You are able to prepare teacher retirement system of texas withdrawal without difficulty by using our online PDF editor. To make our editor better and less complicated to use, we consistently implement new features, taking into account feedback coming from our users. It just takes a few basic steps:

Step 1: Open the PDF form inside our tool by clicking on the "Get Form Button" above on this webpage.

Step 2: Using our handy PDF editing tool, it is easy to do more than just fill in blank form fields. Try all the functions and make your forms look faultless with custom text put in, or adjust the original content to excellence - all comes along with the capability to incorporate any kind of photos and sign the PDF off.

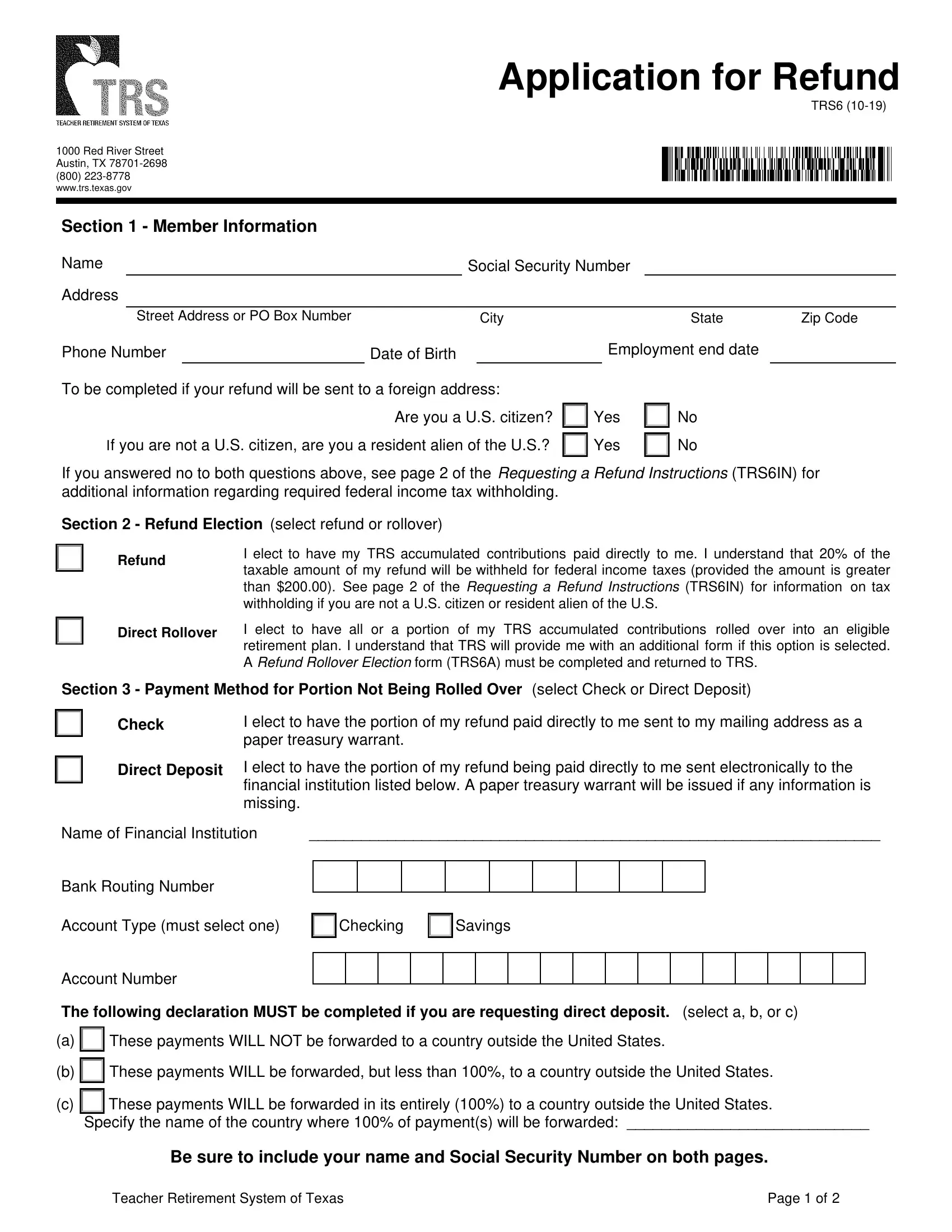

This PDF form will require specific info to be entered, therefore be sure to take whatever time to provide precisely what is expected:

1. The teacher retirement system of texas withdrawal will require particular information to be inserted. Make certain the subsequent fields are finalized:

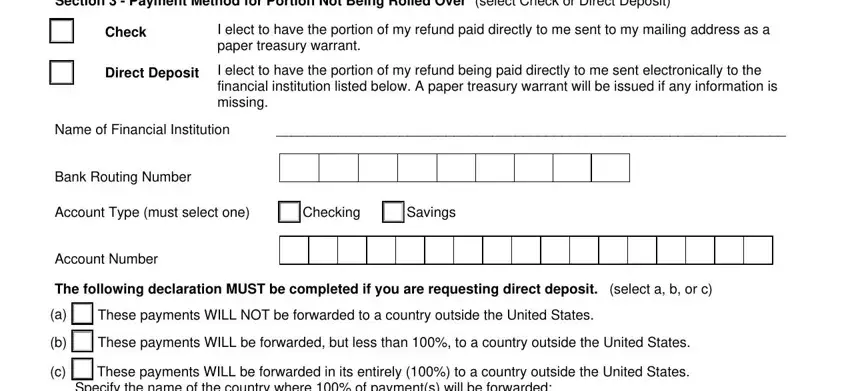

2. Soon after this array of blanks is filled out, go on to enter the applicable information in all these - Section Payment Method for, Check, I elect to have the portion of my, Direct Deposit, I elect to have the portion of my, Name of Financial Institution, Bank Routing Number, Account Type must select one, Checking, Savings, Account Number, The following declaration MUST be, These payments WILL NOT be, These payments WILL be forwarded, and These payments WILL be forwarded.

It is easy to get it wrong while completing the I elect to have the portion of my, therefore you'll want to look again prior to when you submit it.

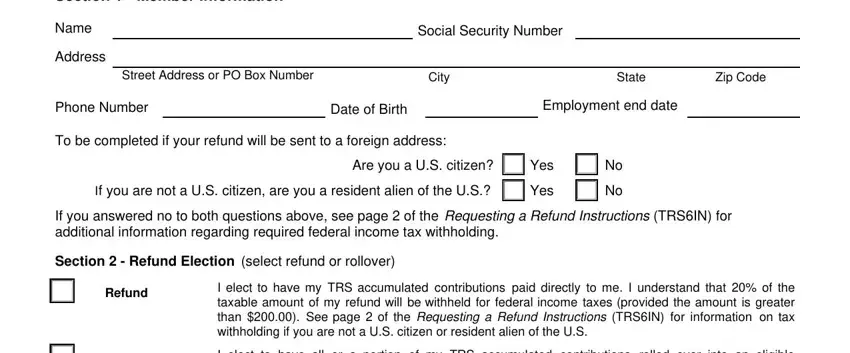

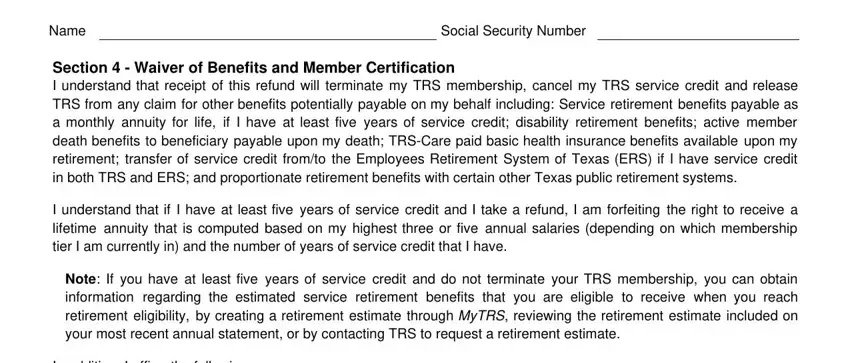

3. Completing Name, Social Security Number, Section Waiver of Benefits and, I understand that if I have at, Note If you have at least five, and In addition I affirm the following is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

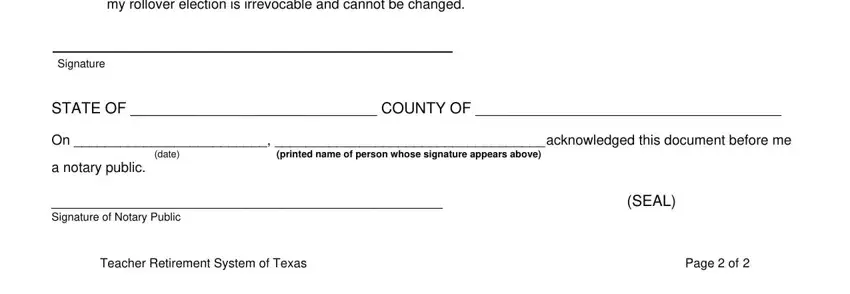

4. The next paragraph needs your information in the subsequent places: I have permanently terminated all, Signature, STATE OF COUNTY OF, On acknowledged this document, date, printed name of person whose, a notary public, Signature of Notary Public, SEAL, Teacher Retirement System of Texas, and Page of. Make certain you type in all required information to move further.

Step 3: Reread all the information you've typed into the form fields and then click on the "Done" button. Try a 7-day free trial plan with us and acquire direct access to teacher retirement system of texas withdrawal - downloadable, emailable, and editable from your personal account. FormsPal is focused on the confidentiality of all our users; we make certain that all information coming through our editor is kept protected.