In case you intend to fill out Virginia Form Va 6H, you won't need to install any software - simply use our PDF tool. The tool is continually maintained by us, receiving awesome functions and becoming greater. With a few basic steps, you can begin your PDF editing:

Step 1: Press the "Get Form" button above. It will open up our pdf tool so you could start filling out your form.

Step 2: Using our online PDF tool, you can actually do more than simply fill out blank form fields. Try all the functions and make your documents look great with customized text incorporated, or fine-tune the original content to excellence - all backed up by an ability to insert any kind of photos and sign it off.

It's simple to finish the document following our helpful tutorial! Here is what you must do:

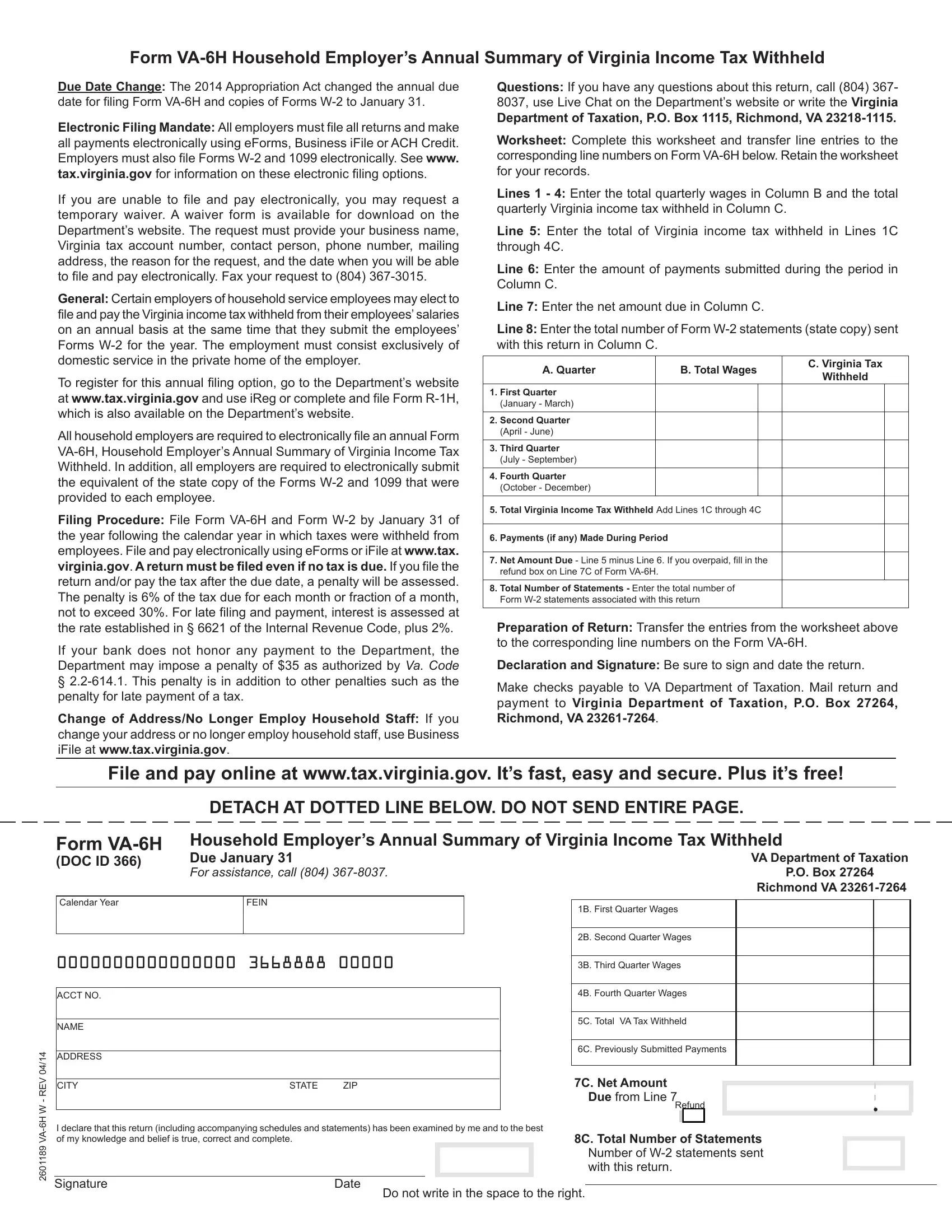

1. You should complete the Virginia Form Va 6H properly, therefore be mindful while working with the sections comprising these blanks:

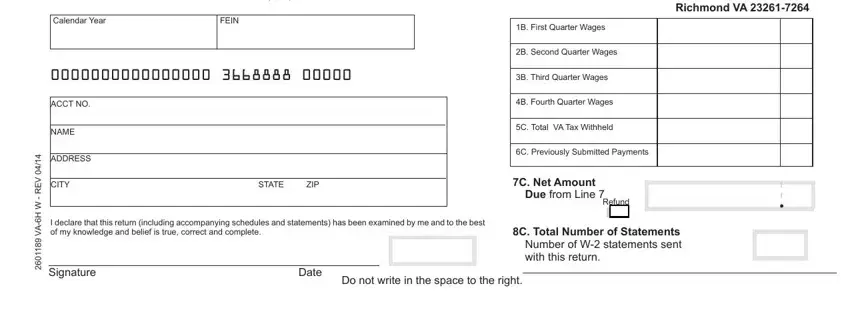

2. Just after performing the previous step, go on to the next stage and fill in all required particulars in these blank fields - Household Employers Annual Summary, PO Box, Calendar Year, FEIN, ACCT NO, NAME, ADDRESS, CITY, V E R, STATE, ZIP, W H A V, Richmond VA, B First Quarter Wages, and B Second Quarter Wages.

It's simple to get it wrong when filling out the Household Employers Annual Summary, consequently be sure you go through it again prior to when you send it in.

Step 3: Check that your details are right and then click on "Done" to finish the process. Go for a 7-day free trial subscription at FormsPal and obtain instant access to Virginia Form Va 6H - which you may then work with as you wish from your FormsPal account page. Here at FormsPal, we do our utmost to make sure all your information is maintained private.