You can fill in false easily by using our online editor for PDFs. Our tool is constantly evolving to provide the very best user experience achievable, and that is thanks to our resolve for constant improvement and listening closely to comments from users. With just several basic steps, you may begin your PDF editing:

Step 1: Click the "Get Form" button above on this page to get into our PDF tool.

Step 2: This tool will let you customize your PDF document in many different ways. Enhance it by writing any text, adjust original content, and add a signature - all doable in no time!

It is easy to complete the document following this helpful tutorial! Here's what you have to do:

1. To get started, once filling in the false, begin with the section that features the subsequent fields:

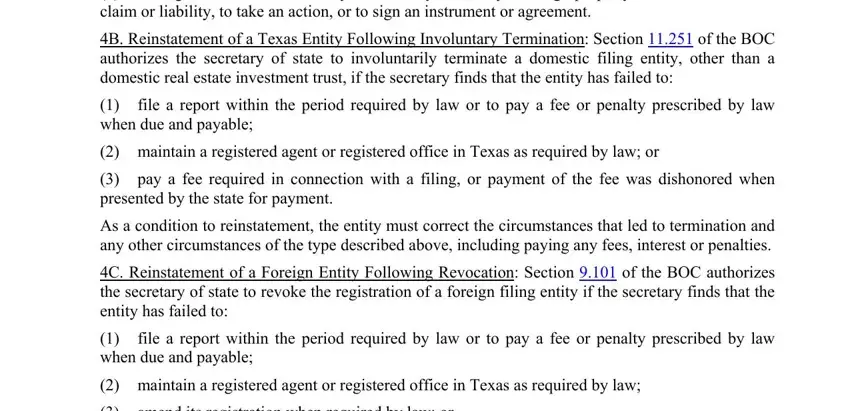

2. Your next stage would be to fill out all of the following fields: the legal existence of the entity, claim or liability to take an, B Reinstatement of a Texas Entity, file a report within the period, when due and payable, maintain a registered agent or, pay a fee required in connection, As a condition to reinstatement, C Reinstatement of a Foreign, file a report within the period, when due and payable, maintain a registered agent or, and amend its registration when.

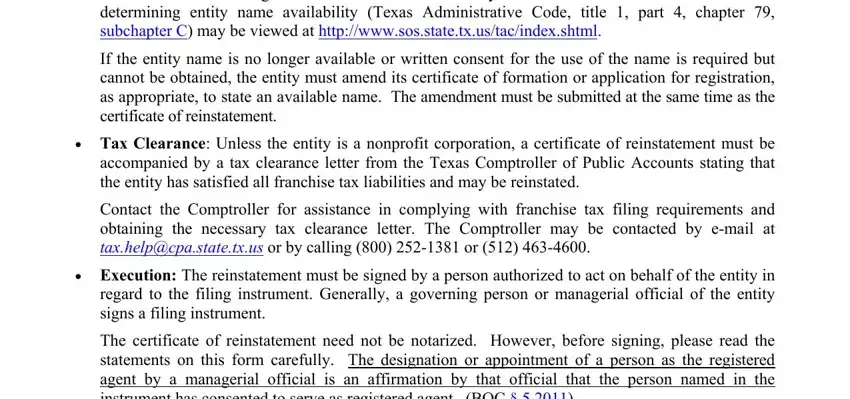

3. Completing Entity Name Availability The, If the entity name is no longer, Tax Clearance Unless the entity, Contact the Comptroller for, Execution The reinstatement must, and The certificate of reinstatement is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Regarding Entity Name Availability The and Execution The reinstatement must, be certain that you review things in this current part. Those two are surely the most important fields in this document.

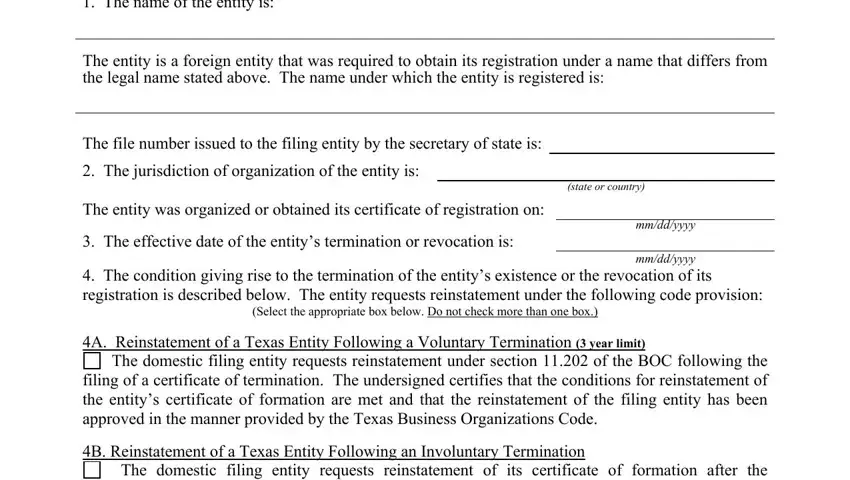

4. Your next part needs your details in the subsequent areas: The name of the entity is, The entity is a foreign entity, The file number issued to the, The jurisdiction of organization, The entity was organized or, The effective date of the entitys, state or country, mmddyyyy, mmddyyyy, The condition giving rise to the, Select the appropriate box below, A Reinstatement of a Texas Entity, The domestic filing entity, B Reinstatement of a Texas Entity, and The domestic filing entity. Ensure you fill out all required details to go forward.

5. This last stage to conclude this PDF form is crucial. You must fill in the appropriate blanks, like C Reinstatement Following, The foreign filing entity requests, and Form, before finalizing. Failing to do this might lead to a flawed and probably unacceptable form!

Step 3: Before finishing the document, make sure that blanks were filled out properly. Once you confirm that it's fine, click “Done." Right after registering a7-day free trial account with us, you'll be able to download false or email it at once. The PDF form will also be accessible in your personal account page with your each and every edit. FormsPal is dedicated to the confidentiality of all our users; we make sure all information used in our tool is secure.