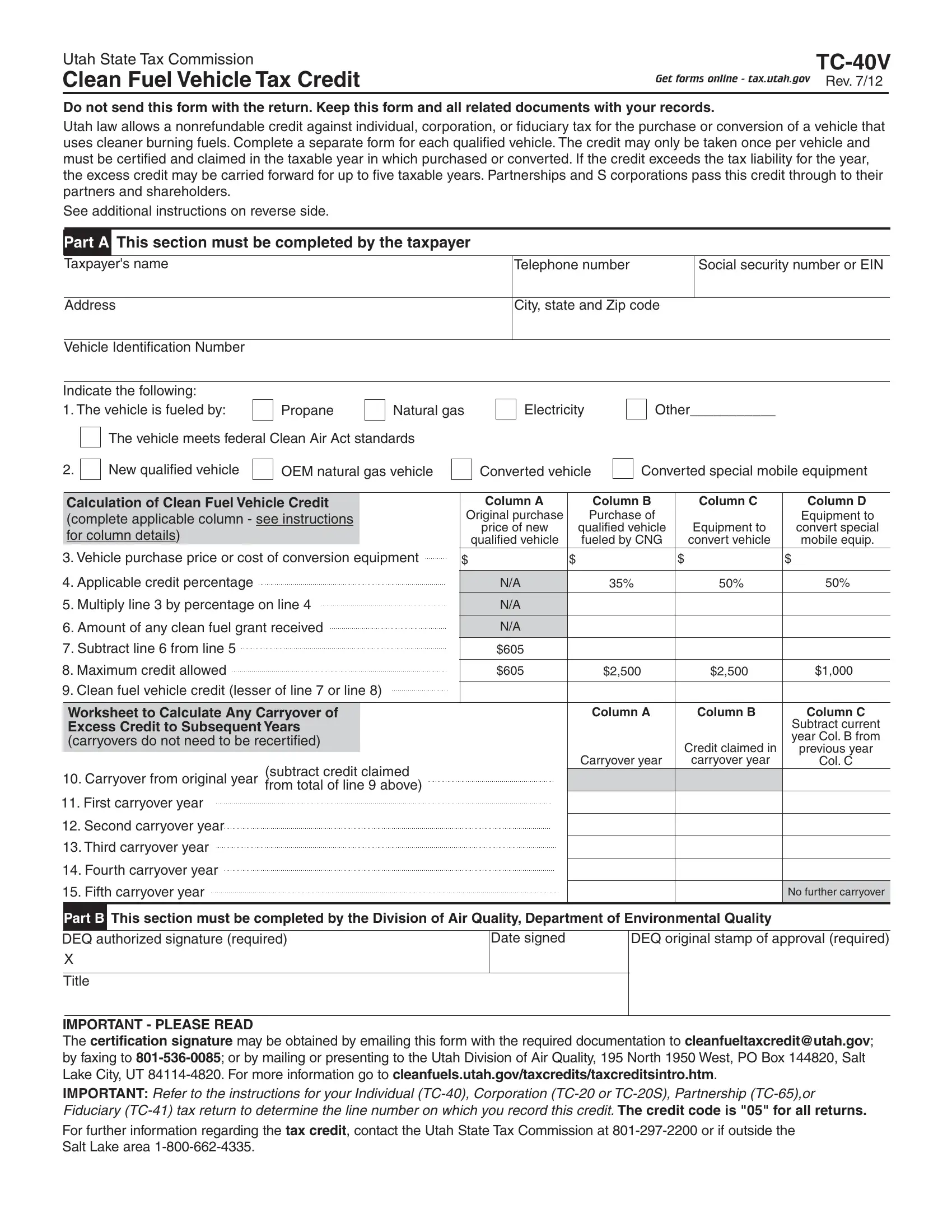

Utah State Tax Commission |

|

TC-40V |

Clean Fuel Vehicle Tax Credit |

Get forms online - tax.utah.gov |

Rev. 7/12 |

|

|

|

|

Do not send this form with the return. Keep this form and all related documents with your records.

Utah law allows a nonrefundable credit against individual, corporation, or fiduciary tax for the purchase or conversion of a vehicle that uses cleaner burning fuels. Complete a separate form for each qualified vehicle. The credit may only be taken once per vehicle and must be certified and claimed in the taxable year in which purchased or converted. If the credit exceeds the tax liability for the year, the excess credit may be carried forward for up to five taxable years. Partnerships and S corporations pass this credit through to their partners and shareholders.

See additional instructions on reverse side.

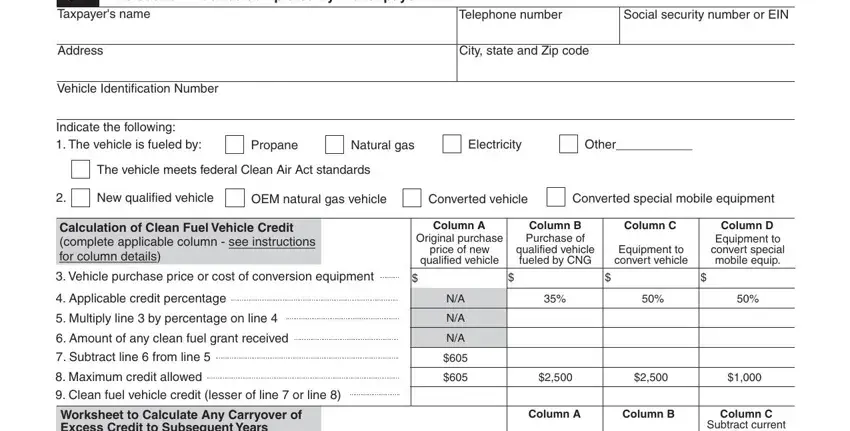

Part A This section must be completed by the taxpayer

Social security number or EIN

Vehicle Identification Number

Indicate the following: |

|

|

1. The vehicle is fueled by: |

Propane |

Natural gas |

The vehicle meets federal Clean Air Act standards

Converted special mobile equipment

|

Calculation of Clean Fuel Vehicle Credit |

|

Column A |

Column B |

Column C |

Column D |

|

(complete applicable column - see instructions |

|

Original purchase |

Purchase of |

Equipment to |

Equipment to |

|

|

price of new |

qualified vehicle |

convert special |

|

for column details) |

|

|

|

qualified vehicle |

fueled by CNG |

convert vehicle |

mobile equip. |

3. Vehicle purchase price or cost of conversion equipment |

|

|

|

|

$ |

$ |

$ |

$ |

4. Applicable credit percentage |

|

|

|

|

N/A |

35% |

50% |

50% |

5. Multiply line 3 by percentage on line 4 |

N/A |

|

|

|

6. Amount of any clean fuel grant received |

N/A |

|

|

|

7. Subtract line 6 from line 5 |

$605 |

|

|

|

8. Maximum credit allowed |

|

|

|

|

$605 |

$2,500 |

$2,500 |

$1,000 |

9. Clean fuel vehicle credit (lesser of line 7 or line 8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Worksheet to Calculate Any Carryover of |

|

|

Column A |

Column B |

Column C |

|

Excess Credit to Subsequent Years |

|

|

|

|

Subtract current |

|

(carryovers do not need to be recertified) |

|

|

|

Credit claimed in |

year Col. B from |

|

|

|

|

previous year |

|

|

|

|

|

|

(subtract credit claimed |

|

Carryover year |

carryover year |

Col. C |

|

|

|

|

|

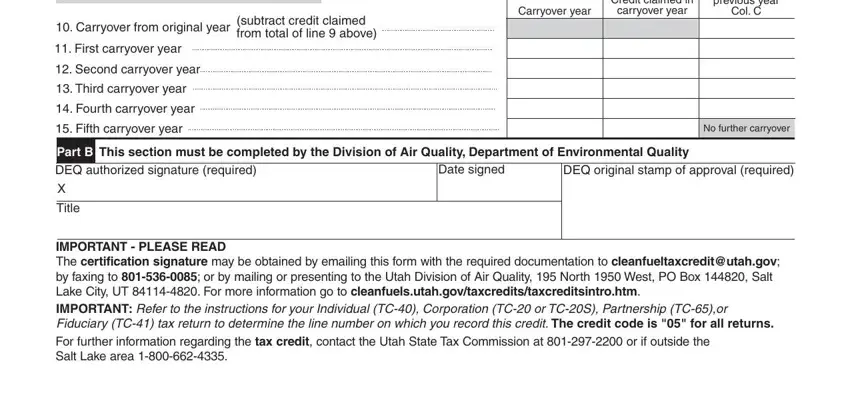

10. Carryover from original year from total of line 9 above) |

|

|

|

|

11. First carryover year |

|

|

|

|

12. Second carryover year |

|

|

|

|

|

|

|

|

13. Third carryover year |

|

|

|

|

|

|

|

|

14. Fourth carryover year |

|

|

|

|

|

|

|

|

15. Fifth carryover year |

|

|

|

|

|

|

|

No further carryover |

|

|

|

|

|

|

|

Part B This section must be completed by the Division of Air Quality, Department of Environmental Quality

DEQ authorized signature (required) |

Date signed |

X

Title

DEQ original stamp of approval (required)

IMPORTANT - PLEASE READ

The certification signature may be obtained by emailing this form with the required documentation to cleanfueltaxcredit@utah.gov; by faxing to 801-536-0085; or by mailing or presenting to the Utah Division of Air Quality, 195 North 1950 West, PO Box 144820, Salt Lake City, UT 84114-4820. For more information go to cleanfuels.utah.gov/taxcredits/taxcreditsintro.htm.

IMPORTANT: Refer to the instructions for your Individual (TC-40), Corporation (TC-20 or TC-20S), Partnership (TC-65),or Fiduciary (TC-41) tax return to determine the line number on which you record this credit. The credit code is "05" for all returns.

For further information regarding the tax credit, contact the Utah State Tax Commission at 801-297-2200 or if outside the Salt Lake area 1-800-662-4335.

Instructions for the Clean Fuel Vehicle Tax Credit - TC-40V

Taxpayers may claim a nonrefundable tax credit against Utah individual income tax, corporate franchise tax or fiduciary tax. (See Utah Code sections 59-7-605 and 59-10-1009)

The credit may only be taken once per vehicle. It must be certified and claimed in the taxable year in which the item is purchased or converted.

Column A - New Vehicle Meeting Air Quality and Fuel Economy Standards for Combined City and Highway, and Not Fueled by Compressed Natural Gas

A qualified vehicle is an original purchase, registered and titled for the first time in Utah, and having less than 7,500 miles. The vehicle must be certified by the Utah Department of Environmental Quality and meet both of the following standards:

1.Fuel Economy Standards for Combined City and Highway

a.at least 31 miles per gallon for gasoline-fueled vehicles;

b.at least 36 miles per gallon for diesel-fueled vehicles;

c.at least 19 miles per gallon for vehicles fueled by a blend of 85% ethanol and 15% gasoline;

d.at least 19 miles per gallon for liquified petroleum gas-fueled vehicles; or

e.meet standards consistent with 40 C.F.R. 600.209-95(d) that are adopted by the Air Quality Board by rule.

2.Air quality standards which are equal to or cleaner than the standards established in bin 2 in Table S04-1, of 40 C.F.R. 86.1811-04(c)(6).

The credit amount is $605.

Column B - OEM Vehicle Fueled by Compressed Natural Gas

A qualified vehicle is one fueled by compressed natural gas, and is registered in Utah.

The credit is the lesser of 35% of the purchase price of the vehicle less any clean fuel grant received, or $2,500.

Column C - Equipment to Convert Vehicle to Run on Propane, Natural Gas, Electricity, or Other Approved Fuel

A qualified vehicle must be registered in Utah and meet one of the following conditions:

1.It converts the engine to be fueled by propane, compressed natural gas, or electricity;

2.It converts the engine to be fueled by another fuel determined by the Air Quality Board to be as effective as the above listed fuels, or

3.It converts the vehicle to meet the clean-fuel vehicle standards in the federal Clean Air Act.

The credit is the lesser of 50% of the cost of the conversion equipment less any clean fuel grant received, or $2,500.

Column D - Equipment to Convert Special Mobile Engine to Operate on Propane, Natural Gas, Electricity, or Other Approved Fuel

A qualified vehicle must meet one of the following conditions:

1.It converts the engine to be fueled by propane, compressed natural gas, or electricity;

2.It converts the engine to be fueled by another fuel determined by the Air Quality Board to be as effective as the above listed fuels, or

3.It converts the engine to be substantially more effective in reducing air pollution than the fuel for which the engine was originally designed.

The credit is the lesser of 50% of the cost of the conversion equipment less any clean fuel grant received, or $1,000.

Procedures

1.If you have purchased a qualifying vehicle or converted a vehicle or special mobile equipment engine, submit the required documentation with a completed form TC-40V to the Utah Division of Air Quality. Information for obtaining clean fuel vehicle certification is located in the Utah Administrative Code at www.rules.utah.gov/publicat/code/r307/r307-121.htm.

R307-121-3: Demonstration of Eligibility for OEM Compressed Natural Gas Vehicles

R307-121-4: Demonstration of Eligibility for Motor Vehicles that meet Air Quality and Fuel Economy Standards

R307-121-5: Demonstration of Eligibility for Motor Vehicles Converted to Natural Gas or Propane

R307-121-6: Demonstration of Eligibility for Motor Vehicles Converted to Electricity

R307-121-7: Demonstration of Eligibility for Special Mobile Equipment Converted to Clean Fuels

2.The taxpayer must receive certification from the Utah Division of Air Quality. The credit is not valid unless both an authorized signature and certification stamp are present.

3.Complete the calculation of the credit in Part A. Carryover credits may be recorded on lines 10 through 15. Carryover credits do not need to be recertified by the Utah Division of Air Quality.

4.Refer to the return instructions to determine the line number on which to record this credit. The credit code is "05" for all returns.

5.Do not send this form with your return. Keep this form and all related documents with your records.