Dealing with PDF forms online can be quite easy using our PDF editor. Anyone can fill out SSN here within minutes. To retain our tool on the cutting edge of convenience, we aim to integrate user-oriented capabilities and enhancements on a regular basis. We're routinely grateful for any feedback - assist us with remolding PDF editing. With just a few easy steps, it is possible to start your PDF journey:

Step 1: Hit the orange "Get Form" button above. It will open our tool so that you could start completing your form.

Step 2: The editor offers the capability to customize most PDF documents in a range of ways. Modify it by writing personalized text, correct what's originally in the PDF, and put in a signature - all at your convenience!

Filling out this form needs thoroughness. Ensure each and every blank is completed accurately.

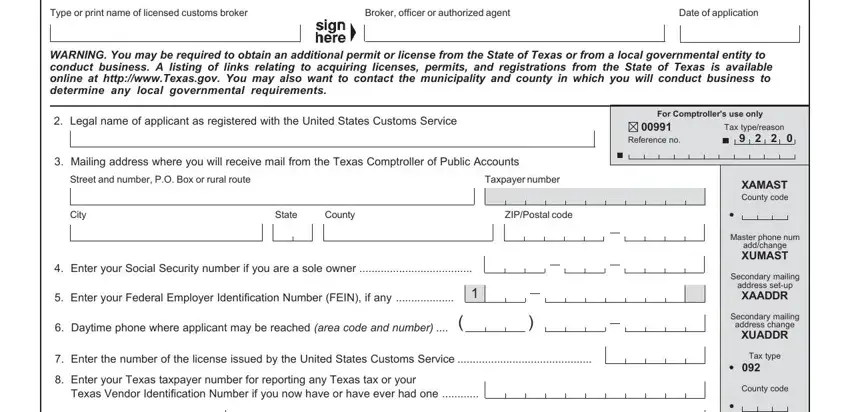

1. It is crucial to fill out the SSN accurately, so be attentive when working with the areas containing all of these fields:

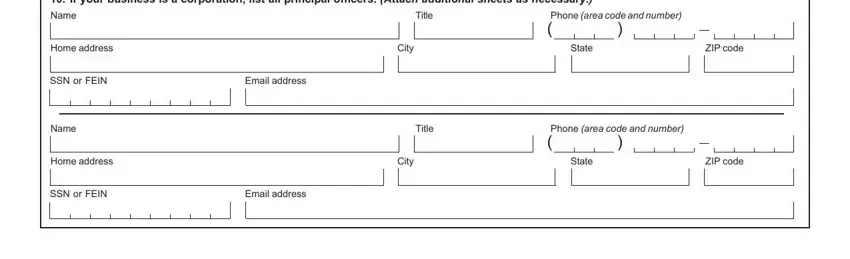

2. Once your current task is complete, take the next step – fill out all of these fields - If your business is a corporation, Name, Home address, SSN or FEIN, Email address, Name, Home address, SSN or FEIN, Email address, Title, City, Title, City, Phone area code and number, and State with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Many people frequently make errors when filling in City in this section. You should review whatever you type in here.

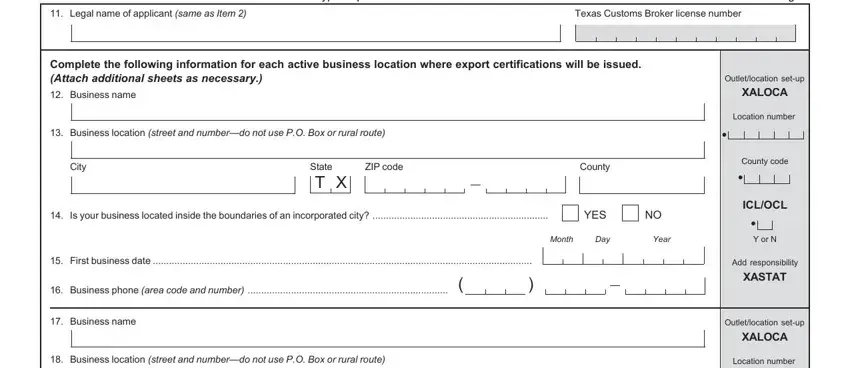

3. The next step will be hassle-free - complete all of the fields in cid Please read instructions, cid Type or print, cid Do NOT write in shaded areas, Page, Legal name of applicant same as, Texas Customs Broker license number, Complete the following information, Business name, Business location street and, City, ZIP code, State T X, County, Is your business located inside, and YES in order to finish this process.

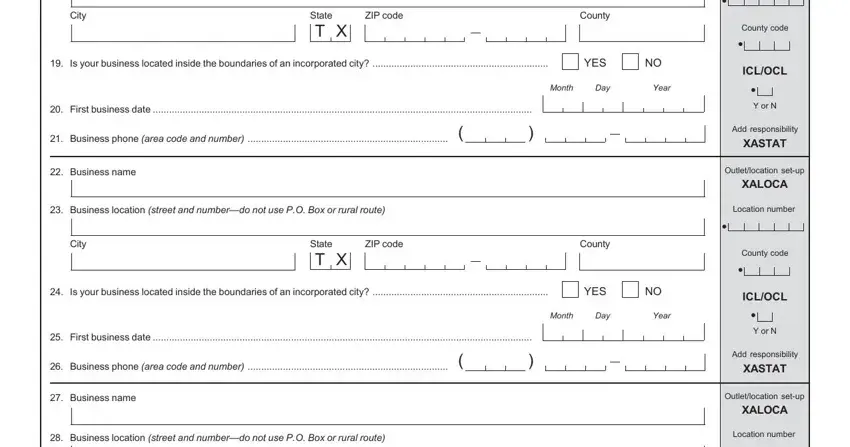

4. Your next part needs your information in the following places: City, ZIP code, State T X, County, Is your business located inside, YES, Month, Day, Year, First business date, Business phone area code and, Business name, Business location street and, City, and ZIP code. Always type in all requested information to go further.

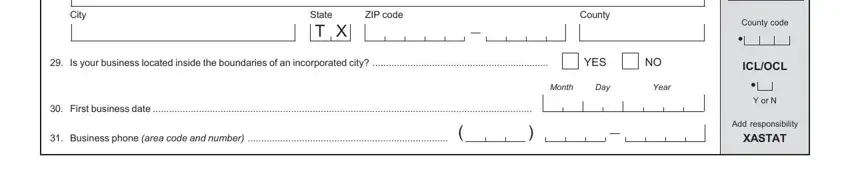

5. This form needs to be completed by going through this area. Here there's a full listing of form fields that require accurate information in order for your form submission to be accomplished: City, ZIP code, State T X, County, Is your business located inside, YES, Month, Day, Year, First business date, Business phone area code and, cid, County code, cid, and ICLOCL.

Step 3: Once you've looked over the details entered, simply click "Done" to finalize your FormsPal process. After starting a7-day free trial account with us, you'll be able to download SSN or email it right off. The PDF document will also be readily accessible through your personal account page with all of your modifications. With FormsPal, you can certainly fill out forms without having to be concerned about database incidents or data entries being shared. Our secure software helps to ensure that your private information is stored safe.