You'll be able to fill in st 12 virginia without difficulty using our PDFinity® PDF editor. Our tool is continually developing to provide the very best user experience achievable, and that is due to our resolve for continual enhancement and listening closely to comments from customers. To get started on your journey, consider these basic steps:

Step 1: Press the "Get Form" button above on this page to access our tool.

Step 2: With this online PDF editing tool, you could accomplish more than merely complete blank form fields. Edit away and make your docs look professional with custom textual content added in, or optimize the original input to perfection - all supported by an ability to insert almost any pictures and sign the PDF off.

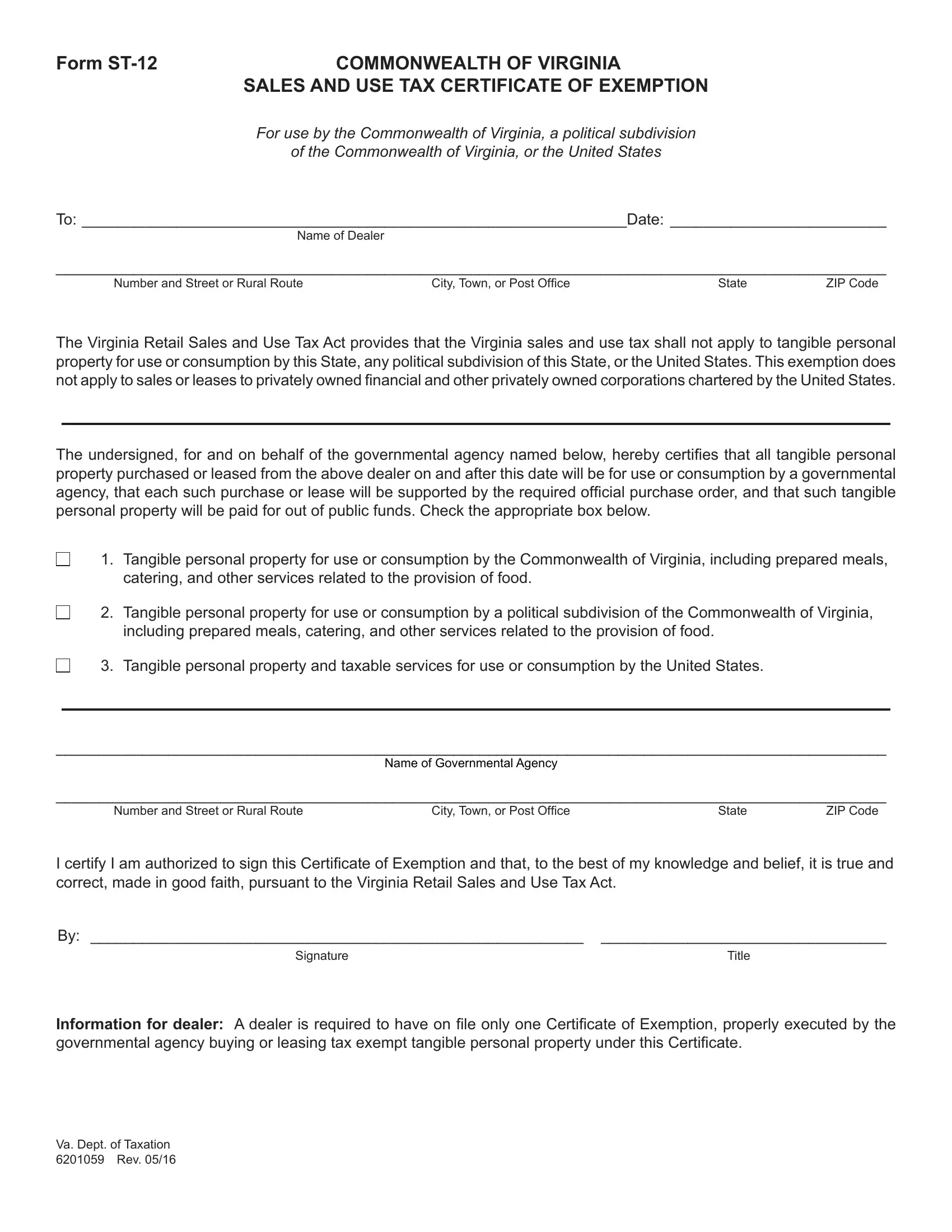

Pay close attention while filling out this form. Ensure that each field is filled out correctly.

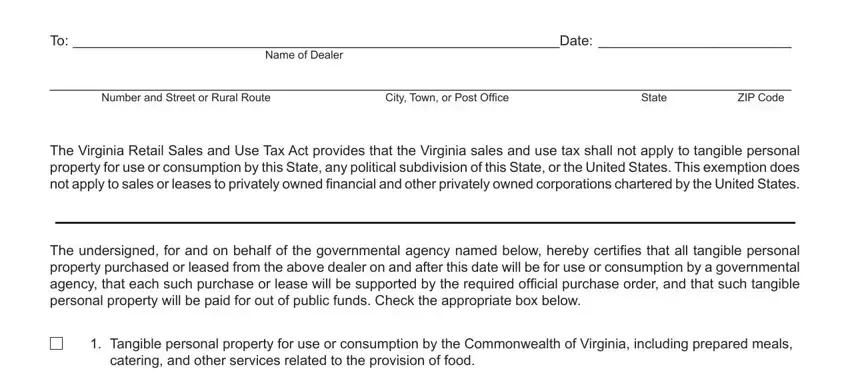

1. Begin completing your st 12 virginia with a group of major blank fields. Collect all of the necessary information and be sure nothing is neglected!

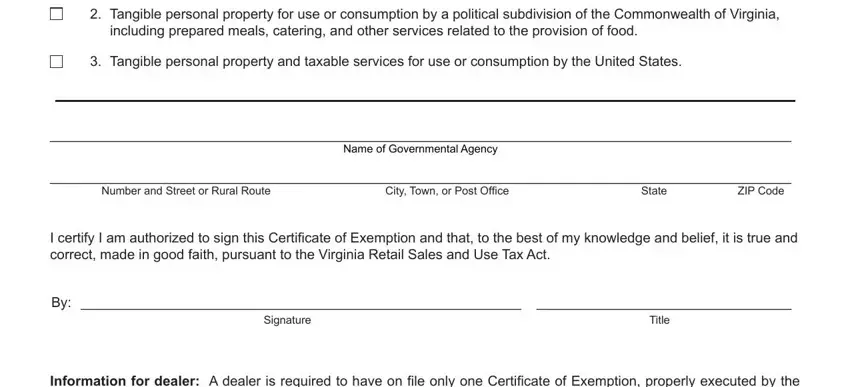

2. Just after the prior part is filled out, go to enter the relevant information in these - Tangible personal property for, including prepared meals catering, Tangible personal property and, Name of Governmental Agency, ZIP Code, Number and Street or Rural Route, City Town or Post Ofice, State, I certify I am authorized to sign, By f, Signature, Title, and Information for dealer A dealer is.

Always be really attentive while filling out Tangible personal property and and Name of Governmental Agency, as this is where most people make a few mistakes.

Step 3: Make sure that the information is accurate and just click "Done" to proceed further. Grab your st 12 virginia after you register online for a free trial. Readily get access to the pdf form inside your FormsPal account page, with any edits and changes being conveniently preserved! At FormsPal, we strive to guarantee that your information is kept protected.