DeCAP can be completed online in no time. Just open FormsPal PDF editor to complete the task in a timely fashion. The editor is consistently maintained by our team, receiving new awesome features and becoming better. It just takes several easy steps:

Step 1: Firstly, open the tool by pressing the "Get Form Button" in the top section of this site.

Step 2: As you access the PDF editor, you'll notice the form ready to be filled in. Besides filling out various blanks, you could also perform several other things with the PDF, such as putting on your own text, changing the initial text, adding graphics, affixing your signature to the form, and more.

It is an easy task to finish the form with our helpful tutorial! This is what you need to do:

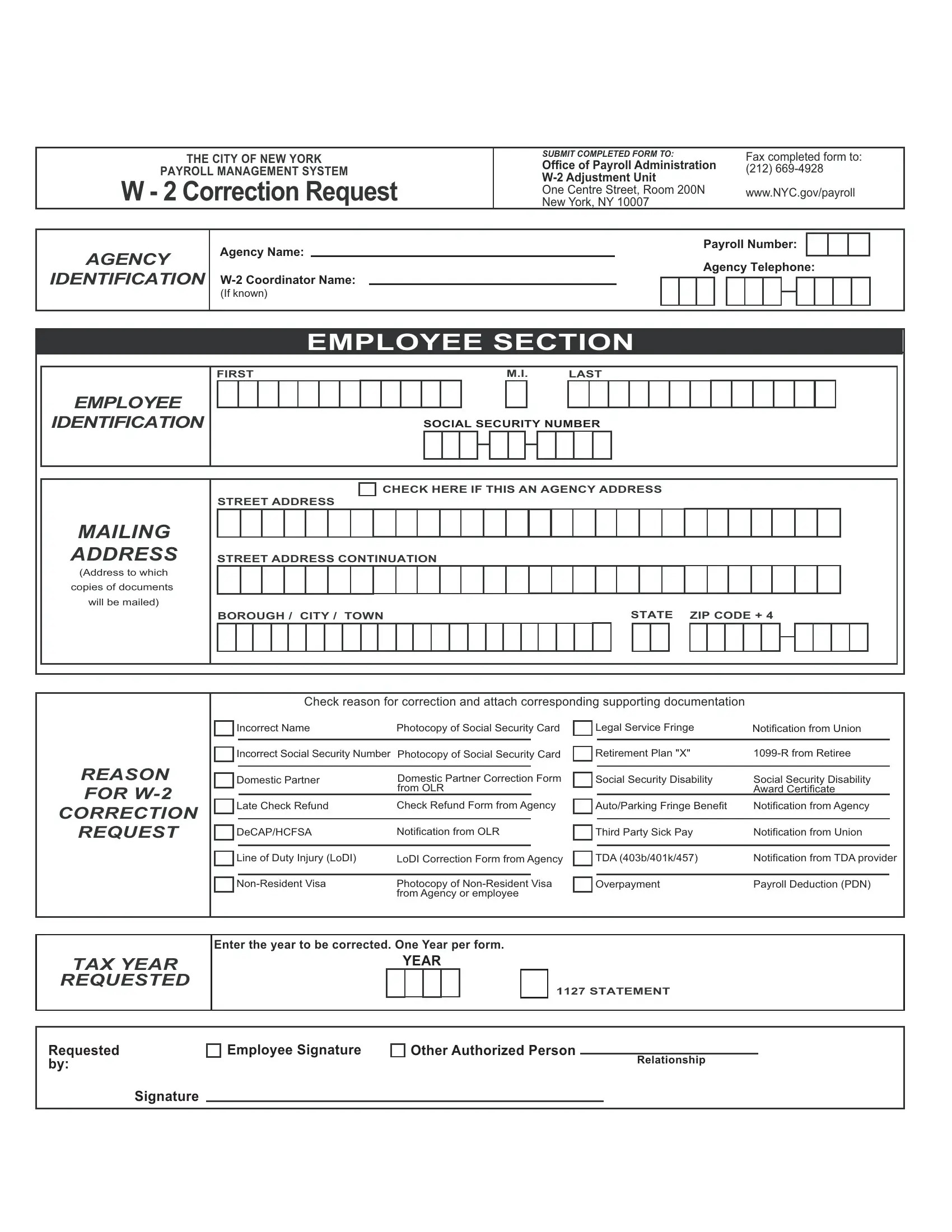

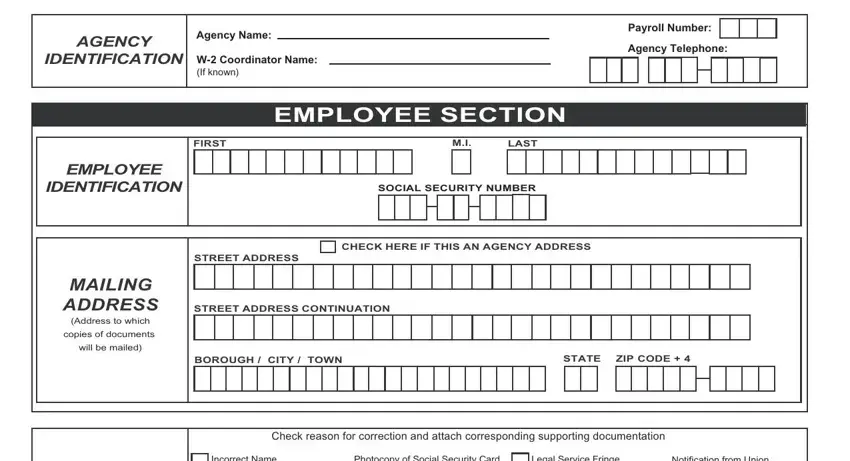

1. The DeCAP involves specific details to be inserted. Be sure that the subsequent fields are complete:

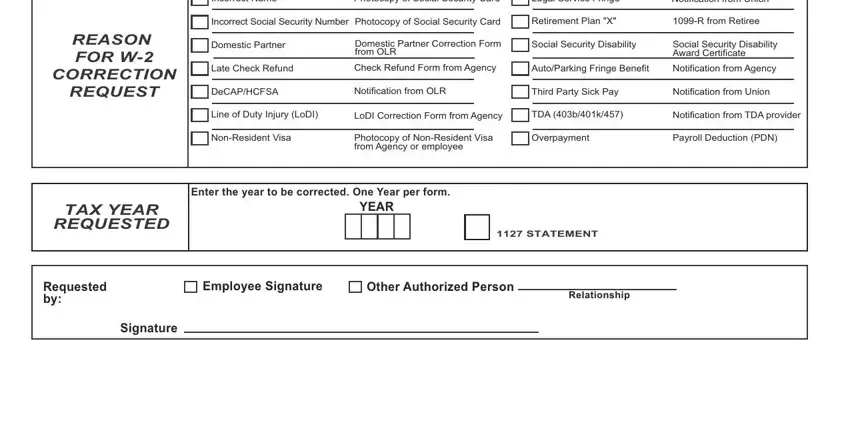

2. When this section is completed, you should put in the essential specifics in REASON FOR W, CORRECTION, REQUEST, Incorrect Name, Photocopy of Social Security Card, Legal Service Fringe, Notification from Union, Incorrect Social Security Number, Retirement Plan X, R from Retiree, Domestic Partner, Domestic Partner Correction Form, Social Security Disability, Social Security Disability Award, and Late Check Refund so that you can go to the next stage.

Be really careful while filling in Social Security Disability and CORRECTION, because this is where a lot of people make a few mistakes.

Step 3: Glance through the information you have entered into the blanks and then press the "Done" button. Try a free trial option with us and obtain instant access to DeCAP - which you may then start using as you would like in your FormsPal account page. FormsPal is dedicated to the confidentiality of all our users; we ensure that all personal data entered into our system remains secure.