The Tax Commission of the City of New York introduced the TC101 form, a crucial document for property owners under tax classes two or four, outlining specific instructions for the 2021 application cycle. This form plays a vital role in enabling property owners to protest the valuation assigned to their properties by the Department of Finance, particularly addressing concerns that the statutory limits on annual increases have been surpassed for the upcoming tax year. Amid the challenges posed by the pandemic, the form's instructions have been adapted to allow for digital submissions, simplifying the process and accommodating the needs of applicants during unprecedented times. The TC101 form, alongside necessary attachments like income schedules and agent statements, must be submitted by a firm deadline, underscoring the importance of timely action by property owners. Moreover, the form details a varied set of requirements depending on the owner's unique circumstances, including different schedules for those with rental income, and outlines the potential need for additional forms such as the TC200, offering a comprehensive guide to navigating the appeals process for property tax assessments.

| Question | Answer |

|---|---|

| Form Name | Tc101 Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | tc101 form, 2011, tc101, TC200 |

TAX COMMISSION OF THE CITY OF NEW YORK 1 Centre Street, Room 2400, New York, NY 10007

FORM TC101 INSTRUCTIONS FOR 2021

APPLICATION FOR CLASS TWO OR CLASS FOUR PROPERTIES

TC101INS

2021/22

Read TC600 How to Appeal a Tentative Assessment before you begin to complete this form.

Who should use this form? Use Form TC101 to protest only the valuation of a property in tax class two or four, including a claim that the statutory limits on annual increases have been exceeded by the Department of Finance for the tax year that will begin on July 1, 2021. If you are making a classification or exemption claim either alone or with a valuation claim, use Form TC106. Use just one application form for each property.

What other forms and instructions are needed?

Form TC10 Receipt.

One or more of the following may also be required as an attachment to the application:

TC200 |

Addendum to Application |

TC201 |

Income Schedule (Rental Property) |

TC203 |

Income Schedule (Coop or Condo) |

TC208 |

Income Schedule (Hotel or Motel) |

TC214 |

Income Schedule for Department Stores, |

|

Theaters, and Service Sites |

TC230 |

Sale Statement |

TC244 |

Agent’s Statement of Authority and |

|

Knowledge (when an agent signs the |

|

application) Note: a Power of Attorney is |

|

required to be filed with Form TC244. |

TC309 |

Accountant’s Certification |

When and how to file.

THIS YEAR BECAUSE OF THE PANDEMIC YOU MAY FILE BY SCANNING AND EMAILING YOUR APPLICATIONS TO tcapplications@oata.nyc.gov. If you file by email, no copies or TC10 forms are required.

The Tax Commission must receive your application by 5:00 P.M. on March 01, 2021. The deadline is set by law and cannot be waived or extended for any reason. Late applications will not be reviewed.

Filing by mail. Mail the completed Form TC101 to the Tax Commission, 1 Centre Street, Room 2400, New York, NY 10007. DO NOT MAIL THE TC101 TO ANY

OTHER ADDRESS. Applications received after the March 1 deadline will not be accepted even if they were mailed before that date. Include a self-

addressed, stamped Tax Commission receipt Form TC10.

Filing in Person: Bring the completed application forms to the Tax Commission’s Manhattan office at 1 Centre St. or to a Finance Dept. Business Center in any borough by the deadline. Get a

A

File an original. Keep a photocopy for your records and to use at your hearing. See TC600 for information about filing additional copies of your application with your original.

Supplemental affidavits. Use Form TC159, supplemental affidavit, to provide additional or missing information, or to correct any information that is misstated in the application or attachments. See Form TC600 and TC159.

Completeness. Your application should be complete when filed. Failure to answer all questions may result in your application being denied review by the Tax Commission.

An income and expense schedule may be required. For most properties, an income and expense schedule must be attached to the application for correction. Use Form TC201 if the property produced rental income in 2020. Use Form TC203 for residential and commercial cooperatives and condominiums. Use Form TC208 for hotels and motels. Use Form TC214 for department stores, public parking garages and lots, and theaters where the Applicant is the business operator or a related person. If the Applicant operates its own business in part of the property, and rents part of the property, attach both Form TC201 and Form TC214. Form TC214 is not required for an operator of a department store having less than 10,000 gross square feet of retail space.

A net lessor leasing to a related lessee who occupies the property may use Form TC200, Part 5, instead of TC201 to report net lease information. A net lessor with a related lessee who sublets any part of the property to unrelated sublessees must use TC201.

An income and expense schedule is not required when:

•Property produced no rental income in 2020;

•Applicant’s operation began after July 1, 2020,

- 1 -

unless the prior operator was a related person;

•Property is exclusively residential with six or fewer apartments; or

•Property is

Information for certain Applicants not otherwise required to report rental income and expenses. If an Applicant owned

Forms and information.

Tax Commission forms are available at www1.nyc.gov/site/taxcommission/index.page, at the Tax Commission’s Manhattan office and at Finance Dept. Business Centers in each borough. If you have questions about the application procedure, contact the Tax Commission by

Form TC200 may be required with TC101. Form TC200 generally is required with TC101 when:

•Applicant is not an owner or lessee of the entire property who pays all property charges, such as taxes, insurance and maintenance of the entire property;

•Applicant is a partial tenant, a tenant who does not pay all property charges, a contract vendee, mortgagee, receiver, trustee in bankruptcy, or owner of a divided interest;

•Applicant is a lessee who does not report the lease information on Form TC201, TC208 or TC214.

•Either question in Part 10 is answered “yes” as to construction, major alteration or a sale. If information regarding a sale or contract of sale is to be provided after the application is filed, it must be reported on either Form TC200 (if the sale is between related parties) or TC230, and filed with a completed Form TC159 at the hearing.

•The application is signed by a fiduciary.

If TC200 is not filed when necessary, the application will not receive Tax Commission review. See TC200 Instructions for complete information on when to file TC200.

Part 7 – Outdoor space. Specify whether the outdoor space is used for signage, cell towers/telecom equipment, and/or generators.

Part 8 - Floor area. Provide approximate gross floor area to the best of your knowledge and ability. Measure from exterior wall to exterior wall for each floor. This section is optional for: (i) residential property with ten or fewer apartments and no commercial space, (ii) residential property with six or fewer apartments and no more than one commercial unit, and (iii) residential cooperatives with less than 2,500 square feet of commercial space, not including a garage.

FEE FOR CERTAIN PROPERTIES - A $175 fee is charged for all Applications for Correction where the assessed value on the Notice of Property Value for 2021/22 is $2 million or more. No fee is due if the Applicant or representative waives review of the application before it is scheduled for review. DO NOT PAY THE FEE WITH THIS APPLICATION. THE FEE WILL BE INCLUDED ON THE REAL PROPERTY TAX BILL. If the fee is unpaid, review of your application may be denied and any offer of correction revoked.

Definitions for purposes of completing Form TC101:

Construction or major alteration. Construction or major alteration work includes any work that (a) increases the enclosed floor area or cubic content of a building, (b) renovates a substantially vacant building (c) converts the use of one or more floors of a building, such as from office to residential use, (d) completes renovation, or tenant installations affecting at least 25% of a building’s area, (e) installs or replaces HVAC, elevators, electric wiring or plumbing, (f) replaces at least one of the exterior faces of the building, or (g) costs or is expected to cost an amount that equals or exceeds the tentative total actual assessment under review.

Demolition. Demolition is any work involving the dismantling, razing or removal of all of a building or structure, or the dismantling, razing or removal of structural members, floors, interior bearing walls, and/or exterior walls or portions thereof.

Owner. The owner is the individual(s) or entity having legal title to the real property assessed. Unless title has been conveyed to a trust, the trust is not the owner.

Related persons. Related persons include individuals related by blood, marriage or adoption, individuals and the business entities they control, business entities under common control, and fiduciaries and the beneficiaries for whom they act. A person includes a corporation or other business entity.

Year of purchase. The year the owner or other Applicant or any related person purchased the property or acquired an interest in the property.

- 2 -

TAX COMMISSION OF THE CITY OF NEW YORK

1 Centre Street, Room 2400, New York, NY 10007 High Value Copy

APPLICATION FOR CORRECTION OF ASSESSED VALUE

OF TAX CLASS TWO OR FOUR PROPERTY

TC101

2021/22

OUR PUBLISHED FORMS MAY NOT REFLECT PROCEDURAL MODIFICATIONS PROMPTED BY THE PANDEMIC. BE SURE TO CHECK OUR WEBSITE FOR UPDATES AT HTTPS://WWW1.NYC.GOV/SITE/TAXCOMMISSION/INDEX.PAGE.

READ TC600 AND THE SEPARATE INSTRUCTIONS (TC101 INS) BEFORE YOU BEGIN. COMPLETE ALL PARTS OF THE FORM. ANSWER “YES” OR “NO” TO QUESTIONS MARKED .

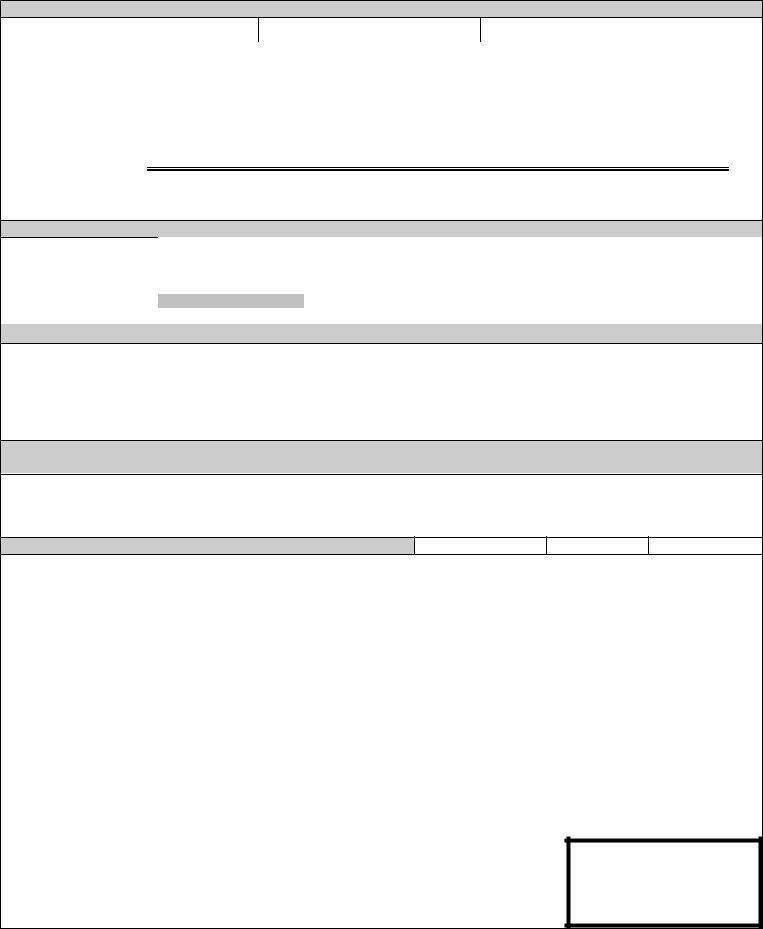

1. PROPERTY IDENTIFICATION - A separate application is required for each tax lot. |

|

|

|

1 |

||||||||

BOROUGH (Bronx, Brooklyn, Manhattan, Queens or Staten Island) |

|

BLOCK |

|

|

|

LOT |

ASSESSMENT YEAR |

2021/22 |

YEAR |

|||

|

|

|

|

|

|

|

|

2021/22 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

FULL ADDRESS OF PROPERTY (WITH ZIP CODE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Lot is filing consolidated income and expense schedule with one or more other blocks and lot(s). (TC166 must be filed.) |

|

|

||||||||||

2. APPLICANT - The Applicant must be an owner or other person adversely affected by the assessment, not an |

|

|

|

|||||||||

attorney or agent. See TC600 “Who May Apply”. |

|

|

|

|

|

|

______________ |

BOROUGH |

||||

Name of Applicant ______________________________________________________________________________________________________ |

||||||||||||

|

|

|||||||||||

Is Applicant an owner/title holder of entire property? _____ |

If YES, is the entire property subject to a net lease? _____ See TC101 Instructions. |

|

|

|||||||||

Is Applicant a lessee (tenant) of entire property who pays all property charges and is not barred from contesting the assessment? ____ If YES, check |

|

|

||||||||||

box (a) or (b). |

|

|

|

|

|

|

|

|

|

|

|

|

(a) Lease from unrelated owner or sublease. Provide lease information on Form TC200 or TC201. See TC101 Instructions. |

|

|

|

|

||||||||

(b) Lease from a related owner. Specify Applicant's relation to owner___________________________________________________________ |

|

|

||||||||||

If neither owner nor lessee of entire property, explain Applicant's relation to property ______________________________________ and submit Form |

|

|

||||||||||

TC200. FAILURE TO SUBMIT FORM TC200 WILL RESULT IN DENIAL OF A REVIEW OF YOUR APPLICATION. |

|

|

_________ |

BLOCK |

||||||||

Does Applicant claim eligibility for review without filing an income schedule (TC201, TC203, TC208 or TC214) or net lease rent on TC200? ______. If |

||||||||||||

|

|

|||||||||||

YES, specify the reason: _________________________________________________________________________________________________. |

|

|

||||||||||

If YES and property is 4, 5, or |

|

|

||||||||||

_____(Y/N). If YES, enter ______% floor area at or above grade that is rented or offered for rent and enter the 2020 gross rent: $ __________ |

|

|

||||||||||

If TC101 is filed after March 01, application is eligible for review because filing is within 20 calendar days of: Apportionment notice |

Notice of |

_______ |

LOT |

|||||||||

increase You must attach a copy of the apportionment notice or notice of increase from the Finance Dept. |

|

|

||||||||||

|

|

|

|

|||||||||

|

|

|

|

|

|

|||||||

3. REPRESENTATION - Complete this section even if you will represent yourself. |

|

|

|

|

||||||||

PHONE NO. |

|

|

FAX NO. |

|

|

|

|

|

|

|

|

|

(_____________) |

(____________) |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||

NAME OF INDIVIDUAL OR FIRM TO BE CONTACTED |

|

|

|

|

|

|

|

GROUP #, IF ANY |

|

|

||

|

|

|

|

|

|

|

|

|

___________ |

GROUP# |

||

MAILING ADDRESS |

|

|

|

|

|

EMAIL ADDRESS |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||

The person listed is: The Applicant |

An attorney |

Other representative |

Employee or officer of owner legal entity named in Pt. 2 |

|||||||||

|

|

|||||||||||

|

|

|

|

|

||||||||

4. ATTACHMENTS - List all schedules and documents attached to this application. Number the pages. |

|

|

|

|

||||||||

_________________________________ |

_________________________________ |

|

___________________________________ |

|

|

TC101 |

||||||

_________________________________ |

_________________________________ |

|

___________________________________ |

|

|

|||||||

|

|

|

|

|||||||||

Lot is consolidated. See attachments to application for block ________ lot ______. |

|

|

Last page number _____ |

|

|

|||||||

Attach a statement of facts and other documents supporting your market value estimate or submit them at hearing. If you request review on papers in Part |

|

|

||||||||||

5, submit supporting facts and other documents with the application. |

|

|

|

|

|

|

|

|

||||

5. HEARING REQUEST - Check only one box.

Review on papers submitted without a personal hearing, OR Personal hearing in Manhattan Personal hearing in the Bronx |

||

Personal hearing in Brooklyn |

Personal hearing in Queens |

Personal hearing in Staten Island |

6. CLAIMS OF UNEQUAL OR EXCESSIVE ASSESSMENT

Applicant objects to the assessment on the grounds that it is (i) unequal or (ii) excessive because the assessment exceeds the full |

|

|

value of the property or statutory limits on increases, as follows: |

|

|

a. Tentative actual assessment |

$____________________________ |

|

b. Applicant's estimate of market value |

$____________________________ |

|

c. Requested assessment = line b x 45% assessment ratio |

$____________________________ |

|

The Applicant reserves the right to allege an assessment ratio lower than 45% and seek a lower assessment in a proceeding for |

|

|

judicial review. |

|

|

Do not use this form to claim unlawful assessment, misclassification, or full or partial exemption; use Form TC106. |

DATE RECEIVED |

|

Signer's initials _______. You must initial this page if you do not use a

7. PROPERTY DESCRIPTION AS OF JANUARY 5, 2021 – Property uses, retail units, dwellings, parking spaces.

NUMBER OF BUILDINGS

NUMBER OF STORIES ABOVE GRADE

YEAR OF CONSTRUCTION

NUMBER OF DWELLING UNITS |

NUMBER OF RETAIL UNITS |

NUMBER OF VEHICLE PARKING SPACES |

|

|

|

Indoor: ______________ |

Outdoor: ________________ |

|

|

|

|

YEAR OF PURCHASE |

|

NUMBER OF VEHICLE PARKING SPACES PAID |

|

|

|

Indoor: ______________ |

Outdoor: ________________ |

|

|

|

|

USES (residential, office, retail, hotel, loft, factory, warehouse, storage, garage, theater, etc.).

FLOORS 3 |

_________________________________________________________________________________________________________________________________ |

SECOND FLOOR |

_________________________________________________________________________________________________________________________________ |

FIRST FLOOR

BASEMENTS

OUTDOOR SPACE

_________________________________________________________________________________________________________________________________

(e.g. cell tower/telecom equipment, signage, generators)_______________________________________________________________________________________________

8. APPROXIMATE GROSS FLOOR AREA AS OF JANUARY 5, 2021

Floor |

All uses (above grade) |

Retail |

Garage |

Offices |

FLOORS 3 - ___ |

sq.ft. |

sq.ft. |

sq.ft. |

sq.ft. |

SECOND FLOOR |

sq.ft. |

sq.ft. |

sq.ft. |

sq.ft. |

FIRST FLOOR |

sq.ft. |

sq.ft. |

sq.ft. |

sq.ft. |

BASEMENTS |

|

sq.ft. |

sq.ft. |

sq.ft. |

TOTAL AREA |

sq.ft. |

sq.ft. |

sq.ft. |

sq.ft. |

9. USE BY APPLICANT

On January 5, 2021, was any of the property used by the Applicant or related persons? _______. If YES, complete this Part 9.

Use by Applicant: Entire property. Part. Specify location in building ___________________________________________________________

Approximate nonresidential gross floor area used by Applicant _______________ sq.ft., of which first floor ______________, basement ____________

Describe Applicant's use ______________________________________________________________________________________________________

__________________________________________________See instructions if used as a department store, public parking garage or lot, theater or hotel.

10.SALE, DEMOLITION OR CONSTRUCTION AFTER JANUARY 5, 2019 – Failure to answer BOTH questions will result in denial of review.

Has the property or an interest in it been bought, sold, transferred or placed under contract of sale after January 5, 2019? Yes No. To be provided at or before hearing (see instructions.). If YES, submit Form TC230 or TC200 (submit TC200 for transfers between related parties only.)

After January 5, 2019, has there been any construction, demolition or major alteration work or have plans for demolition or a new building been filed with the Buildings Dept.? Yes No. If YES, submit Form TC200.

11. SIGNATURE AND OATH

BOROUGH

BLOCK

LOT

This application must be signed by an individual having personal knowledge of the facts who is the Applicant, a fiduciary, an agent, or an officer of a corporation, a general partner of a partnership or a member or manager of a limited liability company (LLC), which legal entity either is the Applicant or a general partner or member or manager of the Applicant. See instructions. NOTE: Forms TC200, TC244 and/or a Power of Attorney may be required. If required and not attached to this application, it will be dismissed.

Signer is (check one of boxes

ii. Officer of corporate Applicant named in Part 2. Title: _________________________________________

iii. General partner of partnership Applicant named in Part 2.

iv. Member or manager of, or individual officer of LLC Applicant named in Part 2. Signer’s Title: _______________________________

v. An attorney, employee, property manager or other agent for Applicant named in Part 2. TC244 and a notarized power of attorney must be attached. vi. Fiduciary. Specify fiduciary’s relationship to Applicant __________________________ Form TC200 may be required. See TC200INS (instructions).

If signing as fiduciary for a corporation, partnership or LLC, enter name of entity: _______________________________________________

vii. An officer, general partner, or member or manager of an entity that is the general partner, member or manager of the Applicant.

Enter name of entity, relationship to Applicant and signer’s title: Name of entity __________________________________________________________

Relationship to Applicant _________________________________________________ Signer’s Title: ________________________________________

OATH I have read this entire application before signing below, including all instructions, whether on this form or on another. I am personally responsible for the accuracy of the information provided on this application and on any attachments and I certify that all such information is true and correct to the best of my knowledge and belief. I also understand that such information is subject to verification, is being relied upon by the City of New York and that the making of any willfully false statement of material fact on this application or any attachments will subject me to the provisions of the penal law relevant to the making and filing of false statements.

PRINT CLEARLY NAME OF PERSON SIGNING ____________________________________________________

Signed: ___________________________________________________________Date: _____________________

Page 2 |

TC101 |