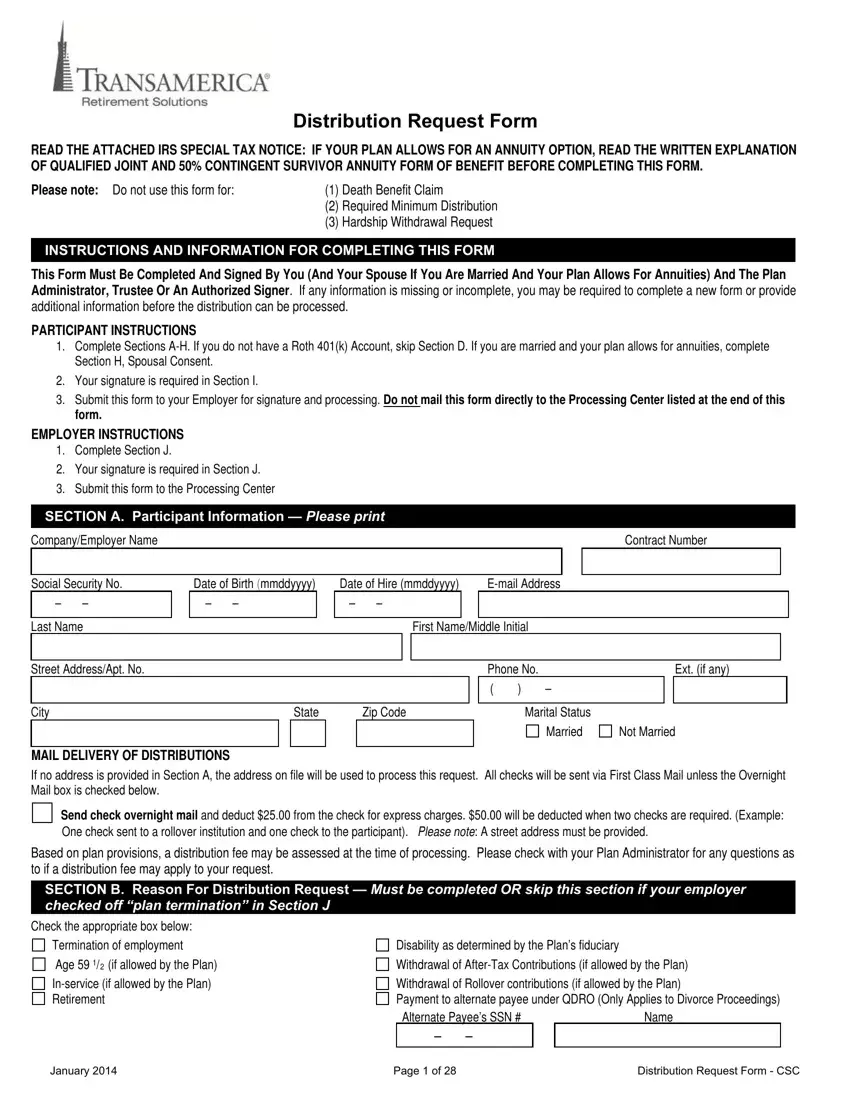

Distribution Request Form

READ THE ATTACHED IRS SPECIAL TAX NOTICE: IF YOUR PLAN ALLOWS FOR AN ANNUITY OPTION, READ THE WRITTEN EXPLANATION OF QUALIFIED JOINT AND 50% CONTINGENT SURVIVOR ANNUITY FORM OF BENEFIT BEFORE COMPLETING THIS FORM.

Please note: Do not use this form for: |

(1) |

Death Benefit Claim |

|

(2) |

Required Minimum Distribution |

|

(3) |

Hardship Withdrawal Request |

INSTRUCTIONS AND INFORMATION FOR COMPLETING THIS FORM

This Form Must Be Completed And Signed By You (And Your Spouse If You Are Married And Your Plan Allows For Annuities) And The Plan Administrator, Trustee Or An Authorized Signer. If any information is missing or incomplete, you may be required to complete a new form or provide additional information before the distribution can be processed.

PARTICIPANT INSTRUCTIONS

1.Complete Sections A-H. If you do not have a Roth 401(k) Account, skip Section D. If you are married and your plan allows for annuities, complete Section H, Spousal Consent.

2.Your signature is required in Section I.

3.Submit this form to your Employer for signature and processing. DoUnot mailUthis form directly to the Processing Center listed at the end of this form.

EMPLOYER INSTRUCTIONS

1.Complete Section J.

2.Your signature is required in Section J.

3.Submit this form to the Processing Center

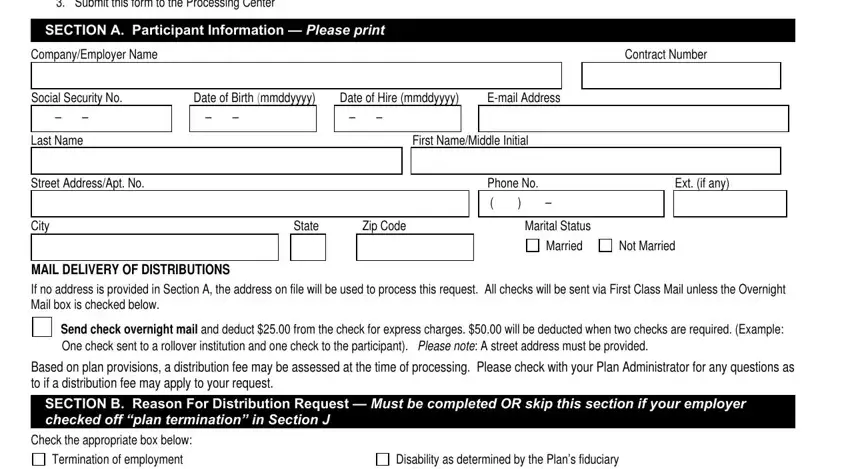

SECTION A. Participant Information — Please print

Company/Employer Name |

|

Contract Number |

|

|

|

Social Security No.

– –

Last Name

Date of Birth (mmddyyyy)

– –

Date of Hire (mmddyyyy) |

|

E-mail Address |

– |

– |

|

|

|

|

|

|

First Name/Middle Initial

Street Address/Apt. No. |

|

|

|

|

|

|

Phone No. |

|

|

Ext. (if any) |

|

|

|

|

|

|

|

( |

) |

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

Zip Code |

|

Marital Status |

|

|

|

|

|

|

|

|

|

|

|

|

Married |

Not Married |

|

|

|

|

|

|

|

|

|

|

|

|

|

MAIL DELIVERY OF DISTRIBUTIONS

If no address is provided in Section A, the address on file will be used to process this request. All checks will be sent via First Class Mail unless the Overnight Mail box is checked below.

Send check overnight mail and deduct $25.00 from the check for express charges. $50.00 will be deducted when two checks are required. (Example: One check sent to a rollover institution and one check to the participant). Please note: A street address must be provided.

Based on plan provisions, a distribution fee may be assessed at the time of processing. Please check with your Plan Administrator for any questions as to if a distribution fee may apply to your request.

SECTION B. Reason For Distribution Request — Must be completed OR skip this section if your employer checked off “plan termination” in Section J

Check the appropriate box below:

Termination of employment

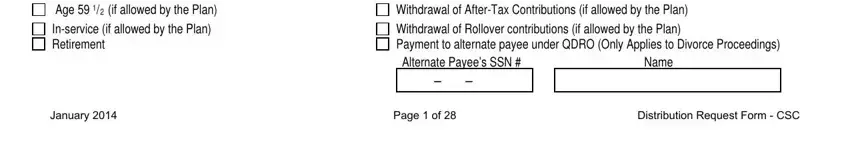

Age 59 1P /P R2R (if allowed by the Plan)

In-service (if allowed by the Plan) Retirement

Disability as determined by the Plan’s fiduciary

Withdrawal of After-Tax Contributions (if allowed by the Plan)

Withdrawal of Rollover contributions (if allowed by the Plan)

Payment to alternate payee under QDRO (Only Applies to Divorce Proceedings)

Alternate Payee’s SSN # |

Name |

– –

January 2014 |

Page 1 of 28 |

Distribution Request Form - CSC |

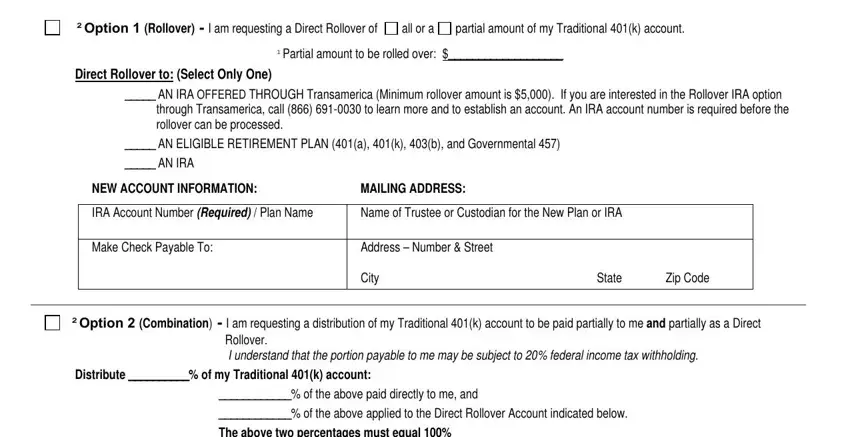

SECTION C. Form of Payment For Traditional 401(k) Account - Only choose one of the three options

SECTION C. Form of Payment For Traditional 401(k) Account - Only choose one of the three options

²Option 1 (Rollover) - I am requesting a Direct Rollover of

partial amount of my Traditional 401(k) account.

¹Partial amount to be rolled over: $___________________

Direct Rollover to: (Select Only One)

_____ AN IRA OFFERED THROUGH Transamerica (Minimum rollover amount is $5,000). If you are interested in the Rollover IRA option

through Transamerica, call (866) 691-0030 to learn more and to establish an account. An IRA account number is required before the rollover can be processed.

_____ AN ELIGIBLE RETIREMENT PLAN (401(a), 401(k), 403(b), and Governmental 457)

_____ AN IRA

|

NEW ACCOUNT INFORMATION: |

MAILING ADDRESS: |

|

|

|

|

|

|

|

|

|

IRA Account Number (Required) / Plan Name |

Name of Trustee or Custodian for the New Plan or IRA |

|

|

|

|

|

|

|

|

|

Make Check Payable To: |

Address – Number & Street |

|

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

²Option 2 (Combination) - I am requesting a distribution of my Traditional 401(k) account to be paid partially to me and partially as a Direct Rollover.

I understand that the portion payable to me may be subject to 20% federal income tax withholding.

Distribute __________% of my Traditional 401(k) account:

____________% of the above paid directly to me, and

____________% of the above applied to the Direct Rollover Account indicated below.

The above two percentages must equal 100%

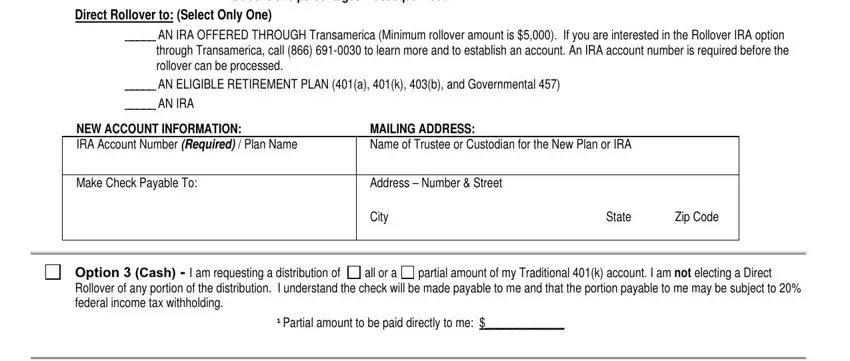

Direct Rollover to: (Select Only One)

_____ AN IRA OFFERED THROUGH Transamerica (Minimum rollover amount is $5,000). If you are interested in the Rollover IRA option

through Transamerica, call (866) 691-0030 to learn more and to establish an account. An IRA account number is required before the rollover can be processed.

_____ AN ELIGIBLE RETIREMENT PLAN (401(a), 401(k), 403(b), and Governmental 457)

_____ AN IRA

NEW ACCOUNT INFORMATION: |

MAILING ADDRESS: |

IRA Account Number (Required) / Plan Name |

Name of Trustee or Custodian for the New Plan or IRA |

Address – Number & Street

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

Option 3 (Cash) - I am requesting a distribution of |

all or a |

partial amount of my Traditional 401(k) account. I am not electing a Direct |

Rollover of any portion of the distribution. I understand the check will be made payable to me and that the portion payable to me may be subject to 20% federal income tax withholding.

¹Partial amount to be paid directly to me: $_____________

¹Actual Value of the distribution may vary based on the final market closing price at the time the distribution is processed, and any applicable processing fees.

PARTIAL DISTRIBUTION AMOUNTS -I understand that if I choose a partial amount in the options above, I am responsible for ensuring that partial distributions are completed by the shorter of my life expectancy or 15 years after the first partial distribution is made to me, as required by the Plan. I also understand that if I choose this option I may lose favorable tax treatment on my distributions

²DIRECT ROLLOVER

In a Direct Rollover, an eligible rollover distribution is paid from your retirement plan directly to an IRA or your new Employer's 401(a), 401(k), 403(b) or governmental 457 Plan. An IRS Form 1099-R will still be completed and submitted to the IRS; however, no federal or state income tax is withheld from amounts directly rolled over. The Direct Rollover check will be made payable to the IRA/plan trustee or custodian for the benefit of the participant or alternate payee unless otherwise indicated above.

January 2014 |

Page 2 of 28 |

Distribution Request Form - CSC |

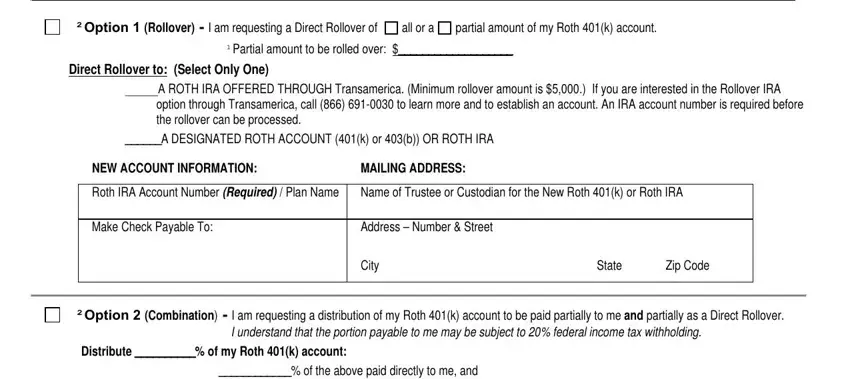

SECTION D. Form of Payment For A Roth 401(k) Account – Complete only if your plan allows for Roth Contributions. Only choose one of the three options

²Option 1 (Rollover) - I am requesting a Direct Rollover of

partial amount of my Roth 401(k) account.

¹Partial amount to be rolled over: $___________________

Direct Rollover to: (Select Only One)

_____A ROTH IRA OFFERED THROUGH Transamerica. (Minimum rollover amount is $5,000.) If you are interested in the Rollover IRA

option through Transamerica, call (866) 691-0030 to learn more and to establish an account. An IRA account number is required before the rollover can be processed.

______A DESIGNATED ROTH ACCOUNT (401(k) or 403(b)) OR ROTH IRA

NEW ACCOUNT INFORMATION: |

MAILING ADDRESS: |

|

|

Roth IRA Account Number (Required) / Plan Name |

Name of Trustee or Custodian for the New Roth 401(k) or Roth IRA |

Address – Number & Street

²Option 2 (Combination) - I am requesting a distribution of my Roth 401(k) account to be paid partially to me and partially as a Direct Rollover.

I understand that the portion payable to me may be subject to 20% federal income tax withholding.

Distribute __________% of my Roth 401(k) account:

____________% of the above paid directly to me, and

____________% of the above applied to the Direct Rollover Account indicated below.

The above two percentages must equal 100%

Direct Rollover to: (Select Only One)

_____ A ROTH IRA OFFERED THROUGH Transamerica. (Minimum rollover amount is $5,000.) If you are interested in the Rollover IRA

option through Transamerica, call (866) 691-0030 to learn more and to establish an account. An IRA account is required before the rollover can be processed.

_____ A DESIGNATED ROTH ACCOUNT (401(k) or 403(b)) OR ROTH IRA

NEW ACCOUNT INFORMATION: |

MAILING ADDRESS: |

IRA Account Number (Required) / Plan Name |

Name of Trustee or Custodian for the New Plan or IRA |

Address – Number & Street

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

Option 3 (Cash) - I am requesting a distribution of |

all or a |

partial amount of my Roth 401(k) account. I am not electing a Direct Rollover of |

any portion of the distribution. I understand the check will be made payable to me and that the portion payable to me may be subject to 20% federal income tax withholding.

¹Partial amount to be paid directly to me: $___________

¹Actual Value of the distribution may vary based on the final market closing price at the time the distribution is processed, and any applicable processing fees.

DISTRIBUTION AMOUNTS -I understand that if I choose a partial amount in the options above, I am responsible for ensuring that partial distributions are completed by the shorter of my life expectancy or 15 years after the first partial distribution is made to me, as required by the Plan. I also understand that if I choose this option I may lose favorable tax treatment on my distributions

²DIRECT ROLLOVER

In a Direct Rollover, an eligible rollover distribution is paid from your retirement plan directly to an IRA or your new Employer's 401(a), 401(k), 403(b) or governmental 457 Plan. An IRS Form 1099-R will still be completed and submitted to the IRS; however, no federal or state income tax is withheld from amounts directly rolled over. The Direct Rollover check will be made payable to the IRA/plan trustee or custodian for the benefit of the participant or alternate payee unless otherwise indicated above.

For participants required to take a minimum distribution during the current year that was not satisfied, please note the following: Your required minimum distribution (RMD) for the current year will need to be completed and made payable to you prior to the processing of your direct rollover request.

January 2014 |

Page 3 of 28 |

Distribution Request Form - CSC |

SECTION E. Annuity Request (Not applicable to vested account under $5000 or if your plan does not offer annuities)

Skip this section if you made an election in Section C or D.

By selecting this option your entire account balance will be distributed in order to purchase the annuity

Annuity: If the plan offers annuities as a form of benefit payment, I elect payment as a monthly annuity with payments to commence ___________________.

Upon my death, my spouse’s payments should be _____% (from 50% to 100%) of my payments. My spouse’s date of birth is _________________. Such

annuity will be a Joint and Contingent Survivor Annuity if I am married and a Single Life Annuity if I am not married. I also understand that if I am married, my spouse need not consent to this election if I choose a Qualified Joint and Contingent Survivor Annuity (“QJSA”).

SECTION F. Outstanding Loan Payoff Instructions — Skip this section if you do not have an outstanding loan or are requesting an In-Service Withdrawal, Withdrawal of After Tax Contributions, 591/2 Withdrawal or a QDRO.

One of the following will occur if you have an outstanding loan amount and your reason for a distribution request in Section B is for Termination of Employment, Disability or a Retirement Benefit.

♦Your Loan will be considered paid in full if you have submitted your payment for the outstanding loan amount to your employer or have attached a money order or cashier’s check to this form.

♦Your outstanding loan balance will default and become taxable to you if Transamerica receives this form and your payment has not been received and processed.

SECTION G. Income Tax Withholding

The income tax withholding requirements vary depending on whether or not the distribution requested is an eligible rollover distribution. Please see the attached Special Tax Notice for the definition of eligible rollover distribution and a detailed explanation of the federal income tax withholding rules. If you request a Direct Rollover, no federal income tax will be withheld from the amount directly rolled over.

FEDERAL INCOME TAX

Eligible Rollover Distributions:

•If you request a Direct Rollover, no federal income tax will be withheld from the amount directly rolled over.

•If you request any portion that is an Eligible Rollover Distribution and payable to you: 20% mandatory federal income tax withholding will apply if the taxable amount of the distribution is more than $200 unless paid over 10 or more years.

STATE INCOME TAX

If your address of record is within a mandatory withholding state, state taxes will be withheld from your distribution in accordance with the respective state rules. Other states allow an independent election and in these states, state tax will be withheld unless you elect otherwise. If your state does not allow withholding, no state tax can be withheld. Please consult a tax advisor or Transamerica if you have questions regarding state tax withholding.

Do not withhold state income tax (ONLY IF INDEPENDENT ELECTION IS PERMITTED).

Withhold state income tax:__________% (If your state requires a greater withholding percentage than what you have indicated, the mandatory state

tax will apply).

SECTION H. Spousal Consent

Check with your Employer/Plan Administrator or Summary Plan Description to determine whether your plan is subject to spousal consent requirements. If spousal consent is required, complete this section. If your plan is not subject to spousal consent requirements, skip to Section I. Please note: You must have your spouse’s signature notarized or have a plan representative witness your spouse’s signature if your vested account balance is greater than $5,000 and your plan provides for joint and survivor annuities. However, if your vested account balance is less than $5,000 spousal consent is not required.

Spousal Consent

I, the undersigned spouse of the participant, have read the “Special Tax Notice Regarding Payments From Qualified Plans” provided to me and understand the effects of the waiver. I understand that federal law requires that the retirement benefit of my spouse must be paid under a Qualified Joint and Survivor Annuity Form as described in the attached “Special Tax Notice Regarding Payments From Qualified Plans,” unless I consent otherwise in writing to another benefit form. I hereby consent to the waiver of the annuity and consent to the form of benefit elected by my spouse.

Signature of Participant’s Spouse: |

|

Date: |

|

|

|

Statement of Plan Representative or Notary Public |

The spouse whose signature I have witnessed is known to me and signed this form in my presence. |

Plan Representative: |

|

|

Date: |

Notary Public Signature: |

|

|

Date: |

PLACE SEAL HERE (if applicable)

January 2014 |

Page 4 of 28 |

Distribution Request Form - CSC |

SECTION I. Participant Signature

SECTION I. Participant Signature

My signature acknowledges that I have read, understand and agree to all the terms of this Distribution Request form, and affirm that all information that I have provided is true and correct. Further, I acknowledge that I have received the “Special Tax Notice Regarding Payments From Qualified Plans” and other required notices. The above information is true and correct to the best of my knowledge. I further understand that I may revoke this election at any time prior to the distribution taking place.

Signature of Participant |

Date |

PARTICIPANT: RETURN COMPLETED FORM TO YOUR PLAN ADMINISTRATOR FOR PROCESSING

Section J. For Completion by Plan Administrator, Trustee Or Authorized Signer Only

Section J. For Completion by Plan Administrator, Trustee Or Authorized Signer Only

Plan Name

Contract Number |

Sub ID/Division # (if applicable) |

Participant’s SSN # |

– –

Participant’s Termination Date (if applicable):

– –

The Participant is entitled to a vested benefit of% of company matching contributions.

The Participant is entitled to a vested benefit of _______________________% of profit sharing contributions.

The Number of hours worked in the Plan Year of Termination: __________________

Please refer to your Plan Document for the vesting schedule. If this information is not provided, the distribution will be processed with the data in Transamerica’s recordkeeping system.

Is payment of this benefit subject to Plan Termination?

By signing below, I hereby authorize Transamerica to process the distribution described in this form. This request is in compliance with plan provisions.

If spousal consent is not provided, then in accordance with the terms and provisions of the plan and under the current law, spousal consent is not required for payment of the requested benefit.

If this request is for a disability distribution, I certify that the participant meets the requirements of Section 72(m)(7).

Only submit this form after final contributions and loan repayments have been processed for termination distributions

Once this form has been completed with all of the necessary information and required signatures, please forward to the Processing Center. This form cannot be processed without the Plan Administrator, Trustee or Authorized Signer’s signature.

Be sure to keep a copy for your records.

By: Signature of Plan Administrator, Trustee or Authorized Signer |

|

Date |

|

|

|

|

Print Name of Plan Administrator, Trustee or Authorized Signer |

|

Date |

FOR PLAN ADMINISTRATOR USE ONLY - MAIL TO: 8488 Shepherd Farm Drive, West Chester, OH 45069,Fax #: (877) 449-4443

January 2014 |

Page 5 of 28 |

Distribution Request Form - CSC |

SPECIAL TAX NOTICE

REGARDING PAYMENTS FROM QUALIFIED PLANS

YOUR ROLLOVER OPTIONS

You are receiving this notice because all or a portion of a payment you are receiving from your Employer’s plan (the "Plan") is eligible to be rolled over to an IRA, a Roth IRA, an employer plan, or a designated Roth account in an employer plan. This notice is intended to help you decide whether to do a rollover.

This notice describes the rollover rules that apply to two types of payments that you may be eligible to receive from the Plan: payments that are from a designated Roth account and payments that are not from a designated Roth account. A designated Roth account is a type of account with special tax rules that is available in some employer plans. If you are eligible to receive payments from the Plan that are from a designated Roth account and payments that are not from such an account, the Plan administrator or the payor will tell you the amount that is being paid from each account.

Rules that apply to most payments from a plan are described in the "General Information About Rollovers" section. In addition, additional rules that apply to most payments from a designated Roth account are described in the "General Information About Rollovers From A Designated Roth Account" section. Special rules that only apply in certain circumstances are described in the "Special Rules and Options" section.

Your Right to Waive the 30-Day Notice Period

Generally, neither a Direct Rollover nor a payment can be made from the plan until at least 30 days after your receipt of this notice. Thus, after receiving this notice, you have at least 30 days to consider whether or not to have your withdrawal directly rolled over. If you do not wish to wait until this 30-day notice period ends before your election is processed, you may waive the notice period by making an affirmative election indicating whether or not you wish to make a Direct Rollover. Your withdrawal will then be processed in accordance with your election as soon as practical after it is received by the Plan Administrator.

GENERAL INFORMATION ABOUT ROLLOVERS

How can a rollover affect my taxes?

You will be taxed on a payment from the Plan if you do not roll it over. If you are under age 59 1/2 and do not do a rollover, you will also have to pay a 10% additional income tax on early distributions (unless an exception applies). However, if you do a rollover, you will not have to pay tax until you receive payments later and the 10% additional income tax will not apply if those payments are made after you are age 59 1/2 (or if an exception applies).

Where may I roll over the payment?

You may roll over the payment to either an IRA (an individual retirement account or individual retirement annuity) or an employer plan (a tax-qualified plan, section 403(b) plan, or governmental section 457(b) plan) that will accept the rollover. The rules of the IRA or employer plan that holds the rollover will determine your investment options, fees, and rights to payment from the IRA or employer plan (for example, no spousal consent rules apply to IRAs and IRAs may not provide loans). Further, the amount rolled over will become subject to the tax rules that apply to the IRA or employer plan.

January 2014 |

Page 6 of 28 |

Distribution Request Form - CSC |

How do I do a rollover?

There are two ways to do a rollover. You can do either a direct rollover or a 60-day rollover.

If you do a direct rollover, the Plan will make the payment directly to your IRA or an employer plan. You should contact the IRA sponsor or the administrator of the employer plan for information on how to do a direct rollover.

If you do not do a direct rollover, you may still do a rollover by making a deposit into an IRA or eligible employer plan that will accept it. You will have 60 days after you receive the payment to make the deposit. If you do not do a direct rollover, the Plan is required to withhold 20% of the payment for federal income taxes (up to the amount of cash and property received other than employer stock). This means that, in order to roll over the entire payment in a 60-day rollover, you must use other funds to make up for the 20% withheld. If you do not roll over the entire amount of the payment, the portion not rolled over will be taxed and will be subject to the 10% additional income tax on early distributions if you are under age 59 1/2 (unless an exception applies).

How much may I roll over?

If you wish to do a rollover, you may roll over all or part of the amount eligible for rollover. Any payment from the Plan is eligible for rollover, except:

●Certain payments spread over a period of at least 10 years or over your life or life expectancy (or the lives or joint life expectancy of you and your beneficiary)

●Required minimum distributions after age 70 1/2 (or after death)

●Hardship distributions

●ESOP dividends

●Corrective distributions of contributions that exceed tax law limitations

●Loans treated as deemed distributions (for example, loans in default due to missed payments before your employment ends)

●Cost of life insurance paid by the Plan

●Contributions made under special automatic enrollment rules that are withdrawn pursuant to your request within 90 days of enrollment

●Amounts treated as distributed because of a prohibited allocation of S corporation stock under an ESOP (also, there will generally be adverse tax consequences if you roll over a distribution of S corporation stock to an IRA).

The Plan administrator or the payor can tell you what portion of a payment is eligible for rollover.

If I don't do a rollover, will I have to pay the 10% additional income tax on early distributions?

If you are under age 59 1/2, you will have to pay the 10% additional income tax on early distributions for any payment from the Plan (including amounts withheld for income tax) that you do not roll over, unless one of the exceptions listed below applies. This tax is in addition to the regular income tax on the payment not rolled over.

The 10% additional income tax does not apply to the following payments from the Plan:

●Payments made after you separate from service if you will be at least age 55 in the year of the separation

●Payments that start after you separate from service if paid at least annually in equal or close to equal amounts over your life or life expectancy (or the lives or joint life expectancy of you and your beneficiary)

●Payments from a governmental defined benefit pension plan made after you separate from service if you are a public safety employee and you are at least age 50 in the year of the separation

●Payments made due to disability

●Payments after your death

●Payments of ESOP dividends

●Corrective distributions of contributions that exceed tax law limitations

●Cost of life insurance paid by the Plan

●Payments made directly to the government to satisfy a federal tax levy

●Payments made under a qualified domestic relations order (QDRO)

●Payments up to the amount of your deductible medical expenses

●Certain payments made while you are on active duty if you were a member of a reserve component called to duty after September 11, 2001 for more than 179 days

●Payments of certain automatic enrollment contributions requested to be withdrawn within 90 days of the first contribution.

January 2014 |

Page 7 of 28 |

Distribution Request Form - CSC |

If I do a rollover to an IRA, will the 10% additional income tax apply to early distributions from the IRA?

If you receive a payment from an IRA when you are under age 59 1/2, you will have to pay the 10% additional income tax on early distributions from the IRA, unless an exception applies. In general, the exceptions to the 10% additional income tax for early distributions from an IRA are the same as the exceptions listed above for early distributions from a plan. However, there are a few differences for payments from an IRA, including:

●There is no exception for payments after separation from service that are made after age 55.

●The exception for qualified domestic relations orders (QDROs) does not apply (although a special rule applies under which, as part of a divorce or separation agreement, a tax-free transfer may be made directly to an IRA of a spouse or former spouse).

●The exception for payments made at least annually in equal or close to equal amounts over a specified period applies without regard to whether you have had a separation from service.

●There are additional exceptions for (1) payments for qualified higher education expenses, (2) payments up to $10,000 used in a qualified first-time home purchase, and (3) payments after you have received unemployment compensation for 12 consecutive weeks (or would have been eligible to receive unemployment compensation but for self-employed status).

Will I owe State income taxes?

This notice does not describe any State or local income tax rules (including withholding rules).

January 2014 |

Page 8 of 28 |

Distribution Request Form - CSC |

GENERAL INFORMATION ABOUT ROLLOVERS

FROM A DESIGNATED ROTH ACCOUNT

How can a rollover affect my taxes?

After-tax contributions included in a payment from a designated Roth account are not taxed, but earnings might be taxed. The tax treatment of earnings included in the payment depends on whether the payment is a qualified distribution. If a payment is only part of your designated Roth account, the payment will include an allocable portion of the earnings in your designated Roth account.

If the payment from the Plan is not a qualified distribution and you do not do a rollover to a Roth IRA or a designated Roth account in an employer plan, you will be taxed on the earnings in the payment. If you are under age 59 1/2, a 10% additional income tax on early distributions will also apply to the earnings (unless an exception applies). However, if you do a rollover, you will not have to pay taxes currently on the earnings and you will not have to pay taxes later on payments that are qualified distributions.

If the payment from the Plan is a qualified distribution, you will not be taxed on any part of the payment even if you do not do a rollover. If you do a rollover, you will not be taxed on the amount you roll over and any earnings on the amount you roll over will not be taxed if paid later in a qualified distribution.

A qualified distribution from a designated Roth account in the Plan is a payment made after you are age 59 1/2 (or after your death or disability) and after you have had a designated Roth account in the Plan for at least 5 years. In applying the 5-year rule, you count from January 1 of the year your first contribution was made to the designated Roth account. However, if you did a direct rollover to a designated Roth account in the Plan from a designated Roth account in another employer plan, your participation will count from January 1 of the year your first contribution was made to the designated Roth account in the Plan or, if earlier, to the designated Roth account in the other employer plan.

Where may I roll over the payment?

You may roll over the payment to either a Roth IRA (a Roth individual retirement account or Roth individual retirement annuity) or a designated Roth account in an employer plan (a tax-qualified plan or section 403(b) plan) that will accept the rollover. The rules of the Roth IRA or employer plan that holds the rollover will determine your investment options, fees, and rights to payment from the Roth IRA or employer plan (for example, no spousal consent rules apply to Roth IRAs and Roth IRAs may not provide loans). Further, the amount rolled over will become subject to the tax rules that apply to the Roth IRA or the designated Roth account in the employer plan. In general, these tax rules are similar to those described elsewhere in this notice, but differences include:

●If you do a rollover to a Roth IRA, all of your Roth IRAs will be considered for purposes of determining whether you have satisfied the 5-year rule (counting from January 1 of the year for which your first contribution was made to any of your Roth IRAs).

●If you do a rollover to a Roth IRA, you will not be required to take a distribution from the Roth IRA during your lifetime and you must keep track of the aggregate amount of the after-tax contributions in all of your Roth IRAs (in order to determine your taxable income for later Roth IRA payments that are not qualified distributions).

●Eligible rollover distributions from a Roth IRA can only be rolled over to another Roth IRA.

January 2014 |

Page 9 of 28 |

Distribution Request Form - CSC |

How do I do a rollover?

There are two ways to do a rollover. You can either do a direct rollover or a 60-day rollover.

If you do a direct rollover, the Plan will make the payment directly to your Roth IRA or designated Roth account in an employer plan. You should contact the Roth IRA sponsor or the administrator of the employer plan for information on how to do a direct rollover.

If you do not do a direct rollover, you may still do a rollover by making a deposit within 60 days into a Roth IRA, whether the payment is a qualified or nonqualified distribution. In addition, you can do a rollover by making a deposit within 60 days into a designated Roth account in an employer plan if the payment is a nonqualified distribution and the rollover does not exceed the amount of the earnings in the payment. You cannot do a 60-day rollover to an employer plan of any part of a qualified distribution. If you receive a distribution that is a nonqualified distribution and you do not roll over an amount at least equal to the earnings allocable to the distribution, you will be taxed on the amount of those earnings not rolled over, including the 10% additional income tax on early distributions if you are under age 59 1/2 (unless an exception applies).

If you do a direct rollover of only a portion of the amount paid from the Plan and a portion is paid to you, each of the payments will include an allocable portion of the earnings in your designated Roth account.

If you do not do a direct rollover and the payment is not a qualified distribution, the Plan is required to withhold 20% of the earnings for federal income taxes (up to the amount of cash and property received other than employer stock). This means that, in order to roll over the entire payment in a 60-day rollover to a Roth IRA, you must use other funds to make up for the 20% withheld.

How much may I roll over?

If you wish to do a rollover, you may roll over all or part of the amount eligible for rollover. Any payment from the Plan is eligible for rollover, except:

●Certain payments spread over a period of at least 10 years or over your life or life expectancy (or the lives or joint life expectancy of you and your beneficiary)

●Required minimum distributions after age 70 1/2 (or after death)

●Hardship distributions

●ESOP dividends

●Corrective distributions of contributions that exceed tax law limitations

●Loans treated as deemed distributions (for example, loans in default due to missed payments before your employment ends)

●Cost of life insurance paid by the Plan

●Contributions made under special automatic enrollment rules that are withdrawn pursuant to your request within 90 days of enrollment

●Amounts treated as distributed because of a prohibited allocation of S corporation stock under an ESOP (also, there will generally be adverse tax consequences if S corporation stock is held by an IRA).

The Plan administrator or the payor can tell you what portion of a payment is eligible for rollover.

January 2014 |

Page 10 of 28 |

Distribution Request Form - CSC |

SECTION I. Participant Signature

SECTION I. Participant Signature

Section J. For Completion by Plan Administrator, Trustee Or Authorized Signer Only

Section J. For Completion by Plan Administrator, Trustee Or Authorized Signer Only