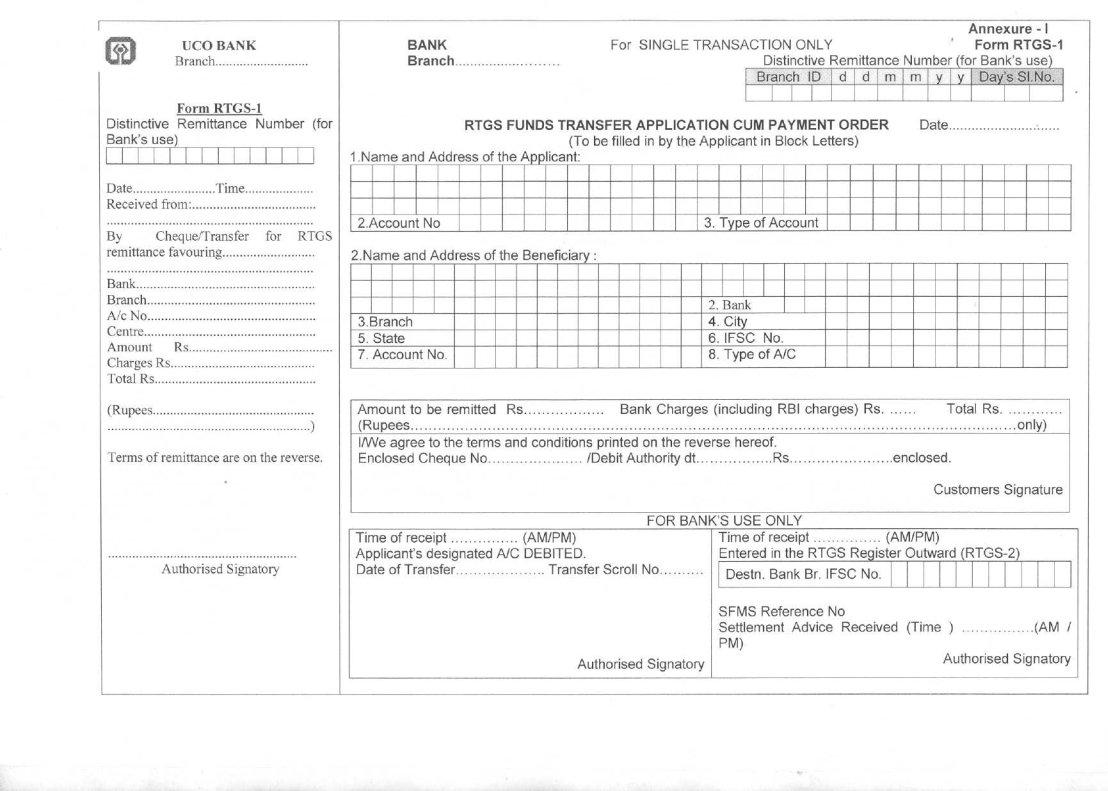

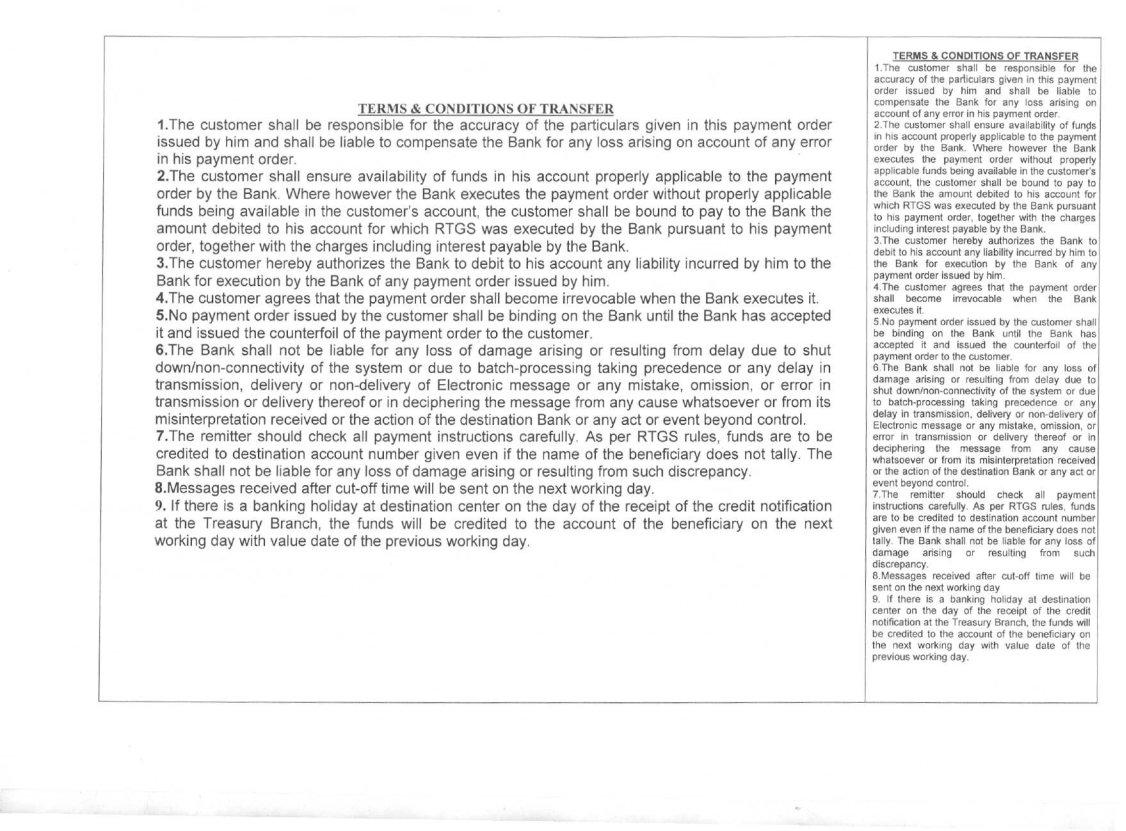

Navigating the complexities of financial transactions requires utmost accuracy and adherence to specified protocols, as emphasized by the Uco Bank KYC form, an essential document that plays a pivotal role in ensuring the security and efficacy of financial transfers, particularly through the RTGS (Real Time Gross Settlement) system. This form is meticulously designed to capture crucial information, including the transaction details, beneficiary bank’s name, and address, the amount to be remitted, and bank charges, emphasizing the accountability of customers for providing accurate particulars. Additionally, it highlights the irrevocable nature of the payment order once executed and underscores the bank’s immunity in events of delays or errors not attributable to its mistake, reflecting the rigor of banking protocols in handling electronic transfers. The terms and conditions detailed on the reverse side of the form further delineate the responsibilities of both the customer and the bank, elucidating the liability for losses due to inaccuracies or insufficient funds in the customer’s account, thereby safeguarding the transaction integrity. Thus, the Uco Bank KYC form is not just a procedural requirement but a critical document ensuring the seamless execution of RTGS transactions, embedded within a framework that protects all parties involved.

| Question | Answer |

|---|---|

| Form Name | Uco Bank Kyc Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | uco bank kyc form, uco bank kyc form pdf download, uco kyc form, uco bank kyc online |