SECTION 4: INSTRUCTIONS FOR COMPLETING THE FORM

Type or print using dark ink. Enter dates as month-day-year (mm-dd-yyyy). Use only numbers. Example: January 31, 2012 = 01-31-2012. Include your name and account number on any documentation that you are required to submit with this form. If you need help completing this form, contact your loan holder. If you want to apply for a deferment on loans that are held by different loan holders, you must submit a separate deferment request to each loan holder.

Return the completed form and any required documentation to the address shown in Section 7.

SECTION 5: DEFINITIONS

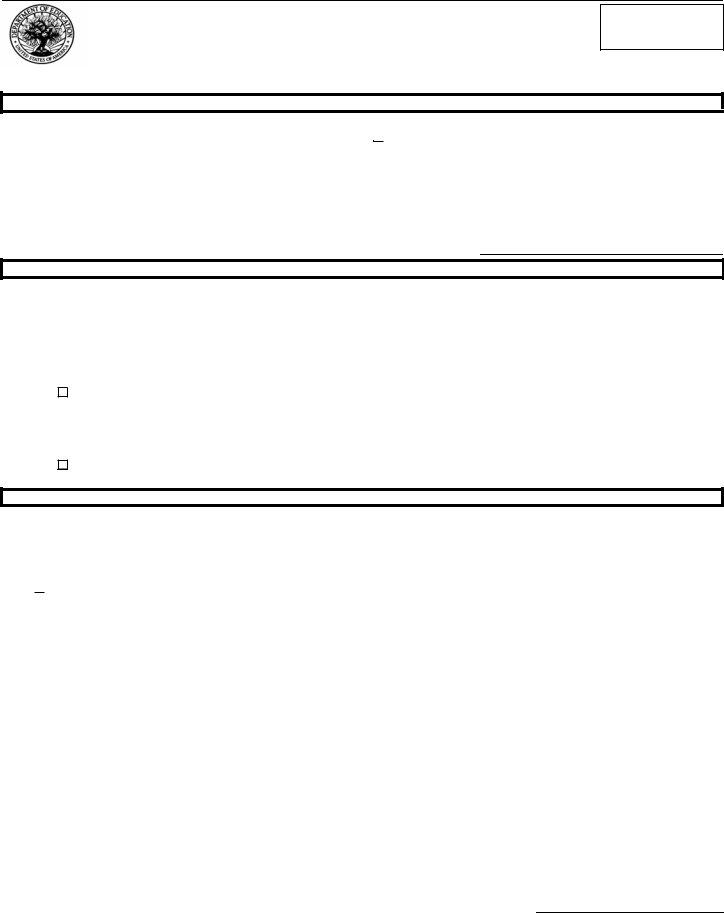

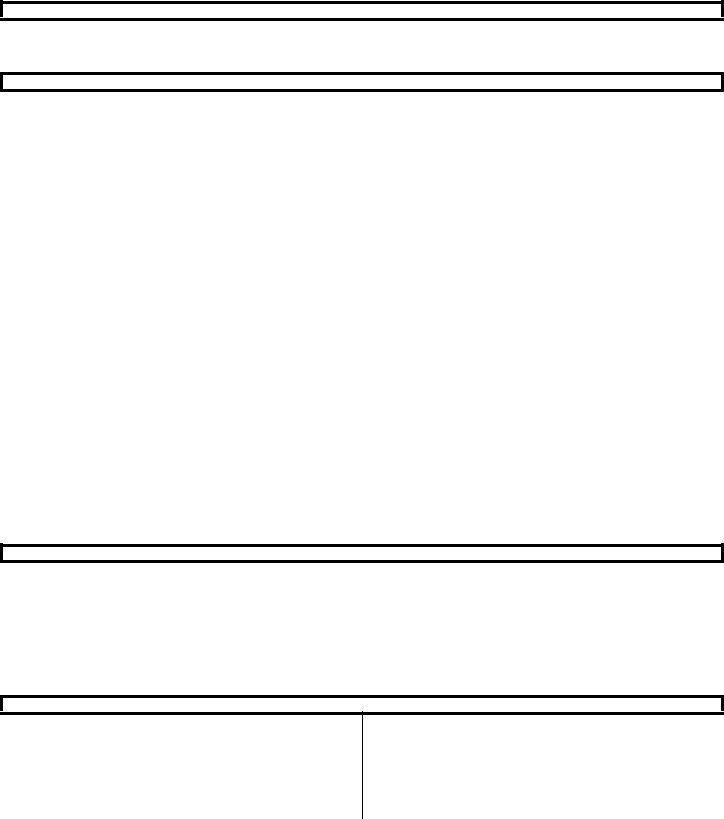

Capitalization is the addition of unpaid interest to the principal balance of your loan. The principal balance of a loan increases when payments are postponed during periods of deferment or forbearance and unpaid interest is capitalized. As a result, more interest may accrue over the life of the loan, the monthly payment amount may be higher, or more payments may be required. The chart below provides estimates, for a $15,000 unsubsidized loan balance at a 6.8% interest rate, of the monthly payments due following a 12-month deferment that started when the loan entered repayment. It compares the effects of paying the interest as it accrues, capitalizing the interest at the end of the deferment, and capitalizing interest quarterly and at the end of the deferment. Please note that the U.S. Department of Education (the Department) and many other holders do not capitalize interest on a quarterly basis. The actual loan interest cost will depend on your interest rate, length of the deferment, and frequency of capitalization. Paying interest during the period of deferment lowers the monthly payment by about $12 and saves about $426 over the lifetime of the loan, as depicted in the chart below.

|

Treatment of Interest Accrued |

Loan |

Capitalized Interest |

Principal to |

Monthly |

Number of |

Total Amount |

Total Interest |

|

During Deferment |

Amount |

for 12 Months |

Be Repaid |

Payment |

Payments |

Repaid |

Paid |

|

|

|

|

|

|

|

|

|

|

Interest is paid |

$15,000.00 |

$0.00 |

$15,000.00 |

$172.62 |

120 |

$21,736.55* |

$6,730.66 |

|

|

|

|

|

|

|

|

|

|

Interest is capitalized at the end of deferment |

$15,000.00 |

$1,022.09 |

$16,022.09 |

$184.38 |

120 |

$22,125.94 |

$7,119.64 |

|

Interest is capitalized quarterly during |

$15,000.00 |

$1,048.51 |

$16,048.51 |

$184.69 |

120 |

$22,162.41 |

$7,156.10 |

|

deferment and at the end of deferment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Total amount repaid includes $1,022.09 of interest paid during the 12-month period of deferment.

A deferment is a period during which you are entitled to postpone repayment of the principal balance of your loan(s). Interest does not accrue during a deferment on a Direct Subsidized Loan, a Direct Subsidized Consolidation Loan, a subsidized Federal Stafford Loan, or, in some cases, the subsidized portion of a Federal Consolidation Loan (see Note). Interest does accrue during a deferment on a Direct Unsubsidized Loan, a Direct PLUS Loan, a Direct Unsubsidized Consolidation Loan, an unsubsidized Federal Stafford Loan, a Federal PLUS Loan, or a Federal SLS Loan. Note: Interest does not accrue on a Federal Consolidation Loan during a deferment only if: (1) the application for the Federal Consolidation Loan was received by your loan holder on or after January 1, 1993, but before August 10, 1993; (2) the application was received by your loan holder on or after August 10, 1993, and the Federal Consolidation Loan includes only Federal Stafford Loans that were eligible for federal interest subsidy; or (3) the application was received by your loan holder on or after November 13, 1997, in which case interest does not accrue on the portion of the Federal Consolidation Loan that paid a subsidized Direct Loan or FFEL Program loan(s).

The Federal Family Education Loan (FFEL) Program includes Federal Stafford Loans, Federal PLUS Loans, Federal Consolidation Loans, and Federal Supplemental Loans for Students (SLS).

A forbearance is a period during which you are permitted to temporarily postpone making payments, allowed an extension of time for making payments, or temporarily allowed to make smaller payments than scheduled.

Full-time employment is defined as working at least 30 hours per week in a position expected to last at least 3 consecutive months.

The holder of your Direct Loan Program loan(s) is the the Department. The holder of your FFEL Program loan(s) may be a lender, guaranty agency, secondary market, or the Department.

The United States, for the purpose of this deferment, includes any state of the Union, the District of Columbia, the Commonwealth of Puerto Rico, American Samoa, Guam, the Virgin Islands, the Commonwealth of the Northern Mariana Islands, the Freely Associated States (the Republic of the Marshall Islands, the Federated States of Micronesia, and the Republic of Palau), and U.S. military bases and embassy compounds in foreign countries.

The William D. Ford Federal Direct Loan (Direct Loan) Program includes Federal Direct Stafford/Ford (Direct Subsidized) Loans, Federal Direct Unsubsidized Stafford/Ford (Direct Unsubsidized) Loans, Federal Direct PLUS (Direct PLUS) Loans, and Federal Direct Consolidation (Direct Consolidation) Loans.

SECTION 6: ELIGIBILITY REQUIREMENTS

To qualify:

(1)You must be diligently seeking but unable to find full-time employment in the United States (as defined in Section 5) in any field or at any salary or responsibility level. You must be registered with a public or private employment agency if there is one within 50 miles of my current address. Further, if you are requesting an extension of an existing Unemployment Deferment, you must have made at least six diligent attempts to find full-time employment in the most recent 6 months. (Check box A in Section 2.)

NOTE: School placement offices and “temporary employment” agencies do not qualify as public or private employment agencies.

OR

(2)You must be eligible for unemployment benefits, and attach documentation of your eligibility for these benefits. The documentation must include your name, address, and social security number, and show that you are eligible to receive unemployment benefits during the period for which you are requesting deferment. (Check box B in Section 2.)

SECTION 7: WHERE TO SEND THE COMPLETED DEFERMENT REQUEST