Through the online PDF tool by FormsPal, you can easily fill out or edit Utah Form Tc 116 right here and now. FormsPal team is always working to enhance the tool and enable it to be much easier for users with its many functions. Take full advantage of the latest revolutionary prospects, and discover a myriad of unique experiences! Starting is effortless! All you have to do is stick to the next simple steps down below:

Step 1: First of all, access the editor by pressing the "Get Form Button" at the top of this webpage.

Step 2: After you launch the editor, you'll see the form all set to be filled in. In addition to filling out different blanks, you may also do other sorts of actions with the Document, such as putting on custom text, changing the original text, adding images, putting your signature on the form, and more.

It is an easy task to fill out the pdf with our helpful guide! Here's what you should do:

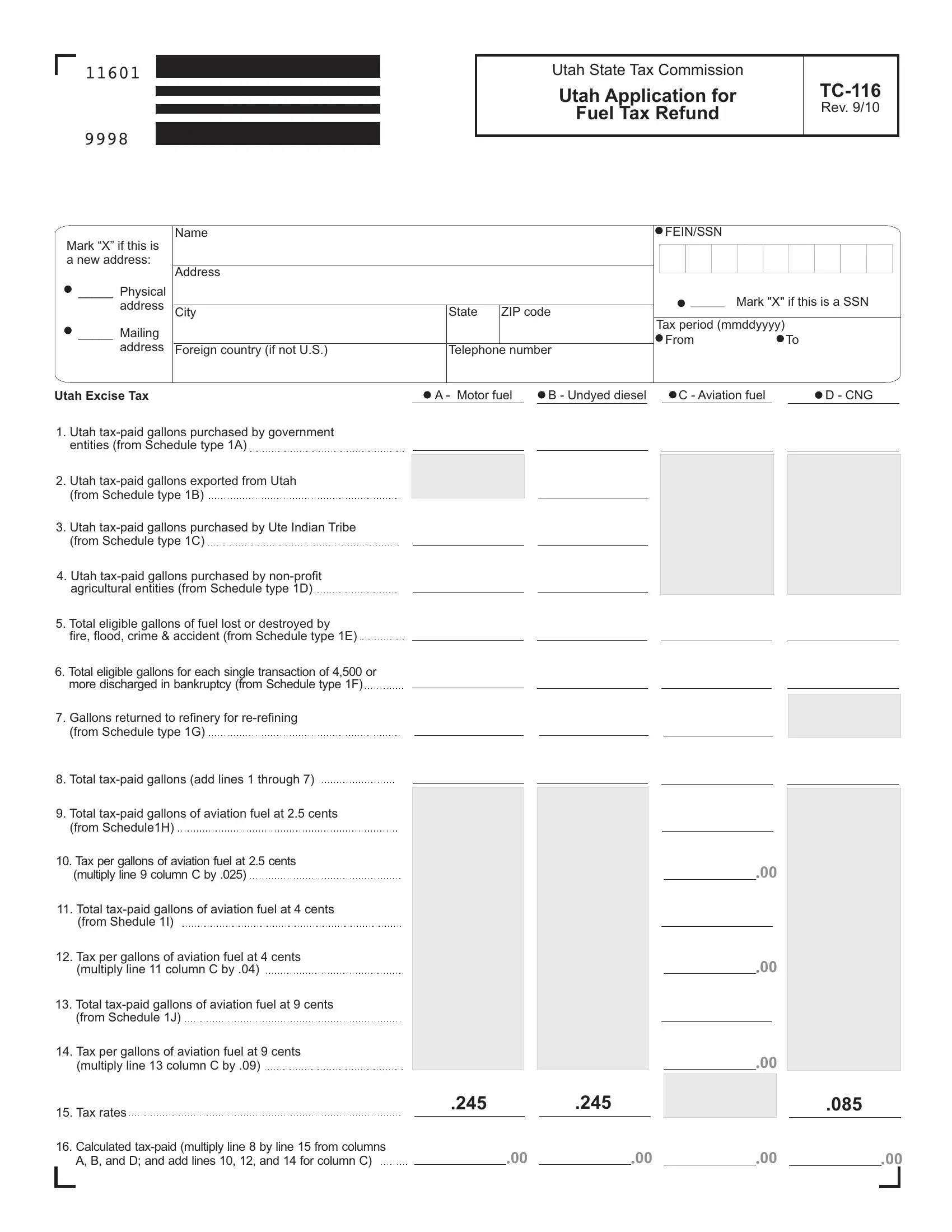

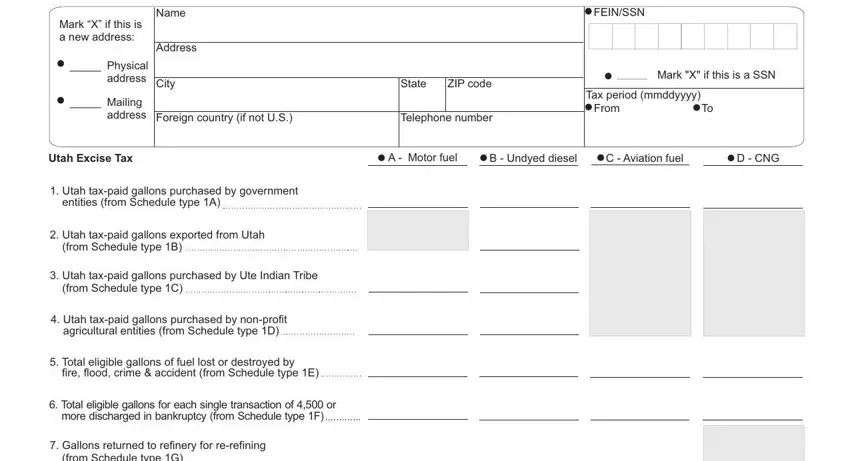

1. Whenever filling out the Utah Form Tc 116, be certain to complete all important blanks in the relevant section. It will help to expedite the work, which allows your information to be handled promptly and properly.

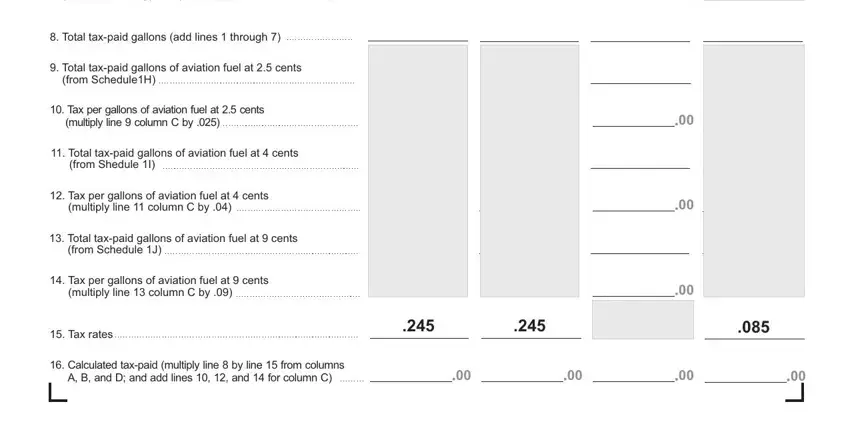

2. Now that the previous array of fields is finished, you have to add the essential particulars in from Schedule type G, Total taxpaid gallons add lines, Total taxpaid gallons of aviation, from ScheduleH, Tax per gallons of aviation fuel, multiply line column C by, Total taxpaid gallons of aviation, from Shedule I, Tax per gallons of aviation fuel, multiply line column C by, Total taxpaid gallons of aviation, from Schedule J, Tax per gallons of aviation fuel, Tax rates, and Calculated taxpaid multiply line allowing you to move forward further.

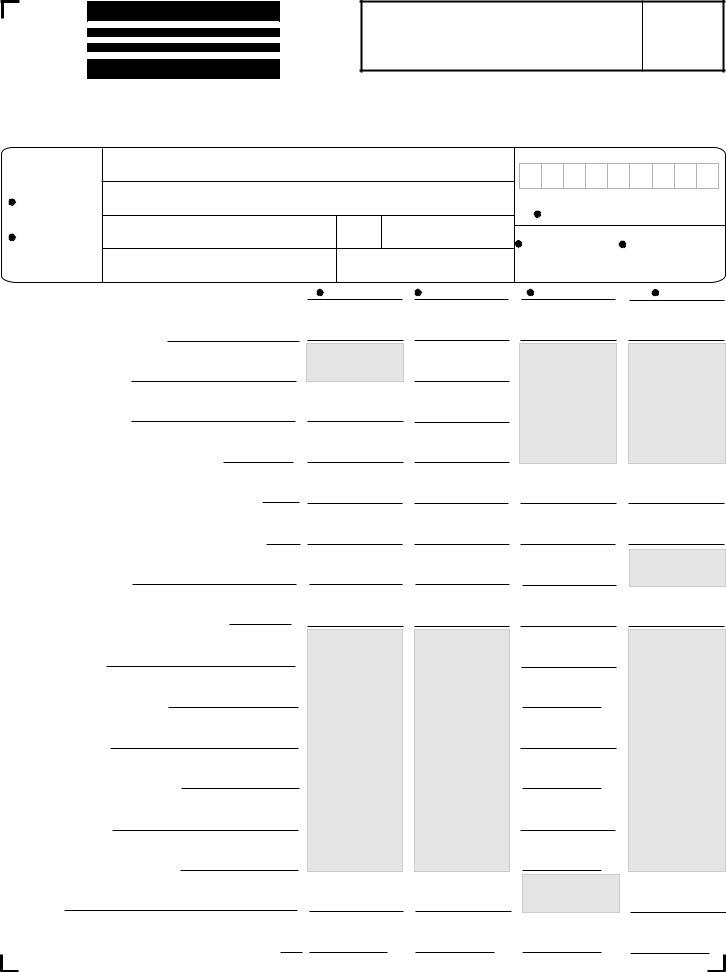

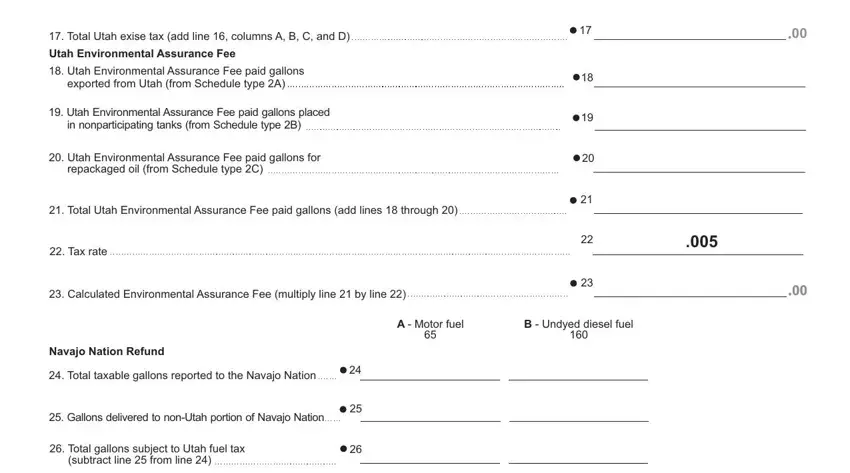

3. This next step will be focused on Total Utah exise tax add line, Utah Environmental Assurance Fee, Utah Environmental Assurance Fee, exported from Utah from Schedule, Utah Environmental Assurance Fee, in nonparticipating tanks from, Utah Environmental Assurance Fee, repackaged oil from Schedule type C, Total Utah Environmental, Tax rate, Calculated Environmental, A Motor fuel, B Undyed diesel fuel, Navajo Nation Refund, and Total taxable gallons reported to - fill in each of these empty form fields.

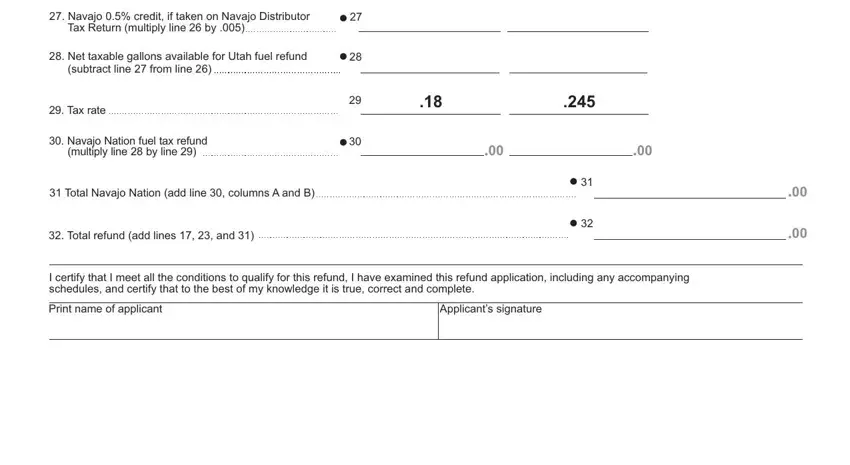

4. To go ahead, the following step involves filling out a handful of blanks. Included in these are Navajo credit if taken on Navajo, Tax Return multiply line by, Net taxable gallons available, subtract line from line, Tax rate, Navajo Nation fuel tax refund, multiply line by line, Total Navajo Nation add line, Total refund add lines and, I certify that I meet all the, Print name of applicant, and Applicants signature, which are key to continuing with this particular form.

It is easy to make a mistake while completing the Navajo Nation fuel tax refund, for that reason you'll want to go through it again before you decide to submit it.

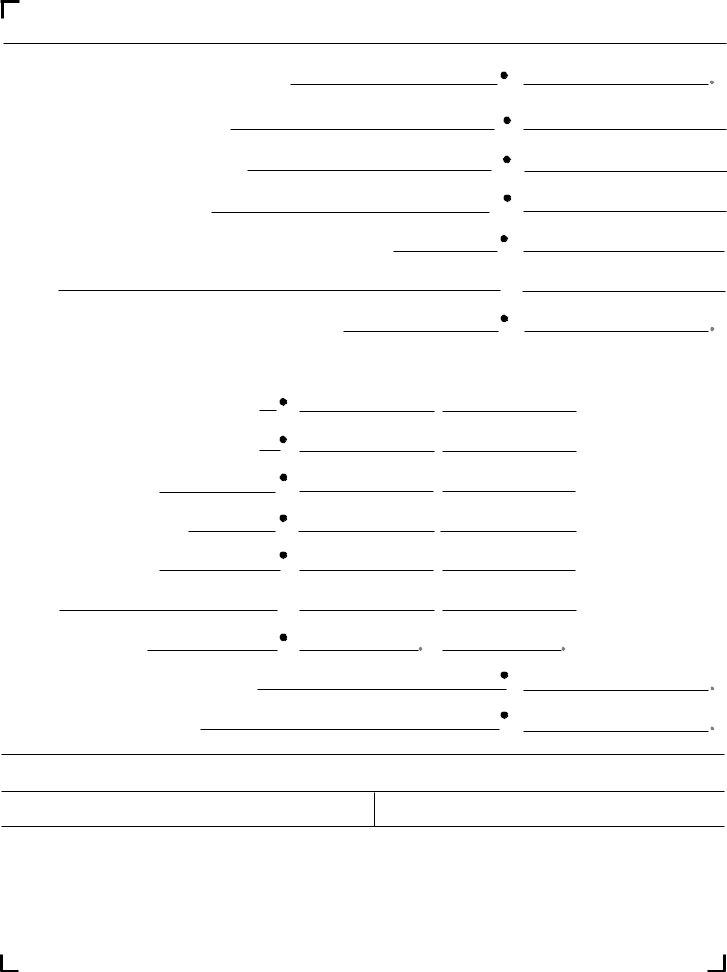

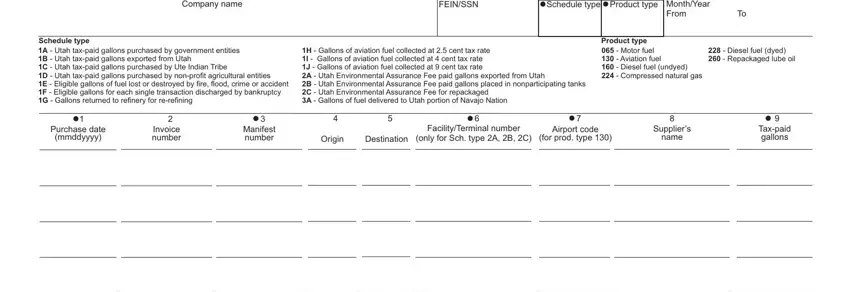

5. Lastly, this final subsection is what you will have to wrap up before finalizing the form. The fields at this stage are the following: Utah Refund Application General, FEINSSN, Schedule type, Product type, MonthYear From, Schedule type A B C D E F G, Utah taxpaid gallons purchased by, H I J A B C A, Gallons of aviation fuel, Product type, Motor fuel Aviation fuel Diesel, Diesel fuel dyed Repackaged lube, Purchase date, mmddyyyy, and Invoice number.

Step 3: After double-checking the form fields you've filled out, press "Done" and you are good to go! Make a free trial plan with us and get immediate access to Utah Form Tc 116 - which you can then make use of as you want inside your personal account page. We do not share any details you enter when working with forms at our website.