In a bid to navigate through the complexities of unemployment, the Unemployment Insurance Oklahoma form emerges as a crucial document, skilfully designed to bridge the gap between those recently finding themselves without work and the temporary financial assistance they require. Revised on September 6, 2016, and under the guidance of Richard McPherson from the Oklahoma Employment Security Commission (OESC), the form aims to expedite the reemployment process, ensuring that individuals can swiftly transition from unemployment to their next employment opportunity. With a promise of various services such as job referrals, skill enhancement, career guidance, and access to other supportive and training services at no cost, the form is a testament to the OESC's commitment to turning the tide on unemployment. It serves not just as a pathway to benefits eligibility but also offers a comprehensive guide—ranging from how to file weekly claims, to understanding the nuances of qualifying for benefits, maintaining eligibility, and ensuring rights are protected during the appeal process. Incorporating sections pertinent to diverse audiences, including veterans and those with disabilities, it underscores a holistic approach to workforce reintegration. As emphasized through contact details for the Unemployment Service Center, Oklahoma Works Center locations, and particulars for registering for employment services, the form is designed to streamline the complexities involved, making the journey from unemployment to employment as smooth as possible for Oklahomans.

| Question | Answer |

|---|---|

| Form Name | Unemployment Insurance Oklahoma Form |

| Form Length | 28 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 7 min |

| Other names | oklahoma unemployment work search log, work search form for oklahoma unemployment, work search job form oklahoma, oklahoma unemployment job search requirements |

ĊĊĒĕđĔĞĒĊēęĘĘĎĘęĆēĈĊċĔėęčĊēĊĒĕđĔĞĊĉ

ēċĔėĒĆęĎĔēĆđĔĔĐđĊę ĔėĔėĐĊėĘčĔėĊēĊĒĕđĔĞĊĉ

ĐđĆčĔĒĆĒĕđĔĞĒĊēęĊĈĚėĎęĞĔĒĒĎĘĘĎĔē

Revised 9/6/2016 — OES 339

NOTE FROM THE DIRECTOR

Richard McPherson

The Oklahoma Employment Security Commission (OESC) is committed to helping you become reemployed as quickly as possible. We realize your first priority is finding another job, and Unemployment Insurance benefits offer eligible recipients a temporary, supportive service to assist in the transition from unemployment to your next job.

We provide a variety of services to help you with your work search and job attainment. These services are aimed at ensuring your unemployment is a temporary condition and include such things as referrals to jobs, skill enhancement services, career guidance, and referrals to other supportive and training services.

These resources are available at no cost to help you as you move past unemployment and into the new job that’s waiting for you. Please take advantage of our services as we help you in your job search and eventual return to work.

Whether you are an employer looking for workers with just the right skills, a job seeker looking for a new employment opportunity, a workforce partner needing to access tools to help your customers, or someone seeking the latest state or local demographics to make more informed decisions in the labor market, we can help!

1

Quick Reference Guide

Unemployment Service Center

(405)

(800)

(866)

Hours of Operation:

Internet Address

(to file a claim or weekly claim)

unemployment.ok.gov

Mailing Address or Fax Number

OESC UI Support

PO Box 52006

Oklahoma City, OK

FAX: (405)

To Locate an Oklahoma Works Center Near You

Or

http://www.ok.gov/oesc_web/Services/Workforce_Services/index.html

Hours of Operation:

To Register for Employment Services and Look for Jobs

OKJobMatch.com

To Inquire about Direct Deposit, Debit Card, or Missing Payments

(866)

(210)

Text Telephone System (TTY/TDD)

If you are hearing impaired or need to use a text telephone system to file your initial claim for

benefits you may do so using the following telephone numbers:

(800)

(800)

Equal Opportunity Employer/Program

Auxiliary aids and services are available upon request to individuals with disabilities

2

TABLE OF CONTENTS |

|

NOTE FROM THE DIRECTOR |

1 |

QUICK REFERENCE GUIDE |

2 |

TABLE OF CONTENTS |

3 |

FREQUENTLY ASKED QUESTIONS ABOUT UNEMPLOYMENT INSURANCE |

|

SERVICES PROVIDED BY OESC |

6 |

SERVICES FOR VETERANS |

6 |

REEMPLOYMENT SERVICES |

|

TRAINING PROGRAMS |

9 |

UNEMPLOYMENT INSURANCE FRAUD |

10 |

UNEMPLOYMENT INSURANCE |

|

HOW DO I FILE MY WEEKLY CLAIM |

13 |

SOME THINGS TO KNOW WHEN FILING YOUR UNEMPLOYMENT CLAIM |

14 |

ISSUES THAT MAY AFFECT YOUR CLAIM |

|

QUALIFYING FOR BENEFITS |

17 |

HOW DO I RECEIVE MY PAYMENTS |

18 |

MAINTAINING YOUR ELIGIBILITY |

19 |

WHAT DO I DO WHEN I RETURN TO WORK |

|

WHAT IF I DON’T QUALIFY |

22 |

PROTECTING YOUR RIGHTS WHILE APPEALING A DETERMINATION |

23 |

WORKFORCE OKLAHOMA CENTER LOCATIONS |

24 |

IMPORTANT REMINDERS |

25 |

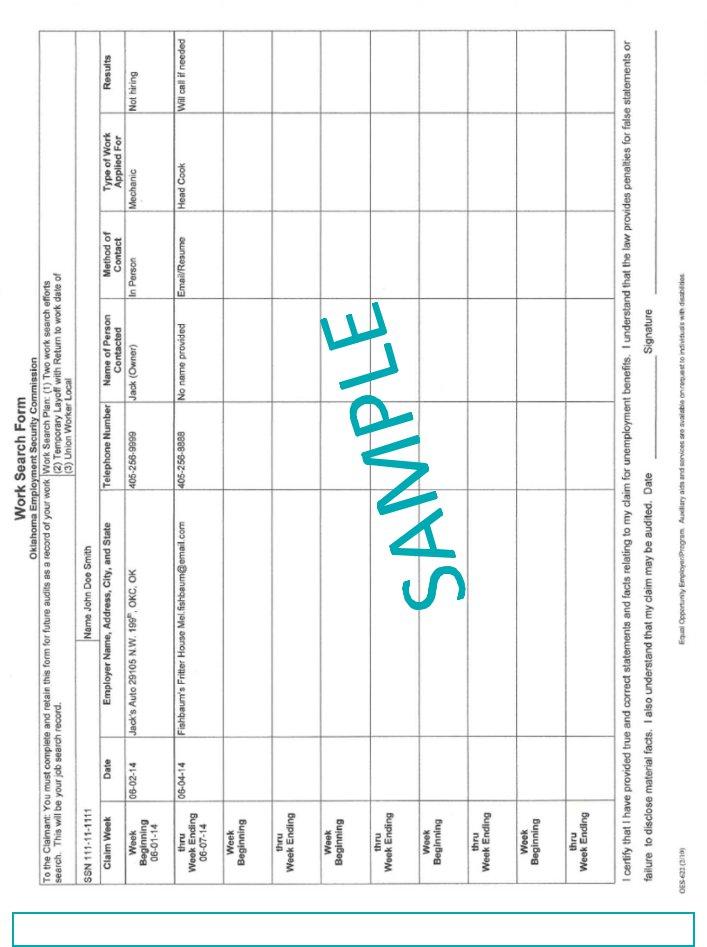

WORK SEARCH FORM (SAMPLE) |

26 |

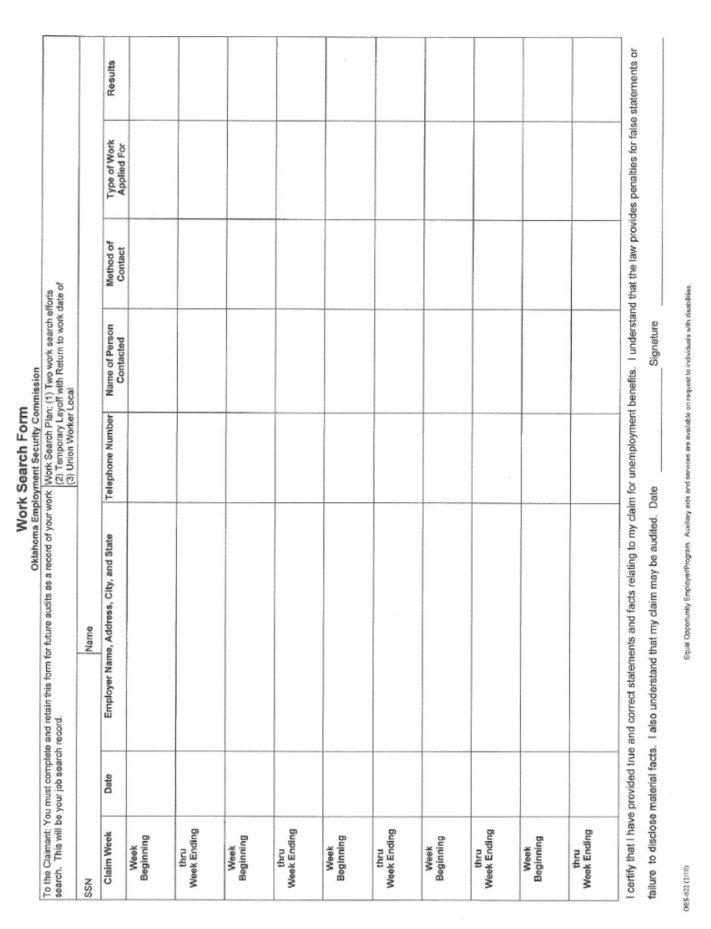

WORK SEARCH FORM |

27 |

This publication is issued by the Oklahoma Employment Security Commission, as authorized by provisions of the Oklahoma Employment Security Act. The publication will be made available online. A copy has been deposited with the publication clearinghouse of the Department of Libraries.

3

Frequently Asked

Questions about

Unemployment Insurance

1WHAT IS EXPECTED OF ME?

When you file for unemployment benefits you will be responsible for filing your weekly claims, attending all required groups and appointments that you may be scheduled for and keeping a log of your work searches. Please read all information included in this book for additional information regarding your claim.

2HOW DO I FIND A JOB?

You are required to register for employment services within seven (7) days of initially filing your claim. This can be accomplished by registering at OKJobMatch.com. This interactive job search tool is designed to help you connect with employers and their job openings.

You may also wish to access our services in one of the local Oklahoma Works Centers conveniently located throughout the state: http://www.ok.gov/ oesc_web/Services/Workforce_Services/ index.html.

3WHEN WILL I RECEIVE MY PAYMENT?

By law, the first payable (or allowable) week of the claim is considered to be a waiting period. Although you must still file your weekly claim (either by phone or internet), you will not be paid for the waiting period week.

Once you file for your waiting period, that triggers the mailing of the debit card, UNLESS you have selected direct deposit as your payment method. If there are issues on your claim that are being investigated or you are not monetarily eligible, please allow

4THERE IS AN “ISSUE” ON MY CLAIM. WHAT DOES THAT MEAN?

An “issue” on your claim (sometimes called a “stop”), means that based on the way you answered a question, either on your initial claim, or on your weekly claim, further investigation is needed to determine if you are eligible for benefits.

An “issue” can also be added for failure to attend a

required reemployment service session or the failure to do something that we have asked you to do.

You will be contacted if additional information is needed. An “issue” on your claim will cause a delay in your claim, and a possible disqualification of benefits depending on the findings. In the meantime, you need to continue to file your weekly claims each week while the issue is pending.

5WHERE IS MY DEBIT CARD? WHAT IS THE BALANCE OF MY DEBIT CARD? HOW DO I SET UP DIRECT DEPOSIT?

If you wish to enroll for direct deposit, you must wait until the next business day after you have filed your claim and then call (866) 320- 8699. If you do not sign up for direct deposit, your payments will be made by debit card, which will be mailed out when you are found eligible for payment. It normally takes

For questions regarding your debit card call (866)

6

HOW DO I CHANGE MY PIN NUMBER?

Our customer service representatives do not have access to your PIN. If you forget your number or want to change, we can reset your PIN so you can establish a new PIN or you can change your PIN online. Contact your Unemployment Service Center or visit the website at unemployment.ok.gov and click on “Change your Pin.”

4

7WHAT DO I NEED TO DO TO HAVE TAXES TAKEN OUT OF MY CHECK?

Unemployment Insurance benefits are subject to federal and state income tax. You must report unemployment benefits you receive when you file your income taxes. By January 31 of each year, the Oklahoma Employment Security Commission will send you a form

8HOW AND WHEN DO I FILE MY WEEKLY CLAIM?

After you have filed your application for benefits, you must file weekly claims in order to receive benefits. The filing week begins on Sunday at 12:01 a.m. and end on Saturday at midnight. You cannot file a

weekly claim until after the week is over. If you attempt to file before the week has ended, your claim will not be accepted.

Weekly claims can be filed by:

Internet - Oklahoma Network Initial Claims (ONIC) unemployment.ok.gov

OR

Telephone – Interactive Voice Response (IVR

Inside the OKC calling area use: (405)

Outside the OKC calling area use: (800)

9WHAT IF I CAN’T FILE MY WEEKLY CLAIM?

Contact your local Service Center during normal business hours if you encounter any problems when filing your weekly claim:

Inside the Oklahoma City calling

Outside the Oklahoma City calling

TTY/TDD

10CAN I WORK

Yes. However, you must report the amount of money you earned, before any deductions were made, for each week, whether or not you were paid during the week. Earnings must be reported during the week you earn them, not when you actually receive the payment. Work is anything you do for wages, including

11

HOW DO I CHANGE MY ADDRESS?

If you plan to change your address, you must report the change to your Unemployment Service Center prior to filing your weekly claim. Information required to change an address includes your name, social security number, old address, new address and the employer from whom you were separated when you filed your claim.

HOW DO I FILE AN APPEAL?

12

You can file an appeal in person, by mail, fax, telephone or email. Include your name, social security number, phone number, date of determination, section of law you are appealing and a detailed explanation of why you disagree with the decision. The mailing address, fax number, telephone number and email address will be listed on your determination.

REMEMBER!

Any questions regarding your Unemployment Insurance Claim can be answered by calling one of the numbers listed on the Quick Reference page of this document or by visiting our website.

5

SERVICES PROVIDED BY OESC

Veteran Services

Reemployment Services

Unemployment Insurance

SERVICES FOR VETERANS

The U.S. Department of Labor provides grant funds to the State of Oklahoma to provide employment and training services to Veterans and eligible Covered Persons within all Department of Labor service programs. As a condition to receiving those funds, priority of service will be given to qualified Veterans and eligible Covered Persons when referring individuals to job openings, and in providing all Department of Labor funded employment and training programs/services.

Veterans and other Covered Persons are encouraged to identify themselves to staff when entering a workforce office. Disabled Veterans, Veterans with significant barriers to employment and other Covered Persons identified by the Secretary of Labor are eligible for specialized services and case management at Oklahoma Works Centers.

For more information on program eligibility and Veteran Priority details visit or contact your local Oklahoma Works Center. Oklahoma Works Center staff are available to explain program mandatory eligibility and Veterans' Priority.

6

REEMPLOYMENT SERVICES

The OESC wants to help you get back to work as soon as possible. Our staff are skilled in matching the right candidate with the right job. We have may resources and tools to help you connect back to work. One of the tools we utilize is OKJobMatch.com — The Right Match for Oklahoma Job Seekers.

OKJobMatch.com is an employment resource that matches job seekers with employers based on a number of criteria, including experience, education, skills, certifications and licenses. The website also allows Oklahoma’s employers to search for talent in a single place. The

process is highly recommended to generate the highest number of results, but you can also upload an existing resume for a revision to OKJobMatch.com standards, or use it

OKJobMatch.com searches more than 16,000 websites, matching you with the right job opportunities in all of Oklahoma’s 77 counties and neighboring states — all at no cost to you. Go to OKJobMatch.com to start your match today, or visit your local Oklahoma Works Centers.

There are 35 Oklahoma Works Centers that provide a variety of

Orientation to the information and services available

Initial assessment of your needs and abilities

Veteran Services

Labor market information and statistics

Federal bonding for certain job seekers

The Work Opportunity Tax Credit

Career Counseling

Basic skills training, such as resume preparation, interviewing skills, math and computer skills

Job Search and Placement Assistance

Job Referrals

Job Readiness Workshops

Job Search Workshops

Career Consultation

Career Exploration - Information & Activities

Job Seeker Networking and Support

Resume Software

Skills Upgrade / Training

Assistance in establishing eligibility for other federal, state or local programs

Typing,

Phones, Fax Machines and Copiers

7

REEMPLOYMENT SERVICES

Unemployment Claimants may be required to participate in Reemployment Services provided through the Oklahoma Works Centers. Our goal is to get claimants connected to work as soon as possible. If you receive notice to report to an Oklahoma Works Center for Worker Profiling and Reemployment Services, you are required to attend. Failure to attend may result in a denial of unemployment benefits. Some of the services you can expect to receive are listed below.

OKLAHOMA WORKS CENTER

ORIENTATION

Claimants will get an overview of all available Reemployment Services provided through the Oklahoma Works Centers and develop an employment plan to become reemployed.

REGISTRATION FOR WORK

Claimants are required to register for work at OKJobMatch.com. This will allow claimants to complete a resume and automatically connect with employers. This technology matches knowledge, skills and abilities against the employer’s requirements and qualifications for job openings.

Failure to register for work will result in denial of unemployment benefits.

JOB REFERRALS AND JOB PLACEMENT

Claimants will be given job referrals based upon their skills, knowledge and abilities. Staff will match the claimants qualifications with the employers requirements for the job opening. Staff may also contact employers on behalf of the claimants to develop job opportunities.

WORK SEARCH AUDITS

Each week that you file for benefits you must look for work and keep a list of all your work search contacts. If you do not look for work, apply for work, or accept suitable work, you may not be eligible to receive benefits. OESC will randomly check your work search activities and ask for a copy of your work search list. Your efforts to find a job for each week in which you claim UI benefits will be reviewed. If you do not provide your work searches when asked, or if an employer disputes that you applied, you may be denied benefits. If you have already received benefits for one or more of the ineligible weeks, you will be required to pay back the money received.

REEMPLOYMENT NEEDS INVENTORY

Designed to quickly determine the claimant’s readiness to return to work. The inventory evaluates job search activity, job search skills and confidence, and any barriers that may impact the claimant’s chance of getting a job.

EMPLOYMENT GOAL DETERMINATION AND LABOR MARKET INFORMATION

Staff will review claimant’s work history and collaborate to determine an employment goal and discuss customized labor market information.

JOB SEARCH/JOB SKILLS WORKSHOPS

Job search workshops include information on topics such as online job applications and resume writing as well as soft skills instruction including: interviewing techniques, work habits, communication skills, workplace effectiveness, business etiquette, and job search.

FOLLOW UP ACTIVITIES

After claimants receive the above services, staff will schedule a thirty (30) day follow up meeting to review the claimants progress and discuss any barriers to employment and provide additional job referrals.

8

TRAINING PROGRAMS

WHAT IS APPROVED TRAINING?

Approved training is a program that allows affected individuals to attend training or school while drawing unemployment benefits. The requirement to perform work search efforts is replaced with a requirement to attend scheduled classes and make expected progress in those classes. You should contact your local Oklahoma Works Centers for more information regarding approved training.

Training is considered “approved” only if the individual’s prior work is no longer a demand occupation, and the training program is for a demand occupation. With the exception of TAA/TRA training (explained below), enrolling in an approved training program will not provide additional unemployment benefits.

Individuals attending school who are not in an approved training program must still search for work and be available to begin work when a job is offered.

Different types of approved training include:

Regular approved training: No monetary assistance is given to defray school costs but work search requirements will be replaced with satisfactory attendance and progress in training.

Workforce Investment Act (WIA) approved training: In some instances state agencies may be able to offset portions of tuition.

Trade Adjustment Assistance (TAA) and Trade Readjustment Allowances (TRA) approved training: TAA is a federally funded program designed to provide additional training or schooling for individuals who lost their jobs due to imports from, or shifts in production to, foreign countries. TRA provides monetary assistance after normal state unemployment insurance benefits have expired. In order to receive TAA and TRA benefits, a group of workers must file a petition with the U.S. Department of Labor.

WHAT IS A TAA/TRA CLAIM?

Federal Trade Adjustment Assistance (TAA) pays benefits to workers who lose their jobs or their working hours are reduced as a result of increased imports. If you worked for an employer that has been impacted by TAA, you will receive notification of potential eligibility for the program. See oesc.ok.gov for more information.

TRA

Trade Readjustment Allowance (TRA) is essentially an extension of your weekly unemployment benefits. You must be enrolled in TAA approved training; have completed a TAA approved or TAA approvable training program or have received written certification waiving training requirements to be eligible for TRA. You must exhaust all rights to any state unemployment in order to be eligible for TRA. Once you have exhausted your basic TRA benefits you may request additional TRA weeks if you are still in TAA approved training. Once you have filed a TRA claim, if you are selected for a random audit of your claim, you will be required to submit weekly attendance and progress reports or work search forms for the particular week of your audit. If your claim is selected for audit, you will need to go to the unemployment website unemployment.ok.gov and select the link “Attendance and Progress in Training Form (Form

You must inform the Oklahoma Employment Security Commission of all official school breaks. If you are on an official school break of 30 or less school days you may still be paid for TRA. You will need to continue to call in each week.

9

UNEMPLOYMENT INSURANCE FRAUD

The Oklahoma Employment Security Commission is responsible for protecting the Unemployment Insurance Trust Fund. We have a

Fraud, for Unemployment Insurance purposes, is knowingly making a false statement, misrepresenting a material fact, or withholding information to obtain unemployment benefits. Any statement you make in order to obtain unemployment benefits will be verified. If you are found to be overpaid, you will be required to repay benefits plus penalty and interest and you may be denied future benefits. All fraud cases are subject to possible criminal prosecution, fines and imprisonment.

EXAMPLES OF FRAUD INCLUDE:

Failure to properly report a job separation

Failure to properly report earnings

Failure to report ALL earnings from any source

Divulging your PIN number to anyone

Allowing another person to file your weekly claim

PENALTIES FOR FRAUD INCLUDE:

Denial of unemployment benefits for the week the overpayment is established and the next following 51 weeks for the first offense and 103 weeks for all subsequent offenses

Repayment of the amount of benefits received as a direct result of fraud plus interest

Criminal prosecution under federal or state law

Jail sentence

There is a 25% penalty on the amount of the original overpayment

REPAYING OVERPAYMENTS:

If you have an overpayment, you can repay it in one lump sum or under an installment payment plan; however, the Commission must approve such plans. If you are found to be overpaid due to your error, interest will be assessed at the rate of 1% per month on the unpaid amount until the entire amount is repaid. Interest will only accrue to the amount of the overpayment, for example, if you have a $500 overpayment, your interest due will not exceed $500.

OTHER METHODS OF RECOVERY OF OVERPAYMENTS INCLUDE:

State income tax refund intercept

Federal income tax refund intercept

Bank account lien

Garnishment of wages from future employer

Property lien

Benefits will not be paid on a regular Unemployment Insurance claim until any outstanding overpayment has been recovered. The Commission may recover an overpayment by deducting it from any benefits you may be eligible to receive on a current or future unemployment claim. If you are currently filing for and receiving Unemployment Insurance benefits, we will recoup your weekly claim amount and apply it to your established overpayment.

You will not receive any unemployment benefits until the principal balance is completely recovered. You must pay accrued interest with a personal check or money order.

10

UNEMPLOYMENT INSURANCE

WHAT IS UNEMPLOYMENT INSURANCE?

The intent of Unemployment Insurance is to pay benefits to eligible claimants during times of unemployment when suitable work is not available.

Unemployment Insurance is a temporary income intended to help workers who are unemployed through no fault of their own. It is an insurance paid by employers. Deductions ARE NOT made from your wages to pay Unemployment Insurance.

Benefits are payable to individuals who are:

Unemployed through no fault of their own

Able and available to look for and accept employment

Monetarily eligible

Myth |

Fact |

Employees pay |

Liable Employers |

UI Tax |

pay UI Tax |

HOW MUCH MONEY WILL I BE ELIGIBLE TO DRAW?

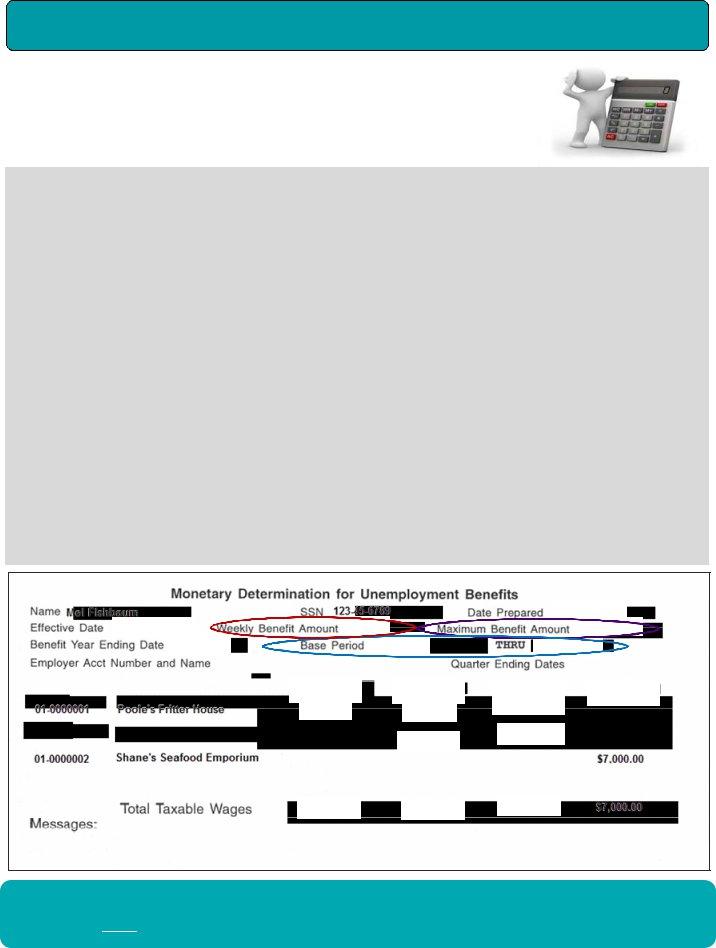

After you file an initial application for unemployment benefits, you will receive a Monetary Determination for Unemployment Benefits.

This determination will show:

The employers that paid unemployment taxes on your wages during the base period

Your benefit year begins on Sunday of the week you file your initial claim and ends one year later

Your weekly benefit amount (WBA)

Your maximum benefit amount (MBA)

Messages regarding your eligibility or overpayments on a prior claim

11

UNEMPLOYMENT INSURANCE

HOW IS MY WEEKLY AND MAXIMUM

BENEFIT AMOUNT CALCULATED?

Your Weekly Benefit Amount - (WBA)

The amount you may receive weekly is one

÷23 = $521. The maximum benefit amount allowed by law for 2016 is $505, since $521 exceeds that amount, your weekly benefit amount would be $505.)

Your Maximum Benefit Amount - (MBA)

State law establishes the maximum amount you may draw during your benefit year.

Your Base Period

Your base period is the twelve (12) month period consisting of the first four (4) of the last five (5) completed calendar quarters before the effective date of your claim. Once a monetarily eligible claim is established the base period cannot be changed. For base period purposes, quarters change after the first Sunday in the quarter (1st

Example: If you filed your initial claim AFTER the first Sunday in January 2016, and BEFORE the first Sunday in April 2016, your base period would be from October 1, 2014 through September 30, 2015.

Mar - 2015 Jun - 2015 Sept - 2015 Dec - 2015

$12,000 $5,000

*$5,000

*$12,000

$12,000 $5,000$0

These numbers are used for illustration purposes only and do not reflect a guaranteed amount.

Note: Most individuals are eligible to receive benefits for approximately 20 weeks.

12

HOW DO I FILE MY WEEKLY CLAIM?

After you have filed your application for benefits, you must file weekly claims in order to receive benefits. Each week begins on Sunday at 12:01 a.m. and ends on Saturday at midnight.

You cannot file a weekly claim until after the week is over. If you attempt to file before the week has ended, your claim will not be accepted. You can begin filing your weekly claim on Sunday for the previous week.

WEEKLY CLAIMS CAN BE FILED

TWO WAYS:

Internet - unemployment.ok.gov

Phone - (405)

(800)

THE INTERNET SYSTEM, CALLED

OKLAHOMA NETWORK INITIAL CLAIMS

(ONIC) CAN BE USED TO:

File a new unemployment claim or reopen an existing claim

Inquire about an existing unemployment claim

Inquire about amount of benefits reported to the

IRS

Visit the Oklahoma Employment Security Commission Home Page

File your weekly claim

Change your address

Change your PIN

Find information regarding electronic payment options

THE TELEPHONE SYSTEM, CALLED OKLAHOMA IVR, IS AN INTERACTIVE

VOICE RESPONSE SYSTEM THAT CAN BE USED TO:

File a new unemployment claim or reopen an existing claim

Inquire about an existing unemployment claim

Inquire about amount of benefits reported to the

IRS

File your weekly claim

Find information on an existing overpayment

Speak to a Customer Assistance Representative

Get general information regarding Unemployment benefits

BEFORE YOU CALL THE IVR SYSTEM,

MAKE SURE YOU HAVE THE FOLLOWING INFORMATION HANDY:

Social Security Number

Personal Identification Number (PIN)

Information on any earnings and the number of hours you worked during the week (including vacation, holiday and severance pay)

SAVE YOURSELF SOME TIME!

When filing your weekly claim by phone, you must listen to the entire question before entering your

response. If you try to enter your response before the system prompts you, it will start the question over!

Reminder

Weekly claims filed 15 or more calendar days after the week has ended are considered untimely and in most cases will not be paid.

13

SOME THINGS TO KNOW WHEN FILING YOUR WEEKLY CLAIM

EXAMPLE TELEPHONE CLAIMS QUESTIONS

Press 1 for YES and 9 for NO

Oklahoma requires that you are able and available to work each week if employment is offered. Were you able and available for work during the week you are claiming?

You must report all work performed. Did you perform work during the week for which you were or will be paid?

**Note: If yes, you will be prompted to enter hours worked and gross wages earned.

Did you receive or are you entitled to severance pay for the week?

Did you receive or are you entitled to vacation pay for the week? **Note: (Vacation pay is deductible if you have a return to work date.)

Are you entitled to holiday pay for the week you are claiming? **Note: (Holiday pay is deductible in the week in which the holiday falls.)

Did you receive bonus pay for the week you are claiming?

**Note: (Bonus pay is deductible in the week in which it is received.)

Has there been any change in the amount of retirement pay or pension previously reported?

Did you refuse work during the week you are claiming benefits? Did you quit a job during the week you are claiming benefits?

Were you discharged or fired during the week you are claiming benefits?

Oklahoma requires that you search for work each week in accordance to our work search plan that you established at the time you filed your claim. Did you make the required number of work searches in accordance with your work search plan?

Realizing you are liable for any false statements made to receive unemployment, do you certify that you have answered these questions truthfully and accurately?

We recommend that you do not use a cellular phone. It is best to use a land line when using the IVR system.

If you need to file for more than two weeks, you will need to hang up and call back for the remaining weeks

The IVR system will give you

part of your claim

Remember: Making false statements is FRAUD!

NOTE: Some questions may vary based on your claim type.

14

ISSUES THAT MAY AFFECT YOUR CLAIM

YOU MAY BE MONETARILY ELIGIBLE FOR

UNEMPLOYMENT BENEFITS AND STILL BE

DENIED BENEFITS FOR OTHER REASONS

Any situation that may keep you from receiving benefits is called an “ISSUE” or a “STOP” on your claim. When this happens, OESC representatives will investigate the issue, and may ask you to provide additional information regarding the situation before a decision can be made on your unemployment claim.

1DISCHARGED OR FIRED:

You may be eligible for payment if you were discharged or fired from your job. An investigation of your job separation by the OESC will determine whether your discharge was due to misconduct or not. If your job separation was due to misconduct, you will be disapproved for benefits.

Misconduct shall include, but is not limited to, the following:

Any intentional act or omission by an employee which constitutes a material or substantial breach of the employee’s job duties or responsibilities or obligations pursuant to his or her employment or contract of employment;

Unapproved or excessive absenteeism or tardiness;

Indifference to, breach of, or neglect of the duties required which result in a material or substantial breach of the employee’s job duties or responsibilities;

Actions or omissions that place in jeopardy the health, life, or property of self or others;

Dishonesty;

Wrongdoing;

Violation of a law; or

A violation of a policy or rule enacted to ensure orderly and proper job performance or the safety or self or others.

2QUITTING YOUR JOB:

You have the right to leave a job for any reason at any time, but the circumstances of the separation will determine if and when you will qualify for benefits.

If you quit your job you will have to prove that your job separation was for good cause. Good cause may include:

A job working condition that has changed to such a degree that it was harmful, detrimental, or adverse to the persons health, safety, or morals, that leaving the work was justified.

Substantially unfair treatment or the employer was creating difficult working conditions

Separation under some collective bargaining agreements

Not being paid for work performed

The burden of proof, when you quit, falls upon you as the claimant. You will have to offer evidence of the reason, and show that you tried to correct the problem with your employer before quitting. One’s word versus the other’s word is not likely to prove good cause to quit. Quitting for personal reasons is not considered good cause connected to the work and will likely be denied.

Quitting for Medical Reasons:

If you had to quit due to a medical condition or to care for someone in your immediate family, you may be eligible depending on the circumstances. However, you must be able to work and available to seek and accept work while filing your unemployment claim. You must also be willing to accept any suitable job offers.

You are responsible for the answers you provide and you can be penalized under the law for withholding or willfully giving incorrect information.

15

ISSUES THAT MAY AFFECT YOUR CLAIM

OTHER REASONS YOU MAY BE

DISQUALIFIED INCLUDE:

If you fail to participate in required reemployment services (See pages 7 & 8)

If you fail to search for or accept work

If you refuse a job offer for suitable work or refuse a referral to a suitable job

You are not able and available to seek and accept work

You are not a U.S. citizen and not authorized to work in the U.S.

You have limited the wages, hours, days or areas of a job you will accept

If you were employed by an educational institution (certain conditions apply)

If you are

If you receive deductible retirement pay

If you receive deductible severance pay

If you receive deductible vacation pay

If you work

If you received bonuses

If you are a union member involved in a strike

*Note: You must be able and available to seek and accept work in keeping with your past work experience and education. If you are going to school while filing for unemployment benefits, you must still meet this requirement. Under certain conditions, if you get accepted into approved training in coordination with an approval process at the Oklahoma Works Centers, then your work searches can be waived. Work searches can only be waived upon receiving this specific approval. Contact your local Oklahoma Works Centers for more information.

IN ADDITION, THERE ARE SOME NON- WORK RELATED REASONS THAT MAY ALLOW YOU TO BECOME ELIGIBLE FOR BENEFITS. SOME OF THESE INCLUDE:

You or a family member has a medically documented illness that prevented you from working, but you are now able to work

Quit to move with your spouse who obtained a new job more than 50 miles away or was transferred

You were displaced due to being a victim of domestic violence

WORKING WHILE RECEIVING BENEFITS:

Any employment

You may be entitled to a reduced amount of Unemployment Insurance benefits while you are working.

You shall be considered “unemployed” any week that you perform no services and are paid no wages or any week that you work less than

You must report your gross earnings before any deductions were made for each week, whether or not you were paid during the week.

Earnings must be reported during the week you earn them, not when you actually receive the payment.

16

QUALIFYING FOR BENEFITS

IN ORDER TO QUALIFY FOR BENEFITS YOU

MUST:

1.BE MONETARILY QUALIFIED

2.BE UNEMPLOYED THROUGH NO FAULT OF YOUR OWN

3.BE ABLE, AVAILABLE, AND ACTIVELY SEEK- ING WORK

4.BE REGISTERED FOR WORK IN OKJOBMATCH

1 To be monetarily qualified you must have earned a minimum of $1,500 during your base

period AND have total wages of one and

WORK SEARCH REQUIREMENTS

You received specific work search instructions at the time you filed your unemployment claim and are required to keep a record of the contacts on a form in the back of this booklet. You must be involved in a minimum of two activities per week (including work search contacts) in attempting to secure employment.

Work search contacts must be made within |

the week for which benefits are being |

claimed. |

You must contact a minimum of two |

different employers each week to meet the |

minimum work search requirement. |

|

made with an individual in the company who |

has hiring authority. |

2

In order to qualify for benefits, you must have lost your job through no fault of your own; for

Contacts should be for work you are willing |

and qualified to do, pay that you are willing |

example, a layoff or reduction in hours or pay not related to your performance.

In order to qualify for benefits, you must be

3able and available for work. You must also be actively seeking work.

In order to qualify

4for benefits, you must be registered and actively seeking work in OKJobMatch.

You will be told whether your weekly claim has been accepted. If you meet all eligibility requirements, your weekly claim will be processed for payment.

If the week is not accepted, you will be given additional instructions. You can contact your Unemployment Service Center at:

(405)

(800)

to accept, and in the area that you are willing |

to work. |

Contacts cannot be repeated with the same |

employer until four weeks have passed. The |

same contact should not be listed on |

consecutive weeks except for agencies that |

offer multiple placement services. All work |

search contacts are subject to verification. |

Failure to make the required number of work |

searches each week could result in a denial in |

benefits and possible overpayment. |

Your claim may be selected for an audit. It is your responsibility to retain your booklet with this information for two years.

Union members that have a hiring hall must contact the hiring hall each week. If you do not have a hiring hall, you must make the required number of work searches each week.

You will need to keep track of your work searches using the work search log in the back of this guide.

17

HOW DO I RECEIVE MY PAYMENTS?

The Oklahoma Electronic Payment Program is handled by XEROX.

Payments are made either by Debit Card or by Direct Deposit.

You will need to contact Xerox

directly to inquire about the following:

Request forms for direct deposit

Inquire about payments

Have a problem with your payment?

Call toll free or go online at:

(866)

You can print the direct deposit forms by

clicking here: unemployment.ok.gov

Direct deposit will be deactivated for all bank accounts that have had no deposits in the last 6 months (180 days). If you want to receive your current benefit payments by direct deposit, you MUST fill out a new direct deposit form; otherwise you will receive your payments via debit card. Additionally, if you have changed banks, you need to submit a new direct deposit form.

If you choose to have your payments made by debit card, it will be mailed to you once you have served your waiting period week. The debit card will look like the picture below and will come in an envelope like the one shown below.

Don’t share your pin with

ANYONE!

18

MAINTAINING YOUR ELIGIBILITY

TO MAINTAIN YOUR ELIGIBILITY FOR

BENEFITS YOU MUST:

File your weekly claim each week

Be actively seeking work and recording your work searches

Be able and available to seek and accept work

Report ANY and ALL wages (amount before deductions), cash or anything of value (including commission or bonuses) in the week you earn it, NOT the week you are paid

WHAT IF I CAN’T RETURN TO MY

PREVIOUS JOB OR CAREER?

There are specialists at your local Oklahoma Works Centers that will customize an individual service plan which includes employment goals, plans to overcome barriers, job search workshops and job referrals. You MUST attend a

YOU MUST NOTIFY THE

UNEMPLOYMENT SERVICE CENTER IF:

You refused a job referral from a local Oklahoma Works Center

You refused a job offer

You are

You are enrolled in or plan to enroll in school or training

For any reason you are not able and available to seek and accept employment

You change your address or telephone number. The post office will NOT forward government mail.

You need instructions on how to continue filing for benefits if you are moving to another state

You make an error while filing your weekly claim

Note: If you fail to respond to any correspondence, you could be denied future benefits.

NOTIFICATION OF CHANGE OF ADDRESS:

It is your responsibility to keep the Oklahoma Employment Security Commission (OESC) informed of your current mailing address at all times. You MUST inform OESC in writing, by telephone, or online.

You may be mailed important documents and/or instructions to follow that, if action is not taken, might delay your claim or cause a denial of benefits.

19

WHAT DO I DO WHEN I RETURN TO WORK?

What do I do when I return to work?

This will depend on when you return to work (what day of the week) and whether you return to

What do I do when I return to work full

Stop filing for unemployment benefits the week you return to

Report your new job to your local Oklahoma Works Center.

Retain your work search efforts for at least two years

What if I return to work

Individuals who accept

Report gross earnings during the week they are earned, not the week you are paid.

Continue to search for

Continue to attend all required groups and workshops.

NOTE:

What if I start a

If you work less than 32 hours the first week of employment you may still file for benefits for that week only.

You must report your hours worked and gross earnings for that week when you file your weekly claim.

Failure to report your hours and earnings is considered fraud and will be subject to the fraud penalties.

What if my new job ends?

You may reestablish your unemployment claim by using one of the methods found on page 21 of this manual.

You must provide the name, address and phone number of the job that just ended, along with the reason for separation. Notification will be sent to that employer.

A determination will be made on whether you are eligible to continue drawing unemployment benefits.

Please note: Unemployment claims are good for one year. If your employment ends after that one year time period, you will have to file a new claim which will result in new weekly and maximum benefit amounts.

If you are unwilling or unable to continue to search for

Unemployment Insurance is payable only when you are unemployed

Once you begin your job, even if you do not receive your first paycheck for a few weeks, you must stop filing for weekly benefits. If you continue to file and do not report your earnings (remember, they are reportable the week they are earned, not the week paid) you are committing fraud and will be subject to the fraud penalties.

20

WHAT DO I DO WHEN I RETURN TO WORK?

Unemployment insurance is to be used for the time period you are unemployed. When you return to work you need to stop filing for benefits. Once you are

One of the main causes of overpayments is an individual’s failure to stop filing after returning to work.

Remember!

If you accept employment and your start date is within three (3) weeks or less, you may continue to file your weekly claims until the week you begin work. You will not have to search for work during this time period, however, you must notify the Service Center of the scheduled date to begin work.

REOPENING YOUR CLAIM

If you quit filing weekly claims for three weeks or more, your claim will become inactive. You can reactivate your claim online at:

unemployment.ok.gov

Or call your Unemployment Service Center.

Do not delay reopening your claim because your

reopened claim will be effective the Sunday of

the week in which you file and previous weeks

cannot be paid.

The Oklahoma Employment Security Commission has a Fraud Investigation Unit that obtains information from the State and Federal New Hire Directories. Employers are required to report new hires and former employees who have returned to work. The Commission cross matches those reports against our active claim files to determine if someone returned to work and continued to file for unemployment benefits. If a match is found an investigation is done to determine why the individual continued to file. If it is determined that the individual should not have filed, an overpayment will be established for each week in which benefits were improperly claimed and paid. Remember, failure to report earnings during the week in which they are earned may be considered fraud. Fraudulent overpayments accrue interest, have a 25% penalty, could result in incarceration and will prevent future claims filing for one to two years, depending on the particular case.

Main resources for recouping overpayments include:

State and federal tax return intercepts

Wage garnishments

Lottery winnings

Liens against property; and

Offsets of weekly benefit amounts

Keep track of your hours and earnings using our earnings log in the back of this guide. You will need to report this information when you make your weekly claim.

Additionally, you must report when you no longer work for an employer.

You must report earnings during the week in which they are earned, not the week you are paid. Failure to report earnings is considered fraud against the State of Oklahoma. Penalties for fraud include having to pay back all money obtained through fraudulent means, paying interest of 1% on the outstanding balance and a penalty of

21

WHAT IF I DON’T QUALIFY?

When you have an issue or stop on your claim, it can take up to six weeks for OESC to investigate and determine whether you qualify. We must notify your last employer and investigate your job separation and any other issues. When we complete the investigation, OESC will mail you a determination on each issue telling you whether or not you are approved for benefits. If you disagree, you can appeal the decision.

APPEALING A NOTICE OF DETERMINATION

If it is determined that you have been overpaid, you will have twenty (20) days after the date of the mailing of the notice to file an appeal with the Appeal Tribunal.

If the overpayment is a result of a determination, you must appeal both the overpayment and the determination.

Any time a determination of eligibility is made on your claim, you will receive a determination in the mail that will explain if you are allowed or disallowed benefits. If you do not understand the determination, or have questions regarding the appeal process, contact your Unemployment Service Center at (405)

Parties have ten (10) calendar days from the mail date of the determination to appeal the determination. If the tenth (10) day falls on a weekend or legal holiday, the tenth (10) day will be the following business day. If you are unable to file an appeal within ten (10) days, you must provide a detailed explanation as to why you are filing untimely. The Appeal Tribunal will determine if good cause for filing an untimely appeal is established before a hearing is held on the issue being appealed.

You can file an appeal in person, by mail, fax, telephone or email. Include your name, social security number, phone number, date of determination, and section of law you are appealing, which can be found on the determination, and a detailed explanation of why you disagree

with the decision. The mailing address, fax number, telephone number and email address will be listed on the Notice of Determination.

APPEAL HEARINGS

Once an appeal is filed, parties will be mailed an appeal packet with copies of all pertinent claim information. After your hearing has been set, you will then be mailed a notice of hearing. The notice will indicate what action is required for you to participate in the hearing. It is important for you to participate in the hearing since the decision on your claim will be based on information given at the hearing.

FAILURE TO PARTICIPATE MAY RESULT IN A

DECISION DENYING BENEFITS!

If witnesses are needed to help present your case, you must arrange for them to participate. Information about subpoena of records or individuals will be included in the appeal packet.

22

PROTECTING YOUR RIGHTS WHILE APPEALING

A DETERMINATION

Protecting your Rights while

Appealing a Determination Denying

your Benefits

YOU MUST CONTINUE FILING YOUR WEEKLY CLAIMS WHILE YOU ARE IN THE APPEAL PROCESS! If you are found eligible for benefits, you will not be paid for any weeks that you have not filed.

If you fail to appear for your scheduled hearing, you must contact the Appeal Tribunal within ten (10) days after the mailing of the Appeal Tribunal’s Order of Decision if you would like to reopen your appeal.

If you are found to be eligible for benefits, your employer has the same appeal rights as you. If your employer appeals the decision, the appeal does not stop your benefits. However, if the employer wins the appeal, you will be considered overpaid for any benefits you received. It is important that you participate in the hearing on the employer’s appeal so you may present your side of the case.

BOARD OF REVIEW APPEAL

If the Appeal Tribunal determines you are not eligible for benefits you may appeal that decision to the Board of Review.

Your appeal must be filed within ten (10) calendar days from the mail date of the Appeal Tribunal decision.

If you file the appeal late, you must explain why you are filing untimely.

The Board of Review may affirm, modify, reverse or remand any decision of the Appeal Tribunal. The hearing tape and decision are reviewed to ensure the evidence and UI law supports the Appeal Tribunal decision. You will be notified in writing of the Board’s decision. The Board of Review’s mailing address and fax number will be listed on the Appeal Tribunal decision.

The Board of Review decision shall be final unless within thirty (30) days of the mailing of the decision either party appeals the decision to district court.

If you have any questions, contact the Board of Review at (405)

23

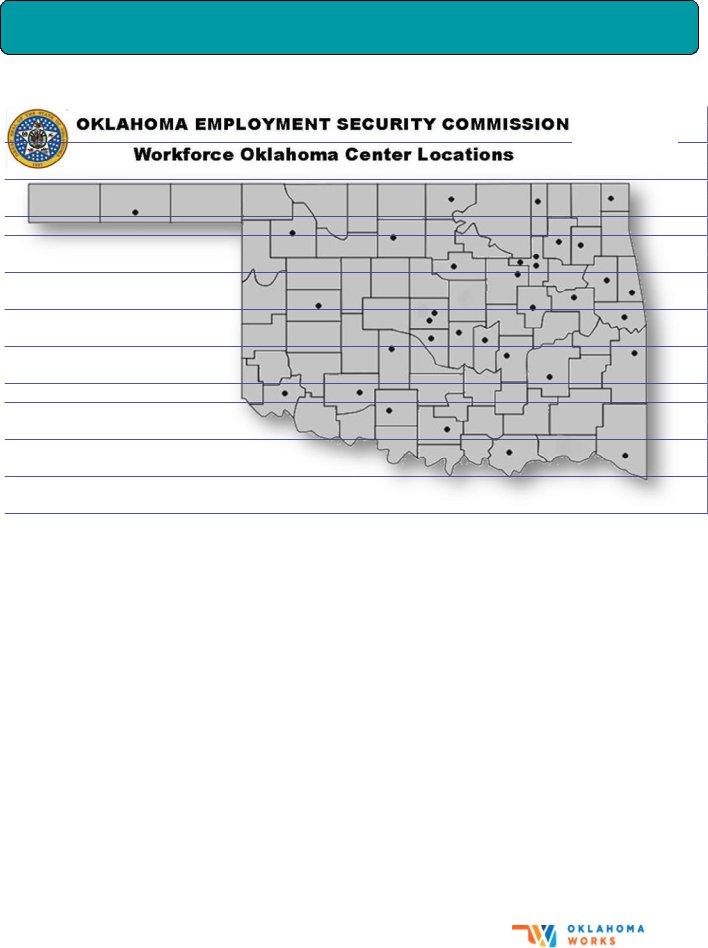

OKLAHOMA WORKS CENTER LOCATIONS

Ada |

Guymon |

OKC Eastside |

Seminole |

Altus |

Holdenville |

Okmulgee |

Shawnee |

Ardmore |

Idabel |

Ponca City |

Stillwater |

Bartlesville |

Lawton |

Poteau |

Stilwell |

Chickasha |

McAlester |

Pryor |

Tahlequah |

Claremore |

Miami |

Sallisaw |

Tulsa Eastgate |

Clinton |

Muskogee |

Sand Springs |

Tulsa Skyline |

Duncan |

Norman |

Sapulpa |

Woodward |

Durant |

OKC Brookwood |

|

|

Enid

Note: Click on the Oklahoma Works Center to find

information on a center near you.

Proud Partner of

24

IMPORTANT REMINDERS!

Reemployment Services at OESC are responsible for administering Labor Exchange programs and services to employers and job seekers through local Oklahoma Works Centers strategically located throughout the state. Our mission is to provide a smooth transition to

To locate the nearest Oklahoma Works Centers click on the following link:

http://www.ok.gov/oesc_web/Services/Workforce_Services/index.html

You are required to register for work within seven (7) days of filing your unemployment claim. You can do this either online or by going to your local Oklahoma Works Centers for assistance. Go to OKJobMatch.com and click on “Create a Job Seeker Account” to register for work by creating an account

and completing your resume. Failure to register may cause a delay or denial of your claim.

NOTE: YOUR CLAIM WILL BECOME INACTIVE IF YOU QUIT FILING

FOR THREE CONSECUTIVE WEEKS.

If you do not receive your unemployment payment,

please contact XEROX at

Please wait 10 days from the date of issuance to inquire

about missing payments.

NOTE: You must report earnings during the week in which they are earned, not the week you are paid. Failure to report earnings is considered fraud against the State of Oklahoma. Penalties for fraud include having to pay back all money obtained through fraudulent means, paying interest of 1% on the outstanding balance and a penalty of twenty- five percent (25%) of the amount of the original overpayment.

REMEMBER:

If you move you will need to change your address with an Unemployment Service Center! Government mail will not be forwarded by the Post Office and you will miss important information regarding your claim.

Don’t share your pin with

ANYONE!

BE SURE TO KEEP YOUR WORK SEARCHES FOR AT LEAST TWO (2) YEARS. YOUR CLAIM MAY BE AUDITED AND YOU WILL BE REQUIRED TO PROVIDE DOCUMENTATION OF YOUR

Confidentiality of Records

Your social security number is required to file an unemployment claim. OESC has an agreement with various state and federal agencies to share data. Please be advised that when you file your claim for unemployment benefits, we may request information from other agencies as well as share common data we have on file.

25

26

Revised 9/6/2016 — OES 339 |

27 |