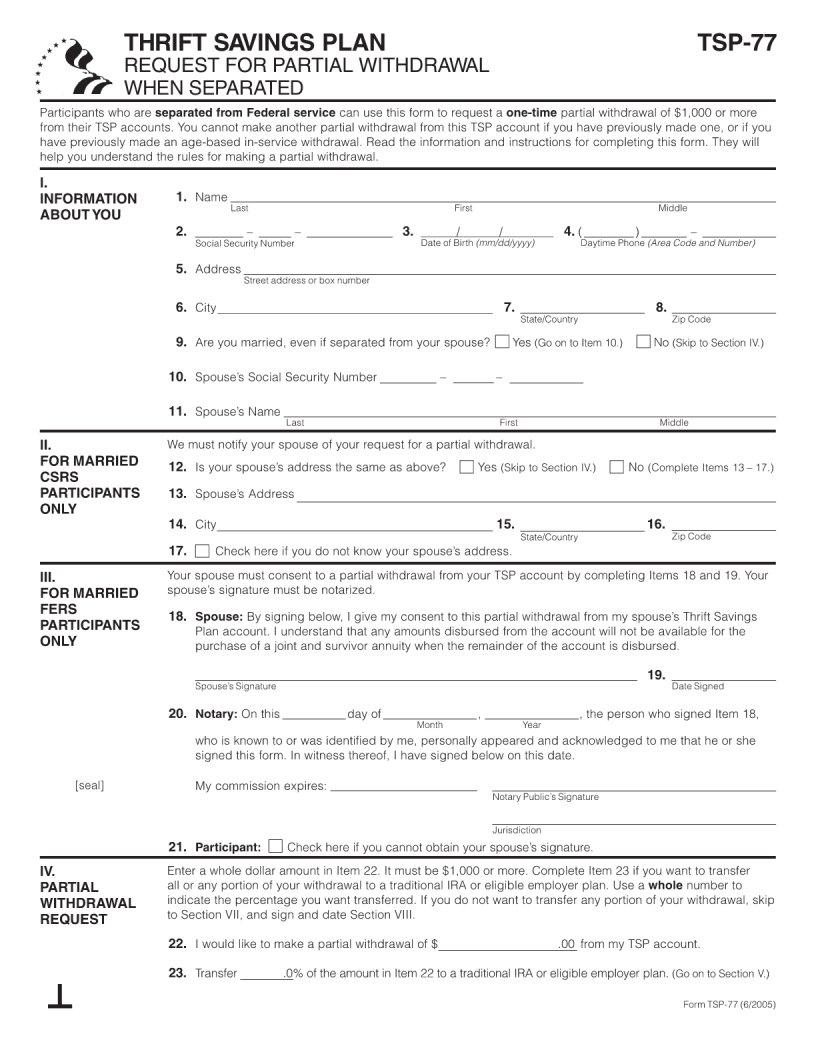

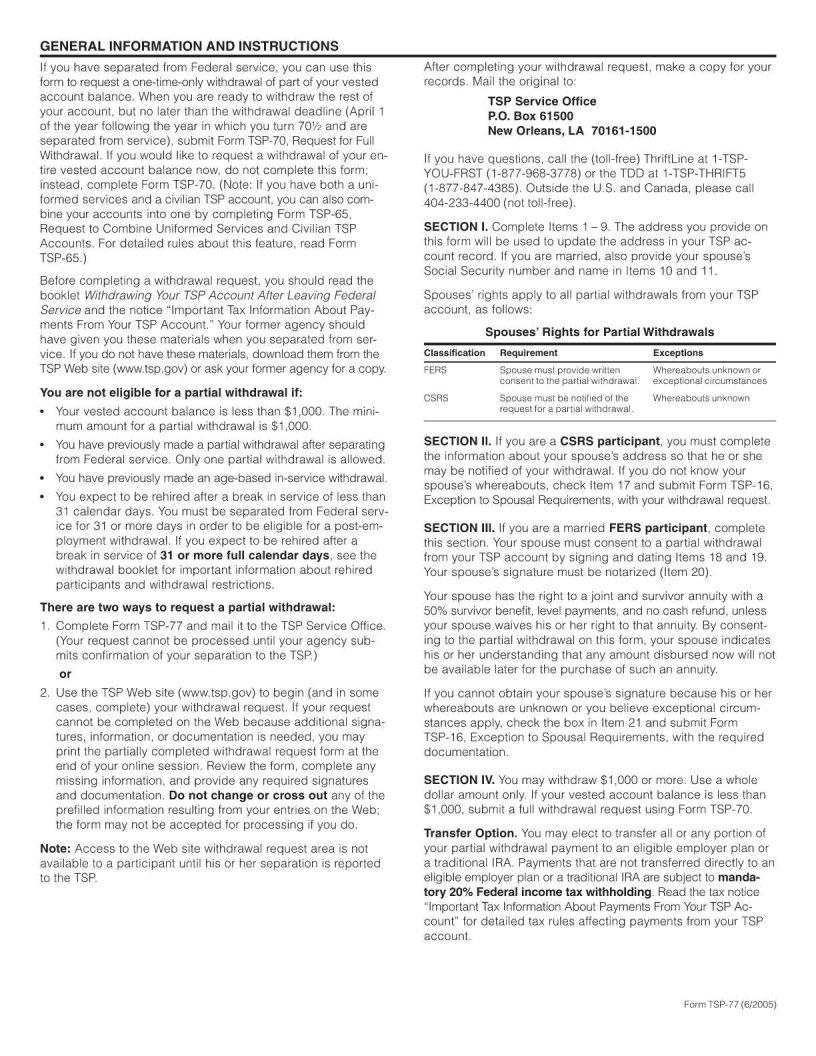

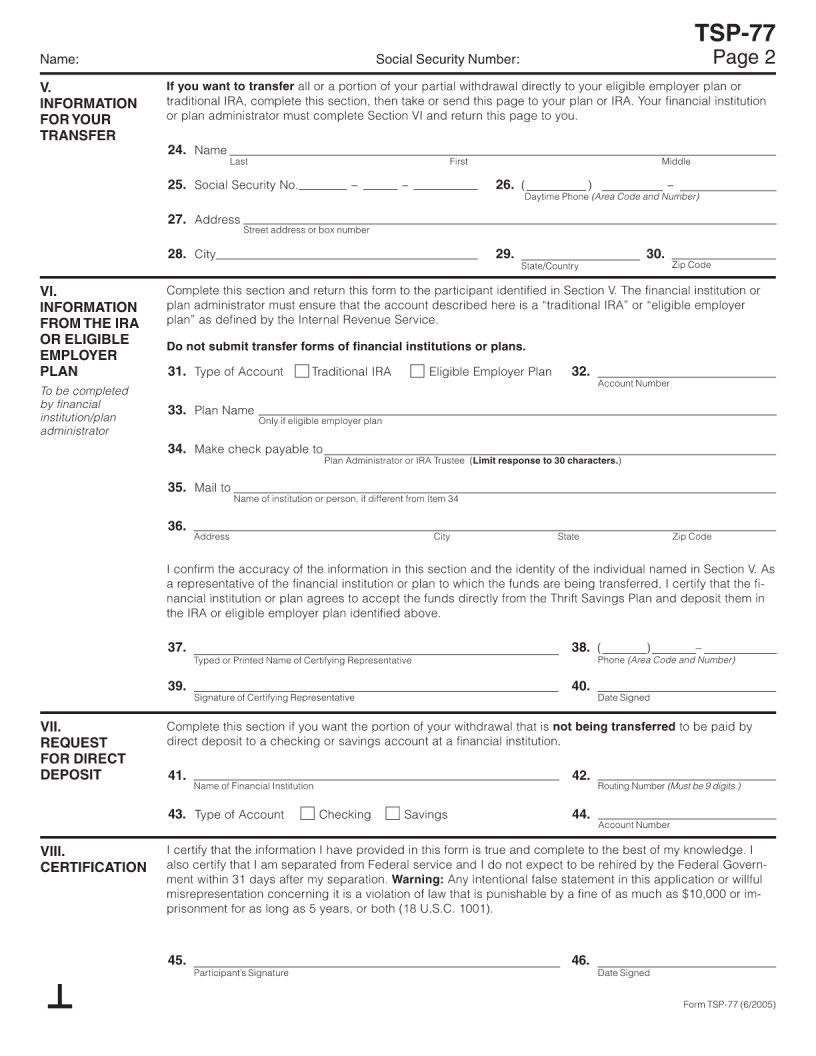

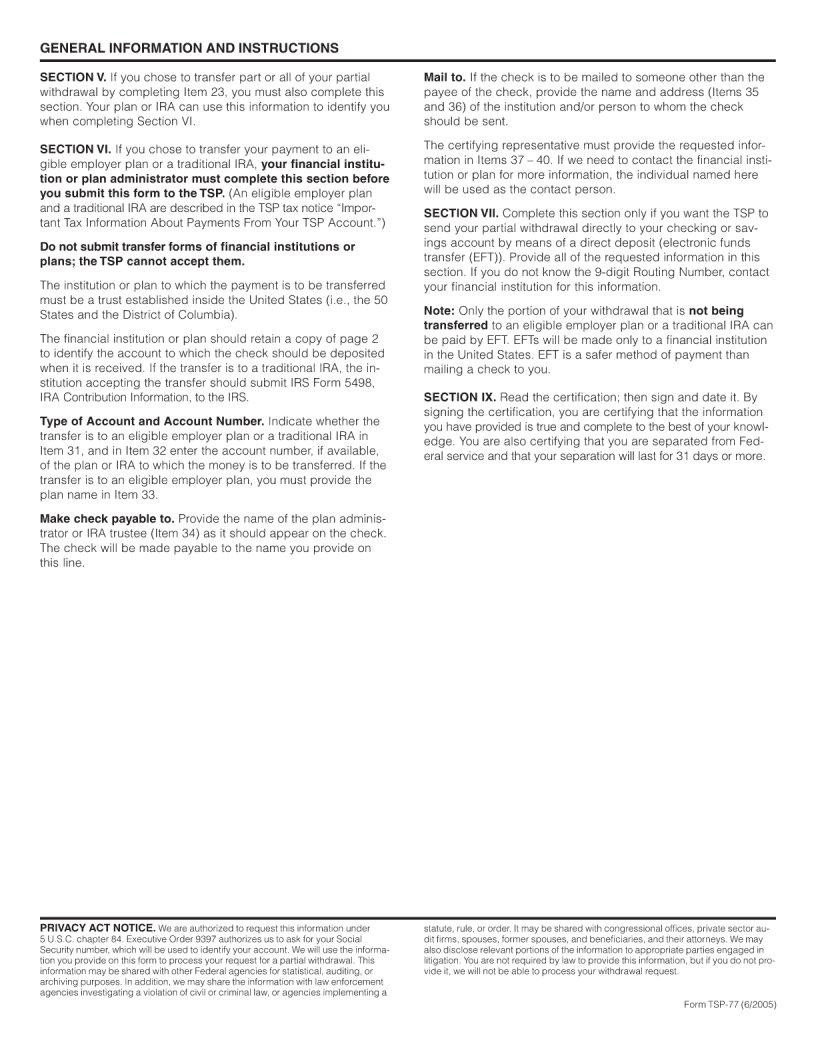

For many public sector workers, thinking ahead about retirement is a crucial step in securing their future, and part of that planning involves managing their thrift savings plan (TSP). The TSP 77 form plays a significant role in this process, offering individuals the opportunity to request partial withdrawal of their funds after they have reached retirement. This form is specifically designed to accommodate those who need to access a portion of their savings, providing a flexible option for managing retirement income. Whether it's due to a change in financial circumstances, or simply a strategic move to optimize retirement benefits, the ability to make partial withdrawals can be a game-changer. It's essential for employees to understand how to correctly fill out this form to ensure they can benefit from this option without unnecessary complications or delays. The form itself covers various aspects, including personal information, the type of withdrawal requested, and where the funds should be sent, thus making it a critical tool in retirement planning for federal employees and members of the uniformed services.

| Question | Answer |

|---|---|

| Form Name | Form Tsp 77 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | tsp 77 1 2018, tsp 77 fillable form no download needed, 77, tsp 77 fillable 1 2018 |