You may work with state of michigan form 1027 effectively using our online PDF editor. To make our editor better and easier to use, we continuously work on new features, with our users' feedback in mind. With some simple steps, you can begin your PDF editing:

Step 1: First of all, open the pdf tool by pressing the "Get Form Button" at the top of this page.

Step 2: As you open the PDF editor, there'll be the form prepared to be filled in. In addition to filling in different blank fields, you might also perform various other things with the file, particularly putting on your own words, changing the initial text, adding illustrations or photos, signing the form, and much more.

Filling out this document demands focus on details. Ensure that all required fields are filled out accurately.

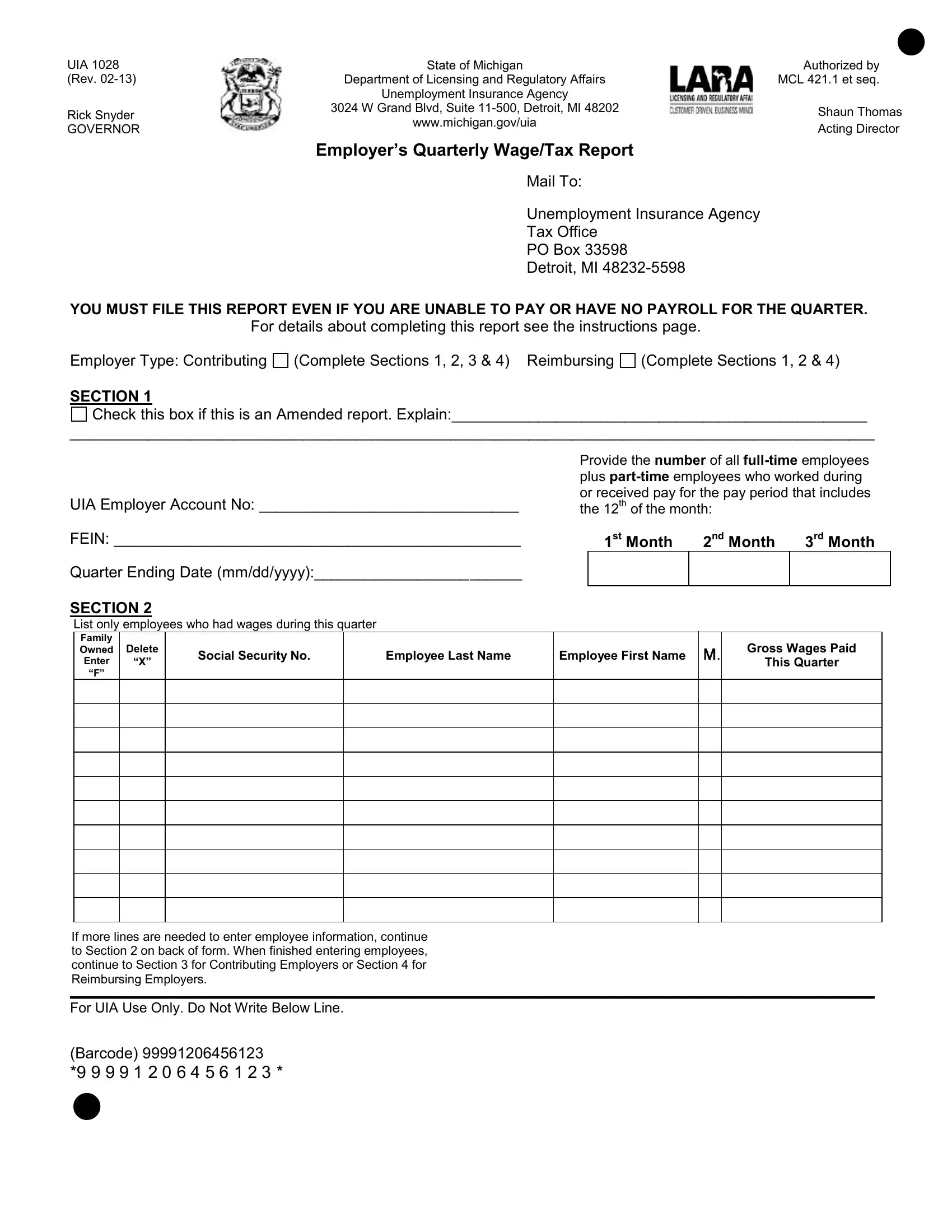

1. It is recommended to fill out the state of michigan form 1027 correctly, hence be careful when filling out the parts that contain all of these fields:

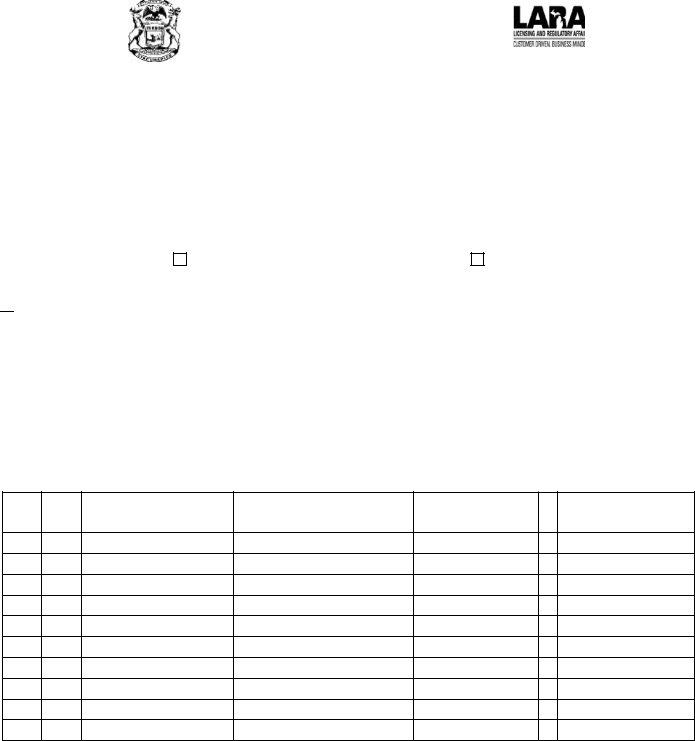

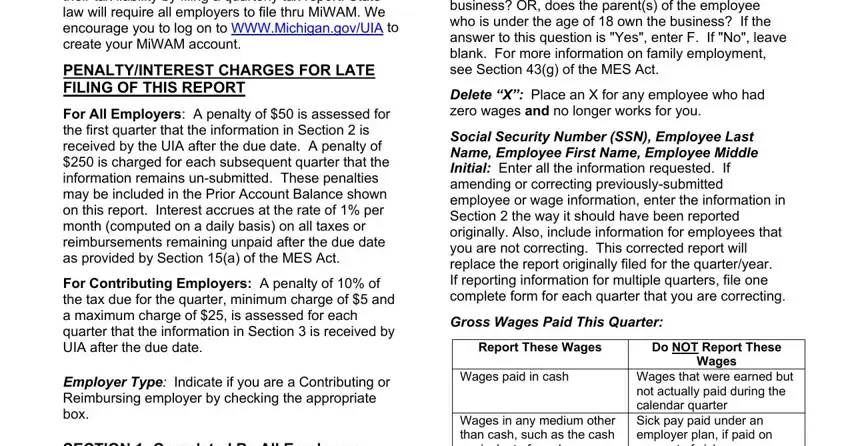

2. Right after finishing the previous part, head on to the subsequent step and fill out the necessary details in these fields - pay Include employees who earned, Social Security Number SSN, Report These Wages, Do NOT Report These, REPORTING REQUIREMENTS All liable, Wages paid in cash, Wages in any medium other than, Wages, and Wages that were earned but not.

People generally make errors when completing Wages in this area. Be sure to re-examine what you type in right here.

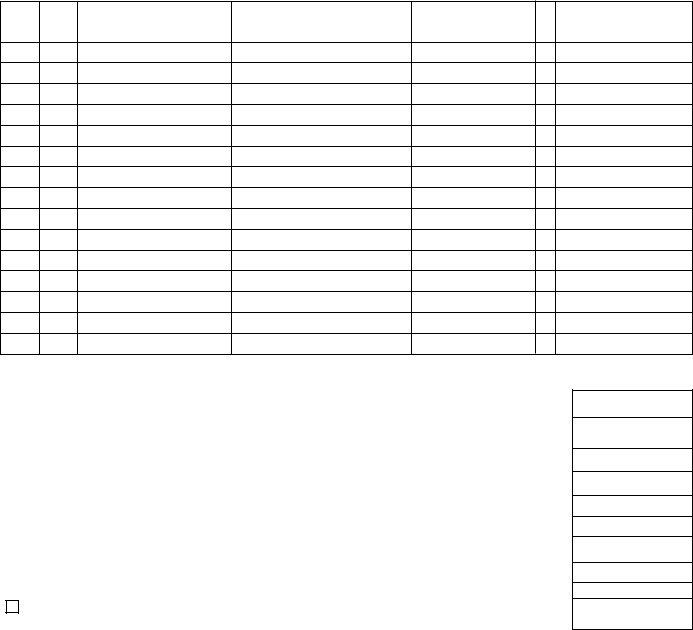

3. Completing st Qtr TOTAL NOTE FOR, Prior Balance Indicates any prior, Unemployment Insurance Agency Tax, and CONTACT US UIA forms are available is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Step 3: Prior to moving forward, double-check that blank fields are filled out as intended. The moment you believe it's all fine, press “Done." Try a 7-day free trial option at FormsPal and obtain instant access to state of michigan form 1027 - download, email, or change in your FormsPal cabinet. FormsPal guarantees secure document editor with no personal information recording or any type of sharing. Rest assured that your details are in good hands here!