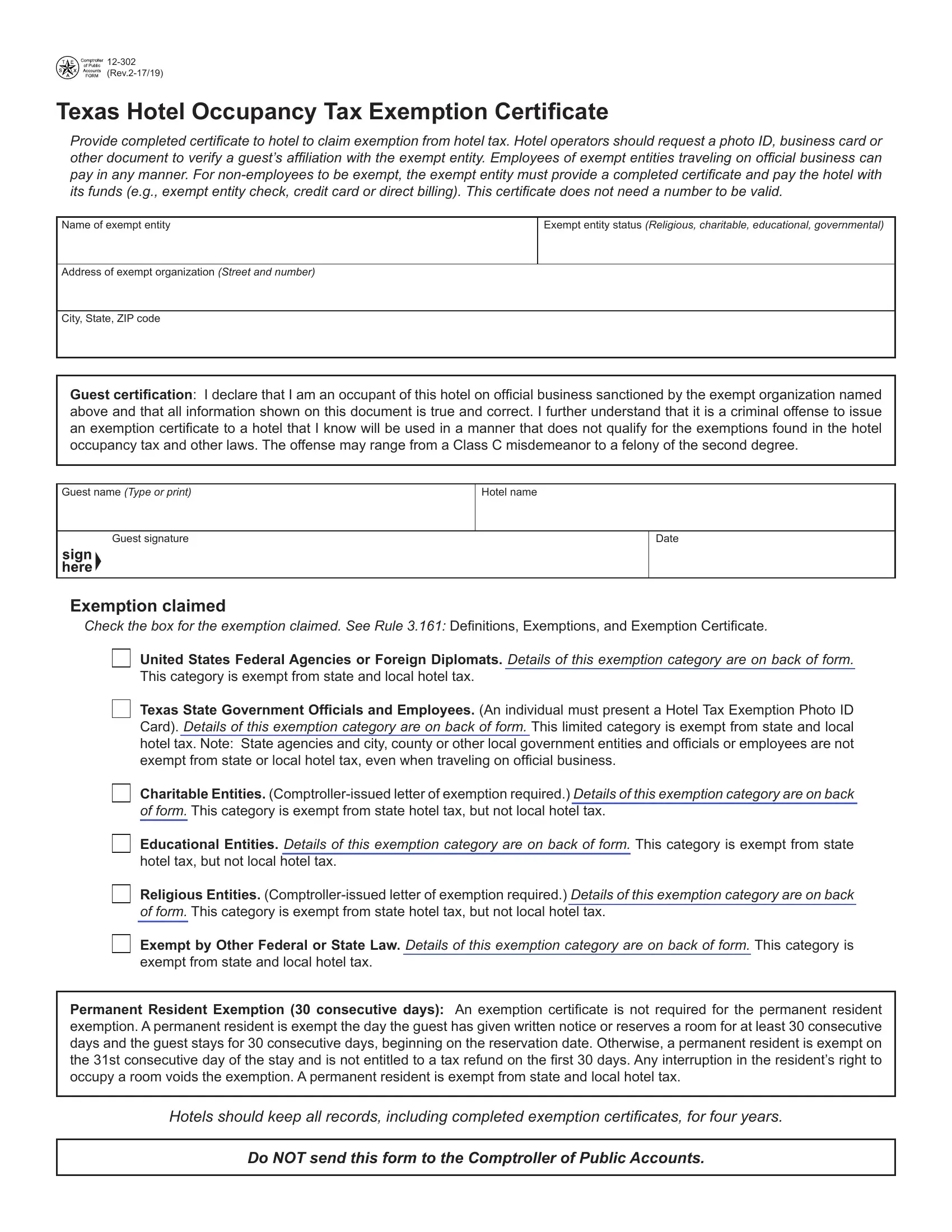

Form 12-302 (Back)(Rev.2-17/19)

Texas Hotel Occupancy Tax Exemptions

See Rule 3.161: Deinitions, Exemptions, and Exemption Certiicate for additional information.

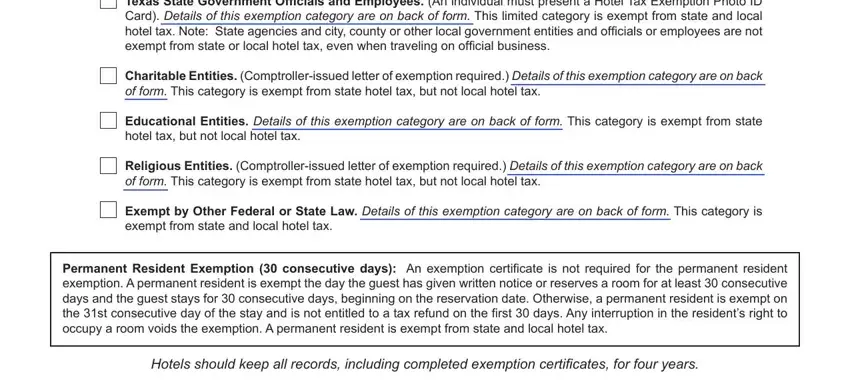

United States Federal Agencies or Foreign Diplomats (exempt from state and local hotel tax)

This exemption category includes the following:

•the United States federal government, its agencies and departments, including branches of the military, federal credit unions, and their employees traveling on oficial business;

•rooms paid by vouchers issued by the American Red Cross and the Federal Emergency Management Agency; and

•foreign diplomats who present a Tax Exemption Card issued by the U.S. Department of State, unless the card speciically excludes hotel occupancy tax.

Federal government contractors are not exempt.

Texas State Government Oficials and Employees (exempt from state and local hotel tax)

This exemption category includes only Texas state oficials or employees who present a Hotel Tax Exemption Photo Identiication Card. State employees without a Hotel Tax Exemption Photo Identiication Card and Texas state agencies are not exempt. (The state employee must pay hotel tax, but their state agency can apply for a refund.)

Charitable Entities (exempt from state hotel tax, but not local hotel tax)

This exemption category includes entities that have been issued a letter of tax exemption as a charitable organization and their employees traveling on oficial business. See website referenced below.

A charitable entity devotes all or substantially all of its activities to the alleviation of poverty, disease, pain and suffering by providing food, clothing, medicine, medical treatment, shelter or psychological counseling directly to indigent or similarly deserving members of society.

Not all 501(c)(3) or nonproit organizations qualify under this category.

Educational Entities (exempt from state hotel tax, but not local hotel tax)

This exemption category includes in-state and out-of-state school districts, private or public elementary, middle and high schools, Texas Regional Education Service Centers and Texas institutions of higher education (see Texas Education Code Section 61.003) and their employees traveling on oficial business.

A letter of tax exemption from the Comptroller of Public Accounts as an educational organization is not required, but an educational organization might have one.

Out-of-state colleges and universities are not exempt.

Religious Organizations (exempt from state hotel tax, but not local hotel tax)

This exemption category includes nonproit churches and their guiding or governing bodies that have been issued a letter of tax exemption from the Comptroller of Public Accounts as a religious organization and their employees traveling on oficial business. See website referenced below.

Exempt by Other Federal or State Law (exempt from state and local hotel tax)

This exemption category includes the following:

•entities exempted by other federal law, such as federal land banks and federal land credit associations and their employees traveling on oficial business; and

•Texas entities exempted by other state law that have been issued a letter of tax exemption from the Comptroller of Public Accounts and their employees traveling on oficial business. See website referenced below. These entities include the following:

•nonproit electric and telephone cooperatives,

•housing authorities,

•housing inance corporations,

•public facility corporations,

•health facilities development corporations,

•cultural education facilities inance corporations, and

•major sporting event local organizing committees.

For Exemption Information