You are able to fill out Utah Form Tc 55A instantly with our PDFinity® online PDF tool. Our expert team is constantly endeavoring to expand the editor and ensure it is much easier for users with its handy features. Take your experience to a higher level with continually developing and amazing opportunities available today! It just takes a few simple steps:

Step 1: Simply click on the "Get Form Button" in the top section of this webpage to start up our pdf file editor. This way, you will find everything that is required to work with your file.

Step 2: Using our online PDF editor, you could accomplish more than simply fill out blank form fields. Try each of the features and make your documents seem professional with customized text incorporated, or adjust the original input to excellence - all that comes with the capability to incorporate stunning images and sign the file off.

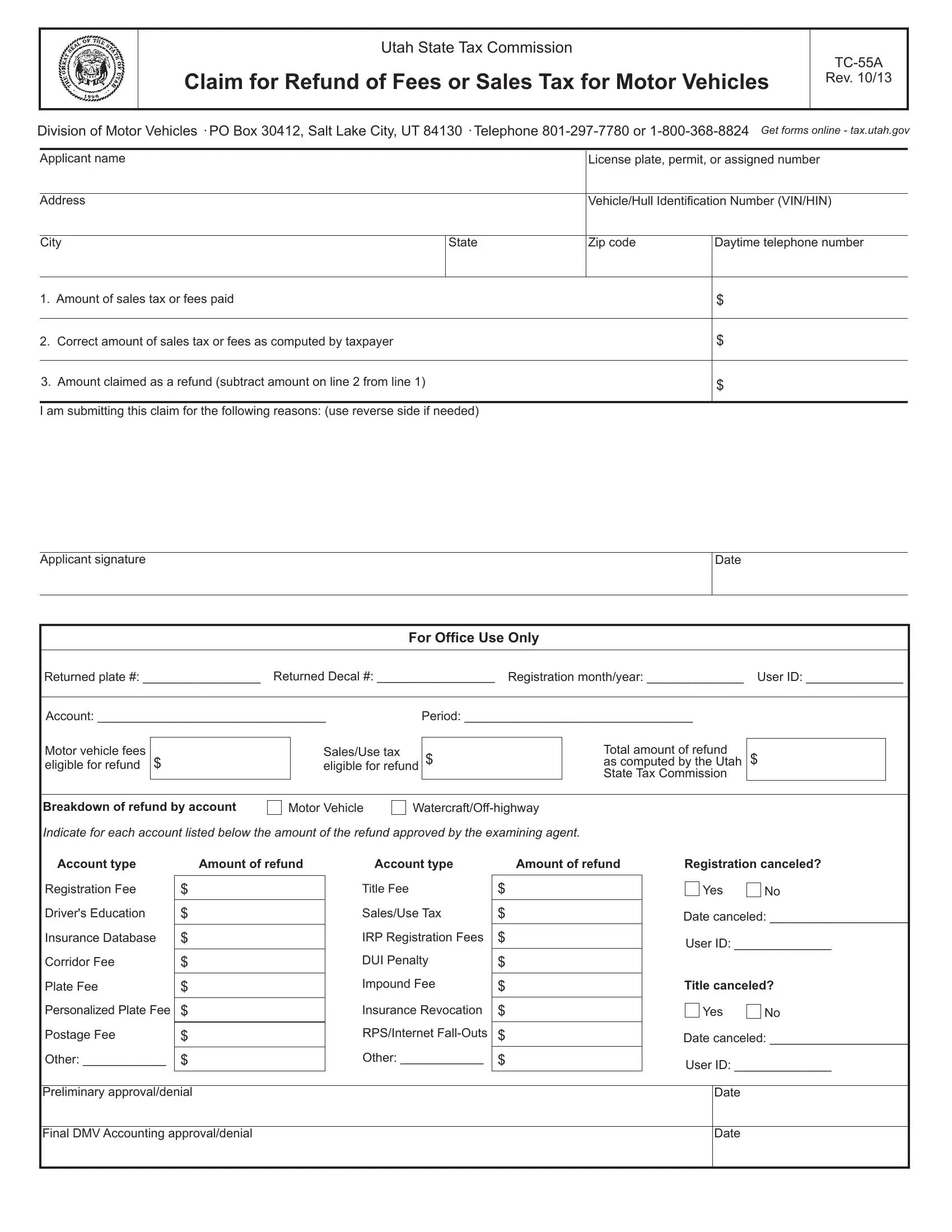

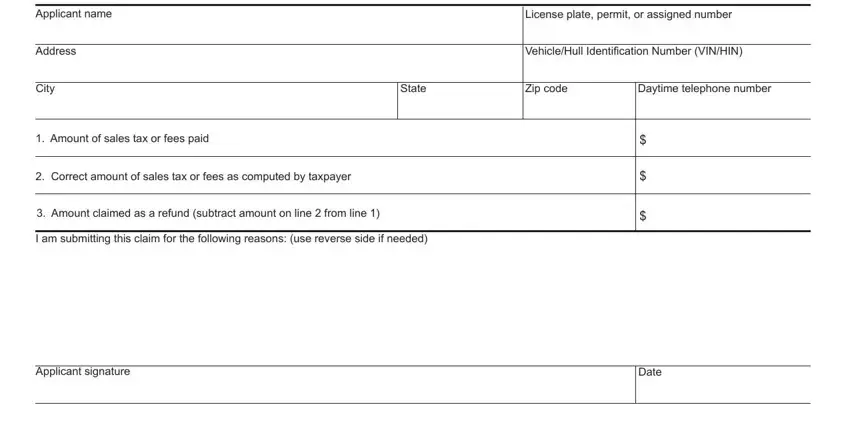

This document will require specific information to be filled out, so you need to take some time to type in precisely what is expected:

1. While filling in the Utah Form Tc 55A, be certain to include all of the important blank fields in their corresponding form section. It will help speed up the work, allowing for your details to be processed promptly and accurately.

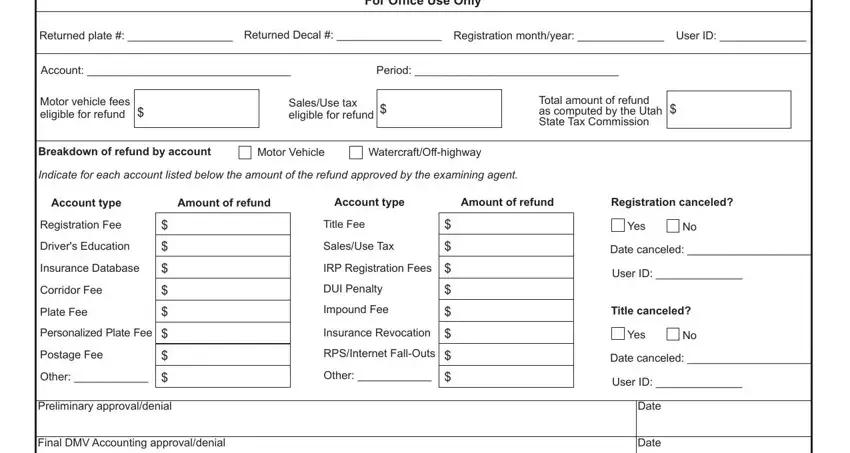

2. Once the previous array of fields is finished, it is time to add the required specifics in Returned plate Returned Decal, User ID, For Office Use Only, Account, Period, Motor vehicle fees eligible for, SalesUse tax eligible for refund, Total amount of refund as computed, Breakdown of refund by account, Motor Vehicle, WatercraftOffhighway, Indicate for each account listed, Account type, Amount of refund, and Account type allowing you to progress to the third part.

3. The following part is considered quite uncomplicated, - all of these form fields has to be completed here.

Always be very attentive while completing this field and next field, as this is where most users make mistakes.

Step 3: Go through all the details you've typed into the blanks and then hit the "Done" button. Join FormsPal right now and immediately access Utah Form Tc 55A, prepared for downloading. All modifications you make are saved , so that you can edit the document further anytime. FormsPal ensures your data confidentiality by having a protected system that never records or distributes any personal information used in the file. Be confident knowing your files are kept confidential every time you work with our tools!