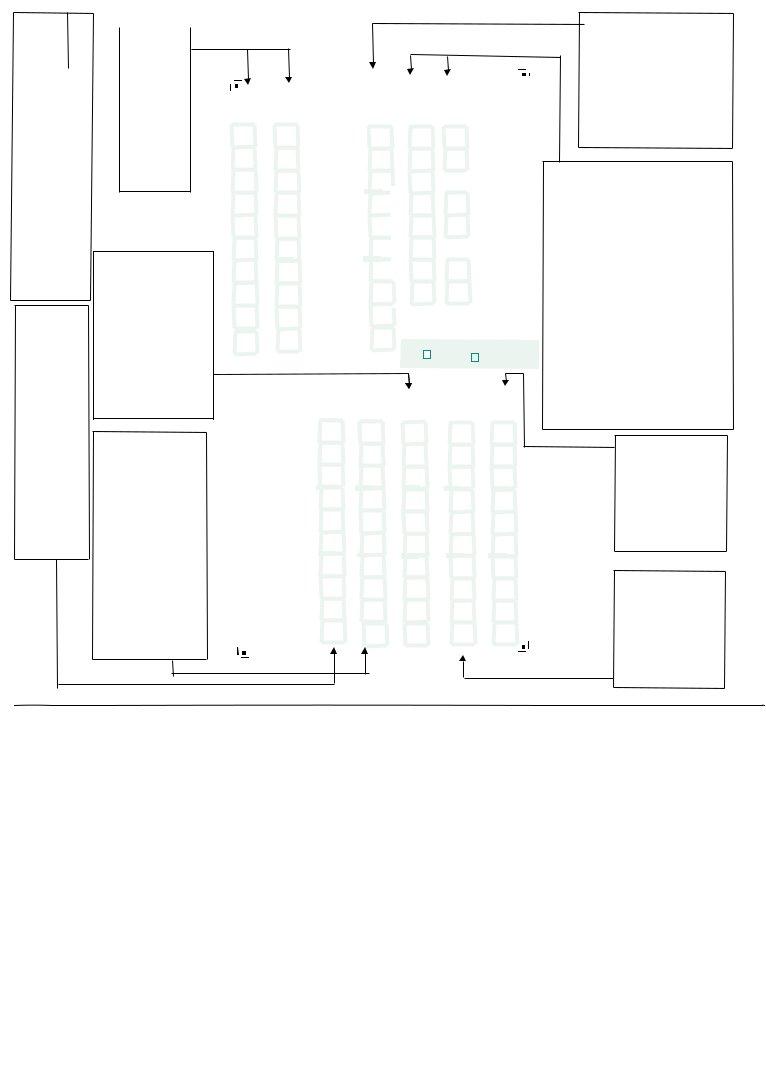

Navigating the complexities of Value Added Tax (VAT) compliance is crucial for businesses operating within the jurisdictions that impose this tax. The VAT 3 return form serves as a critical instrument in this process, facilitating the accurate reporting and payment of VAT to the Collector-General. On this form, businesses must meticulously document their VAT on sales (T1) and VAT on purchases (T2) for a specified period, which highlights the essence of comprehensive record-keeping in corporate finance management. Additionally, the form caters to both payment due instances and scenarios where a repayment is sought, incorporating methods like Single Debit Authority for direct bank deductions and provisions for cheque payments, underscoring the flexibility afforded to taxpayers in managing their obligations. The inclusion of bank details becomes imperative when seeking a repayment or when opting for the Single Debit Authority payment method, illustrating the seamless integration of banking information with tax return processes. Moreover, the VAT 3 form emphasizes the significance of timeliness in payments, warning of interest penalties and enforcement actions such as sheriff intervention, court proceedings, or attachment for delinquencies. This insistence on punctuality and accuracy in the submission underscores the broader commitment of tax authorities to maintain fiscal discipline among businesses. Guided completion instructions and the obligatory method of repayment section further ensure that businesses are well-informed about the correct completion and submission procedures, thereby aiding in the steadfast adherence to tax compliance requirements.

| Question | Answer |

|---|---|

| Form Name | Vat 3 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | download vat 3 returns form, vat 3 returns form ireland, vat 3 returns form, vat form 11 0 1 |

In all correspondence please quote: |

|

|

|

|

Sarsfield House |

Registration No: IE |

Francis Street |

Limerick |

Notice No:

Period:

Enquiries: 1890 203070

to

Payment due by:

VAT 3 RETURN

Please complete and sign the return below. The return should then be detached and forwarded (with payment or debit instructions, if liability arises) in the prepaid envelope enclosed, to arrive no later than the due date as shown above. Guidelines on the correct completion of the return are shown overleaf.

IMPORTANCE OF PROMPT PAYMENTS

Make sure that you allow sufficient time - at least three working days - for your payment to reach the

Late payment of tax carries an interest penalty.

Failure to pay a tax liability, or to pay on time, can result in enforced collection through the Sheriff, Court proceedings or Attachment. Enforcement gives rise to costs in addition to any interest penalty charged.

METHOD OF PAYMENT

Single Debit Authority: If you want your payment to be debited directly from your bank account, complete the bank details on the left of the return below, ensuring that the amount of the payment you wish to make is entered in the Debit Amount box.

Please note that the account must be in a bank within the Republic of Ireland and must be a current account.

·Simply provide your bank details and the amount you wish to have debited from your account.

·Forward the completed return to the

·A

·The

Revenue

Direct Debit: For information on how to pay VAT by monthly Direct Debit, please contact the Helpline at1890 33 84 48 .

METHOD OF REPAYMENT

Any repayment due will be credited to your bank/building society account. Account details are only required if this return is a repayment (T4 line completed) and you have not previously advised Revenue of the account details or you wish to amend the account details to which previous repayments were credited.

Please print one figure only in each space using a black

Enter whole Euro only - do not enter cents. Photocopies of this form are not acceptable.

VAT3 RETURN (and PAYSLIP) Please complete below, detach and return

Bank Details - to be supplied if :

Payment is being made by Single Debit Authority

(do not complete this authority if you are paying by cheque), or

A repayment is being sought (see Method of Repayment above).

Office

Use

AMD

VAT on Sales

T1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

VAT on Purchases

Branch |

T2 |

.00 |

Sort Code |

||

|

, |

, |

|

|

|

Excess of T1 over T2 (Payable) |

|

Account |

||||

|

||||

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O/S |

T3 |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

.00 |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

Single Debit Authority |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Debit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

Excess of T2 over T1 (Repayable) |

|

|

|

|

|

|

||||||||||||||

Amount |

|

|

|

|

|

|

, |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

T4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

||

|

|

Please debit my account with the amount specified. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount of Payment |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

,, |

.00 |

|

Value of Goods Sent to other EU Countries |

,, |

||

|

I declare that this is a correct return of Value Added Tax for the period specified. |

|||

|

|

|

||

E1 |

, |

, |

.00 |

|

|

||||

|

Value of Goods Received from other EU Countries |

|

||

E2 |

, |

, |

.00 |

VAT3 |

|

B |

|||

Please Note: Please print one figure

neli sen Pel ) t a o ot se ht E( ne e 1 t r e |

EE1/ 2 |

E l r U ni ht c e) et uo or ot nt re al r |

|

E2 |

E1 |

outAmn |

itDeb |

Number Account |

Sort |

Branch |

|

|

|

|

|

||

|

|

|

|

|

Code |

|

(donot comp |

Payme |

aBnk De |

|

Arepa |

er pa my en ct al mi .

by

hc qe ue

or

ht e r e ut nr

is

L y ht D ot C ea ou at eb m mo ve br yo it ka p t a A l h n u e e i k h ut a te s d a h p t l v o a h i e n e r y i e t i s a t m l b i a y i l l . e n l s s P n a . o t e nk p le b if r a y y if ov se S o p i e i u |

De bit

mA ou nt

whole Euro only - do not enter cents. line. are not acceptable.

ofPl

rea pe se

ayen meet nr t cthe al a mim , luo aent

veof

ht oy siu

lr ni p e a y

b

alme nknt . he re I. n t he

ca se

only in each space using a black

mA uo nt

of

Pa my en t

esi cei val ve ue df of r |

mo go o |

E( ds |

2 |

Aut Pya hor mne yit mt o a rc y he be q m ue. ad eb yS ngi el Deb it |

.nrutershithtwnmyiteap lulftimbusodteruqiererauoY .enilsihnoecntereffdehitrenetesaepl ,tnuoma2Tsdeecxetnuoma1TfI |

|

.oppapopsadaeeairrirrt mmwRdnuoaunveouoyoeudnaeerftti vbuSkhaceocececnotifirttjhhsiesst,tii |

di If f T fe 2 enr ma ec ou on nt hti exc sl ee nei ds . T 1a mou nt, pel ase |

T4 |

bll per eo ay ff me set nt |

net er het |

|

|

|

|

|

|

|

|

|

1 |

Please |

|

|

||

|

|

|

|

|

|

|

|

debit |

|

|

|||

|

|

Value |

|

|

Value |

|

|

1 |

|

|

|||

|

|

|

|

|

|

1 |

my |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

of |

|

|

of |

|

|

1 |

account |

, |

Single |

||

|

|

|

|

|

|

|

|||||||

|

|

Goods |

|

|

Goods |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

1 |

with |

|

Debit |

||||

T |

|

Received |

|

|

Sent |

|

|

1 |

|

Authority |

|||

|

|

|

|

|

the |

|

|||||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

SAMPLE |

|

|

|||||||||

|

|

from |

, |

|

to |

|

|

1 |

amount |

, |

|

||

|

|

|

|

|

1 |

|

|||||||

3 |

|

|

|

other |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

EU |

|

|

|

|

|

|

specified |

|

|

||

|

|

other |

|

|

EU |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Countries |

|

|

1 |

|

|

|

|

|

|

|

Countries |

|

|

|

|

1 |

|

. |

|

|

||

|

|

|

|

|

|

|

|

|

|

||||

|

. |

. |

|

|

|

1 |

|

|

|

. |

|

||

|

|

|

|

|

|

|

|

|

|||||

|

00 |

|

00 |

|

|

|

|

|

|

|

00 |

|

|

|

|

|

specified |

I |

|

|

|

|

|

|

|

|

|

: |

|

- |

declare |

|

|

|

|

|

|

|

|

|

|

No |

Name: |

Signed: |

|

|

|

|

|

|

|

|

|

T4 |

|

Reg |

|

|

|

|

|

|

|

|

|

|

|

|

or |

|

|

_______________________ |

. |

that |

|

|

|

|

|

|

Not |

||

|

|

|

|

this |

|

|

|

|

|

|

|

|

|

|

|

|

|

is |

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

|

|

|

|

|

|

|

|

|

Period: |

|

|

|

correct |

|

, |

|

Amount |

, |

c, |

|||

|

|

|

|

|

|

|

|

|

|

|

Ex |

||

|

|

|

|

return |

|

|

|

- |

|

|

es s |

||

|

|

|

|

|

|

|

|

of |

|

|

|

R( epbaaye)l |

|

SampleB AV |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

f o |

|

|

|

|

of |

|

|

|

|

Payment |

|

|

T 2 |

|

|

|

Date: |

|

VAT |

|

|

|

|

|

|

|

|

r o v e |

|

|

|

|

|

|

|

|

|

|

, |

, |

||

|

|

|

|

for |

|

, |

|

|

|

|

T 1 |

||

|

|

- |

|

the |

|

|

|

|

|

|

|

|

|

|

|

|

|

period |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

. |

|

|

|

. |

. |

|

|

|

|

|

|

|

|

00 |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

00 |

00 |

||

|

|

T3 |

|

|

|

|

|

|

|

|

|

|

|

For |

||

|

O/S |

|

T3 |

T2 |

|

Excess |

, |

VAT |

on |

||

over |

|

Purchases |

of |

|

|

T1 |

|

|

T2 |

, |

|

(Payable) |

|

|

|

|

|

|

. |

|

|

00 |

|

yment |

|

|

is |

|

|

being |

|

R |

sought(see |

|

epa my en |

Method |

|

Sst ec |

ofRepayment |

|

oit nF ax N |

above). |

|

0o. 65 |

|

|

684 361 6. |

AMD |

Use |

Office |

|

T1 |

|

, |

VAT |

|

on |

||

|

||

|

Sales |

|

, |

|

. 00

yo ur

VA T r ep ay me nt

ba kn

d

at sil

p el as e f ax

de at sli

ot

VA T

ht si

er ut nr

si

no at

er pa my en at nd

oy u s ilt wl si h t o c ah gn e

er pa my en st

we re

cr ed eit d,

epl as e e ent br an k d e at sli

he er I. f

w si h t o a me nd

ht e a cc ou nt

de at sil

ot

wh ci h p er ovi us

a

ha ve

no t p er ovi us yl

ad svi ed

us of

ht e a cc uo nt

ed at sil

or

yo u

yai ng |

d n n w de su gl i r e s e h |

Rep may e |

yapowhsti ohwtsiuoy hAtuDtbei mneyaP(t |

nr T

( a i 3oti hnt

snirues:)4TtrihtfI |

mil’nutoabedti‘eht mYsuuode.tibedev abeheneaetrteslpy, yapow:)hsutioyfI |

ae a n y

rb sl kd ou

e e o e r

p l

o lin taea t

my ent and you |

w. nt il ab er so il het ft yit a he by mou acc Sni ynt nou gel o t |

|

u |

EntertotalVATliability inrespectofgoods& |

|

|

EntertotaldeductibleVAT inrespectof purchases+ |

Ba nk

De at sli

T1

T2

GUIDE TO COMPLETION OF RETURN