Making use of the online tool for PDF editing by FormsPal, you can complete or change w9 form ma right here and now. Our editor is continually evolving to present the very best user experience attainable, and that is thanks to our resolve for continual improvement and listening closely to user opinions. If you are seeking to get started, here is what it takes:

Step 1: Open the PDF form inside our editor by clicking the "Get Form Button" at the top of this webpage.

Step 2: With the help of this advanced PDF tool, you'll be able to do more than merely fill out forms. Try each of the features and make your forms look high-quality with customized textual content incorporated, or adjust the original input to perfection - all that accompanied by the capability to incorporate your personal pictures and sign the file off.

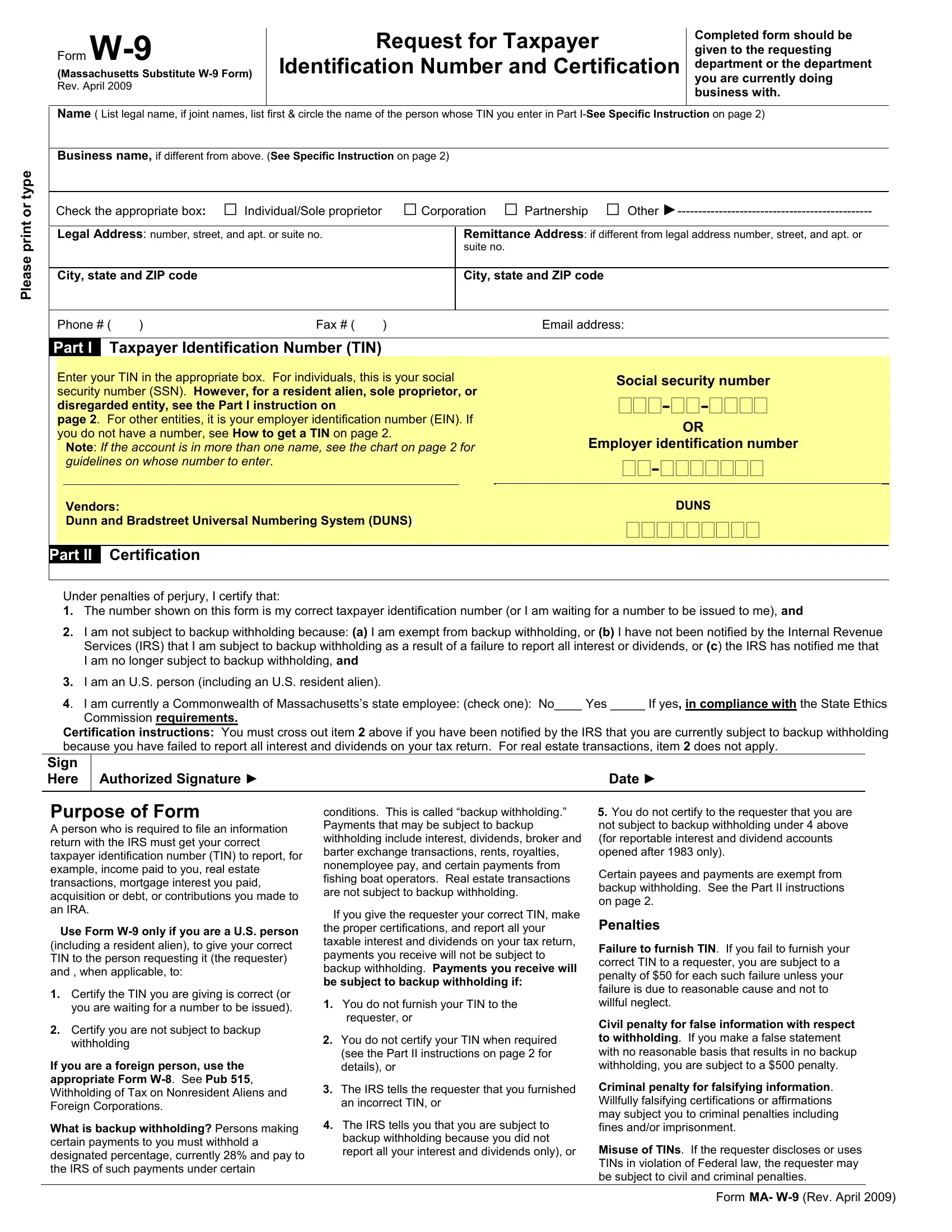

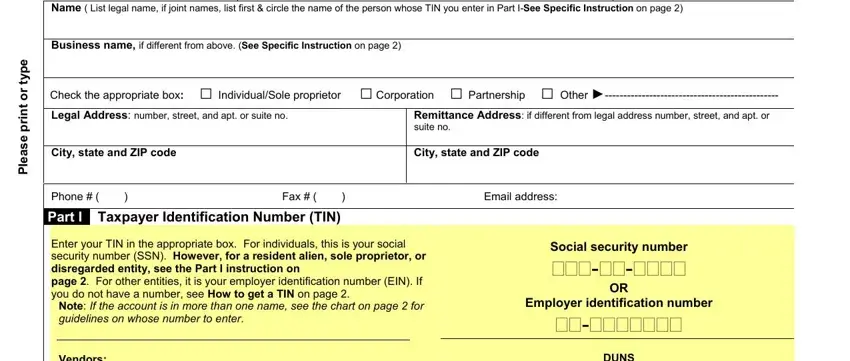

As for the fields of this particular form, here's what you need to do:

1. Begin completing your w9 form ma with a number of major blank fields. Collect all the important information and make sure not a single thing missed!

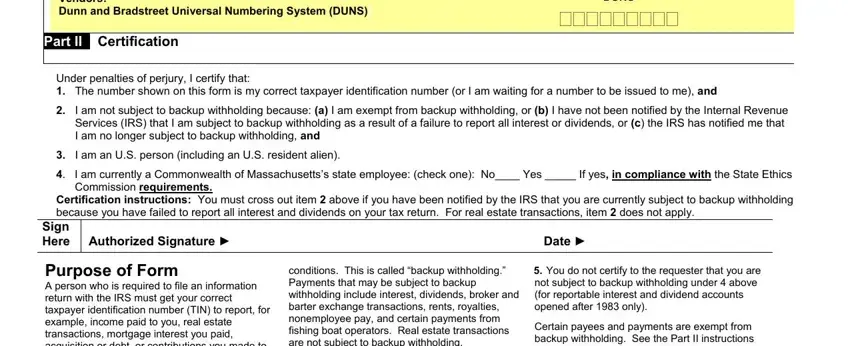

2. Once the last segment is done, you should include the necessary details in Vendors Dunn and Bradstreet, Part II Certification, DUNS, Under penalties of perjury I, I am not subject to backup, I am an US person including an US, I am currently a Commonwealth of, Commission requirements, Certification instructions You, Sign Here, Authorized Signature Date, Purpose of Form A person who is, conditions This is called backup, and You do not certify to the so you're able to proceed further.

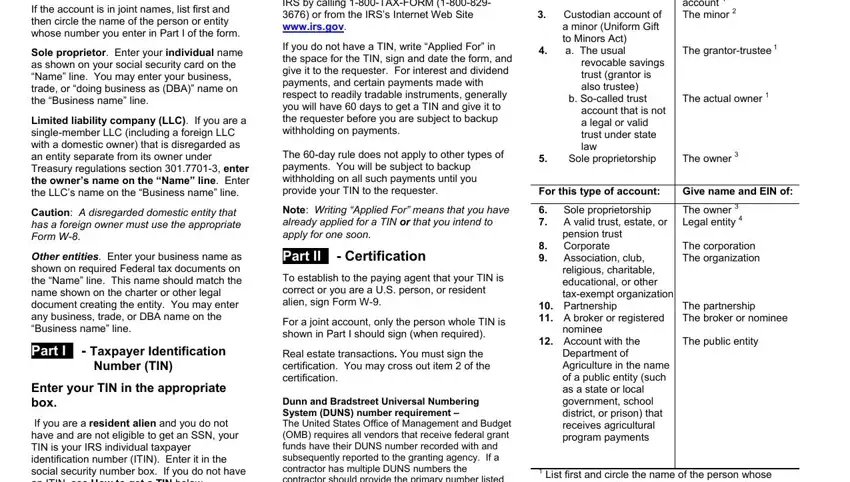

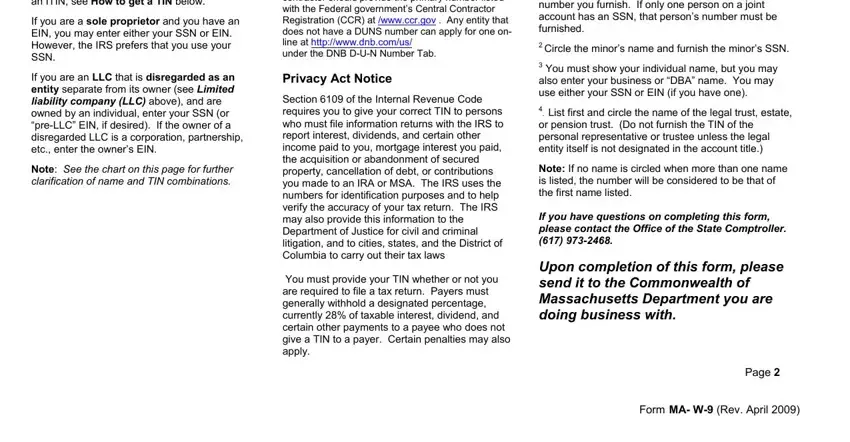

3. In this stage, review Name If you are an individual you, Number TIN, Enter your TIN in the appropriate, How to get a TIN If you do not, Custodian account of a minor, revocable savings trust grantor is, b Socalled trust, account that is not a legal or, Sole proprietorship, The individual The actual owner of, The grantortrustee, The actual owner, The owner, For this type of account, and Give name and EIN of. These should be taken care of with greatest precision.

4. To go ahead, your next part requires typing in a few empty form fields. Examples of these are Enter your TIN in the appropriate, How to get a TIN If you do not, List first and circle the name of, Circle the minors name and, Page, and Form MA W Rev April, which are essential to moving forward with this particular document.

When it comes to Circle the minors name and and How to get a TIN If you do not, ensure you double-check them in this current part. These are viewed as the most significant ones in the page.

Step 3: Just after looking through the fields, click "Done" and you are all set! Try a free trial option with us and obtain immediate access to w9 form ma - downloadable, emailable, and editable in your FormsPal cabinet. FormsPal guarantees your information confidentiality with a protected system that never records or shares any sort of sensitive information involved. Be confident knowing your documents are kept protected when you use our services!