Number:

Was the license cancelled in good standing?

No

Yes

⁴VIN information must be entered below in order to process your request for a KYU license. Applications without VIN information will be returned. Do not declare weights in excess of 80,000 pounds or less than 60,000

pounds.

Motor Carriers will add up to 5 vehicle VIN numbers. The Motor Carrier Portal will allow you to add additional VIN numbers after the KYU number has been assigned Visit https://drive ky gov to add additional vehicle

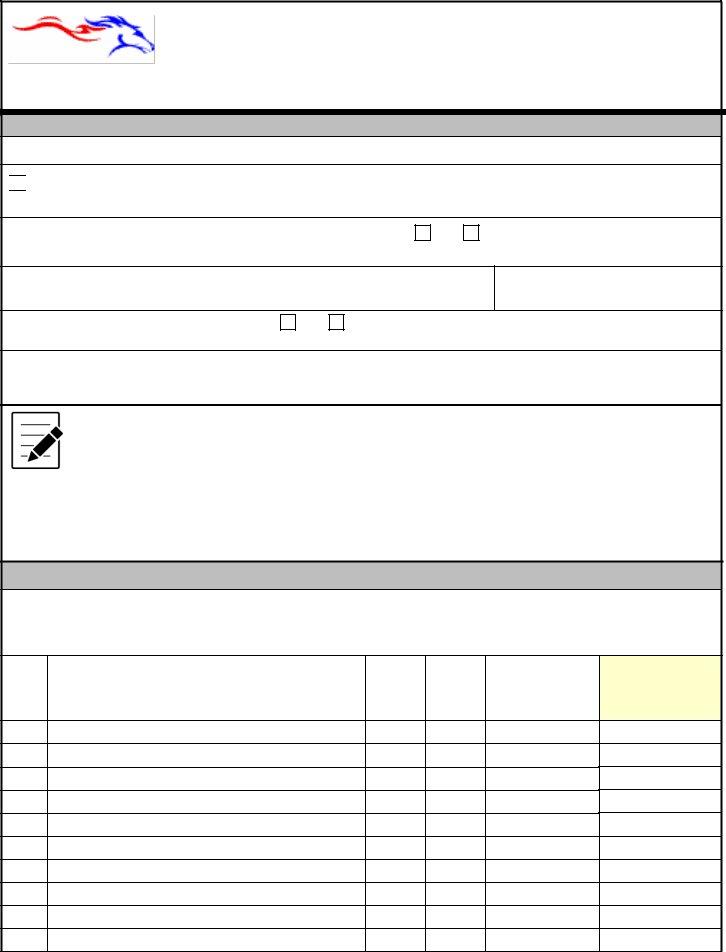

|

|

|

|

|

|

|

³Combine |

|

|

|

|

|

Model |

|

Licensed |

Title Number |

State |

|

VehicleIdentification Number |

Unit# |

|

Weight |

|

|

|

Year |

Make |

||||

|

(Last 6 |

(See |

|||||

|

Registered |

Plate # |

|

||||

|

(Full |

|

(4 digits) |

(4 chars) |

|||

|

digits) |

below) |

|||||

|

|

|

|

||||

1. |

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

³Per KRS 138.655, the Combined Licensed Weight shall mean the greater of:

a)The declared combined maximum gross weight of the vehicle and any towed unit for registration purposes for the current registration period; or

b)The highest actual combined gross weight of the vehicle and any towed unit when operated on the public highways of the state during the current registration period.

4Per 601 KAR 1:200 Section 4 (7)(a)1, a KYU licensee shall register each vehicle subject to the tax imposed by KRS 138.660(3) with the Transportation Cabinet.

•The KYU license number requires filing quarterly tax returns regardless of travel for all qualified motor vehicles. Tax returns not filed and paid or filed late will be subject to penalties per KRS.

|

TC |

KENTUCKY TRANSPORTATION CABINET |

09/2021 |

Department of Vehicle Regulation |

|

DIVISION OF MOTOR CARRIERS |

Page 4 of 6 |

|

KENTUCKY TRUCKING APPLICATION

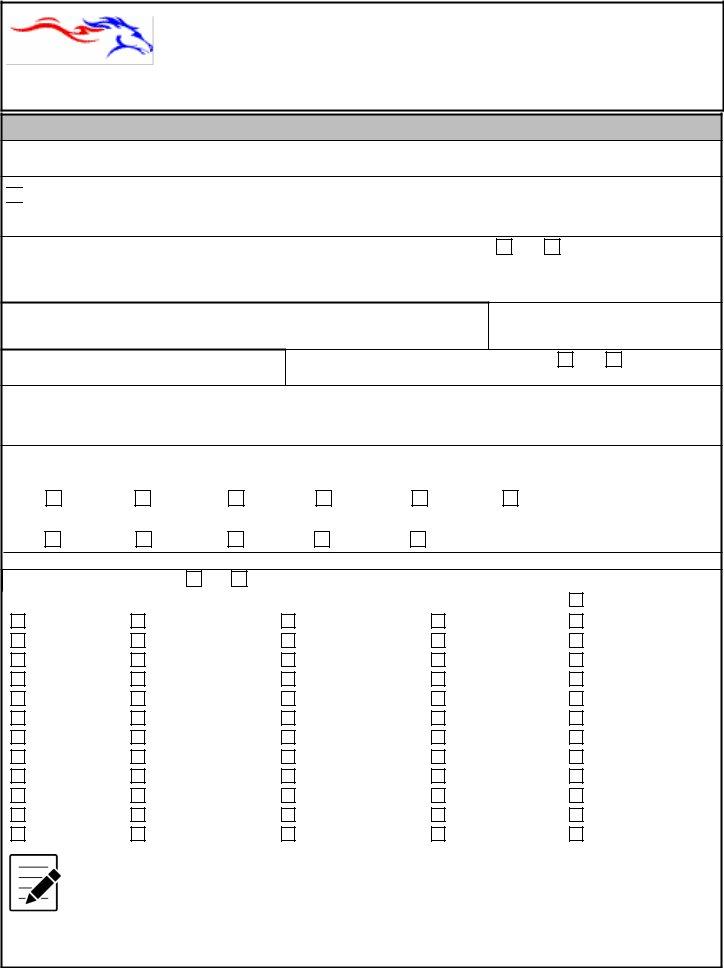

Section 4: International Fuel Tax Agreement (IFTA)

Instructions: This section is for

IFTA License – Carriers that cross state lines with vehicles that have a combined licensed weight³ of 26,001 lbs. or greater or with power units that have 3 or more axles, regardless of weight, are subject to IFTA.

Have you ever had an IFTA license issued to you in another name or jurisdiction? |

No |

(If yes, you are required to provide the name, number, and jurisdiction you operated under.)

Yes

Name:

Jurisdiction:

IFTA License Number:

Was the license cancelled in good standing? |

No |

Yes |

Number of decal sets requested:

(One (1) set of decals per vehicle and one IFTA license will be issued after the application is processed.)

Check box below for the fuel type(s) consumed by your

Diesel

Gasoline

Ethanol

LPG

LNG

CNG

E85

A55

Biodiesel

Gasohol

Methanol

Do you store bulk fuel? Yes

No

If Yes, click or mark the box for the jurisdiction(s) where bulk fuel is stored.

|

|

|

|

|

AB – Alberta |

|

|

|

|

|

|

|

AL – Alabama |

IA – Iowa |

NE - Nebraska |

RI – Rhode Island |

BC – British Columbia |

|

|

|

|

|

|

|

AZ – Arizona |

KS - Kansas |

NV - Nevada |

SC – South Carolina |

NB – New Brunswick |

|

|

|

|

|

|

|

AR – Arkansas |

KY – Kentucky |

NH – New Hampshire |

SD – South Dakota |

MB – Manitoba |

|

|

|

|

|

|

|

CA – California |

LA – Louisiana |

NJ – New Jersey |

TN – Tennessee |

ON – Ontario |

|

|

|

|

|

|

|

CO – Colorado |

ME – Maine |

NM – New Mexico |

TX – Texas |

QC – Quebec |

|

|

|

|

|

|

|

CT Connecticut |

MD – Maryland |

NY – New York |

UT – Utah |

SK – Saskatchewan |

|

|

|

|

|

|

|

DE – Delaware |

MA – Massachusetts |

NC – North Carolina |

VA – Virginia |

NL – Newfoundland |

|

|

|

|

|

|

|

FL – Florida |

MI – Michigan |

ND – North Dakota |

VT – Vermont |

NW – NW Territory |

|

|

|

|

|

|

|

GA – Georgia |

MN – Minnesota |

OH |

WA – Washington |

NS – Nova Scotia |

|

|

|

|

|

|

|

ID – Idaho |

MS – Mississippi |

OK – Oklahoma |

WV – W. Virginia |

PE – Prince Edward Isl. |

|

|

|

|

|

|

|

IL – Illinois |

MO – Missouri |

OR – Oregon |

WI – Wisconsin |

YU – Yukon Territory |

|

|

|

|

|

|

|

IN – Indiana |

MT – Montana |

PA – Pennsylvania |

WY – Wyoming |

DC – Dist. of Columbia |

|

|

|

|

|

|

•The IFTA license requires filing quarterly tax returns regardless of travel for all qualified motor vehicles. Miles reported should be actual miles and not estimated. Mileage may be rounded to the nearest whole number (e.g., 1234.5 = 1235).

•Tax returns not filed and paid or filed late will be subject to penalties, per KRS.

•The license must be renewed annually and must be active and in good standing prior to renewing.

|

TC |

KENTUCKY TRANSPORTATION CABINET |

09/2021 |

Department of Vehicle Regulation |

|

DIVISION OF MOTOR CARRIERS |

Page 5 of 6 |

|

KENTUCKY TRUCKING APPLICATION

Section 5: Kentucky Intrastate Tax Fuel (KIT)

Instructions: This section is for

KIT License –

Have you ever had a KIT license issued to you in another name? |

No |

Yes |

(If yes, you are required to provide the name and number you operated under in the boxes below.)

Name:

KIT Number:

Was the license cancelled in good standing?

No

Yes

Number of decal sets requested:

(One (1) set of decals per vehicle and one IFTA license will be issued after the application is processed.)

•The KIT license requires filing quarterly tax returns regardless of travel for all qualified motor vehicles.

•All fuel consumed and all highway and off road miles for every qualified vehicle operated in Kentucky must be reported.

•Farm licensed vehicles do not require this fuel tax license.

•Tax returns not filed and paid or filed late will be subject to penalty, interest, and a bond.

•The license must be renewed annually and must be active and in good standing prior to renewing.

Section 6: IFTA or KIT VIN/Decal Request

Instructions: List the VIN(s) in the space below for vehicles that have a combined licensed weight³ of 26,001 lbs. or greater or power units that have 3 or more axles, regardless of weight, that are subject to IFTA or KIT.

If more than 10 VIN’s, use another sheet of paper.

|

|

|

Make of |

Unit Number |

|

Complete Vehicle Identification Number |

|

(If greater than 6 |

|

|

|

|

||

|

Year |

Vehicle |

||

|

|

|||

|

(Full |

|

||

|

(4 digits) |

(4 chars) |

digits, list the last 6.) |

|

|

|

|

|

|

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

³Combined

Licensed

Weight

(See page 3 for def.)

|

TC |

||

KENTUCKY TRANSPORTATION CABINET |

09/2021 |

||

Department of Vehicle Regulation |

|||

Page 6 of |

6 |

||

DIVISION OF MOTOR CARRIERS |

|||

|

|

||

KENTUCKY TRUCKING APPLICATION

Section 7: Kentucky Intrastate

Instructions: This section is not for all carriers. See below for applicable fees.

Have you ever had a KY Intra

No Yes

N Name:

Was the certificate cancelled?

No

Yes

Please check the one box below that represents your carrier operation on the Federal Motor Carrier Safety Administration:

Please check the box if operating as a Towing Company

Intrastate

This certificate will require a $25.00 fee, a $10.00 per vehicle fee, and an original Form E insurance filing from your insurance company

Total number of vehicle(s) to be operated under this authority: Application Fee:

Total:

x $10.00 = $ |

|

+ $ |

25.00 |

= $

Interstate

This certificate will require a

Make check or money order payable to Kentucky State Treasurer.

•The Form E filing must read exactly as it appears under Section 1 of this application. For faster delivery, the insurance company may utilize the National Online Registry (NOR) system to submit the Form E filing electronically or the original Form E filing must be submitted with the application before a license is issued. Applications received with no Form E will be returned.

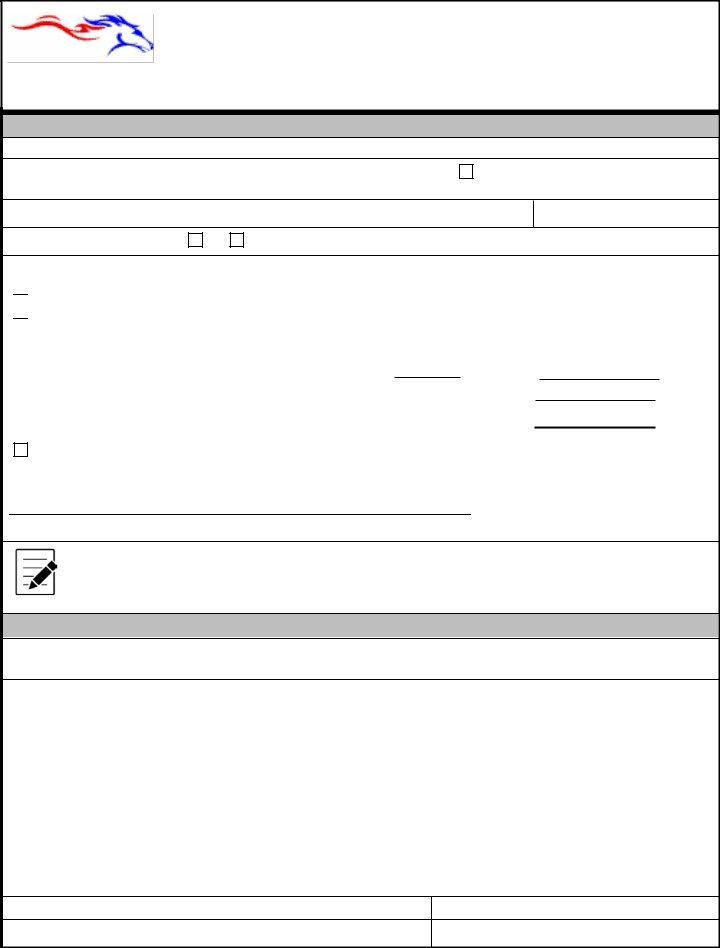

Section 8: Signature Authorization

The carrier must sign and meet the requirements below. If a third party provider signs theapplicationon behalfof the carrier, they must also meet the requirements below and attach a Power of Attorney (POA) signed by both parties.

Under penalties of perjury, I certify that the information given is, to the best of my knowledge, true, accurate, and

complete. In addition, I certify that I do not have any outstanding road tax obligations or delinquencies. I agree to comply with tax reporting, payment, record keeping, and license display requirements as specified in the International Fuel Tax Agreement, and the rules and regulations of the Kentucky Department of Vehicle Regulation. I further agree that the Department of Vehicle Regulation may withhold any refunds due if I am delinquent on fuel taxes due to any member jurisdiction. I further certify that I am familiar with the Federal Motor Carrier Safety Regulations and the Federal Hazardous Materials Regulations. Failure to comply with these provisions shall be grounds for revocation of any license and/or authority in Kentucky or all member jurisdictions.

Original signature of responsible party is required. Faxes not accepted. If a

Furthermore, I understand that by signing this document my signature could also hold me as the responsible party and that I can personally be liable for any delinquencies owed regarding the operations of this company and/or any other company I may be associated.

Signature:

Printed Name:

Title:

Date: