In case you want to fill out fae 172 instructions 2019, you don't need to download and install any software - simply give a try to our PDF editor. FormsPal is aimed at making sure you have the perfect experience with our tool by continuously releasing new capabilities and improvements. With all of these improvements, using our tool becomes better than ever! It merely requires a couple of simple steps:

Step 1: Press the "Get Form" button above. It is going to open our tool so that you can begin filling out your form.

Step 2: When you launch the editor, you will see the form ready to be filled in. In addition to filling out different fields, you can also do other sorts of things with the PDF, namely adding your own text, changing the initial textual content, adding illustrations or photos, affixing your signature to the PDF, and more.

It's straightforward to fill out the form with this practical tutorial! This is what you have to do:

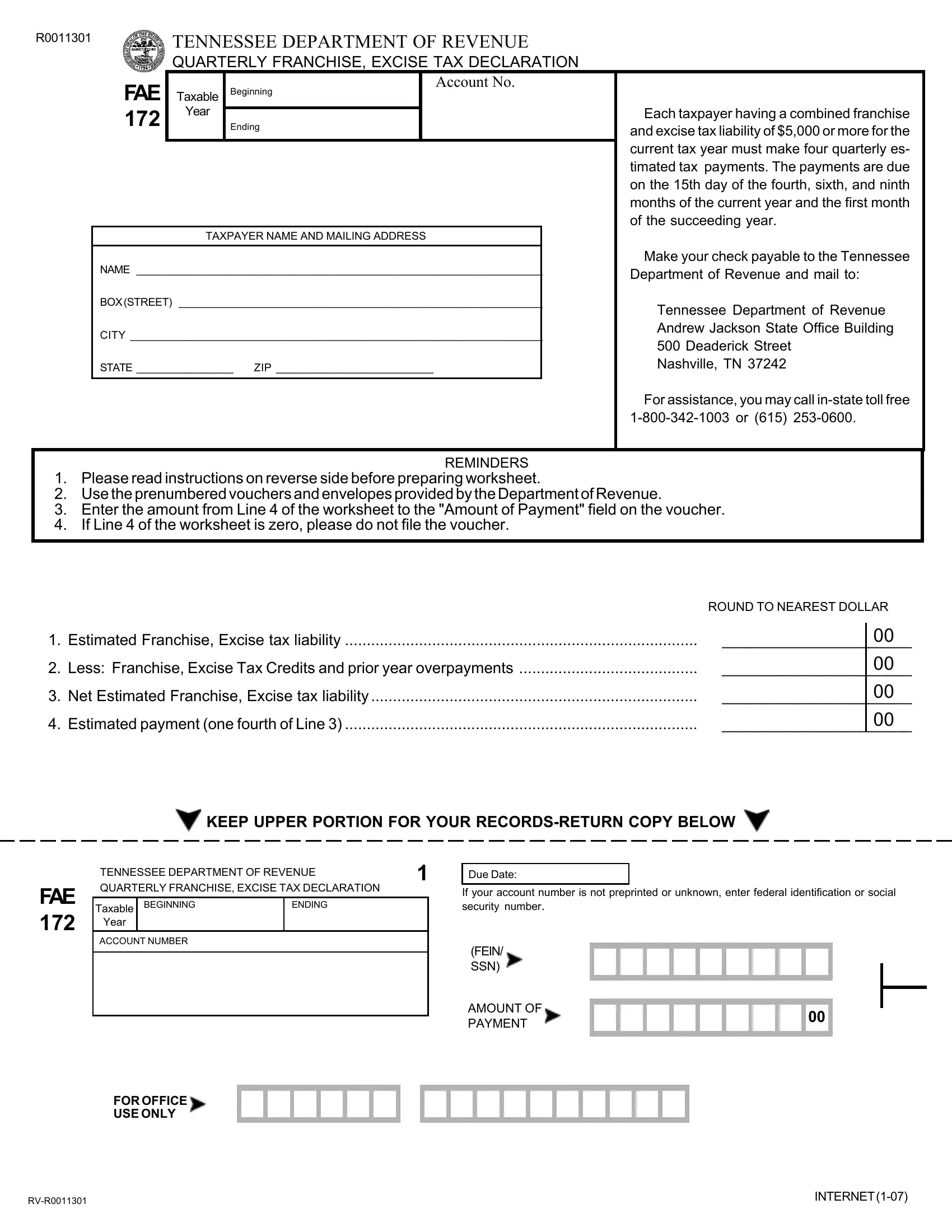

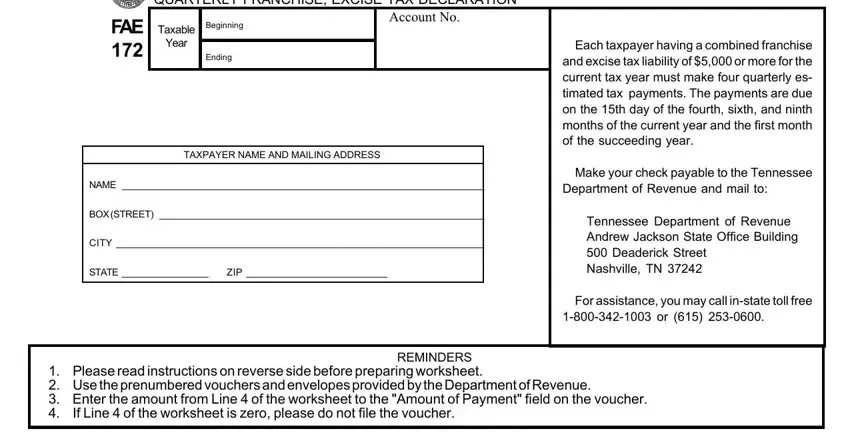

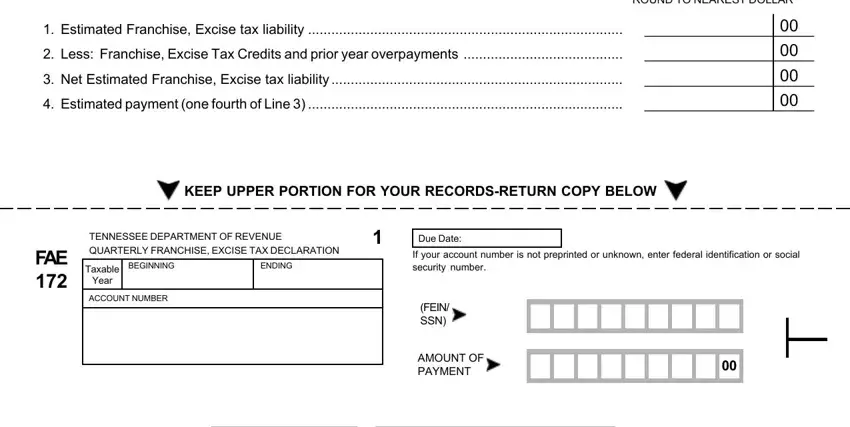

1. Complete the fae 172 instructions 2019 with a group of necessary blanks. Consider all the required information and ensure there's nothing omitted!

2. Once your current task is complete, take the next step – fill out all of these fields - Estimated Franchise Excise tax, Less Franchise Excise Tax Credits, Net Estimated Franchise Excise, Estimated payment one fourth of, ROUND TO NEAREST DOLLAR, KEEP UPPER PORTION FOR YOUR, FAE, TENNESSEE DEPARTMENT OF REVENUE, BEGINNING, ENDING, Taxable, Year, ACCOUNT NUMBER, Due Date, and If your account number is not with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

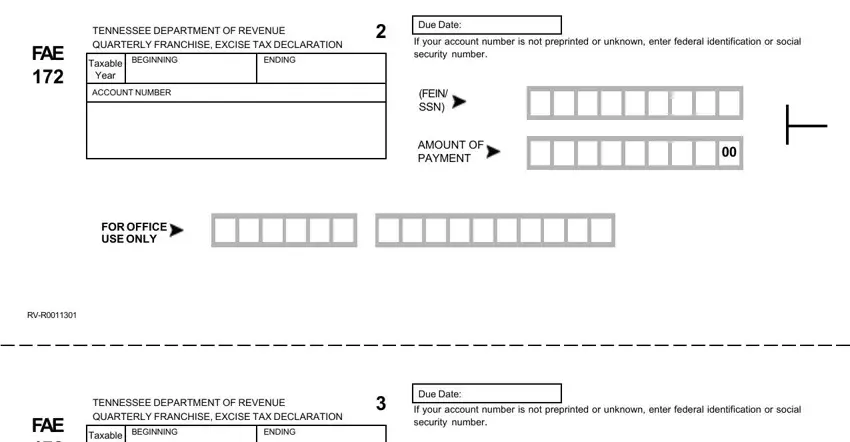

3. In this stage, look at FOR OFFICE USE ONLY, RVR, and INTERNET. All these will need to be completed with utmost attention to detail.

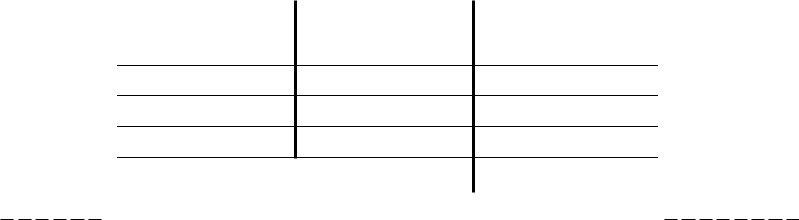

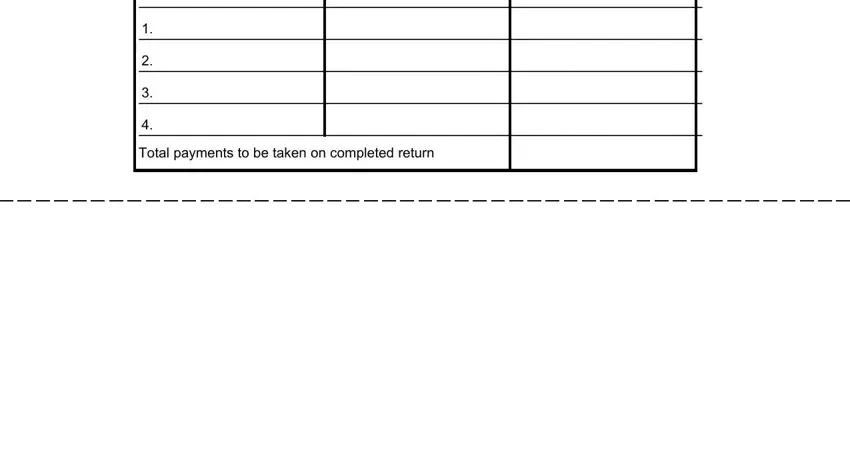

4. The following paragraph needs your attention in the following places: DUE DATE OF PAYMENT, and Total payments to be taken on. Just be sure you fill out all of the needed details to go onward.

Regarding Total payments to be taken on and Total payments to be taken on, make sure that you double-check them in this section. Those two are definitely the key ones in this PDF.

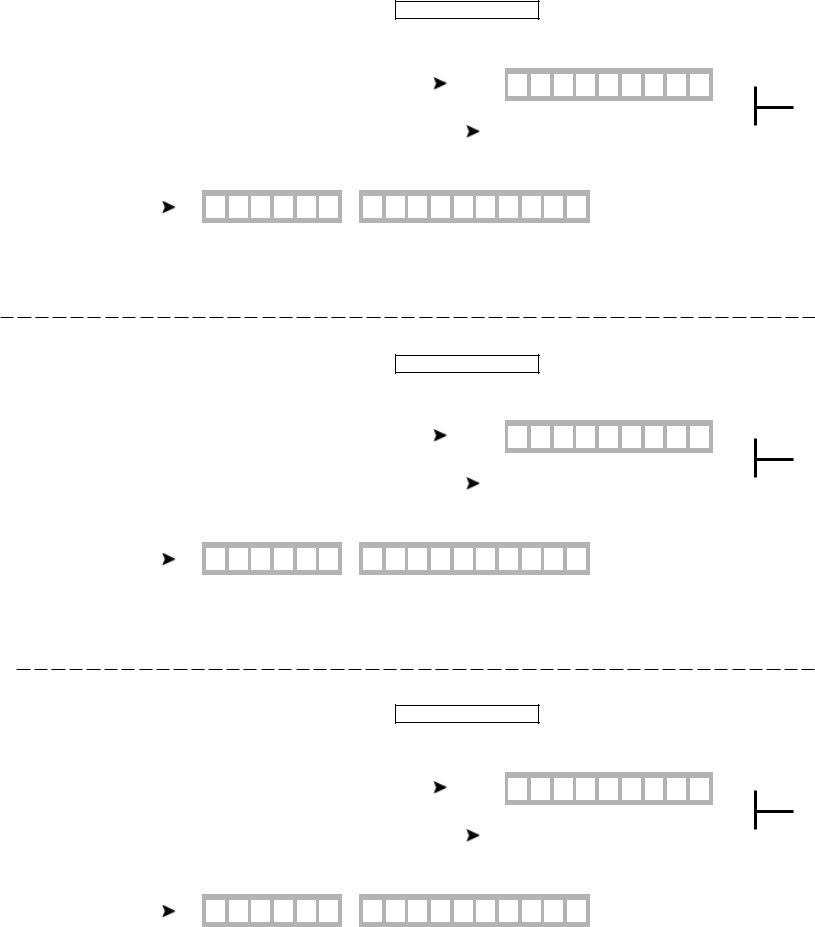

5. To finish your form, the final section requires several extra fields. Typing in FAE, TENNESSEE DEPARTMENT OF REVENUE, BEGINNING, ENDING, Taxable, Year, ACCOUNT NUMBER, Due Date, If your account number is not, FEIN SSN, AMOUNT OF PAYMENT, FOR OFFICE USE ONLY, RVR, FAE, and TENNESSEE DEPARTMENT OF REVENUE should finalize everything and you'll be done in no time at all!

Step 3: Make sure your details are accurate and then press "Done" to complete the task. Join FormsPal right now and immediately use fae 172 instructions 2019, ready for download. Every modification made is conveniently saved , helping you to customize the pdf later on if necessary. Here at FormsPal, we do our utmost to ensure that your details are maintained private.