Should you desire to fill out print customs forms, it's not necessary to download any sort of applications - simply try using our PDF editor. FormsPal development team is ceaselessly working to develop the tool and help it become much better for people with its handy features. Discover an endlessly innovative experience now - take a look at and find out new possibilities as you go! Here is what you will want to do to begin:

Step 1: Open the PDF in our tool by clicking the "Get Form Button" in the top area of this page.

Step 2: After you launch the online editor, you will see the document made ready to be filled out. Aside from filling out different fields, you may also do many other things with the file, namely writing your own textual content, modifying the original text, adding images, placing your signature to the form, and a lot more.

This PDF doc requires specific details; to guarantee accuracy, take the time to take heed of the tips down below:

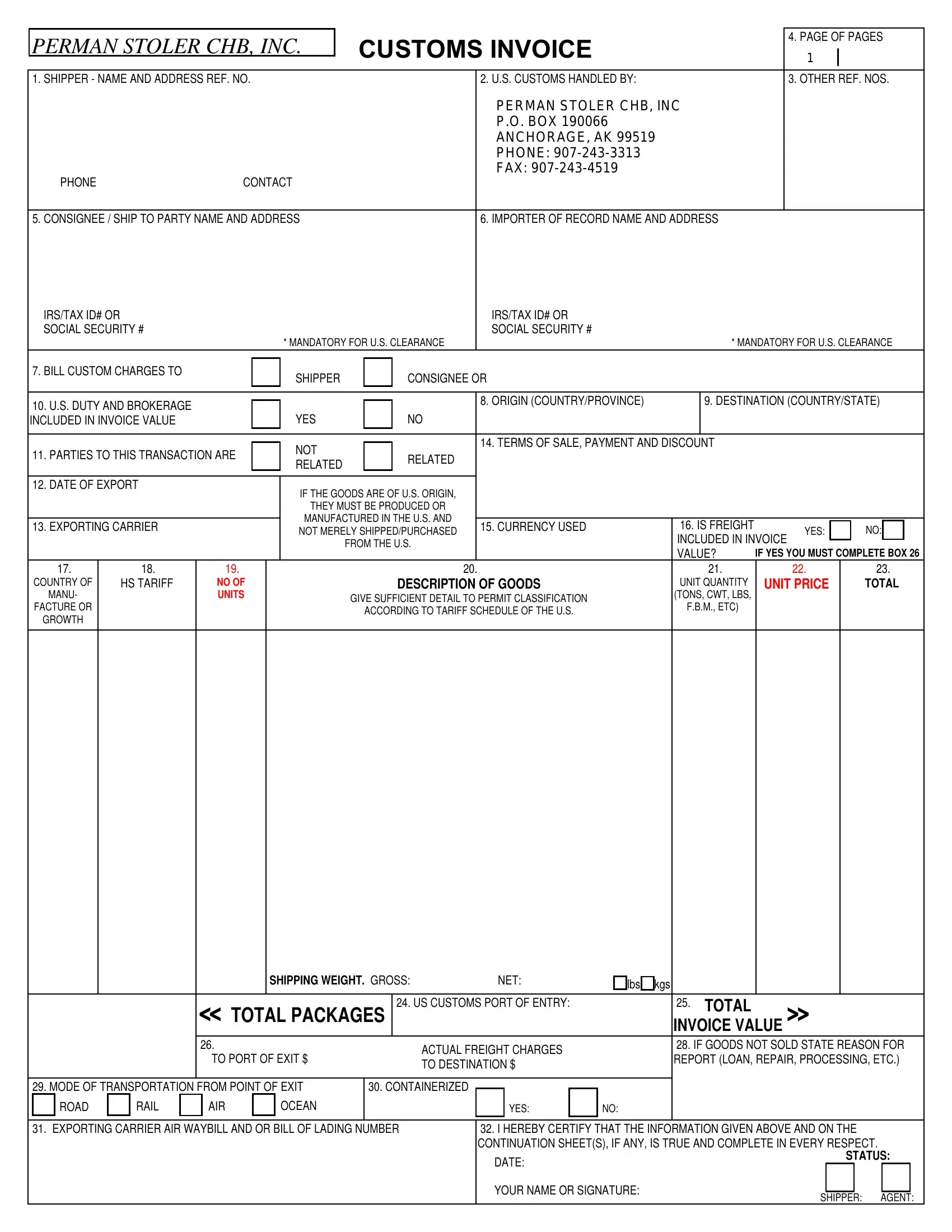

1. You'll want to fill out the print customs forms accurately, therefore be careful when filling out the segments including these blank fields:

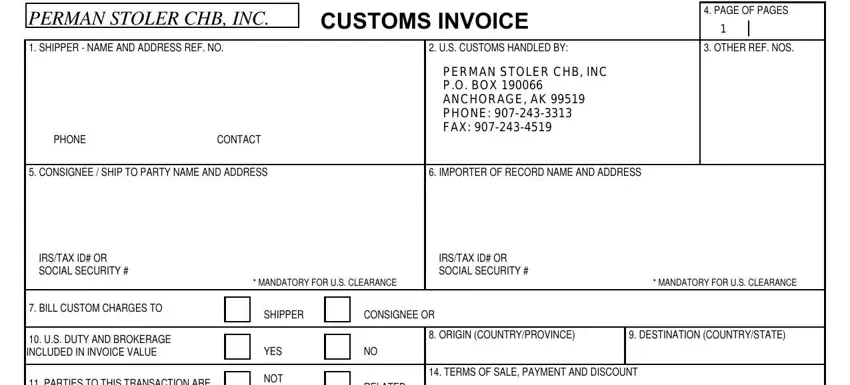

2. The next step is usually to submit the next few fields: PARTIES TO THIS TRANSACTION ARE, DATE OF EXPORT, EXPORTING CARRIER, COUNTRY OF, MANU, FACTURE OR, GROWTH, HS TARIFF, NO OF UNITS, NOT RELATED, RELATED, IF THE GOODS ARE OF US ORIGIN, THEY MUST BE PRODUCED OR, MANUFACTURED IN THE US AND NOT, and FROM THE US.

Concerning MANUFACTURED IN THE US AND NOT and GROWTH, make sure that you take a second look in this current part. Both of these are the most important fields in this form.

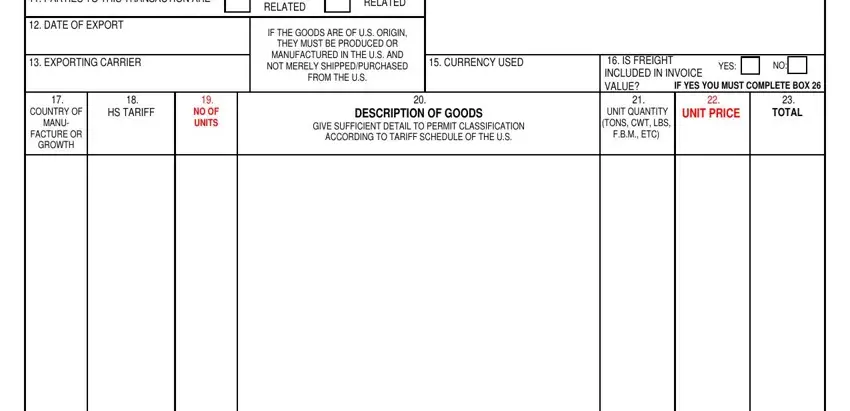

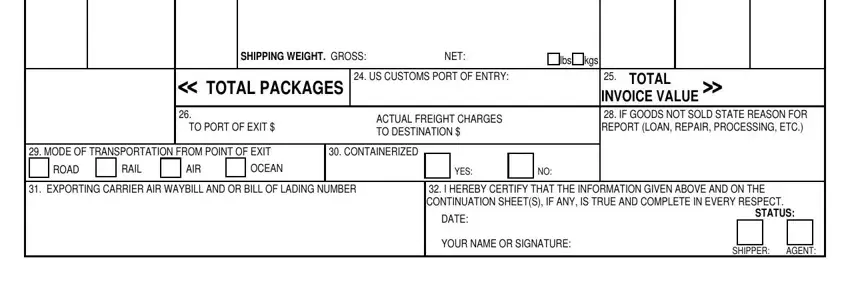

3. This subsequent part is normally rather simple, SHIPPING WEIGHT GROSS, NET, lbs kgs, TOTAL PACKAGES, US CUSTOMS PORT OF ENTRY, TOTAL, INVOICE VALUE, TO PORT OF EXIT, ACTUAL FREIGHT CHARGES TO, IF GOODS NOT SOLD STATE REASON, MODE OF TRANSPORTATION FROM POINT, CONTAINERIZED, ROAD, RAIL, and AIR - all of these empty fields must be filled out here.

Step 3: Go through the details you have entered into the blank fields and click the "Done" button. Try a 7-day free trial plan with us and gain instant access to print customs forms - which you can then make use of as you would like inside your personal cabinet. We do not share or sell the details that you use whenever completing forms at our website.