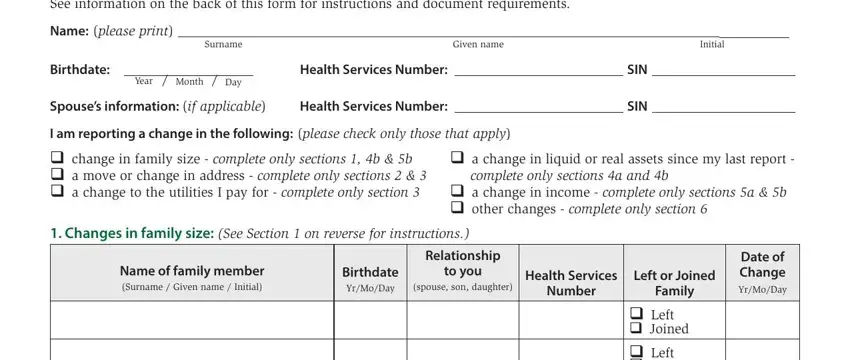

Change Form

Transitional Employment Allowance

See information on the back of this form for instructions and document requirements.

Name: (please print) ______________________________________________________________________________

|

|

Surname |

Given name |

|

Initial |

Birthdate: |

|

|

Health Services Number: |

SIN |

|

Year |

/ Month / Day |

|

|

|

|

|

Spouse’s information: (if applicable) |

Health Services Number: |

|

SIN |

|

I am reporting a change in the following: (please check only those that apply)

qchange in family size - complete only sections 1, 4b & 5b

qa move or change in address - complete only sections 2 & 3

qa change to the utilities I pay for - complete only section 3

qa change in liquid or real assets since my last report - complete only sections 4a and 4b

qa change in income - complete only sections 5a & 5b

qother changes - complete only section 6

1.Changes in family size: (See Section 1 on reverse for instructions.)

|

|

Relationship |

|

|

Date of |

Name of family member |

Birthdate |

to you |

Health Services |

Left or Joined |

Change |

(Surname / Given name / Initial) |

|

(spouse, son, daughter) |

|

Yr/Mo/Day |

Number |

Family |

Yr/Mo/Day |

|

|

|

|

|

|

|

|

|

|

|

|

|

q Left |

|

|

|

|

|

q Joined |

|

|

|

|

|

q Left |

|

|

|

|

|

q Joined |

|

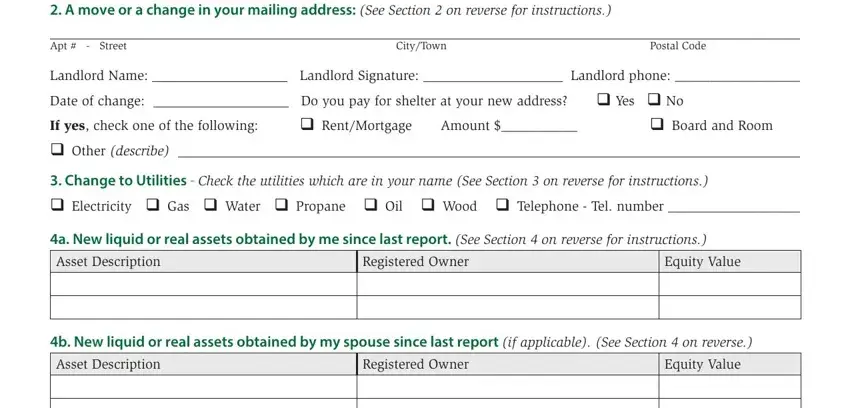

2.A move or a change in your mailing address: (See Section 2 on reverse for instructions.)

|

|

|

|

|

|

|

|

|

Apt # - Street |

City/Town |

|

Postal Code |

Landlord Name: |

|

Landlord Signature: |

|

|

Landlord phone: __________________ |

Date of change: |

|

Do you pay for shelter at your new address? |

q Yes |

q No |

If yes, check one of the following: |

q Rent/Mortgage |

Amount $___________ |

q Board and Room |

q Other (describe) |

|

|

|

|

|

|

3.Change to Utilities - Check the utilities which are in your name (See Section 3 on reverse for instructions.)

q Electricity q Gas q Water q Propane q Oil q Wood q Telephone - Tel. number ___________________

4a. New liquid or real assets obtained by me since last report. (See Section 4 on reverse for instructions.)

Asset Description |

Registered Owner |

|

|

4b. New liquid or real assets obtained by my spouse since last report (if applicable). (See Section 4 on reverse.)

Asset Description |

Registered Owner |

|

|

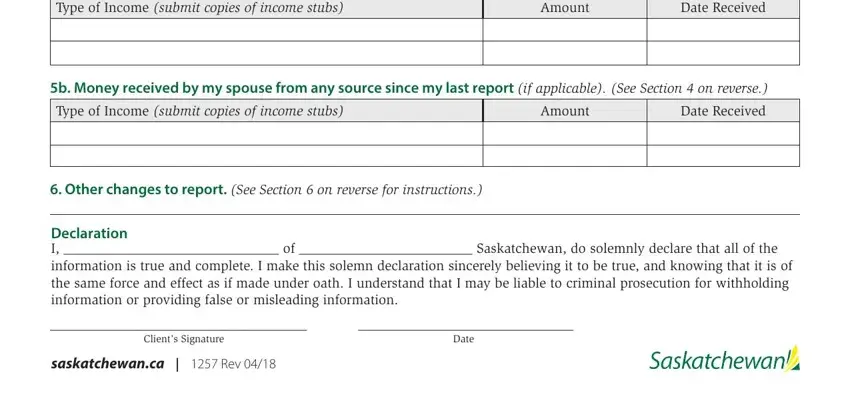

5a. Money received by me from any source since my last report. (See Section 5 on reverse for instructions.)

Type of Income (submit copies of income stubs)

5b. Money received by my spouse from any source since my last report (if applicable). (See Section 4 on reverse.)

Type of Income (submit copies of income stubs)

6.Other changes to report. (See Section 6 on reverse for instructions.)

Declaration

I, _______________________________ of _________________________ Saskatchewan, do solemnly declare that all of the

information is true and complete. I make this solemn declaration sincerely believing it to be true, and knowing that it is of the same force and effect as if made under oath. I understand that I may be liable to criminal prosecution for withholding information or providing false or misleading information.

_____________________________________ |

_______________________________ |

Client’s Signature |

Date |

saskatchewan.ca | 1257 Rev 04/18

Information for Reporting Changes

Transitional Employment Allowance

Your changes must be reported on a Transitional Employment Allowance Change Form. These forms are

available at the Career and Employment office in your area or in the Social Assistance office nearest you or online at: https://publications.saskatchewan.ca/api/v1/products/72784/formats/81143/download

Who should complete and sign this form?

The person who signed the Transitional Employment Allowance Application for Benefits is the person who is required to complete and sign the Report Form. If you have a spouse, your spouse cannot complete and sign this form.

You must report the following changes immediately and documents may be required to confirm the changes you report. Instructions and document requirements are listed by Section below.

Section 1 - Changes to your family size:

You must report if you have added to your family or someone has left your family. If you are reporting any change to the family unit, complete Section 1. If the change you are reporting is the addition of a spouse, you must complete Section 1, Sections 4b and Sections 5b. Ensure you include the spouse Social Insurance Number and Saskatchewan Health Services number at the top of the Change Form.

Section 2 - Address changes:

You must report if you have a change of mailing address or if you have moved. To report an address change complete Section 2 and Section 3 in full. If your mailing address is different than your resident address, please indicate this and include a resident address and/or home directions. If you are renting, you must give your

landlord one month written notice prior to vacating the premises. This means your landlord must be notified before you pay your final month’s rent. You are responsible for any damages to the place you rent. You are also responsible for reporting your change of address to the Saskatchewan Ministry of Health (call toll free

1-800-667-7551 or in Regina call 306-787-3251).

Section 3 - Changes to utilities:

You must report if you are no longer paying for a utility, if you start to pay for a utility, or report utility changes resulting from a move. Utilities include phone, water, electricity and home heating which are in your name

or your spouse's name. To receive a utility allowance you are required to submit copies of current bill(s) or statement(s). If you do not have verification of your utility changes, copies of the bill(s) or statement(s) can be submitted at a later date and a utility allowance adjustment will be made upon receipt.

Section 4a and 4b - Liquid or Real Asset Changes:

You must report the addition or change of bank accounts, cash in any RRSP’s or investments, stocks, bonds, the purchase or sale of a house, land, etc.

Section 4a: Report any liquid or real asset changes related to the applicant.

Section 4b: Report any liquid or real asset changes related to a current spouse or new spouse joining the family unit.

If the applicant sells, cashes in, or redeems an asset, the money received is reported as an income change under Section 5a and/or 5b. Copies of bank statements, pass books, RRSP/investment statements, mortgage documents, etc. are required to confirm reported changes. Failure to submit verification documents will result in a delay of benefits.

Section 5a and 5b - Income changes:

You must report if you start to receive an income or if you stop getting an income. Income includes money from any source received by you and your spouse (if applicable). A Change Form is not required to report fluctuating income already reported. In these situations you simply submit copies of your pay stubs monthly. Please ensure the income stubs includes the payee’s name, i.e. spouse's name.

Section 5a: Report any income changes related to the applicant

Section 5b: Report any income changes related to current spouse or a new spouse joining the family unit.

Copies of income stubs are required to confirm all money received. Please ensure the income stub includes the name of the payee i.e. spouse name. Failure to submit income stubs may result in a delay of benefits.

Section 6 - Other:

This section is used to report additional changes not outlined in sections 1 to 5.

If you have any questions about reporting changes, please call 1-866-221-5200 or in Regina call 798-0660.

Page 2 of 2 | 1257 Rev 04/18