Division of Taxation |

|

120 SE 10th Ave |

Phone: 785-368-8222 |

PO Box 3506 |

Fax: 785-296-2703 |

Topeka, KS 66625-3506 |

www.ksrevenue.org |

Mark A. Burghart, Secretary |

Laura Kelly, Governor |

RE: Renewal of Tobacco Product Distributor’s License

Tobacco Product Distributor's Licenses expire on December 31. If your payment is received after December 31, you will be assessed a penalty of 100% of the license fee. The license fee is $25 for each license. Your license will not be issued if there is a balance on your account, there are non-filed periods, or you do not have an active bond.

You may renew your license online at www.kdor.ks.gov/Apps/kcsc/login.aspx, please see the instructions below. You may also renew your license by mail to Cigarette and Tobacco, PO Box 750680, Topeka, KS 66625-0680. Make your check payable to KDOR. Please indicate in the memo or description portion of your check, "Tobacco Renewal".

The monthly tobacco report forms are available for download at http://ksrevenue.org/bustaxtypescig.html. Your license will not be issued if there is a balance due or non-filed period(s) on your account.

As per K.S.A. 79-3373, “…A person outside this state who ships or transports tobacco products to retailers in this state, to be sold by those retailers, may make application for license as a distributor, be granted such a license by the director and thereafter be subject to all the provisions of this act and entitled to act as a licensed distributor if the person files with the application proof that the person has appointed the secretary of state as the person's agent for service of process relating to any matter or issue arising under this act.” If your company has not already appointed the Secretary of State for service of process, please download form TB-144 from our website. The cost for filing is $15.00 payable to the Secretary ofState.

If you have not previously renewed online follow the instructions below:

If you are not registered to use the “Customer Service Center”, click on “Register Now.” After completing the required information, click on “Register” and then “Continue.” Then select “Account Management.”

If you are already registered to use the “Customer Service Center”, click on “Log In” and sign in using your User ID and Password. Click on the “Business account” link. Then select “Add an account to this login.”

At this point, you will enter the FEIN (Federal Employers Identification Number) or [SSN (Social Security Number) if you do not have a FEIN] in the “Identification Number” field. Enter your Access Code and select “Continue.” To obtain an “Access Code” contact Cigarette and Tobacco at the phone number below.

To renew your license(s):

1.Select the link for “Your License List.”

2.Select the link for “View/Renew” next to the license you wish torenew.

3.Verify license information, read the statement at the bottom of the screen, and click the “I Agree” box. Then, select “Continue.”

4.Repeat steps 3 and 4 for each license to be renewed. When finished, click“Continue.”

5.To submit and pay for the renewal(s), select the link for “Submit applications and pay fees.” Follow the instructions on the screen.

If you have any questions or need additional assistance, please contact our office at 785-368-8222, choose option 5, option 4 and option 1 from 8 a.m. to 4:45 p.m., Monday through Friday, or email us at: kdor_cigtob@ks.gov, or if needing forms visit our website at: http://www.ksrevenue.org/bustaxtypescig.html

KANSAS DEPARTMENT OF REVENUE |

484518 |

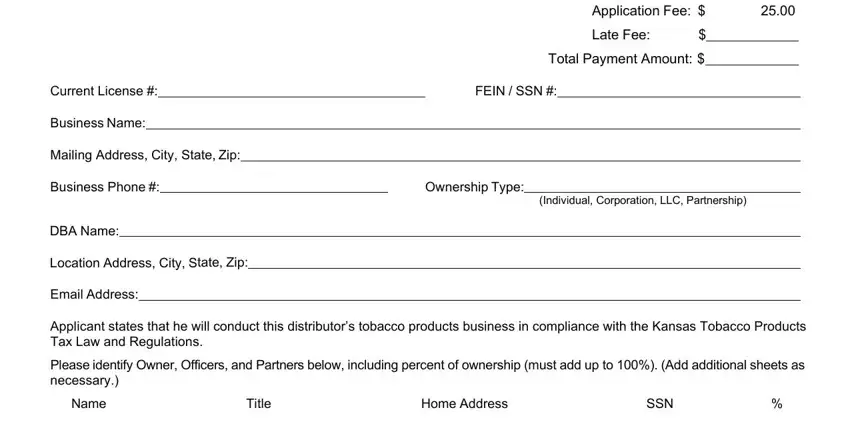

TOBACCO PRODUCT DISTRIBUTOR'S RENEWAL APPLICATION 2022

Application Fee: $ |

25.00 |

Late Fee: |

$ |

|

Total Payment Amount: $

Current License #: |

|

FEIN / SSN #: |

Business Name:

Mailing Address, City, State, Zip:

Business Phone #: |

|

Ownership Type: |

(Individual, Corporation, LLC, Partnership)

DBA Name:

Location Address, City, State, Zip:

Email Address:

Applicant states that he will conduct this distributor’s tobacco products business in compliance with the Kansas Tobacco Products Tax Law and Regulations.

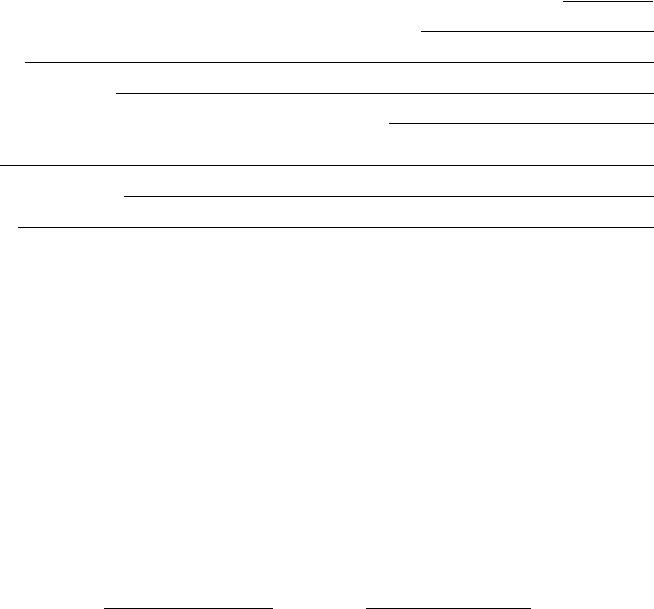

Please identify Owner, Officers, and Partners below, including percent of ownership (must add up to 100%). (Add additional sheets as necessary.)

Name |

Title |

Home Address |

SSN |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

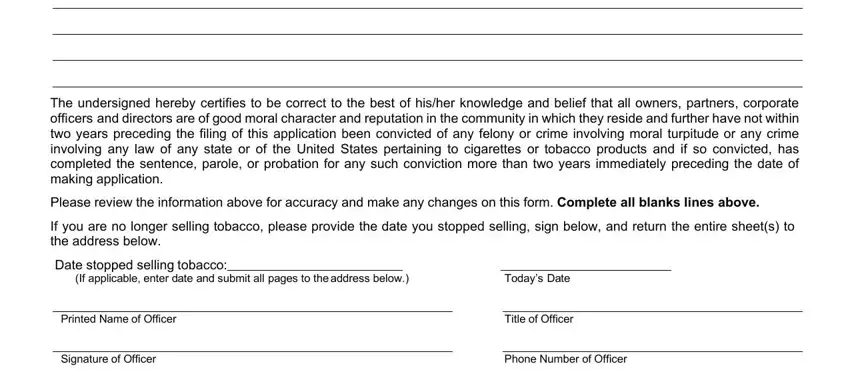

The undersigned hereby certifies to be correct to the best of his/her knowledge and belief that all owners, partners, corporate officers and directors are of good moral character and reputation in the community in which they reside and further have not within two years preceding the filing of this application been convicted of any felony or crime involving moral turpitude or any crime involving any law of any state or of the United States pertaining to cigarettes or tobacco products and if so convicted, has completed the sentence, parole, or probation for any such conviction more than two years immediately preceding the date of making application.

Please review the information above for accuracy and make any changes on this form. Complete all blanks lines above.

If you are no longer selling tobacco, please provide the date you stopped selling, sign below, and return the entire sheet(s) to the address below.

Date stopped selling tobacco:

(If applicable, enter date and submit all pages to theaddress below.) |

|

Today’s Date |

|

|

|

Printed Name of Officer |

|

Title of Officer |

|

|

|

Signature of Officer |

|

Phone Number of Officer |

Submit this application and total payment amount to the KDOR Cigarette and Tobacco, PO Box 750680, Topeka, KS 66625-0680. Make your check payable to KDOR.

If you have any questions or need additional assistance, please contact our office at 785-368-8222, choose option 5, option 4 and option 1 from 8 a.m. to 4:45 p.m., Monday through Friday, and email us at: kdor_cigtob@ks.gov, or if needing forms visit our website at: http://www.ksrevenue.org/bustaxtypescig.html