Any time you intend to fill out unum beneficiary life insurance form, you won't need to install any sort of applications - simply try our PDF editor. To retain our editor on the cutting edge of efficiency, we aim to integrate user-oriented features and enhancements on a regular basis. We're always glad to receive suggestions - join us in remolding PDF editing. With just a couple of simple steps, you are able to start your PDF journey:

Step 1: First of all, access the pdf editor by pressing the "Get Form Button" at the top of this page.

Step 2: With the help of our state-of-the-art PDF editor, you can actually accomplish more than just complete blank fields. Try each of the functions and make your forms appear perfect with custom text put in, or optimize the file's original input to perfection - all that comes with the capability to incorporate almost any graphics and sign the document off.

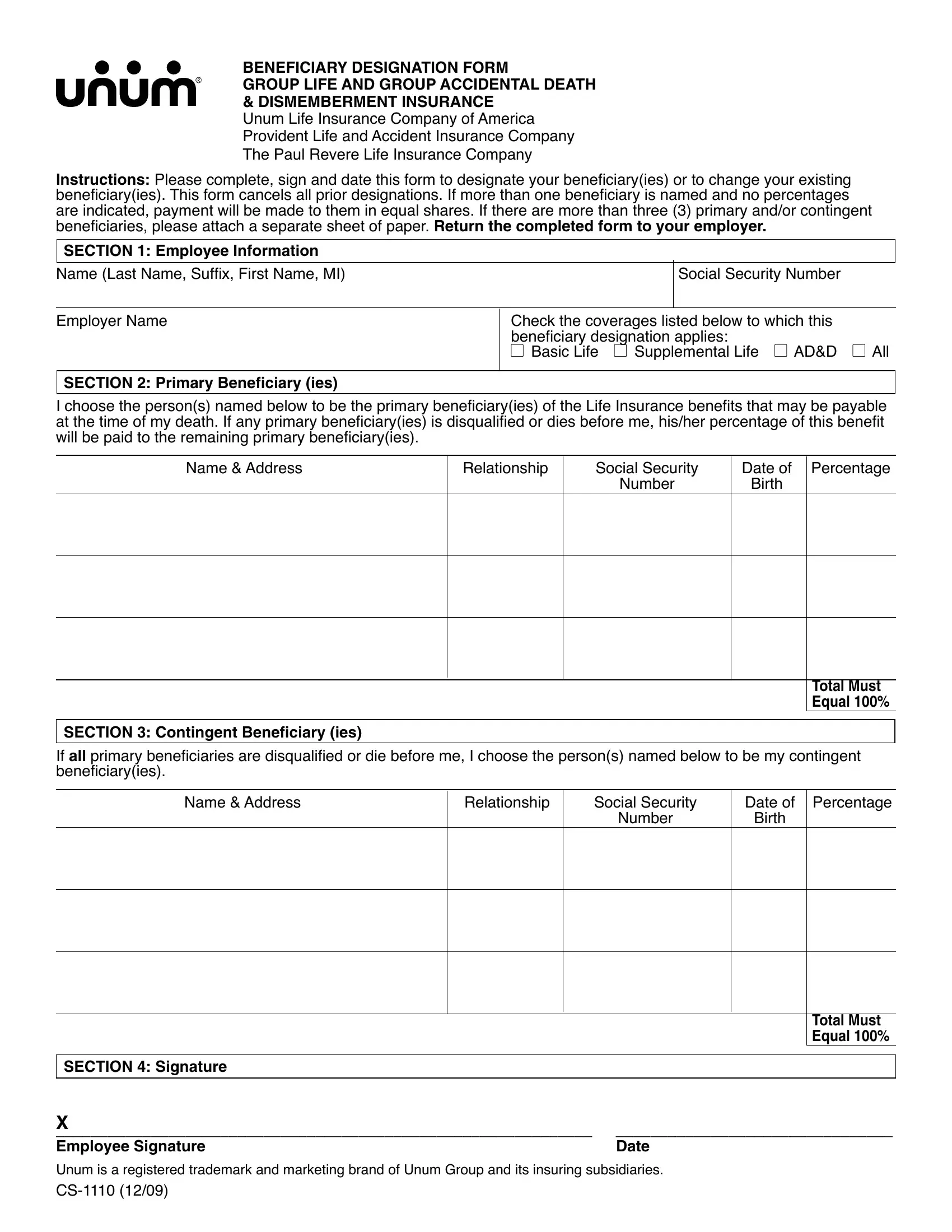

As for the fields of this precise form, here's what you need to do:

1. Whenever completing the unum beneficiary life insurance form, be certain to complete all of the essential blank fields within the corresponding section. This will help to hasten the work, allowing for your information to be handled efficiently and properly.

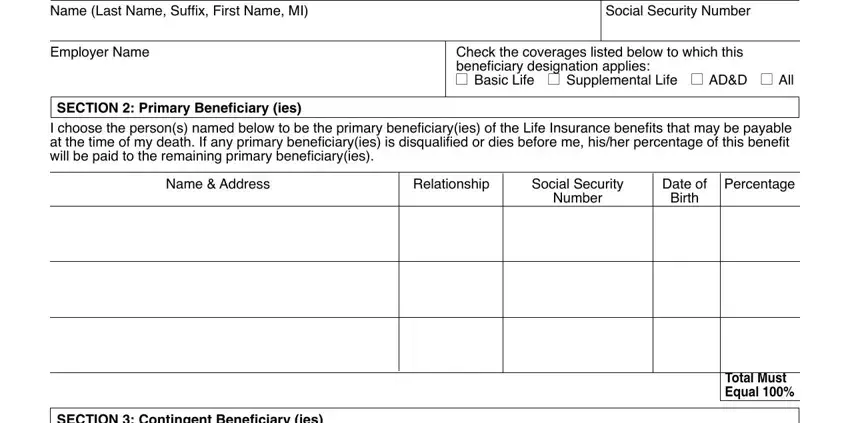

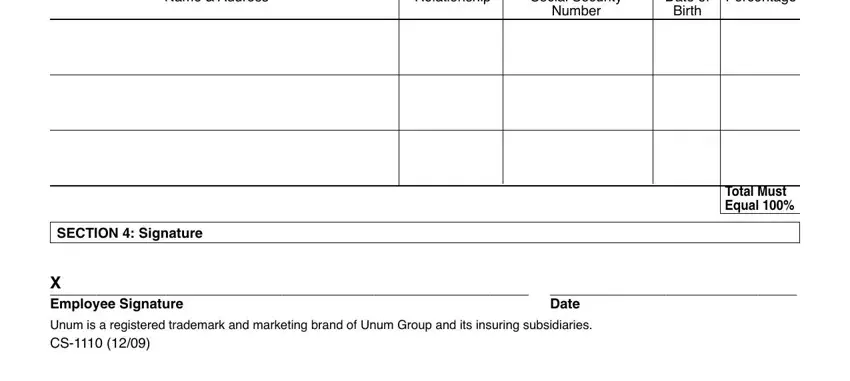

2. Soon after completing this section, go to the subsequent step and fill in the necessary details in all these fields - Name Address, Relationship, Social Security, Date of Percentage, Number, Birth, SECTION Signature, Total Must Equal, X Employee Signature, Date, and Unum is a registered trademark and.

It's very easy to get it wrong while filling out your Name Address, so make sure that you take a second look prior to deciding to submit it.

Step 3: Always make sure that your details are correct and simply click "Done" to conclude the project. After registering afree trial account at FormsPal, you will be able to download unum beneficiary life insurance form or email it promptly. The PDF document will also be at your disposal in your personal account with your each modification. FormsPal is dedicated to the confidentiality of our users; we ensure that all information handled by our system continues to be protected.