Transnet Supplier Declaration/Application

THE FINANCIAL DIRECTOR OR COMPANY SECRETARY:

Transnet Vendor Management has received a request to load your company on to the Transnet vendor database. Please furnish us with the following to enable us to process this request:

a)Complete the “Supplier Declaration Form” (SDF) on page 2 of this letter

b)Original cancelled cheque OR letter from the bank verifying banking details (with bank stamp)

c)Certified copy of Identity document of Shareholders/Directors/Members (where applicable)

d)Certified copy of certificate of incorporation, CM29 / CM9 (name change)

e)Certified copy of share Certificates of Shareholders, CK1 / CK2 (if CC)

f)A letter with the company’s letterhead confirming physical and postal addresses

g)Original or certified copy of SARS Tax Clearance certificate and VAT registration certificate

h)A signed letter from the Auditor / Accountant confirming most recent annual turnover and percentage black ownership in the company AND/OR BBBEE certificate and detailed scorecard from an accredited rating agency (SANAS member).

i)Complete the Transnet Supplier Code of Conduct form on the following website: www.transnet-supplier.net

j)Valid IRP 30 exemption certificate

k)A copy of a recent months EMP 201 form

l)Declaration that at least 3 employees are on a full time basis

m)Declaration in terms of 80% of income

Failure to submit the above documentation will delay the vendor creation process.

Where applicable, the respective Transnet Operating Division processing your application may request further information from you.

The Service Provider warrants that the details of its bank account (“the nominated account”) provided herein are correct and acknowledges that payments due to the Supplier will be made into the nominated account. If details of the nominated account should change, the Service Provider must notify Transnet in writing of such change, failing which any payments made by Transnet into the nominated account will constitute a full discharge of the indebtedness of Transnet to the Supplier in respect of the payment so made. Transnet will incur no liability for any payments made to the incorrect account or any costs associated therewith. In such event, the Service Provider indemnifies and holds Transnet harmless in respect of any payments made to an incorrect bank account and will, on demand, pay Transnet any costs associated herewith.

IMPORTANT NOTES:

a)If your annual turnover is less than R5 million, then in terms of the DTI codes, you are classified as an Exempted Micro Enterprise (EME). If your company is classified as an EME, please include in your submission, a signed letter from your Auditor / Accountant confirming your company’s most recent annual turnover is less than R5 million and percentage of black ownership and black female ownership in the company AND/OR BBBEE certificate and detailed scorecard from an accredited rating agency (e.g. permanent SANAS Member), should you feel you will be able to attain a better BBBEE score.

b)If your annual turnover is between R5 million and R35million, then in terms of the DTI codes, you are classified as a Qualifying Small Enterprise (QSE) and you claim a specific BBBEE level based on any 4 of the 7 elements of the BBBEE score-card, please include your BEE certificate in your submission as confirmation of your status.

NB: BBBEE certificate and detailed scorecard should be obtained from an accredited rating agency (e.g. permanent SANAS Member).

c)If your annual turnover is in excess of R35million, then in terms of the DTI codes, you are classified as a Large Enterprise and you claim a specific BEE level based on all seven elements of the BBBEE generic score- card. Please include your BEE certificate in your submission as confirmation of your status.

NB: BBBEE certificate and detailed scorecard should be obtained from an accredited rating agency (permanent SANAS Member).

d)The supplier to furnish proof to the procurement department as required in the Fourth Schedule of the Income Tax Act. 58 of 1962 whether a supplier of service is to be classified as an “employee”, ”personal service provider” or “labour broker”. Failure to do so will result in the supplier being subject to employee’s tax.

e)No payments can be made to a vendor until the vendor has been registered, and no vendor can be registered until the vendor application form, together with its supporting documentation, has been received and processed.

f)From 1 February 2010 only BBBEE certificates issued by SANAS accredited verification agencies will be valid. Any BBBEE certificate issued by a non–accredited verification agency prior to 1 February 2010 will remain valid for 12 months from the date of issue.

Please return the completed Supplier Declaration Form (SDF) together with the required supporting documents and annexure mentioned above to the Transnet Official who is intending to procure your company’s services/products

1

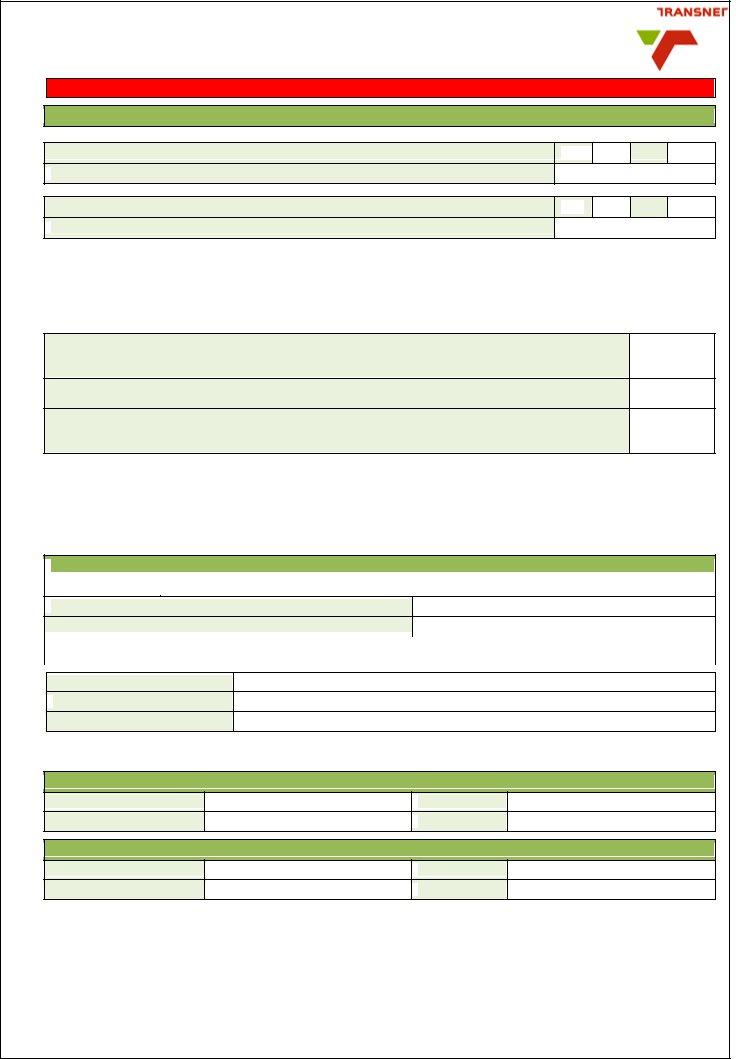

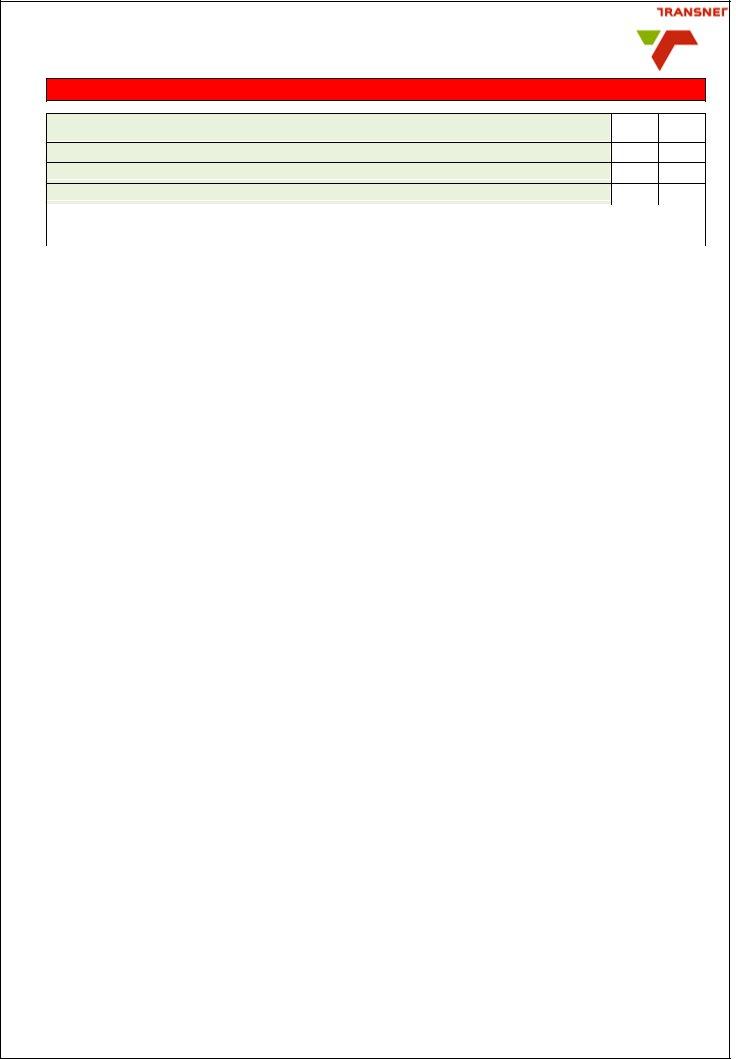

i)Supplier Declaration Form

Company Trading Name

Company Registered Name

|

Did your company previously operate under another name? |

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If YES state the previous name below |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trading Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registered Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Registration Number Or ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number If A Sole Proprietor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form of entity |

|

|

|

CC |

|

|

Trust |

Pty Ltd |

|

Limited |

|

|

Partnership |

|

|

Sole Proprietor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Is your company VAT Registered? |

|

|

Yes |

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

Exempt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If Yes, state VAT Registration Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If No or Exempt, state reason |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank Account Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Physical Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Postal Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Telephone number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Fax Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company E-Mail Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Website Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact Person |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Designation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Financial Year Annual Turnover |

|

<R1Million |

|

|

|

|

R1-R5Million |

|

|

|

R5-R35Million |

|

|

>R35Million |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate using a ‘X’ the business sector in |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

which your company is involved/operating |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Agriculture |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electricity, Gas and Water |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail, Motor Trade and Repair Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Catering, accommodation and Other Trade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Community, Social and Personal Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mining and Quarrying |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance and Business Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wholesale Trade, Commercial Agents and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allied Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transport, Storage and Communications |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (Specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

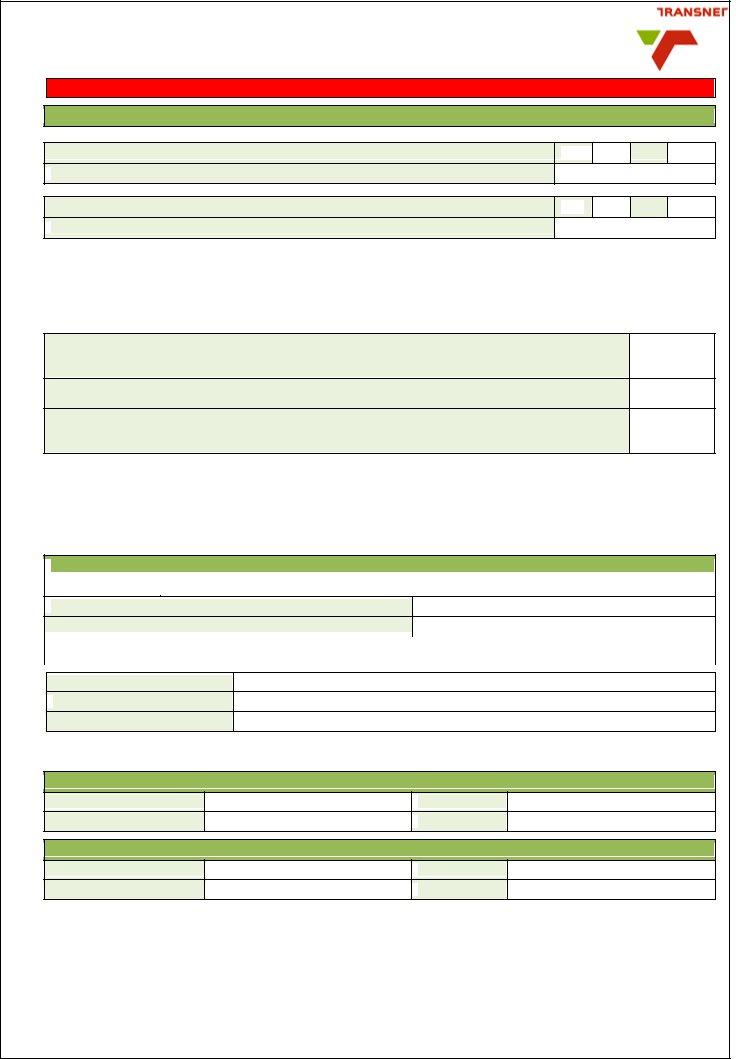

ii)Category of Supplier

The following information needs to be completed by the supplier to determine which category of supply to follow.

A. Are you a supplier of goods and /or products? |

Yes |

No |

If yes, what goods and /or products are being supplied?

B. Are you a supplier of services and /or labour? |

Yes |

No |

If yes, what services and /or labour is being supplied?

NB: If your answer to Question A is “YES”, the supplier is not subject to Employees’ Tax. The supplier is to be captured as a TRADE VENDOR via the PROCUREMENT OFFICE and referred to the Accounts Payable Department for payment. You will be required to attach supporting documents 1 -12 from the checklist.

If your answer to Question B is “YES”, please answer the questions below:

Yes/ No

1.1.Is the service provider a natural person (i.e. labour broker) who supplies Transnet with other persons to render services, or perform work for Transnet; and who is remunerated by the service provider?

1.2.Is the service provider a natural person (i.e. contractor) who supplies services to Transnet?

1.3.Is the service provider a company, close corporation or trust who supplies Transnet with services or labour?

•If the answer to question 1.1 is “YES” the service provider has to complete ANNEXURE A of the Supplier Declaration Form. Please attach supporting documents 1-13 from the checklist

•If the answer to question 1.2 is “YES” the service provider has to complete ANNEXURE B of the Supplier Declaration Form. Please attach supporting document 1-12, 14 -15 from checklist

•If the answer to question 1.3 is “YES” the service provider has to complete ANNEXURE C of the Supplier Declaration Form. Please attach supporting documents 1-12, 14-16 from checklist

BBBEE Ownership Details

|

|

|

|

|

|

|

Does your company have a valid BBBEE certificate? |

|

Yes |

|

No |

|

|

|

|

|

|

|

|

What is your broad based BEE status (Level 1 to 9 / Unknown)

Majority Race of Ownership

|

% Black Ownership |

|

|

|

% Black women ownership |

|

|

% Disabled person/s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ownership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transnet Contact Person

Contact number

Transnet operating division

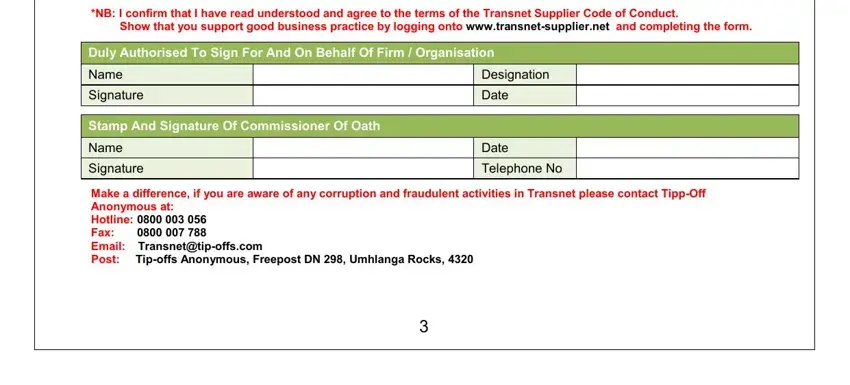

*NB: I confirm that I have read understood and agree to the terms of the Transnet Supplier Code of Conduct.

Show that you support good business practice by logging onto www.transnet-supplier.net and completing the form.

Duly Authorised To Sign For And On Behalf Of Firm / Organisation

Stamp And Signature Of Commissioner Of Oath

Make a difference, if you are aware of any corruption and fraudulent activities in Transnet please contact Tipp-Off Anonymous at:

Hotline: 0800 003 056

Fax: |

0800 007 788 |

Email: |

Transnet@tip-offs.com |

Post: |

Tip-offs Anonymous, Freepost DN 298, Umhlanga Rocks, 4320 |

3

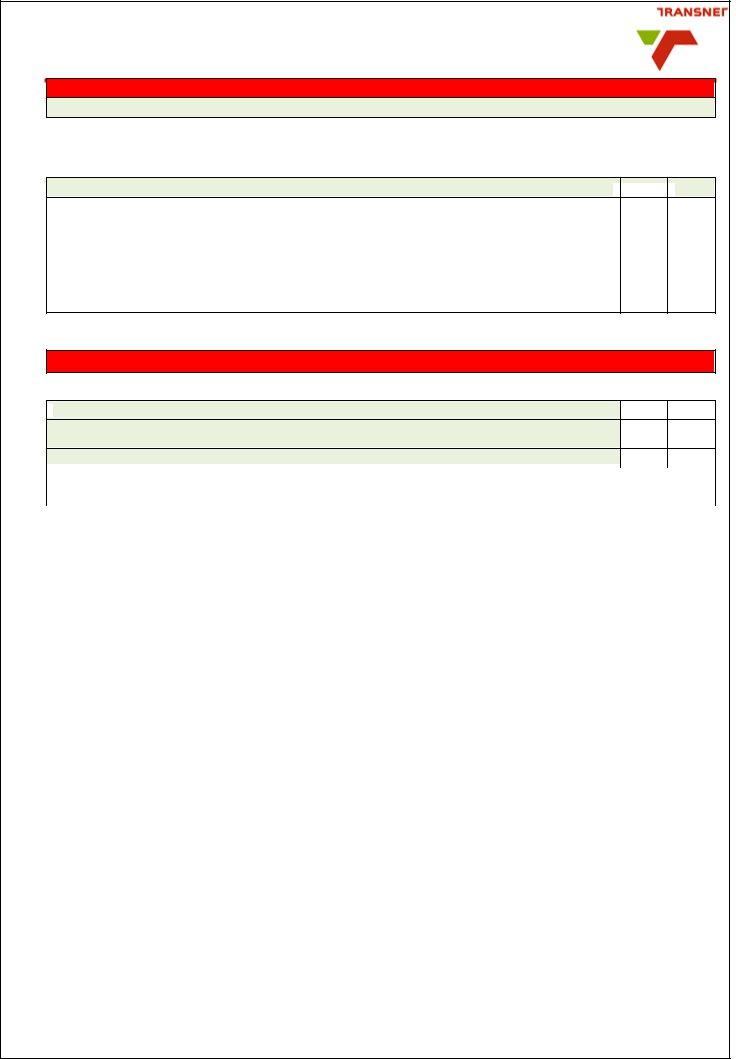

Internal Transnet Departmental Questionnaire (for office use only)

To be completed by the Transnet Requesting / Sourcing Department

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TFR |

|

|

TRE |

|

|

TPT |

|

|

TPL |

|

|

Create |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amend |

|

|

|

Block |

|

|

Unblock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Extend |

|

|

|

Delete |

|

|

|

Undelet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Once-Off / Emergency Request

Internal Sign-Off if Vendor is exempt or not Registered for VAT (Group Tax Department)

|

|

|

|

|

|

|

Deduct |

|

|

|

|

|

|

|

|

|

|

|

Service Provider |

|

|

|

|

No tax |

|

|

Department responsible for payment |

|

|

|

|

|

|

|

tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Labour broker without IRP30 exemption certificate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Labour broker with IRP30 exemption certificate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personal Service Provider |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent Contractor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

None of the above apply, state reason |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Internal Document Checklist |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Document List |

|

|

|

|

|

|

|

|

|

|

Yes / No |

|

|

|

1) |

Complete Supplier Declaration Form (SDF) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2) |

Verification of banking details |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3) |

Original cancelled cheque |

or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4) |

Letter from the bank (with bank stamp) |

|

|

|

|

|

|

|

|

|

5) Certified copy of identity document of Shareholders/Directors/Members

6) Certified copy of certificate of incorporation

7) Certified copy of share certificates of Shareholders

8) A letter with the company’s letterhead confirming physical and postal addresses

9) Original or certified copy of SARS Tax Clearance certificate and VAT registration certificate

10) Confirmation of most recent annual turnover and percentage black ownership

11)Signed letter from the Auditor / Accountant ; AND /OR BBBEE certificate and detailed scorecard from Accredited rating agency (ABVA Member)

12)Completed Transnet Supplier Code of Conduct form and proof of submission (www.transnet- suppliers.net)

13) Valid IRP 30 exemption certificate(Annexure A)

14) A copy of a recent months EMP 201 form (Annexure B & C)

15) Declaration that at least 3 employees are on a full time basis (Annexure B & C)

16) Declaration in terms of 80% of income (Annexure C)

4

Annexure A

Labour Broker Questionnaire

In order for Transnet not to classify you as a “labour broker” as defined in the Fourth Schedule to the Act, you need to provide Transnet with a valid IRP 30 exemption certificate.

Yes No

1. Do you have a valid IRP 30 exemption certificate?

If "yes", you will not be regarded as an “employee” for employees’ tax purposes. Payments made to you will not be subjected to PAYE, UIF or SDL.

If” no", you will be regarded as an “employee” for employees’ tax purposes. Payments made to you will be subject PAYE, UIF and SDL. Normal tax tables will apply

For admin purposes only:

Yes/No

Labour broker exempt therefore not an employee and no PAYE to be deducted ( Accounts Payable)

Labour broker without an IRP 30 exemption certificate therefore regarded as an employee and PAYE must be withheld (HR/Payroll)

Certified copy of IRP30 exemption certificate received?

|

|

|

|

|

Name |

|

|

Signature |

|

|

|

|

|

|

Position |

|

|

Date |

|

|

|

|

|

|

5

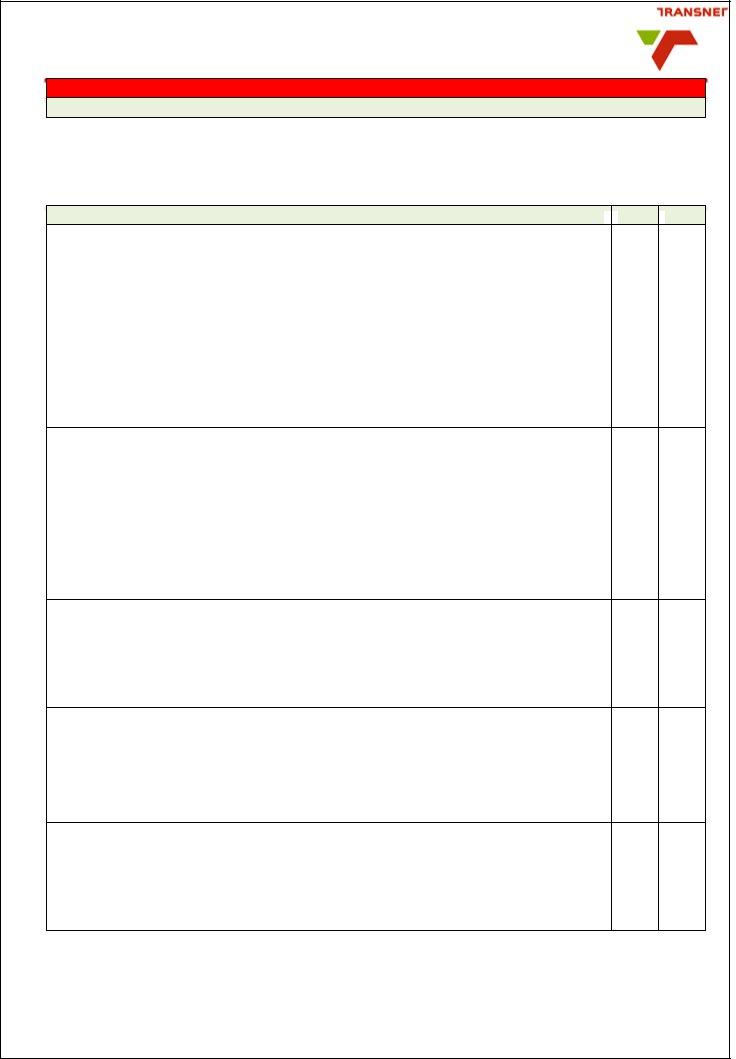

Annexure B

Independent Contractor’s Questionnaire

In order for Transnet to determine whether you are an “independent contractor” as defined in the Fourth Schedule to the Act, you are required to answer the following questions by marking the appropriate column with an X. The answers supplied will be used to determine whether Transnet is obliged to deduct employees’ tax from any payment due to you.

1.) Do you employ three or more full-time employees (excluding “connected persons” in relation to yourself)?

If “yes”, please provide the following documentation;

–A copy of a recent months EMP 201 form;

–A declaration that at least 3 employees are on a full time basis engaged in the business of rendering the services and are not connected persons.

If the above documentation is provided, payments made to you will not be subject to PAYE, UIF or SDL. No need to proceed to questions 2 and 3. If “no”, please proceed to question 2.

2.) Will you render your services mainly at the premises of Transnet?

If “no”, you will be regarded as an independent contractor for employees’ tax purposes. Payments made to you will not be subject to PAYE, UIF or SDL. No need to proceed to question 3. If “yes”, please proceed to question 3.

3.) Will you be working under the supervision and control of Transnet as to the manner in which your duties are performed or as to the hours you are required to work?

If “no”, you will be regarded as an independent contractor for employees’ tax purposes. Payments made to you will not be subject to PAYE, UIF or SDL.

If “yes”, you will not be regarded as an independent contractor for employees’ tax purposes and payments to you will be subject to employees’ tax. Normal tax tables will apply.

4.) Is the contractor required to work for a period of 22 hours or more per week?

If the answer is “yes” the person will be regarded as being in standard employment and payments made to employee will be subject to employees’ tax in accordance with the tax tables for natural persons.

5.) Is the contractor required to work at least 5 hours a day, but Transnet will not pay the contractor more than R208 for that day? If the answer is “yes” employees’ tax should not be withheld.

6.) Will the contractor be working for less than 22 hours for Transnet, but Transnet will be their only employer?

If the answer is “yes” a written declaration should be supplied to Transnet to the effect that Transnet will be the only employer of the contractor. The contractor is in standard employment and employees’ tax needs to be withheld in accordance with the tax tables for natural persons.

7.) Will Transnet expect the contractor to work for a period of less than 22 hours per week? If the answer is “yes” the contractor is in non-standard employment and employees’ tax needs to be withheld at a flat rate of 25%.

8.) Will the contractor be allowed to work for any other employer while performing duties for Transnet? If the answer is “no” the contractor needs to provide Transnet with a written declaration to the effect that Transnet is its only employer. If contractor can supply such declaration it will be regarded as being in standard employment and employees’ tax must be calculated in accordance with the tax tables for natural persons.

6

For admin purposes only:

Yes/No

Independent contract – Not a employee, therefore no PAYE to be deducted (Accounts Payable)

Not an independent contractor – Regarded as an employee, therefore PAYE must be withheld (HR/Payroll)

Declaration in term of 3 or more employee’s received?

If not an independent contractor determine whether in standard employment or non-standard employment

Name |

|

|

Signature |

|

|

|

|

|

|

Position |

|

|

Date |

|

|

|

|

|

|

7

Annexure C

Company /Close Corporation / Trust Questionnaire

In order for Transnet to evaluate whether the supplier is a “Personal Service Provider” as defined in the Fourth Schedule to the Act, the supplier must answer the following questions by marking the appropriate column with an X. The answers supplied will be used to determine whether Transnet is obliged to deduct employees’ tax from any payment due to the supplier.

Yes No

1.) Does your company/close corporation or trust employ three or more full-time employees (other than shareholders, members or connected persons) on a full time basis?

If “yes” please provide the following documentation;

-A copy of a recent months EMP 201 form;

-A declaration that at least 3 employees are on a full time basis engaged in the business of rendering the services and are not connected persons).

If the above documentation is provided, payments to be made will not be subject to PAYE, UIF or SDL. No need to complete questions 2 – 7.

If the above documentation cannot be provided, please continue in completing this form. If the answer is “no”, please proceed to the next question.

2.) Where your organisation is a company, will a shareholder (20% or more) or a “connected person” in relation to such shareholder/s provide the services to Transnet?

Where your organisation is a close corporation, will a member or a “connected person” in relation to such member/s provide the services to Transnet?

Where your organisation is a trust, will a beneficiary or a “connected person” in relation to such trust provide the services to Transnet?

If your answer is “yes” to any one of the above questions, you need to complete each of the remaining questions.

If your answer is “no”, the payments made to the company will not be subject to PAYE, UIF or SDL.

3.) Would the person supplying the services to Transnet be regarded as an employee of Transnet if the services were rendered directly to Transnet, notwithstanding that the services are rendered via a company, close corporation or trust?

If the answer is “yes”, the company/ close corporation or trust is a “personal service provider” and payments made to the company, close corporation or trust are subject to PAYE and SDL. If the answer is “no”, please continue in completing this form.

4.) Will the person rendering the services to Transnet render such services mainly at the premises of Transnet and will such person be working under the supervision and control of Transnet as to the manner in which such person’s duties are performed?

If the answer is “yes”, the company/ close corporation or trust is a “personal service provider” and payments made to the company/close corporation or trust are subject to PAYE and SDL.

If the answer is “no” please continue in completing this form.

5.) Will your company/ close corporation or trust derive more than 80% of its income during the year of assessment from any one client?

If the answer is “yes” the company/ close corporation or trust is a “personal service provider” and payments to the company/ close corporation or trust be will be subject to PAYE and SDL .If the answer is “no”, you should provide Transnet with a written declaration. If a written declaration is provided, no employees’ tax will be deducted from payments to be made the company/close corporation or trust.

8

For Admin purpose only:

Personal Service Provider – Not regarded as an employee, therefore no PAYE to be deducted (Accounts Payable)

Personal Service Provider regarded as an employee, therefore PAYE must be withheld (HR/Payroll)

Declaration in terms of 3 or more employee’s received?

Declaration in terms of 80%of income?

|

|

|

|

Name |

|

Signature |

|

|

|

|

|

Position |

|

Date |

|

|

|

|

|

9