Using PDF documents online is always a breeze with our PDF editor. Anyone can fill in texas c 3 here painlessly. In order to make our tool better and less complicated to utilize, we constantly come up with new features, with our users' feedback in mind. All it takes is a couple of basic steps:

Step 1: Open the PDF in our editor by clicking on the "Get Form Button" in the top area of this page.

Step 2: This tool will let you customize almost all PDF forms in many different ways. Change it with your own text, correct what is originally in the PDF, and include a signature - all within a few clicks!

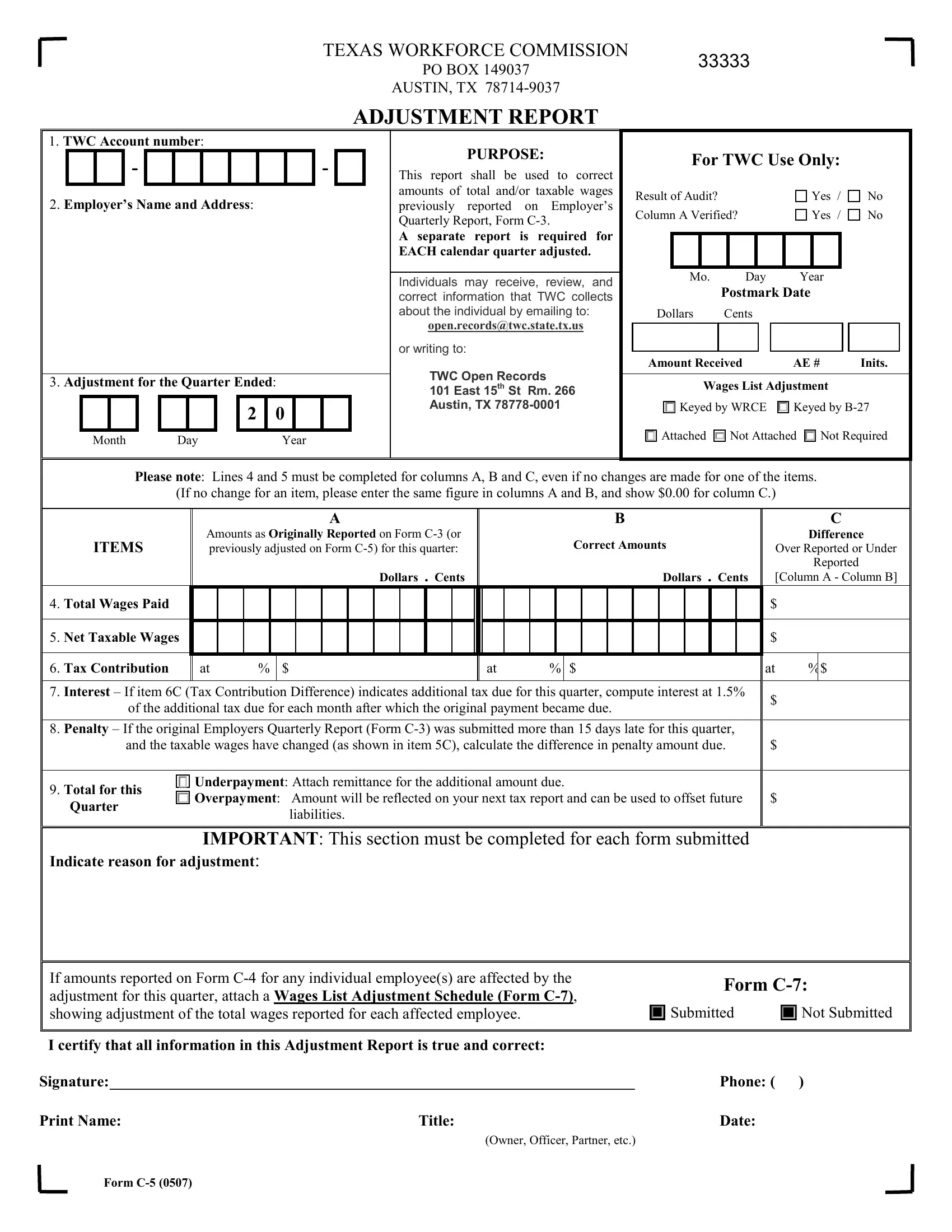

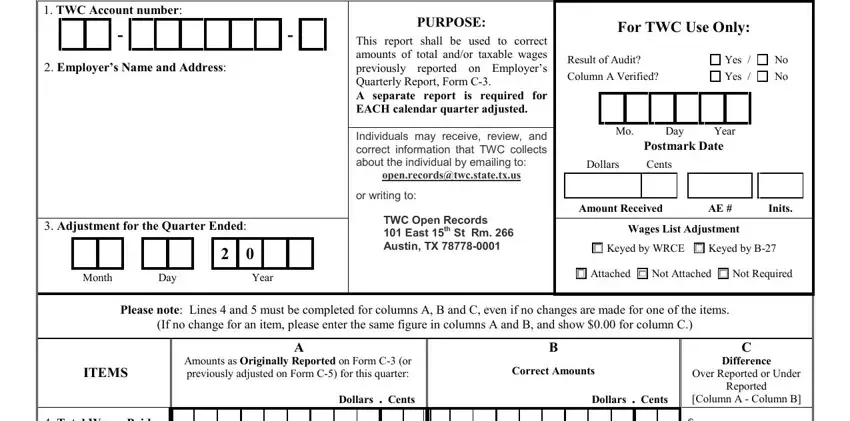

If you want to fill out this document, ensure you type in the right details in each and every area:

1. The texas c 3 usually requires specific details to be typed in. Make certain the next blanks are filled out:

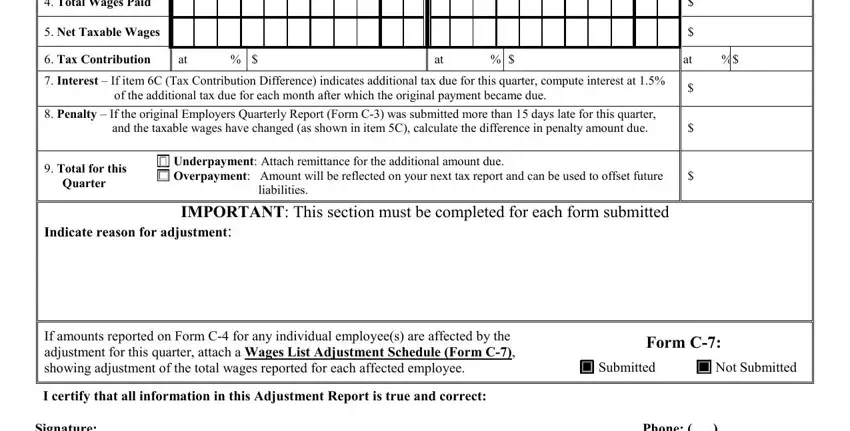

2. After the last part is completed, you should add the required details in Total Wages Paid, Net Taxable Wages, Tax Contribution Interest If, of the additional tax due for each, Penalty If the original, and the taxable wages have changed, Total for this, Quarter, Underpayment Attach remittance for, liabilities, IMPORTANT This section must be, Indicate reason for adjustment, If amounts reported on Form C for, Form C, and Submitted so you can go further.

3. Your next step is usually simple - fill out every one of the fields in Signature, Phone, Print Name, Form C, Title, Owner Officer Partner etc, and Date to complete the current step.

You can potentially make an error when completing your Print Name, and so be sure to go through it again before you'll finalize the form.

Step 3: Check all the information you've inserted in the blanks and then click on the "Done" button. Go for a 7-day free trial account with us and acquire instant access to texas c 3 - with all changes saved and available in your personal account page. We do not share the information you type in while completing forms at our website.