You may work with vat50 instantly using our PDFinity® online tool. In order to make our editor better and more convenient to use, we consistently develop new features, taking into account suggestions from our users. For anyone who is looking to get going, here is what you will need to do:

Step 1: Open the form inside our editor by hitting the "Get Form Button" above on this webpage.

Step 2: The tool enables you to change your PDF in various ways. Change it by adding any text, adjust what's originally in the document, and place in a signature - all readily available!

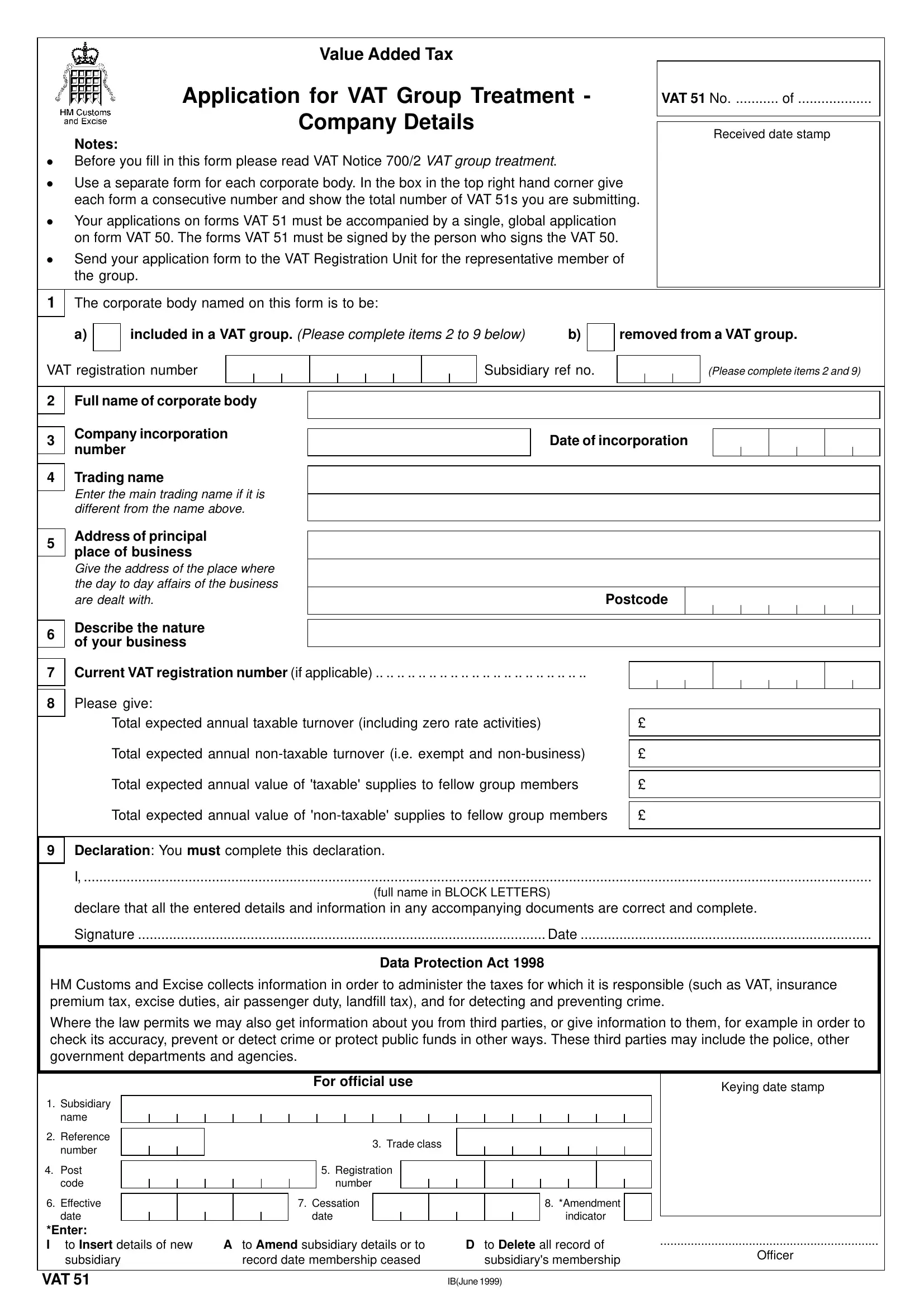

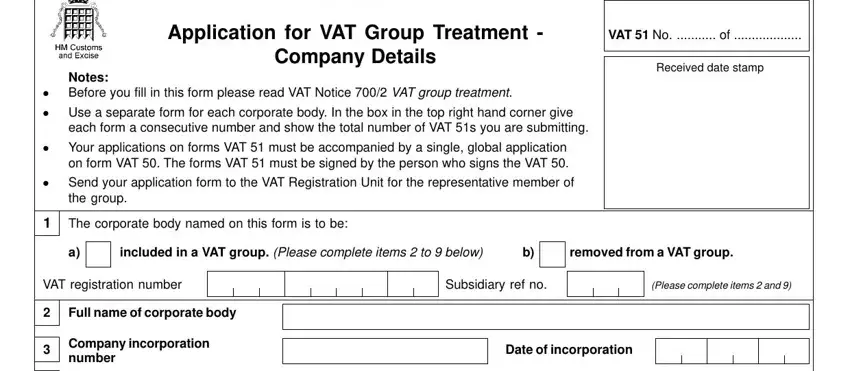

This document will need particular data to be filled out, thus you must take your time to type in what's requested:

1. To begin with, once filling out the vat50, begin with the part that contains the subsequent fields:

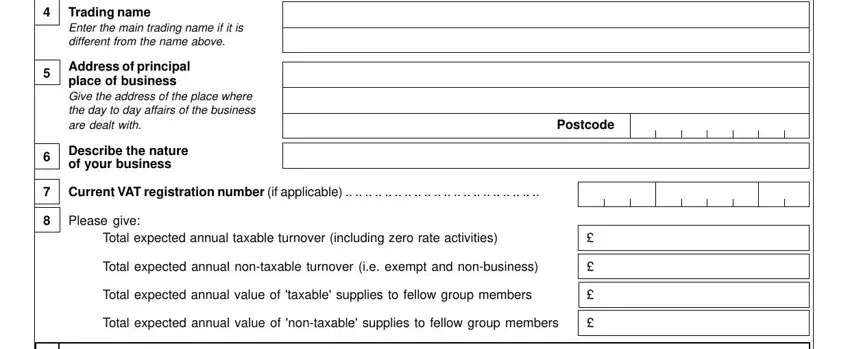

2. Once your current task is complete, take the next step – fill out all of these fields - Trading name Enter the main, Address of principal place of, Describe the nature of your, Postcode, Current VAT registration number, Please give, Total expected annual taxable, Total expected annual nontaxable, Total expected annual value of, and Total expected annual value of with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

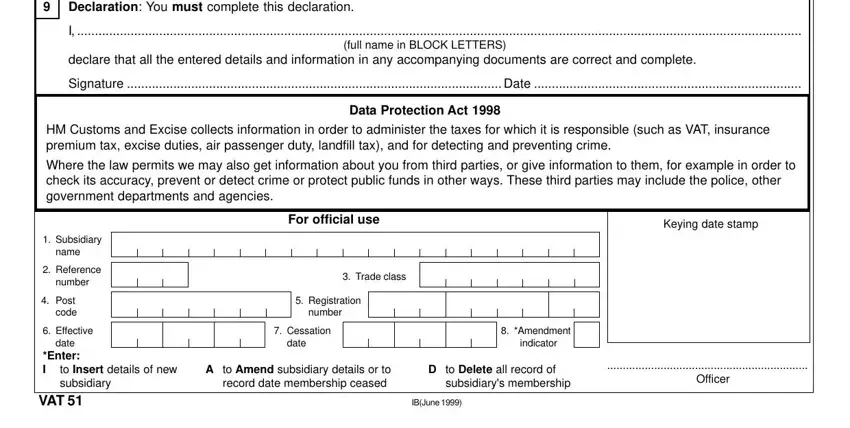

3. Within this part, examine Declaration You must complete, declare that all the entered, full name in BLOCK LETTERS, Signature Date, Data Protection Act, HM Customs and Excise collects, Where the law permits we may also, For official use, Keying date stamp, Subsidiary, name, Reference, number, Post code, and Effective. Each of these need to be completed with greatest attention to detail.

Be really attentive when filling out For official use and Subsidiary, since this is the part where most people make mistakes.

Step 3: Before moving on, ensure that form fields are filled out as intended. As soon as you determine that it is correct, click on “Done." Get the vat50 after you join for a 7-day free trial. Immediately gain access to the document from your personal account page, along with any edits and adjustments being conveniently kept! FormsPal guarantees your data privacy by using a secure method that never saves or shares any type of sensitive information used in the file. Be confident knowing your docs are kept confidential when you use our service!