It is possible to fill out tax credit application form pdf effectively with the help of our PDFinity® online tool. To retain our editor on the forefront of efficiency, we aim to put into action user-driven capabilities and enhancements regularly. We're routinely thankful for any feedback - play a pivotal part in reshaping how you work with PDF files. To get the ball rolling, consider these easy steps:

Step 1: Simply click the "Get Form Button" at the top of this page to start up our pdf file editing tool. This way, you will find all that is necessary to fill out your document.

Step 2: With our handy PDF tool, you'll be able to do more than just fill out blanks. Express yourself and make your documents appear faultless with custom textual content incorporated, or adjust the file's original input to perfection - all that comes along with an ability to add any kind of graphics and sign the file off.

As for the fields of this precise document, here's what you should do:

1. The tax credit application form pdf requires particular information to be inserted. Ensure the next blank fields are complete:

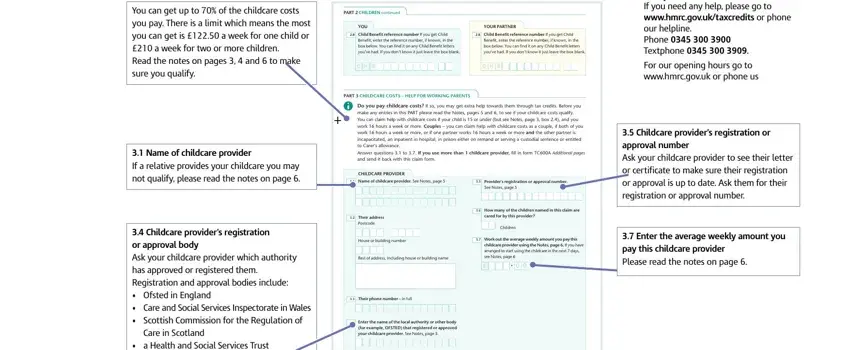

2. Once the previous part is filled out, proceed to enter the suitable information in these: You can get up to of the, PART CHILDREN continued, YOU Child Benefit reference number, YOUR PARTNER Child Benefit, C H B, C H B, PART CHILDCARE COSTS HELP FOR, Do you pay childcare costs If so, Providers registration or approval, How many of the children named in, Children, Work out the average weekly amount, Name of childcare provider If a, CHILDCARE PROVIDER Name of, and Their address Postcode.

3. Completing You will not usually get help with, Enter the average weekly amount, Do not include any amount paid by, for three or four year olds, paid by a government scheme for, Upfront Childcare Fund to help you, If you pay childcare weekly and, If you need help working out your, If you need to use childcare for, and If you or your partner are is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

4. The form's fourth part comes with all of the following blank fields to complete: If you made Gift Aid payments, Income from selfemployment for, If you havent filled in your tax, If you have filled in your tax, If you have more than one business, If your business had other income, If you use averaging because youre, and If you traded outside of the UK in.

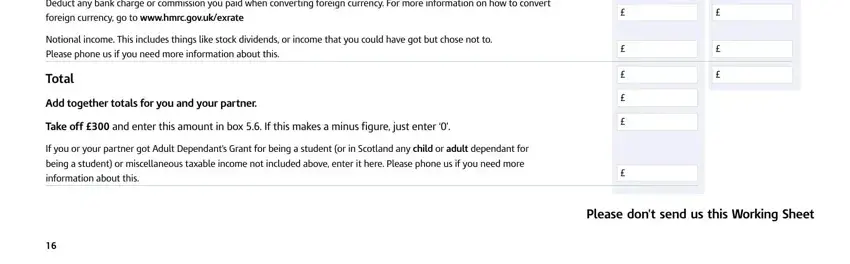

5. Finally, this last section is what you should complete prior to using the PDF. The blanks in this instance include the next: Foreign income for example income, Notional income This includes, Total, Add together totals for you and, Take off and enter this amount in, If you or your partner got Adult, and Please dont send us this Working.

Many people generally make some mistakes when filling in Take off and enter this amount in in this section. Ensure that you reread everything you type in here.

Step 3: Immediately after double-checking your completed blanks, hit "Done" and you're all set! Right after starting a7-day free trial account with us, you'll be able to download tax credit application form pdf or send it via email promptly. The PDF document will also be accessible from your personal account with all your changes. FormsPal is devoted to the personal privacy of our users; we make sure all personal data coming through our editor continues to be protected.