Through the online editor for PDFs by FormsPal, you're able to fill out or alter tennessee education fee discount here and now. To make our tool better and simpler to utilize, we consistently design new features, taking into consideration feedback coming from our users. All it requires is several easy steps:

Step 1: Click on the "Get Form" button in the top section of this page to access our editor.

Step 2: This tool grants the opportunity to customize most PDF documents in many different ways. Improve it with your own text, correct what is originally in the PDF, and place in a signature - all possible in minutes!

This document requires some specific details; to guarantee accuracy and reliability, don't hesitate to heed the recommendations below:

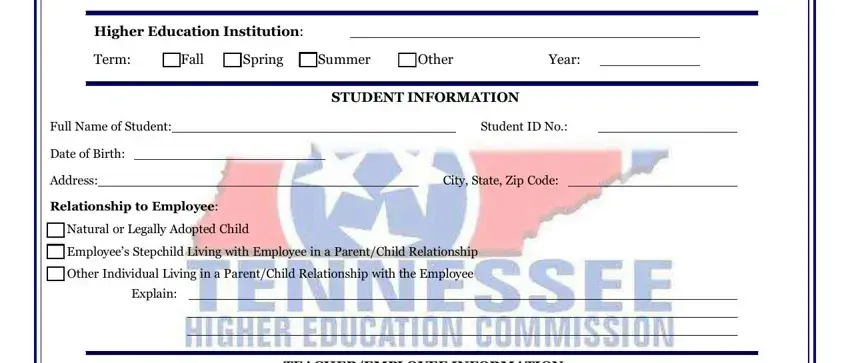

1. Begin completing your tennessee education fee discount with a number of major blanks. Consider all of the necessary information and make certain absolutely nothing is omitted!

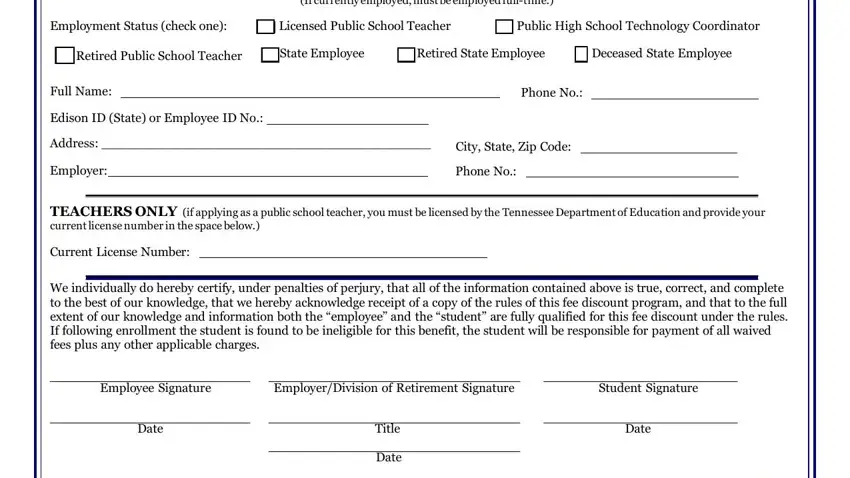

2. The subsequent part is to submit these particular blank fields: If currently employed must be, Employment Status check one, Licensed Public School Teacher, Public High School Technology, Retired Public School Teacher, State Employee, Retired State Employee, Deceased State Employee, Full Name, Edison ID State or Employee ID No, Phone No, Address, City State Zip Code, Employer, and Phone No.

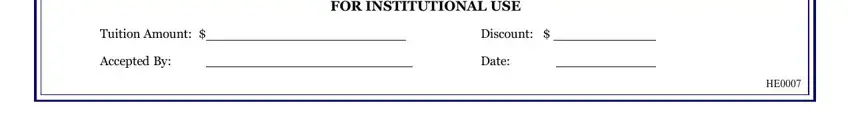

3. The following portion is about Tuition Amount, Accepted By, FOR INSTITUTIONAL USE, Discount, and Date - type in these blank fields.

It is easy to make an error when completing the FOR INSTITUTIONAL USE, consequently ensure that you reread it before you'll submit it.

Step 3: Check what you have typed into the blanks and hit the "Done" button. Acquire the tennessee education fee discount when you join for a free trial. Easily access the pdf file from your FormsPal account, together with any modifications and adjustments being all kept! FormsPal is dedicated to the confidentiality of all our users; we ensure that all personal data handled by our tool is confidential.