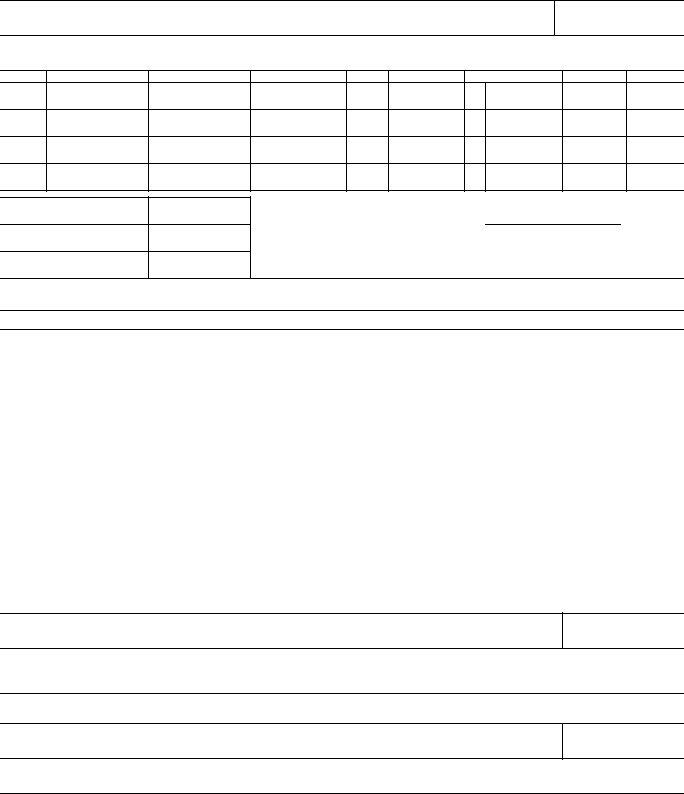

Dealing with unemployment tax-related matters often requires navigating through various forms and notices, one of which is the UC-018-A form issued by the Arizona Department of Economic Security's Employment Security Administration. Designed as a Notice of Assessment, it plays a critical role in communicating tax assessments to employers. This form details the employer's name and address, account number, and crucial financial figures such as total wages, excess wages, taxable wages, the rate of taxes due, interest, penalties, and the total balance due. Additionally, it specifies the type of assessment being made, whether it's a delinquency assessment for late payments or a deficiency assessment for underpayments, based on a thorough review of an employer's books and records or other provided information. The form also outlines essential procedural steps, like the requirement for checks to be made payable to "DES-UNEMPLOYMENT TAX," and the critical timeframe within which a written petition for reassessment must be filed to avoid the finalization of the assessment and the automatic attachment of liens as per A.R.S. Section 23-745. This notice serves not only as a financial statement but also as a legal document, reminding employers of their rights and obligations under Arizona's employment and tax law, all while offering a clear pathway for compliance or dispute.

| Question | Answer |

|---|---|

| Form Name | Uc 018 A Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | uc 018, form uc018 fillable, dept of economic security 2017 forms, arizona form uc 018 pdf |

ARIZONA DEPARTMENT OF ECONOMIC SECURITY

Employment Security Administration - Unemployment Tax

P.O. Box 6028 Phoenix, Arizona

NOTICE OF ASSESSMENT

EMPLOYER'S NAME

ADDRESS (N0., STREET, SUITE NO., P.O., CITY, STATE, ZIP)

ACCOUNT NO.

Yr/Qtr

Total Wages

Excess Wages

Taxable Wages

Rate

Taxes Due

Interest Due

Penalty Due 25% Penalty

TOTAL DUE

PAYMENT

BALANCE DUE

0.00

0.00

Interest has been computed through

and continues to accrue at 1% per month.

MAKE CHECKS PAYABLE TO

EXPLANATION FOR ASSESSMENT

THE ESTABLISHED AMOUNT OF TAXES DUE FOR ANY CALENDAR QUARTER INDICATED ABOVE IS A:

|

Delinquency Assessment (A.R.S. Section |

Quarter(s): |

|

|

|||||

|

Deficiency Assessment (A.R.S. Section |

Quarter(s): |

|

|

|||||

|

|||||||||

|

|

|

|

|

|

|

|

|

|

THIS NOTICE HAS BEEN PREPARED BASED ON: |

|

|

|

|

|

||||

|

A review of the Employer's books and/or records. |

|

|

|

|

|

|||

|

|

|

|

|

|

||||

|

Information provided by |

|

|

|

|

|

|

||

|

|

|

|

|

|

||||

|

Other (Specify) |

|

|

|

|

|

|

||

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||

I CERTIFY THAT THIS NOTICE WAS |

|

|

|

|

|

||||

|

Mailed by certified mail (No.) |

|

|

|

|

|

|

||

|

|

|

|

|

|

||||

|

Delivered to |

|

|

|

|

|

|

||

|

|

|

|

|

|

||||

DEPARTMENT REPRESENTATIVE / SIGNATURE

DATE

The amount of this assessment becomes final and the lien imposed by A.R.S. Section

I certify that to the best of my knowledge and belief, all information contained in this report is correct and complete, and I agree that the amounts determined due are correct.

OWNER, OFFICER, PARTNER, OR AUTHORIZED REPRESENTATIVE'S SIGNATURE

DATE

TITLE (Owner, officer, partner, authorized representative, etc.)

Equal Opportunity Employer/Program

For alternative format/reasonable accommodations: contact the UI Tax Office.