Are you already familiar with different forms of standardized tests? Today's blog post is all about the UC 018 A form, a special twelve-page document designed to provide standard information and evaluations on students in grades nine through twelve. In this article, we'll take a detailed look at what exactly the UC 018 A form covers, who will receive it, when they need to fill it out and why it's an essential part of college entrance exams. We'll also discuss some other documents related to UC 018 A that may be used during college admissions. So if you're looking for comprehensive coverage of this important topic, keep reading!

| Question | Answer |

|---|---|

| Form Name | Uc 018 A Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | uc 018, form uc018 fillable, dept of economic security 2017 forms, arizona form uc 018 pdf |

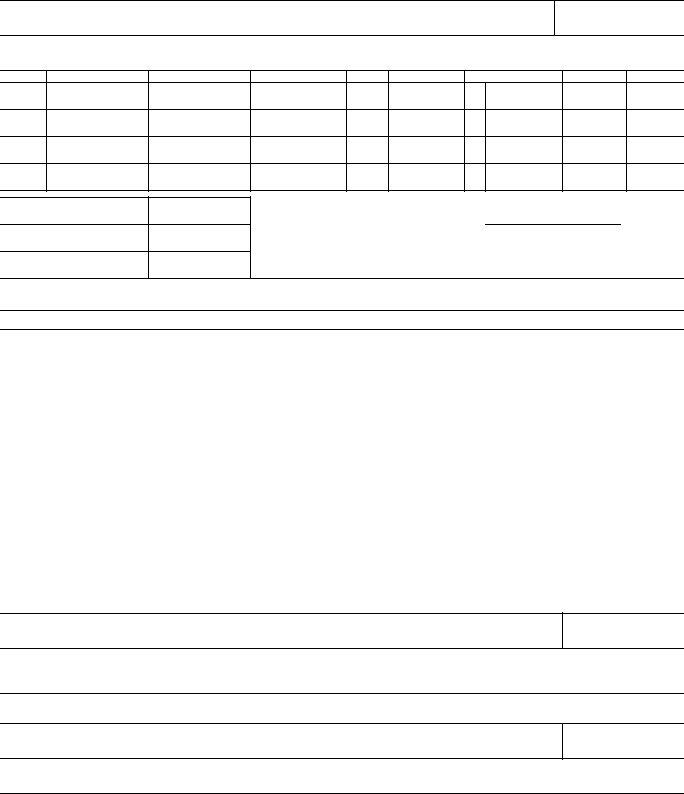

ARIZONA DEPARTMENT OF ECONOMIC SECURITY

Employment Security Administration - Unemployment Tax

P.O. Box 6028 Phoenix, Arizona

NOTICE OF ASSESSMENT

EMPLOYER'S NAME

ADDRESS (N0., STREET, SUITE NO., P.O., CITY, STATE, ZIP)

ACCOUNT NO.

Yr/Qtr

Total Wages

Excess Wages

Taxable Wages

Rate

Taxes Due

Interest Due

Penalty Due 25% Penalty

TOTAL DUE

PAYMENT

BALANCE DUE

0.00

0.00

Interest has been computed through

and continues to accrue at 1% per month.

MAKE CHECKS PAYABLE TO

EXPLANATION FOR ASSESSMENT

THE ESTABLISHED AMOUNT OF TAXES DUE FOR ANY CALENDAR QUARTER INDICATED ABOVE IS A:

|

Delinquency Assessment (A.R.S. Section |

Quarter(s): |

|

|

|||||

|

Deficiency Assessment (A.R.S. Section |

Quarter(s): |

|

|

|||||

|

|||||||||

|

|

|

|

|

|

|

|

|

|

THIS NOTICE HAS BEEN PREPARED BASED ON: |

|

|

|

|

|

||||

|

A review of the Employer's books and/or records. |

|

|

|

|

|

|||

|

|

|

|

|

|

||||

|

Information provided by |

|

|

|

|

|

|

||

|

|

|

|

|

|

||||

|

Other (Specify) |

|

|

|

|

|

|

||

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||

I CERTIFY THAT THIS NOTICE WAS |

|

|

|

|

|

||||

|

Mailed by certified mail (No.) |

|

|

|

|

|

|

||

|

|

|

|

|

|

||||

|

Delivered to |

|

|

|

|

|

|

||

|

|

|

|

|

|

||||

DEPARTMENT REPRESENTATIVE / SIGNATURE

DATE

The amount of this assessment becomes final and the lien imposed by A.R.S. Section

I certify that to the best of my knowledge and belief, all information contained in this report is correct and complete, and I agree that the amounts determined due are correct.

OWNER, OFFICER, PARTNER, OR AUTHORIZED REPRESENTATIVE'S SIGNATURE

DATE

TITLE (Owner, officer, partner, authorized representative, etc.)

Equal Opportunity Employer/Program

For alternative format/reasonable accommodations: contact the UI Tax Office.