When you would like to fill out preprinted, you won't need to download any sort of applications - simply try using our online PDF editor. Our team is always working to develop the editor and ensure it is much easier for people with its handy functions. Enjoy an ever-evolving experience today! Here's what you will have to do to get started:

Step 1: Click on the "Get Form" button at the top of this page to access our PDF editor.

Step 2: With our state-of-the-art PDF editor, you can actually do more than merely fill in blanks. Edit away and make your docs seem sublime with customized text put in, or fine-tune the file's original input to perfection - all that accompanied by the capability to incorporate any images and sign the PDF off.

It really is straightforward to finish the pdf with our detailed tutorial! Here is what you should do:

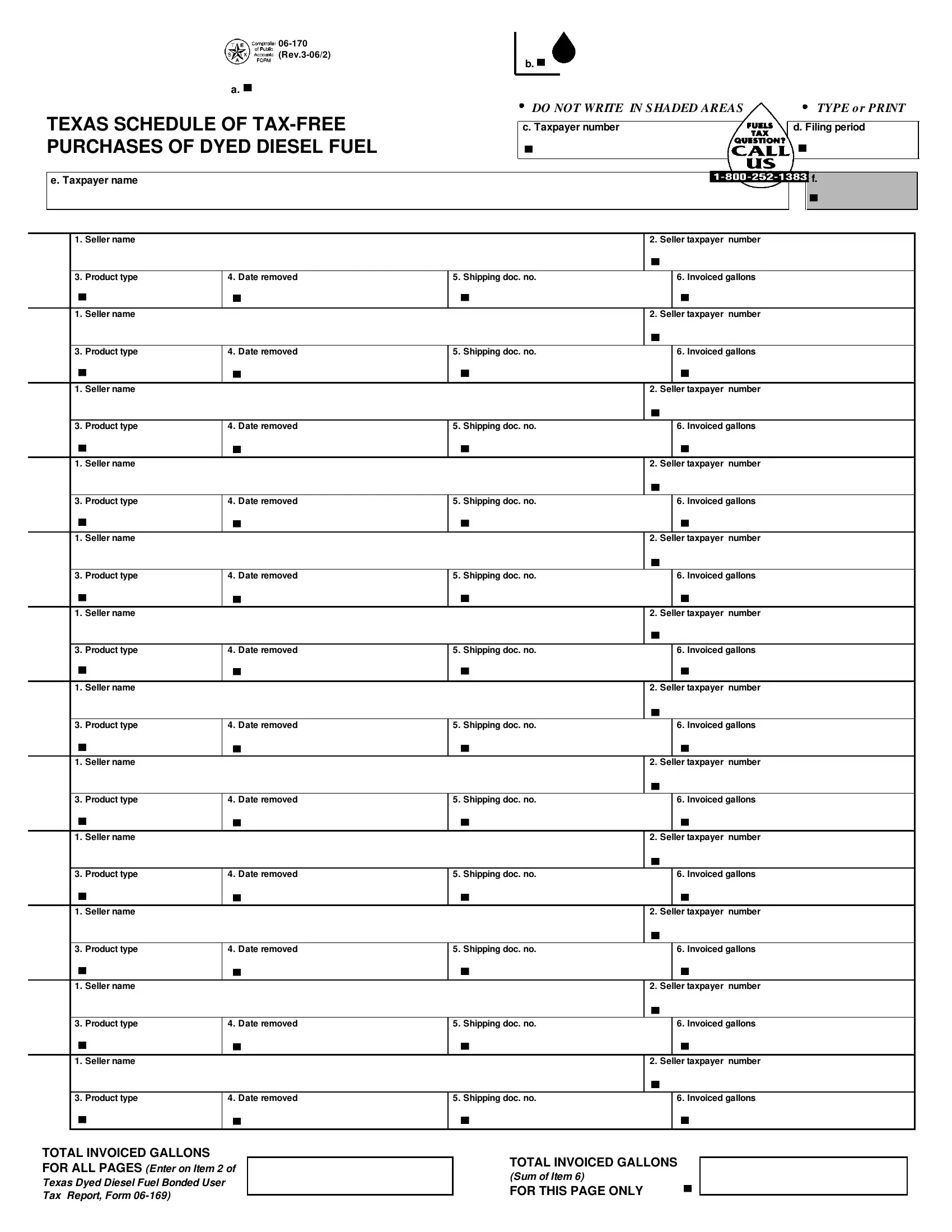

1. Complete the preprinted with a group of necessary blank fields. Get all the necessary information and make certain not a single thing missed!

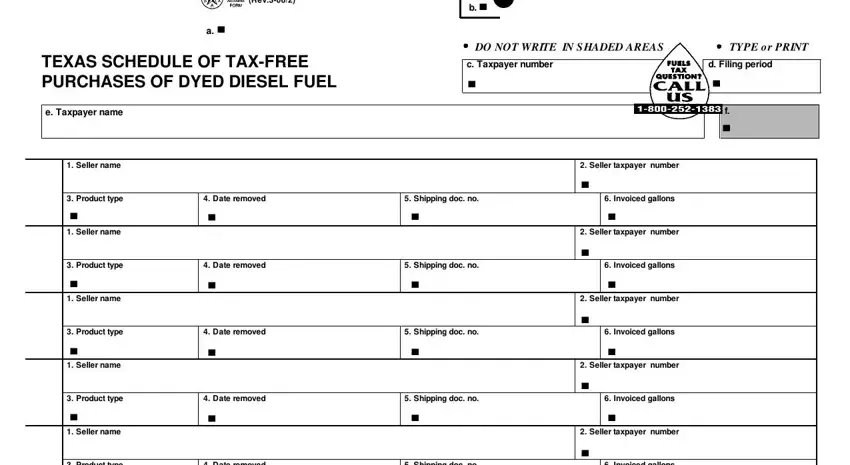

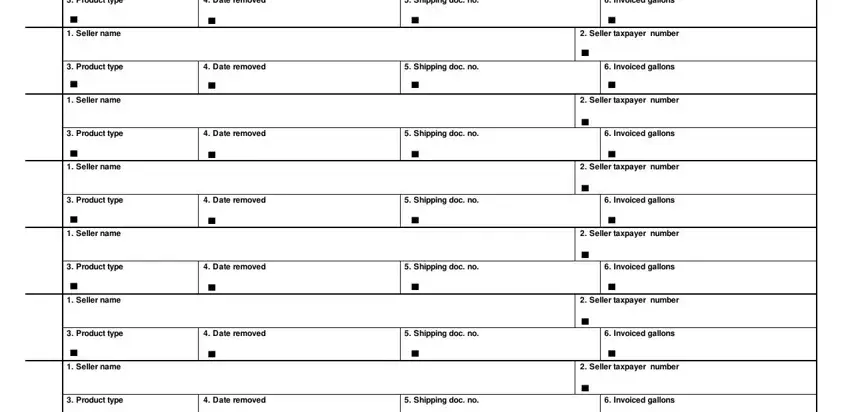

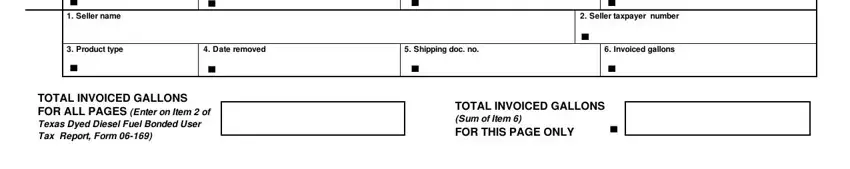

2. The third step is usually to fill out the following blank fields: Product type, Date removed, Shipping doc no, Invoiced gallons, Seller name, Seller taxpayer number, Product type, Date removed, Shipping doc no, Invoiced gallons, Seller name, Seller taxpayer number, Product type, Date removed, and Shipping doc no.

3. The following step is generally pretty uncomplicated, Seller name, Seller taxpayer number, Product type, Date removed, Shipping doc no, Invoiced gallons, TOTAL INVOICED GALLONS FOR ALL, and TOTAL INVOICED GALLONS Sum of Item - every one of these empty fields must be filled in here.

A lot of people generally make mistakes while filling out Date removed in this part. Remember to read again whatever you enter here.

Step 3: You should make sure the information is right and click "Done" to complete the project. After creating a7-day free trial account at FormsPal, you'll be able to download preprinted or send it through email right off. The PDF document will also be at your disposal via your personal account with your every modification. FormsPal guarantees your information confidentiality with a protected system that never records or shares any type of personal information provided. You can relax knowing your paperwork are kept confidential every time you work with our service!