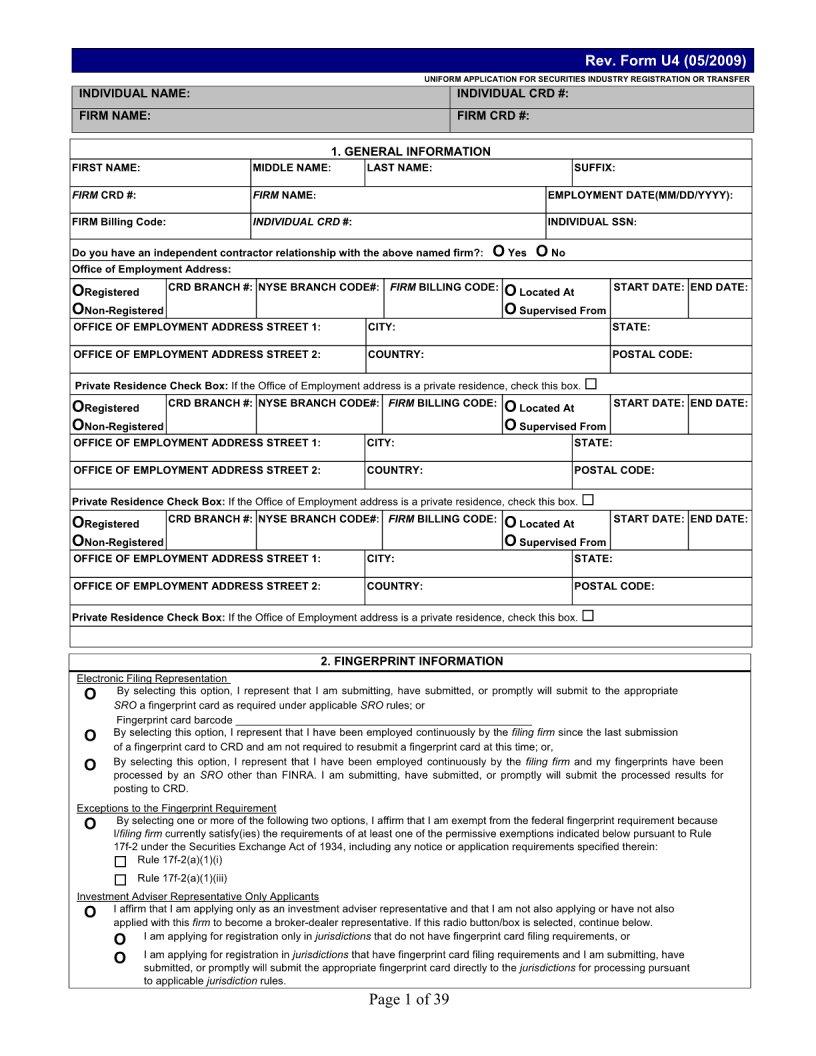

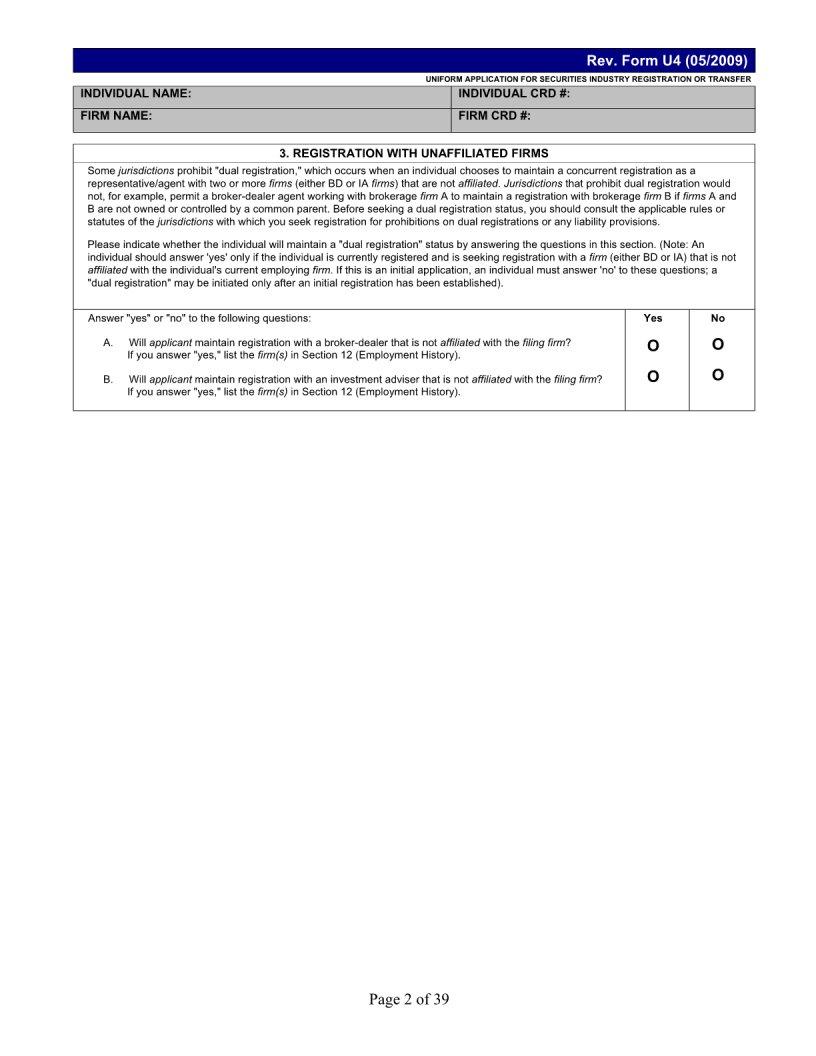

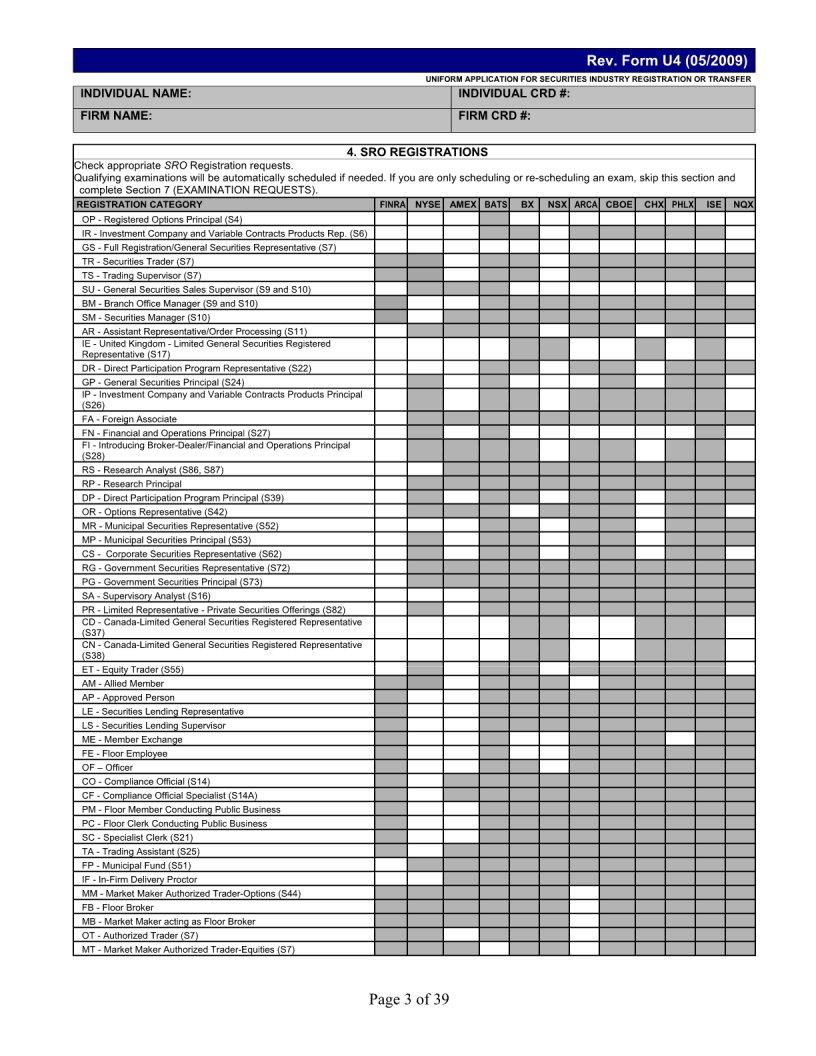

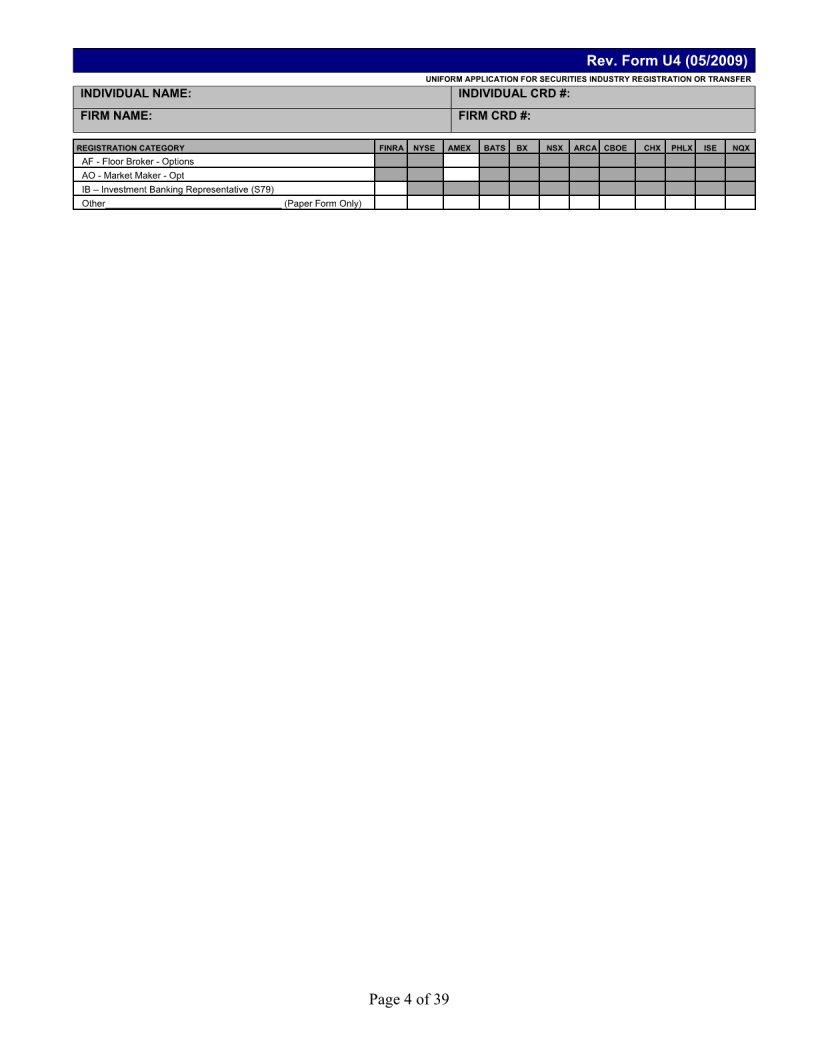

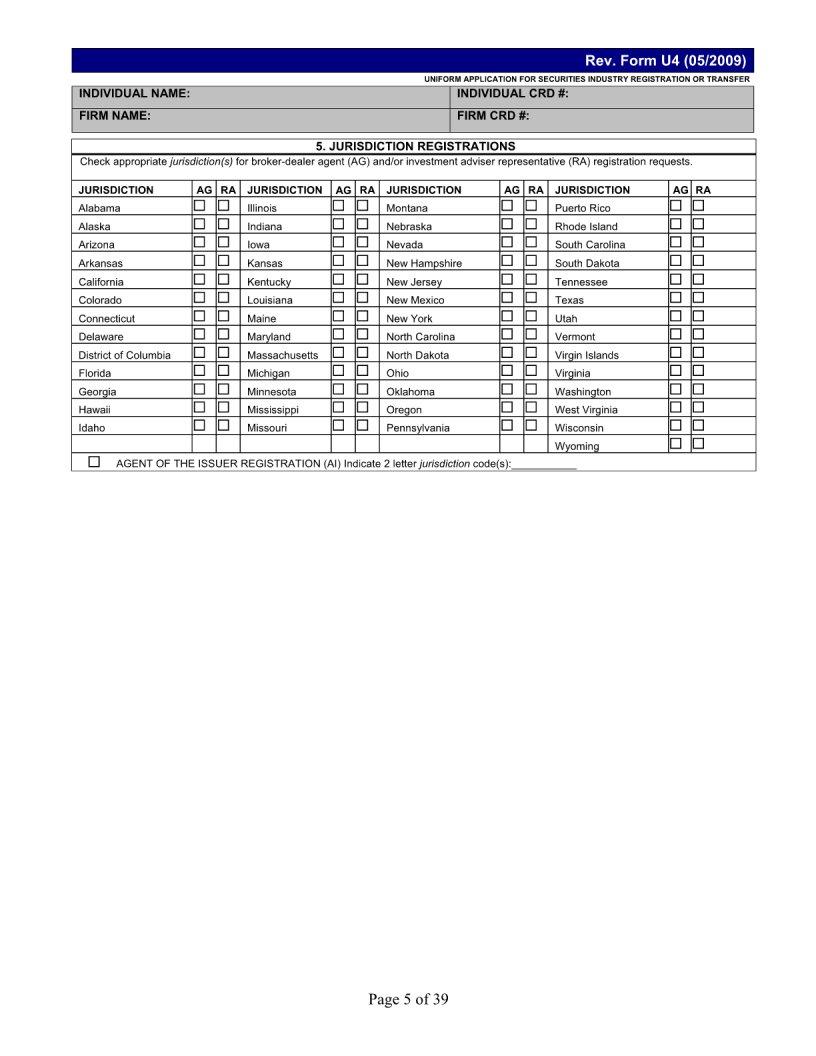

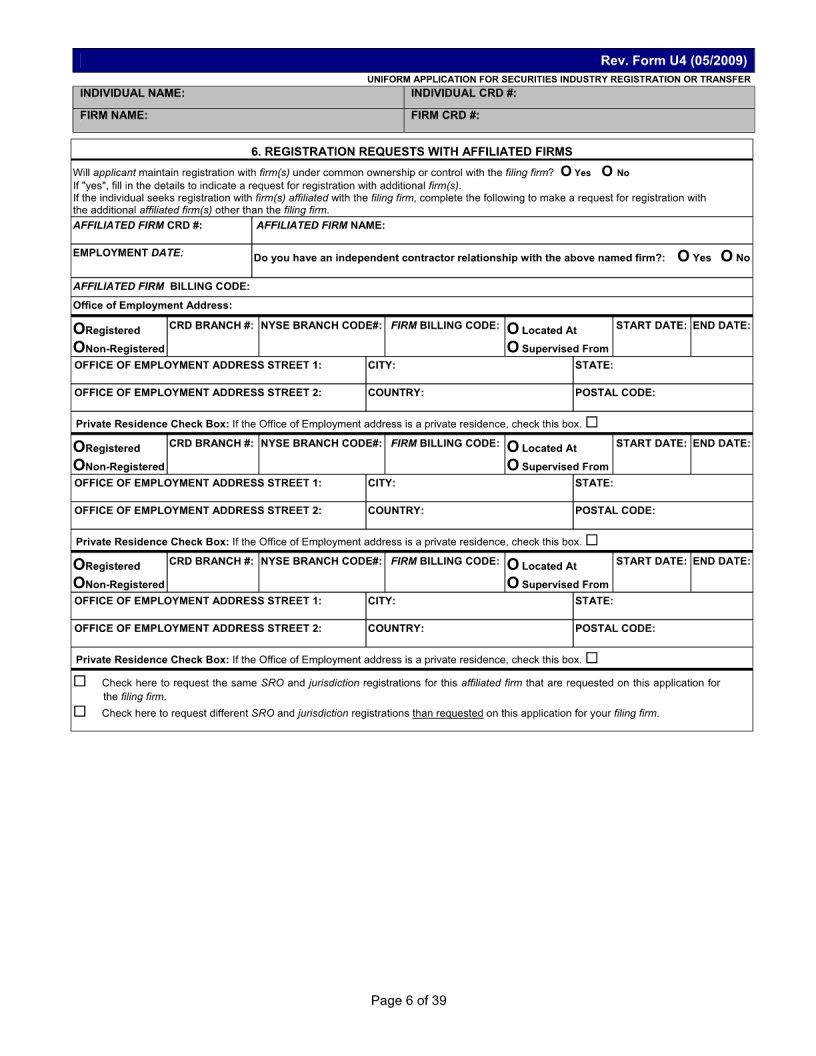

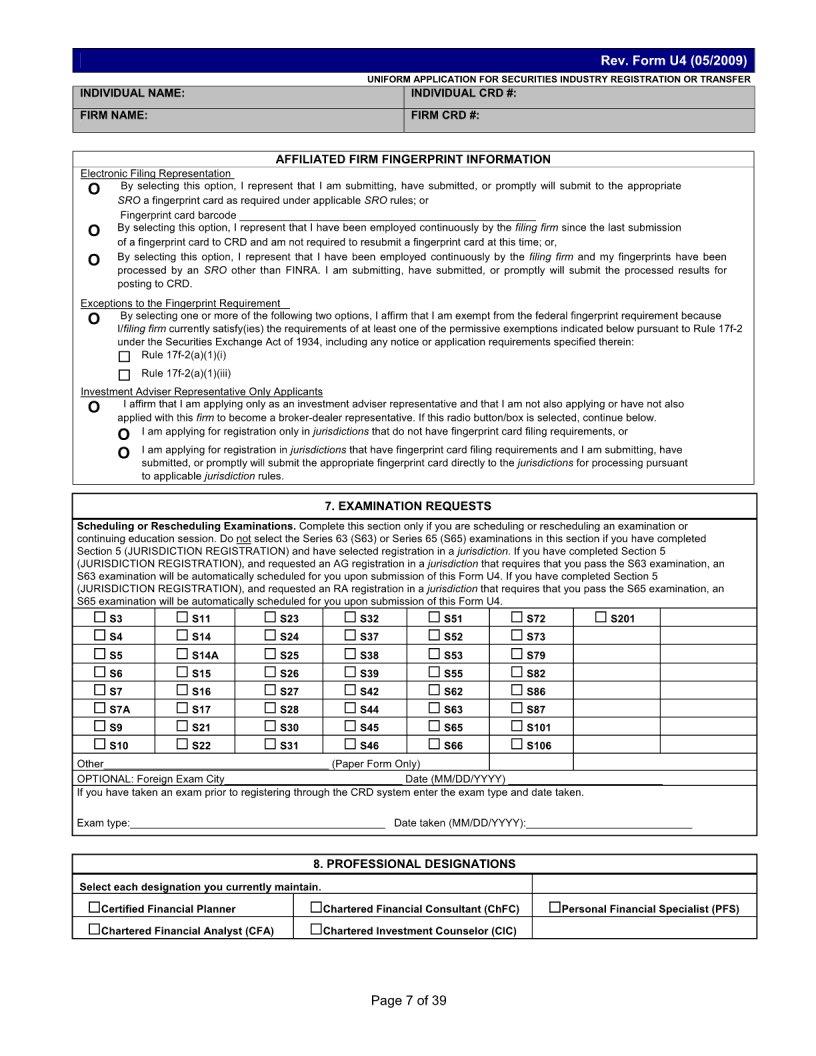

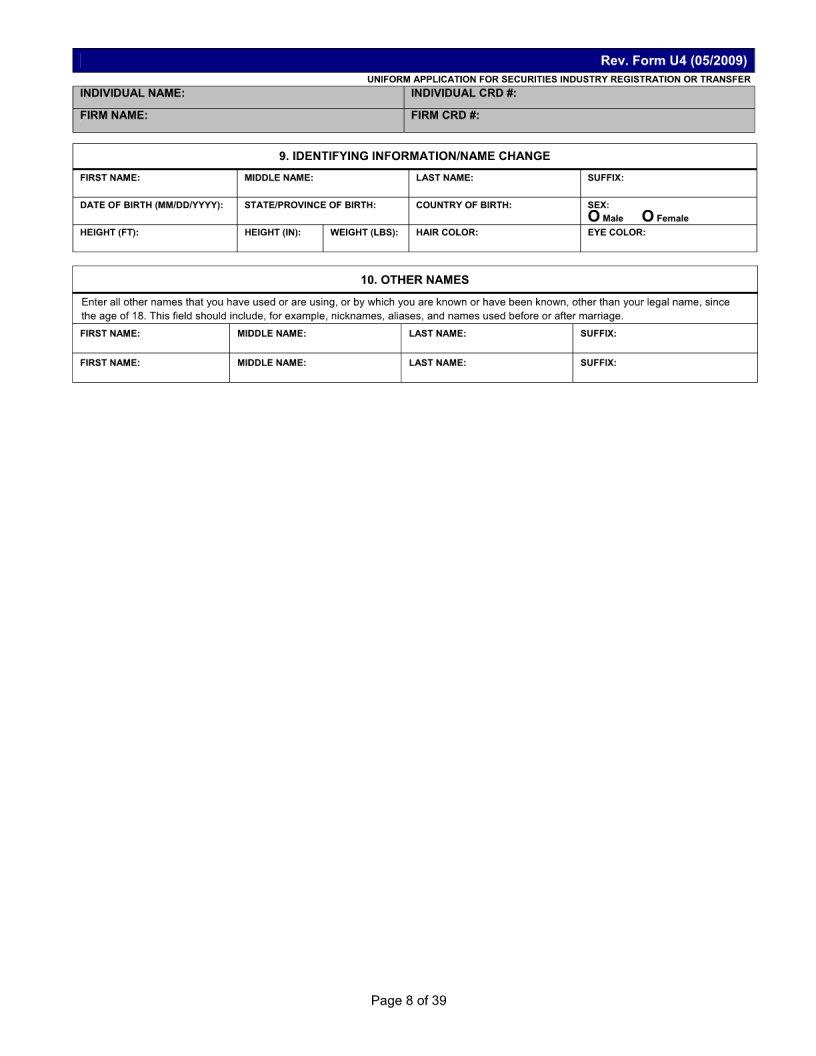

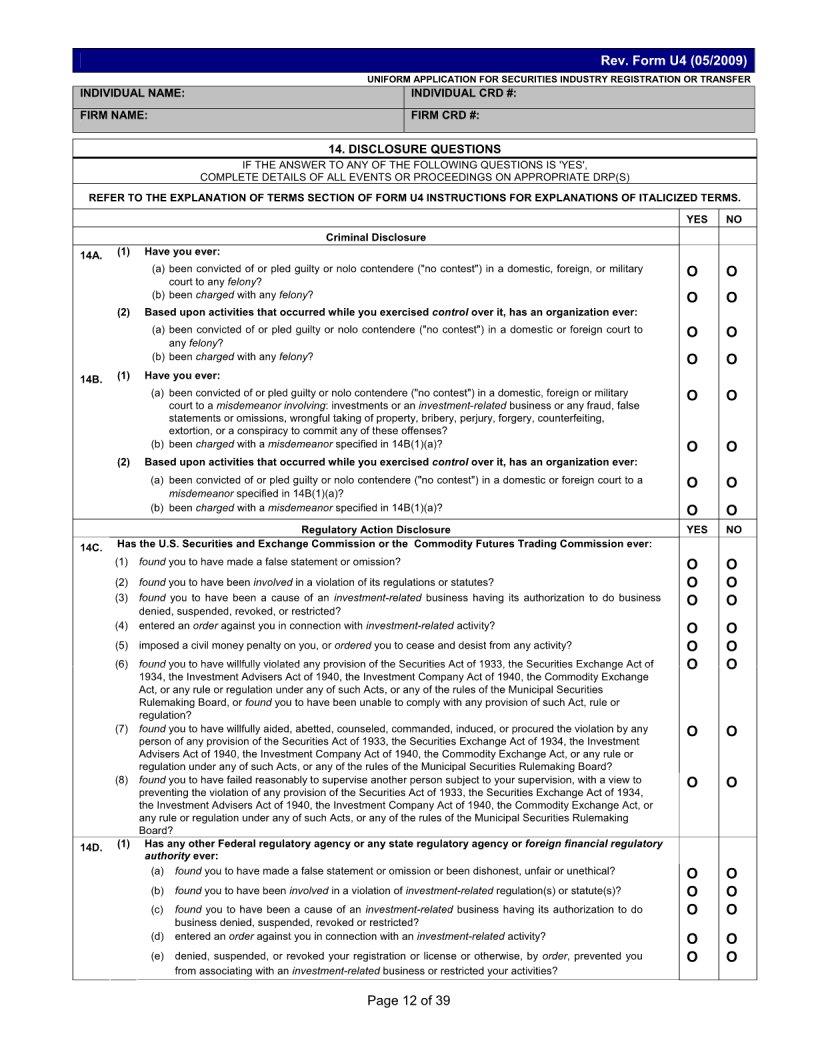

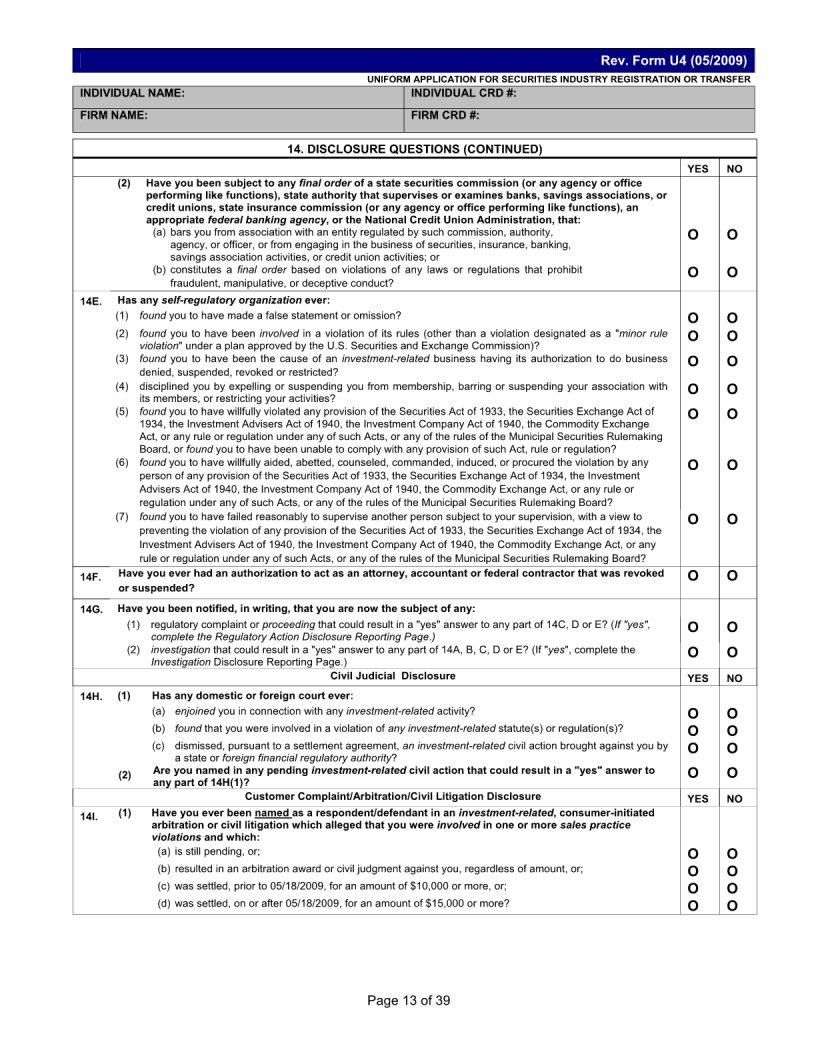

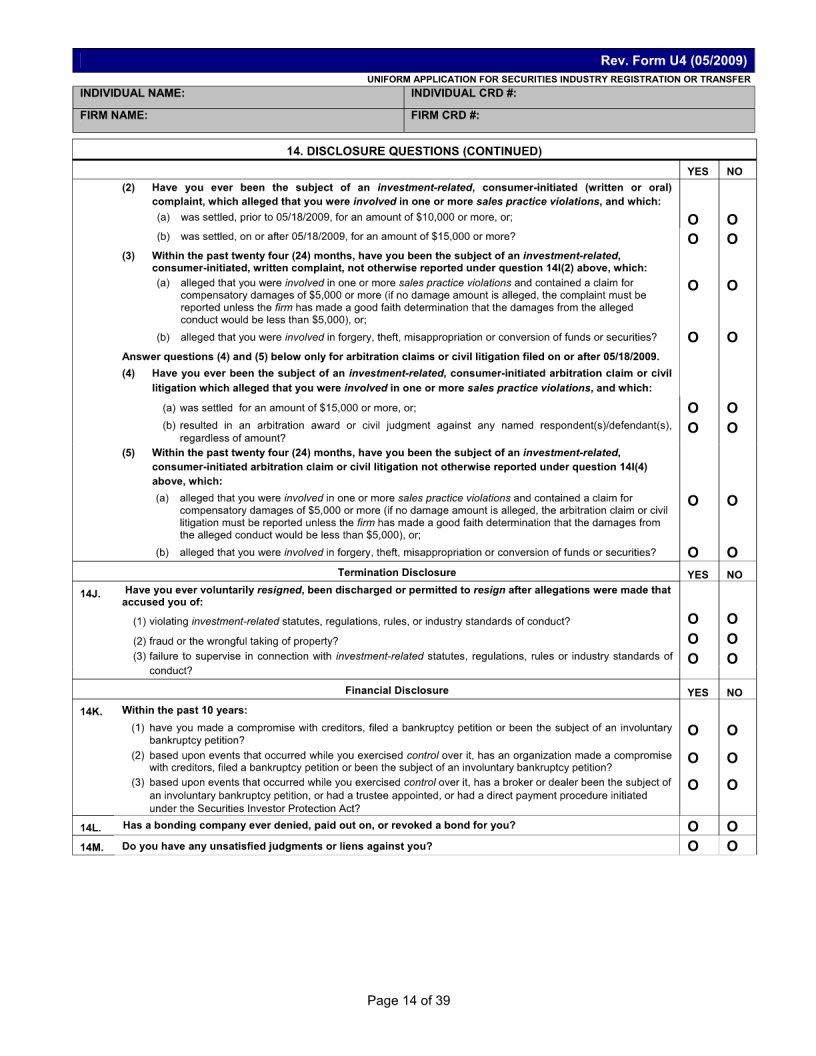

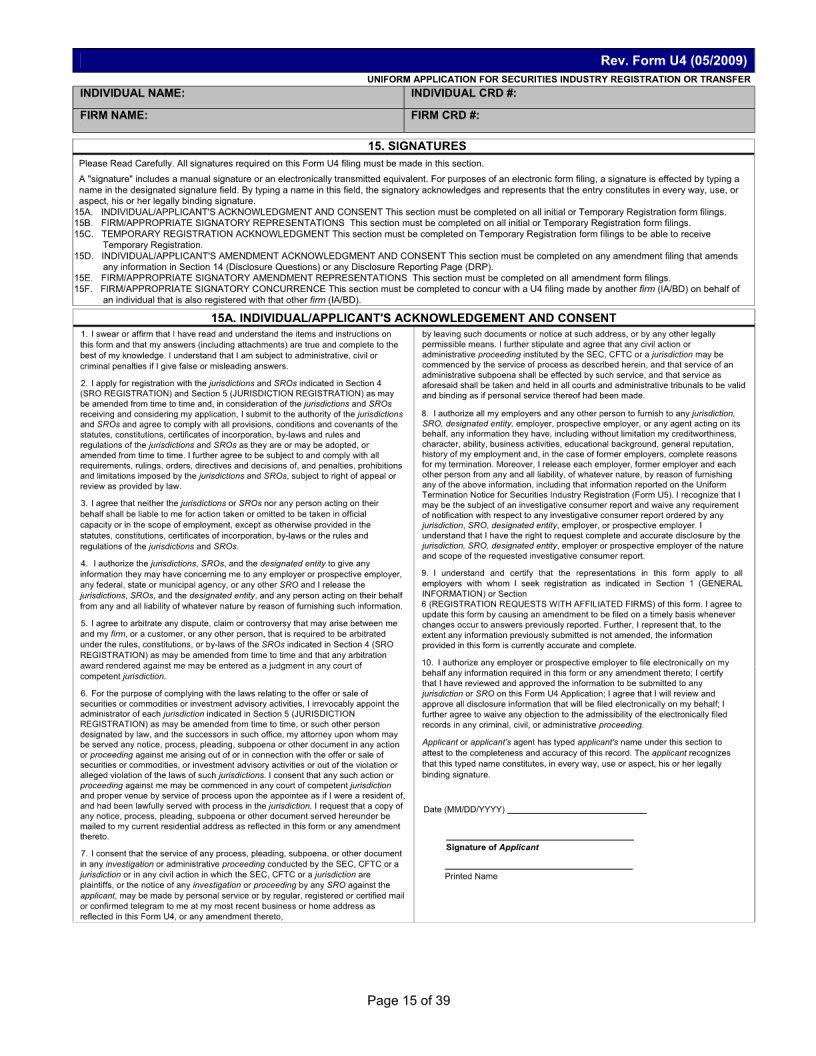

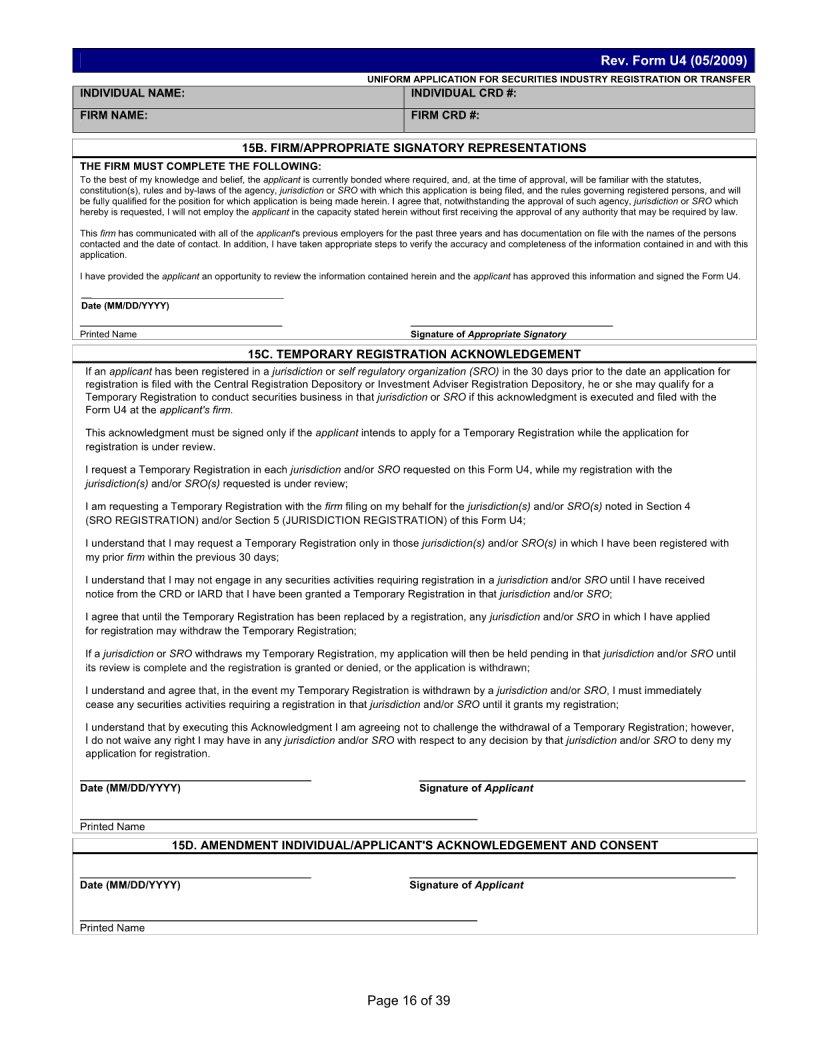

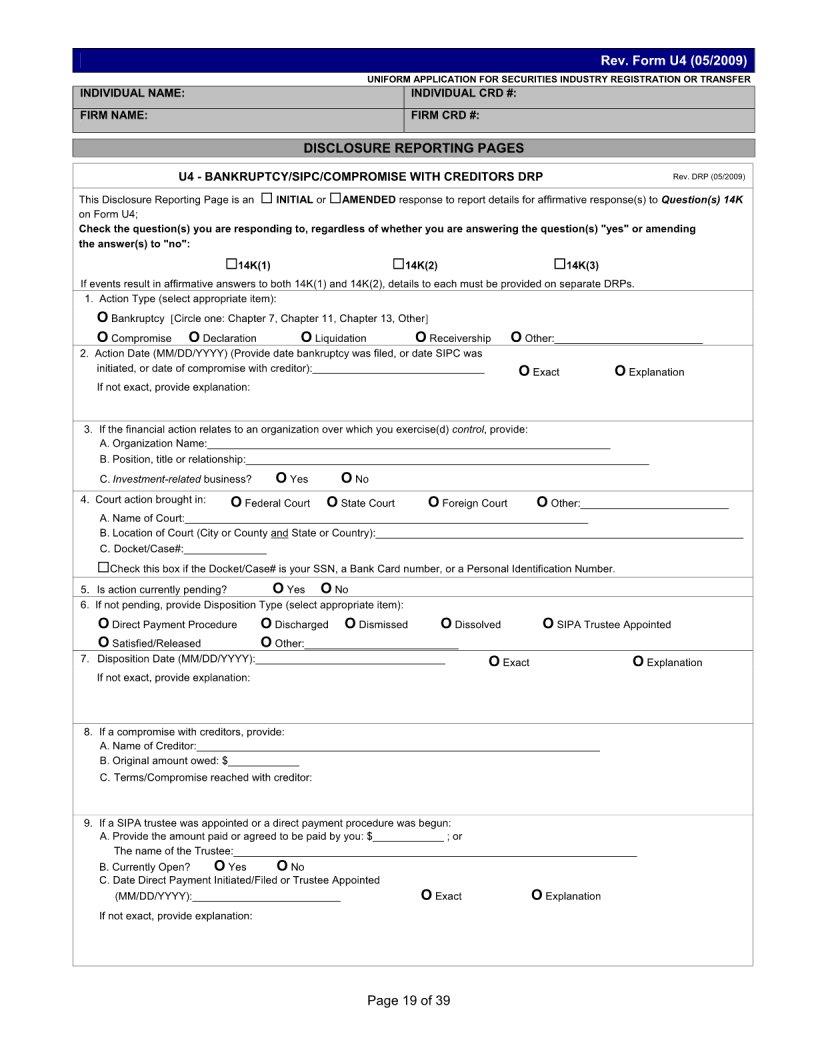

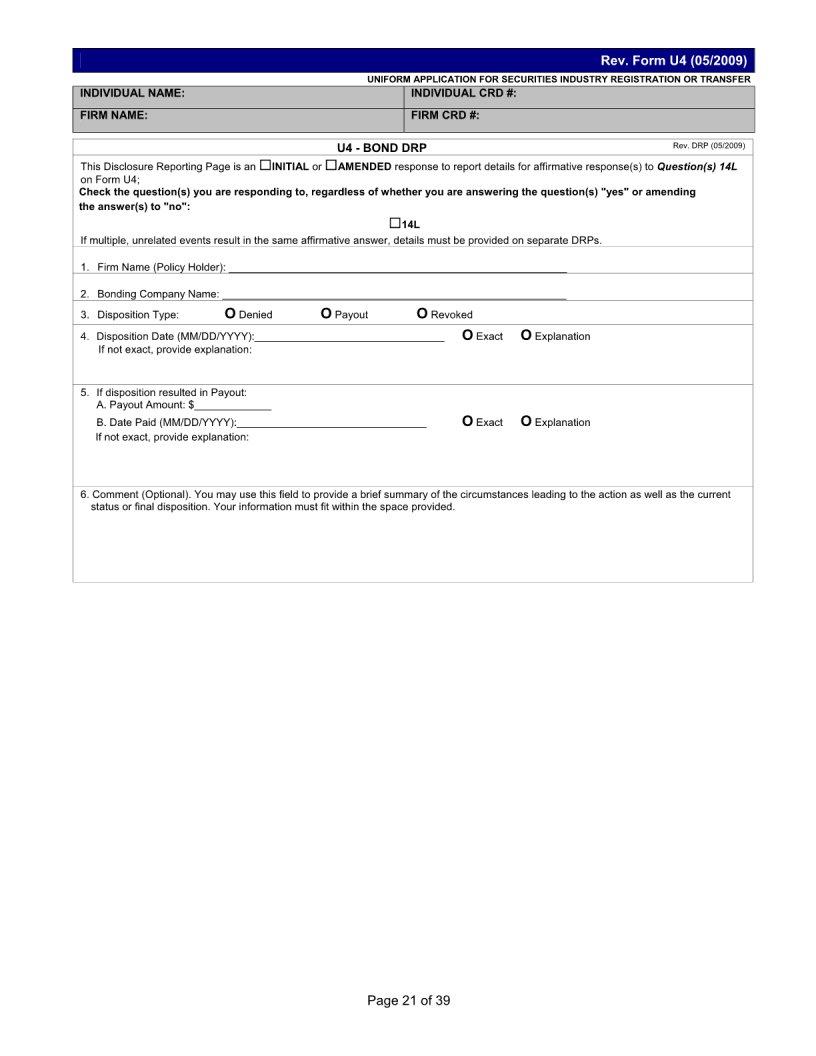

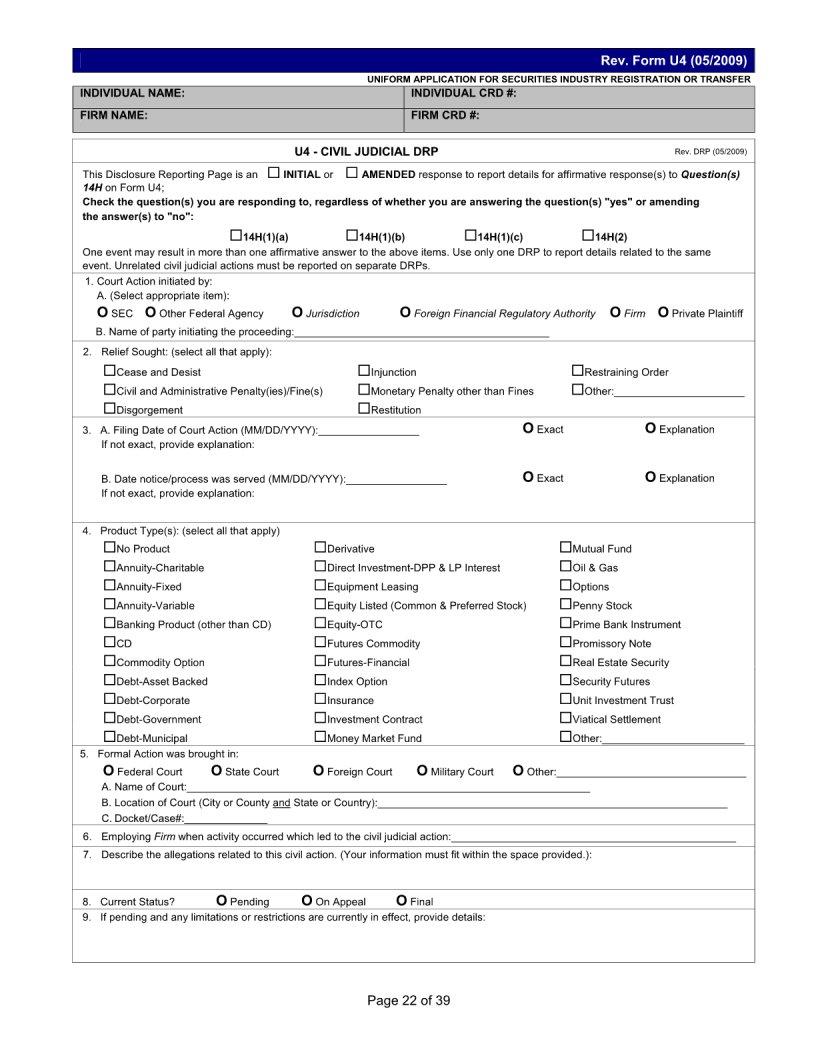

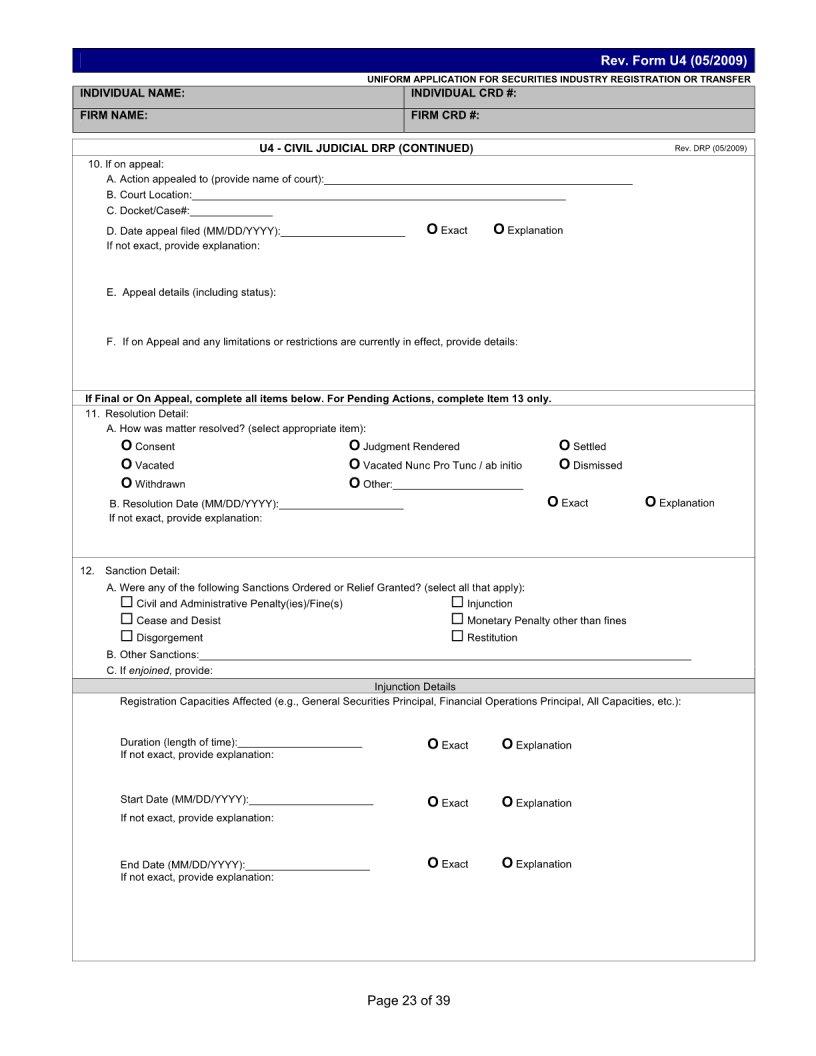

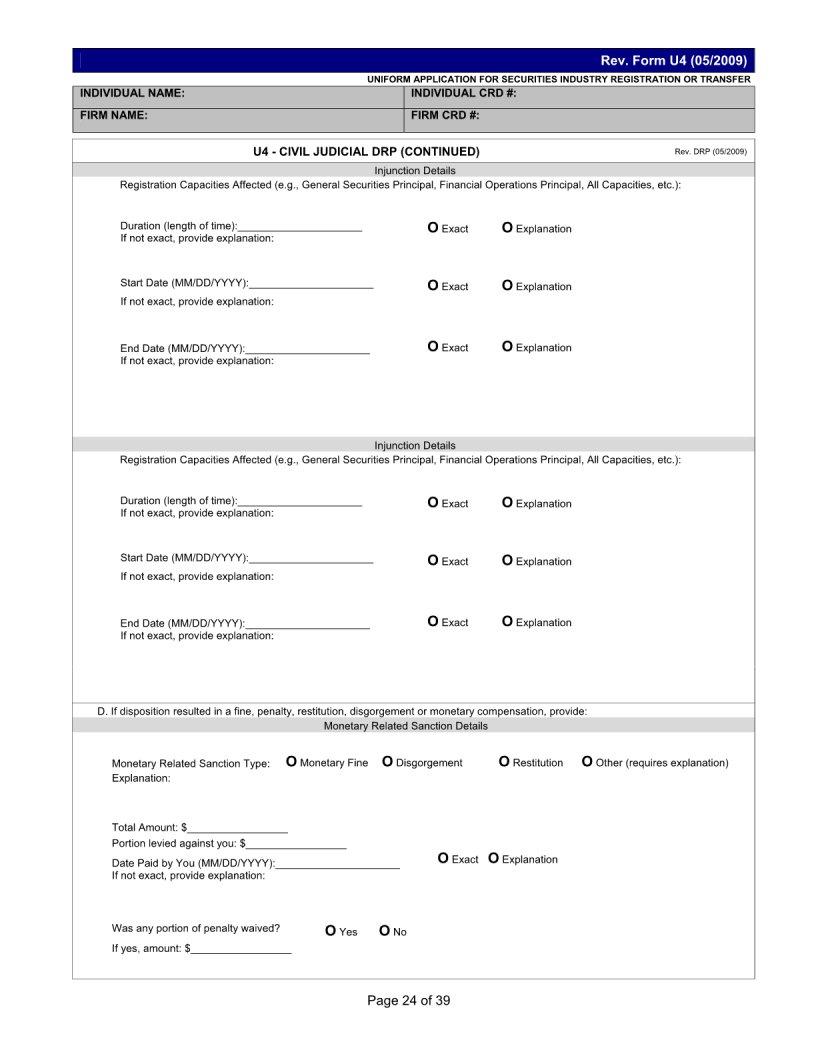

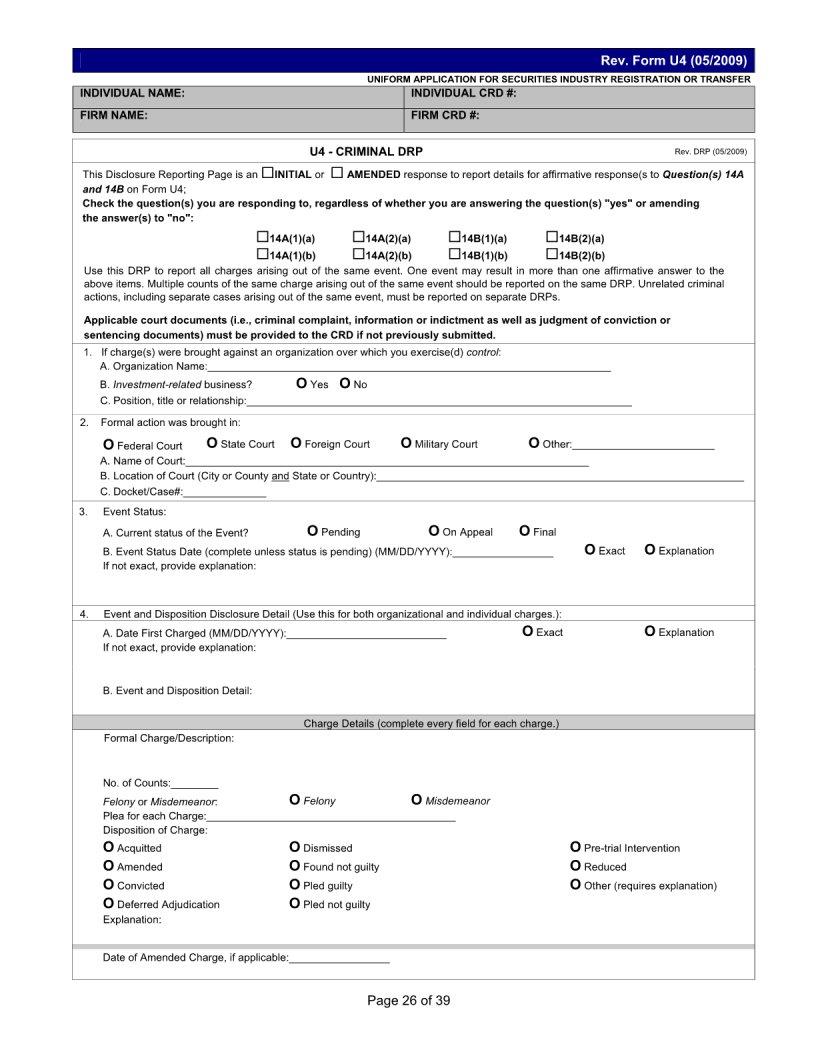

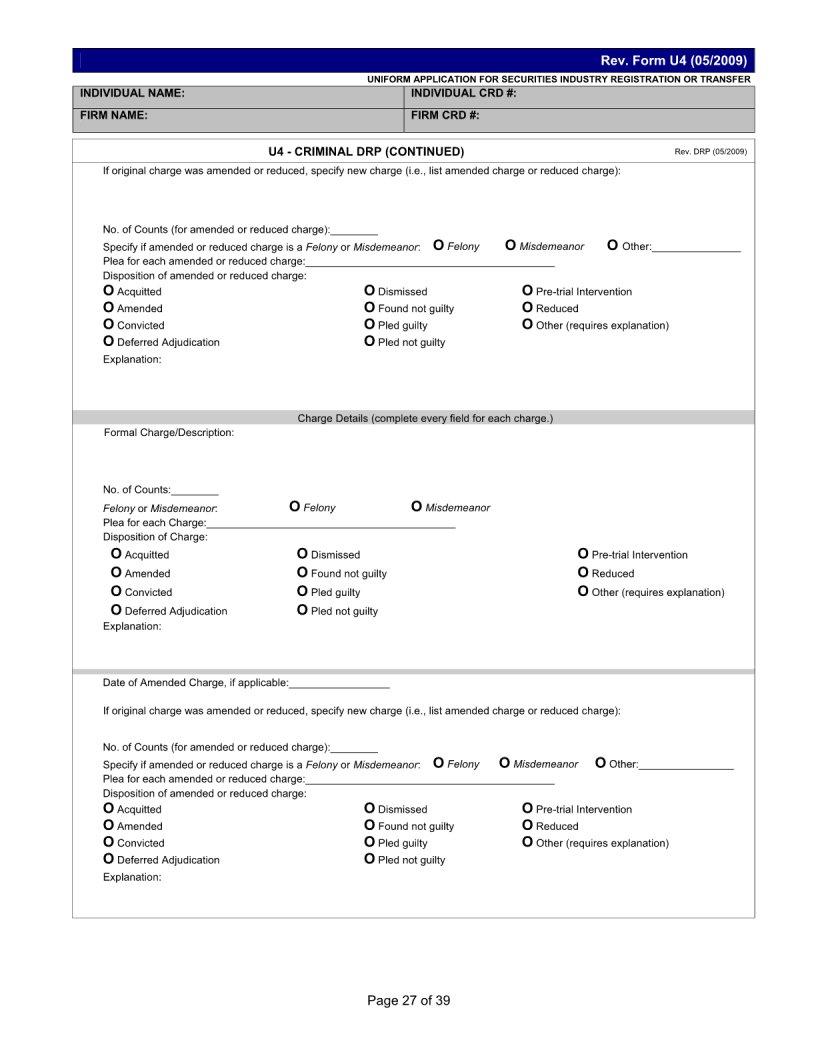

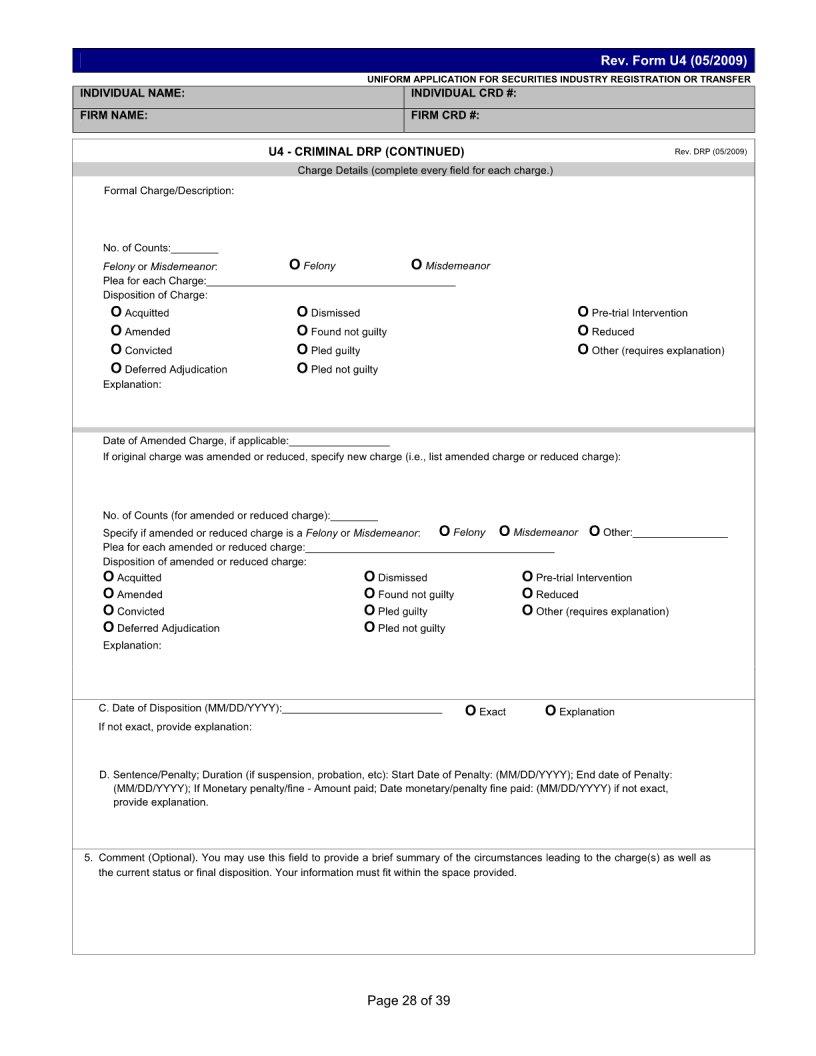

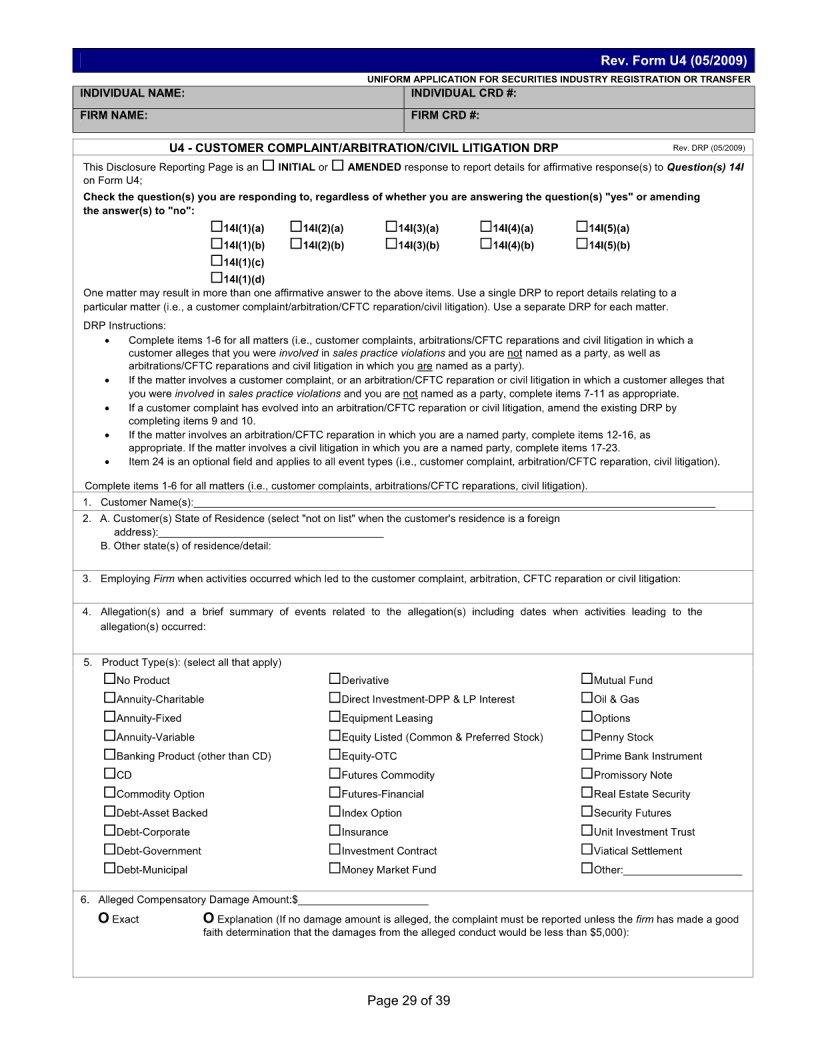

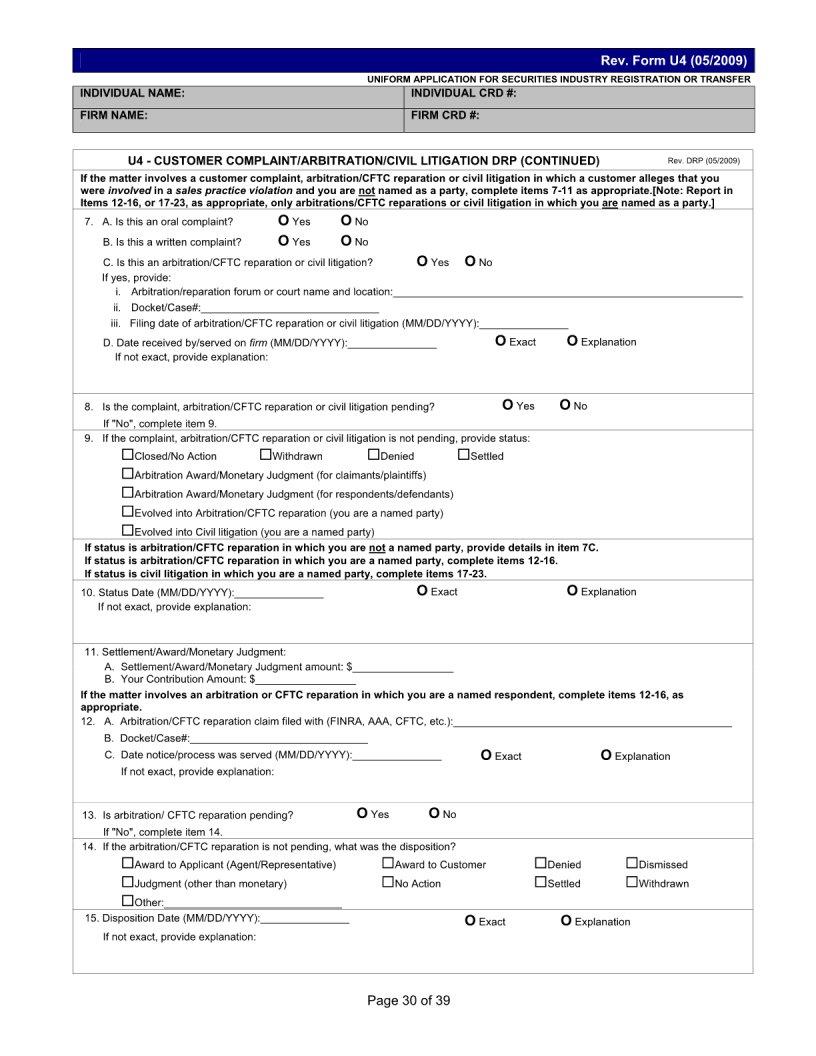

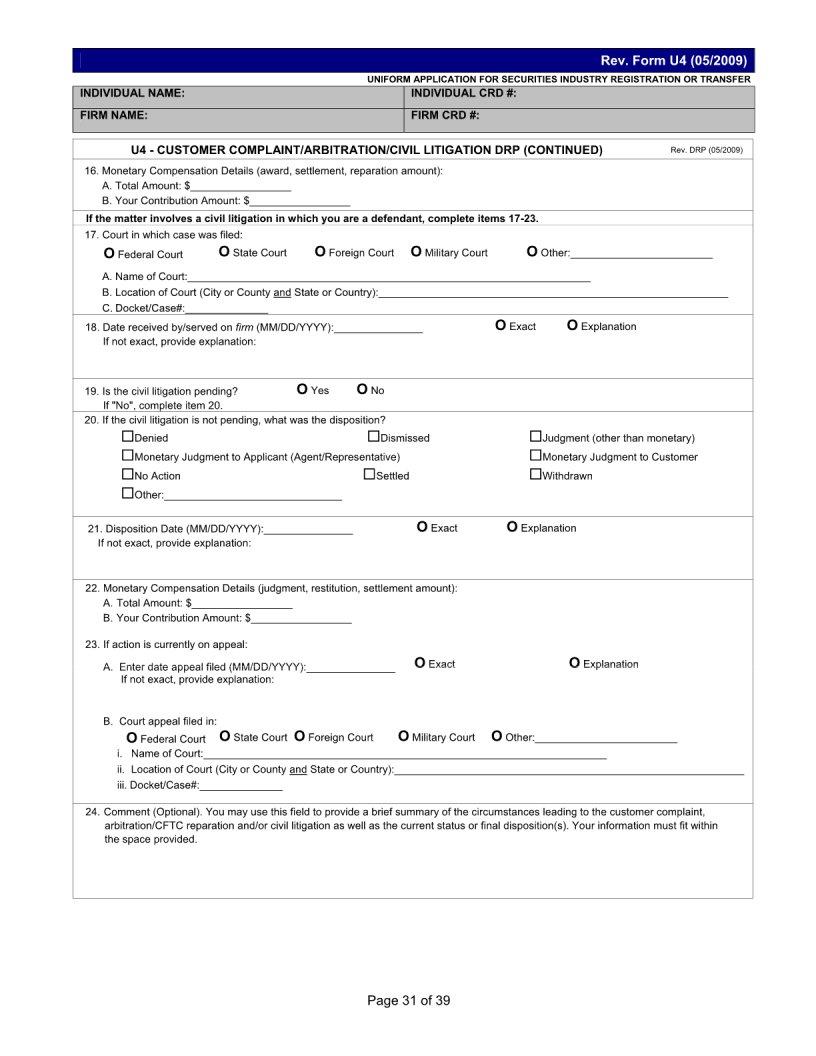

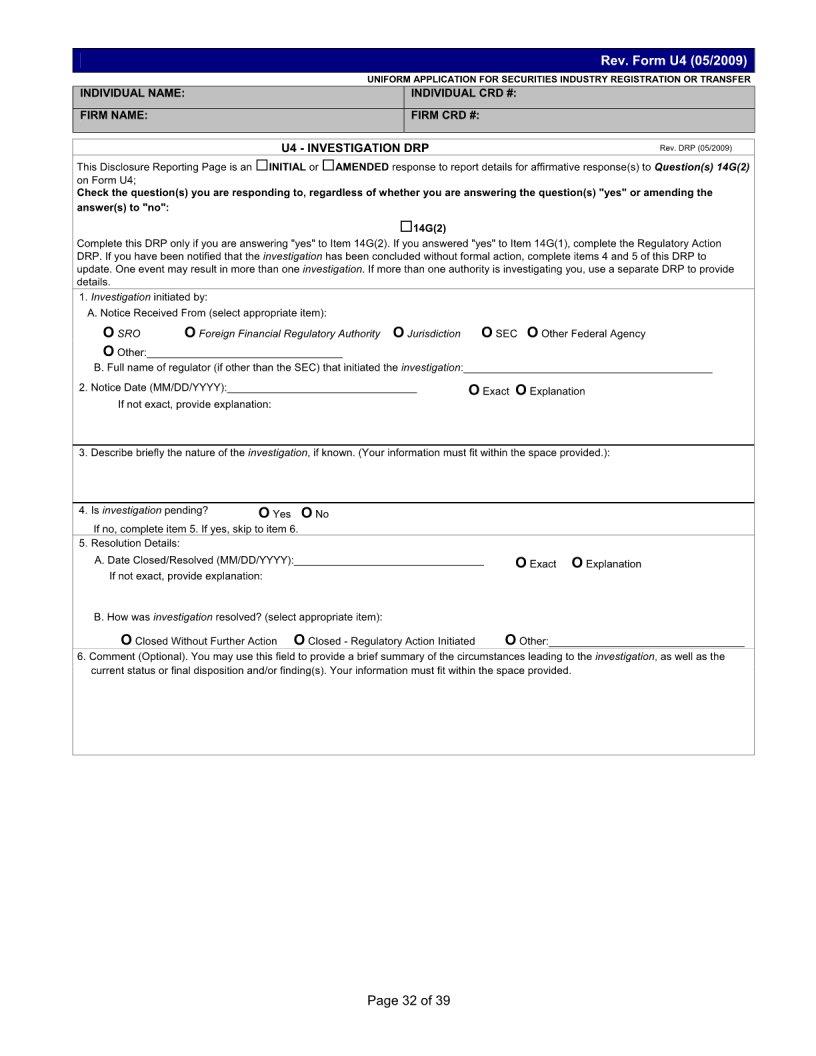

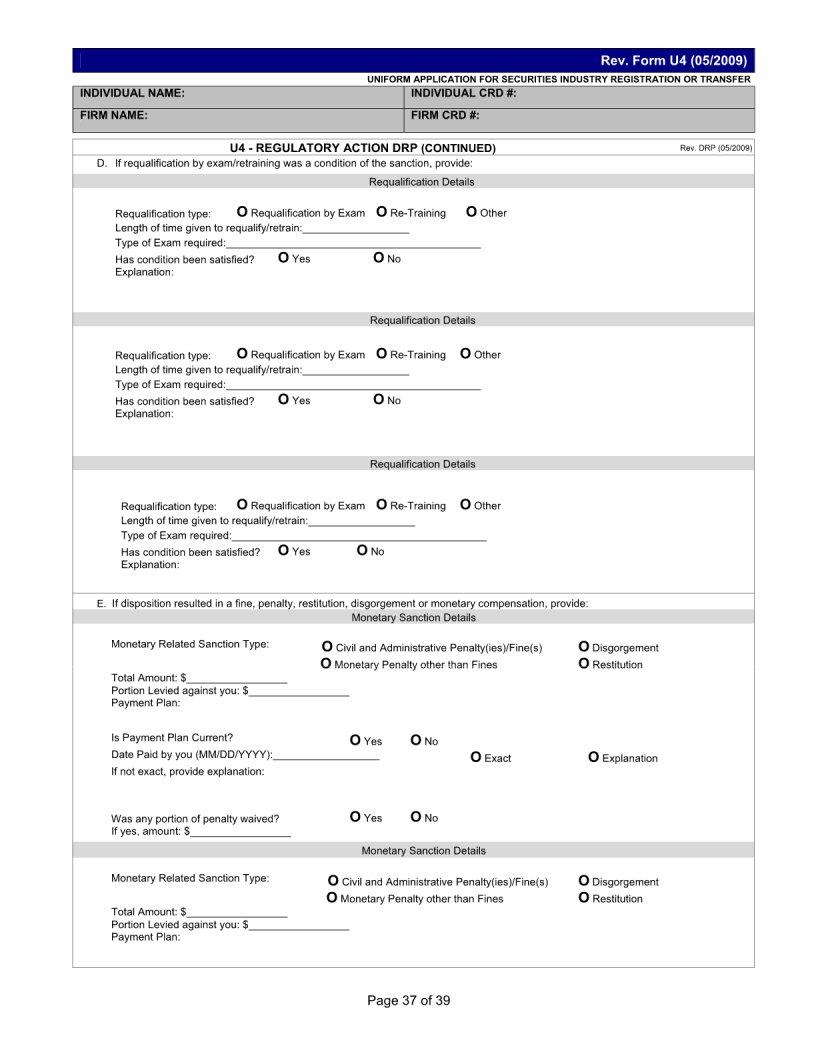

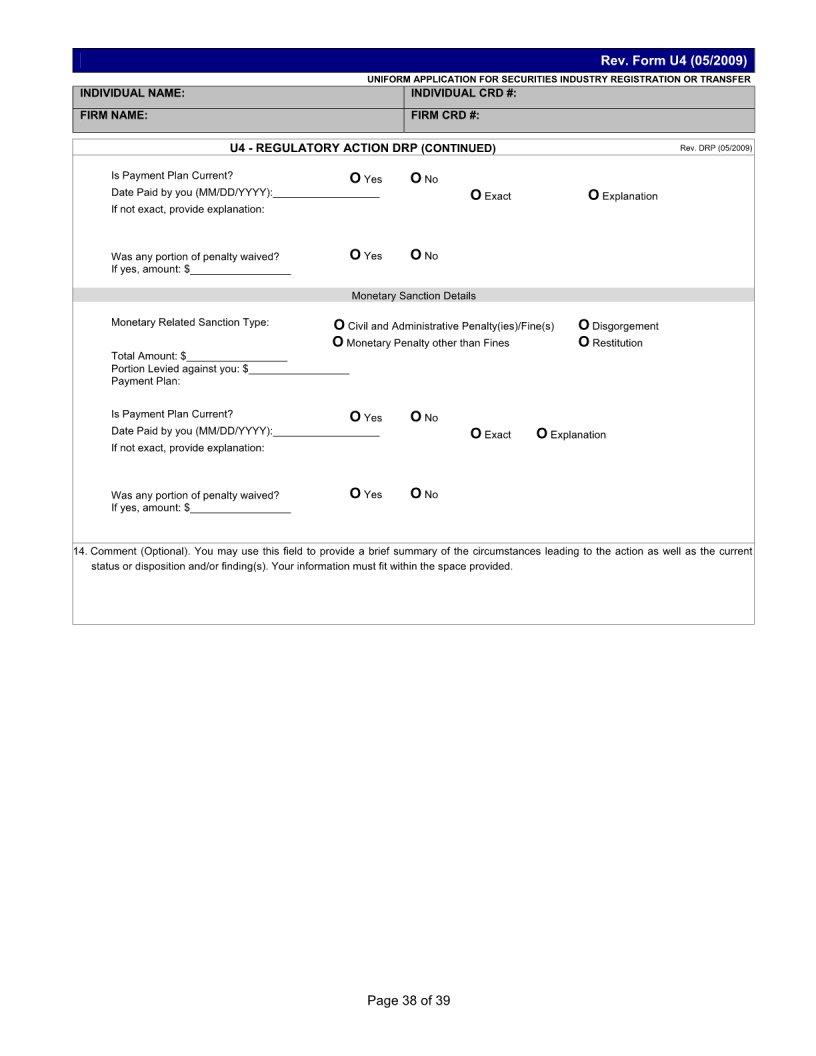

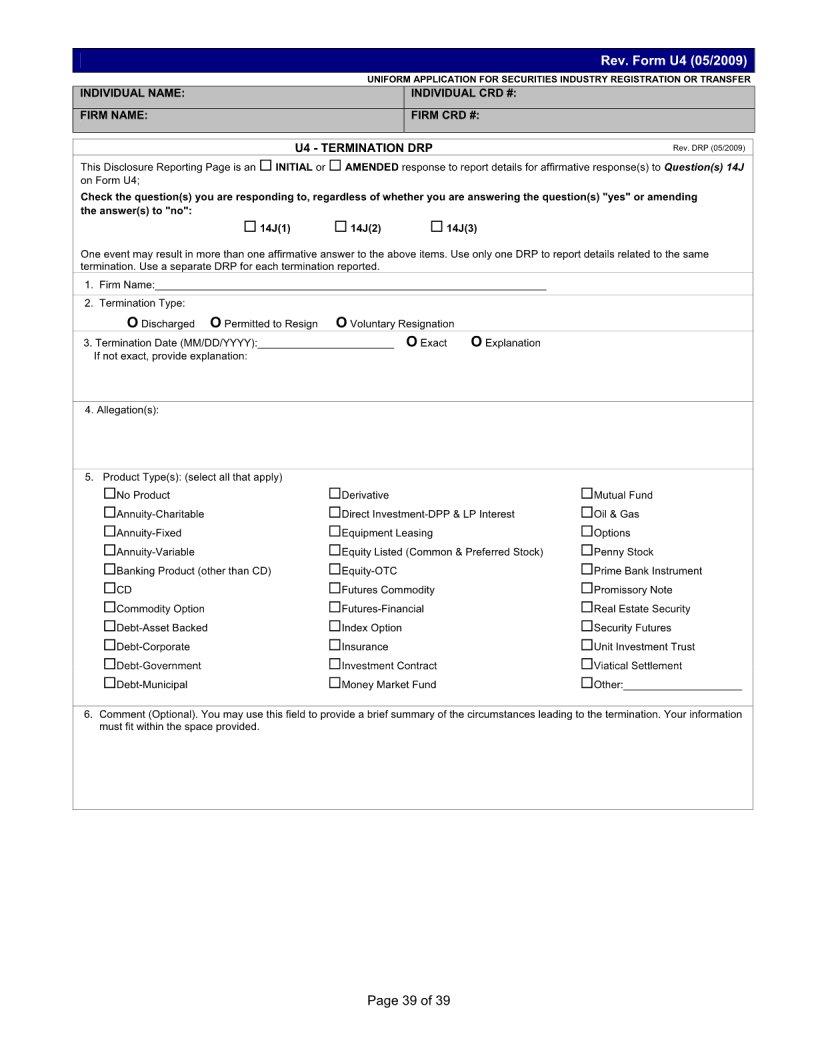

Walking through the gateway of professional financial services requires not just skill and knowledge, but also a formal nod of compliance and integrity. This is where the U4 form steps into the spotlight, a crucial document that introduces professionals to the regulatory landscape of the financial industry. It serves as a uniform application for securities, commodities, and investment advisers, acting as a comprehensive record of an individual’s employment history, regulatory actions, criminal history, and other personal background information. The completion and submission of this form play a pivotal role in the licensing process, ensuring that only individuals who meet the stringent criteria laid out by regulatory bodies can engage in the financial services industry. By providing a detailed glimpse into the professional and personal background of an applicant, the U4 form helps in maintaining the integrity and trustworthiness of the financial markets. As such, understanding its contents, implications, and the responsibility it entails is essential for anyone standing on the threshold of a career in finance or investment advising.

| Question | Answer |

|---|---|

| Form Name | U4 Form |

| Form Length | 39 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 9 min 45 sec |

| Other names | finra form u4, u4, u4 form, form u4 fillable |