The Washington Liq 318 form plays a crucial role for wine authorized representative certificate of approval holders within the state. This form, which must be submitted monthly, is a comprehensive document designed to streamline the tax reporting process for both domestic and foreign wine shipments. Whether the shipments are taxable or non-taxable, including sales to distributors, importers, retailers, or donations to non-profit organizations, the LIQ-318 form serves as a single point of reporting for multiple types of transactions. Its structure helps in segregating non-taxable and taxable shipments, thereby simplifying the calculation of taxes due. Accuracy in completing this form is of paramount importance as it is certified under penalty of perjury by the person completing it. Penalties for late submission are calculated at 2% per month of the amount due, emphasizing the importance of timely and accurate reporting. Moreover, this form provides the Washington State Liquor and Cannabis Board (WSLCB) with detailed insights into the distribution and sale of wine across the state, aiding in regulatory compliance and oversight. As such, the LIQ-318 form is not only a tax document but also a critical tool for maintaining the integrity and oversight of wine sales within Washington.

| Question | Answer |

|---|---|

| Form Name | Washington Form Liq 318 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | wslcb, licensee, taxreporting, payee |

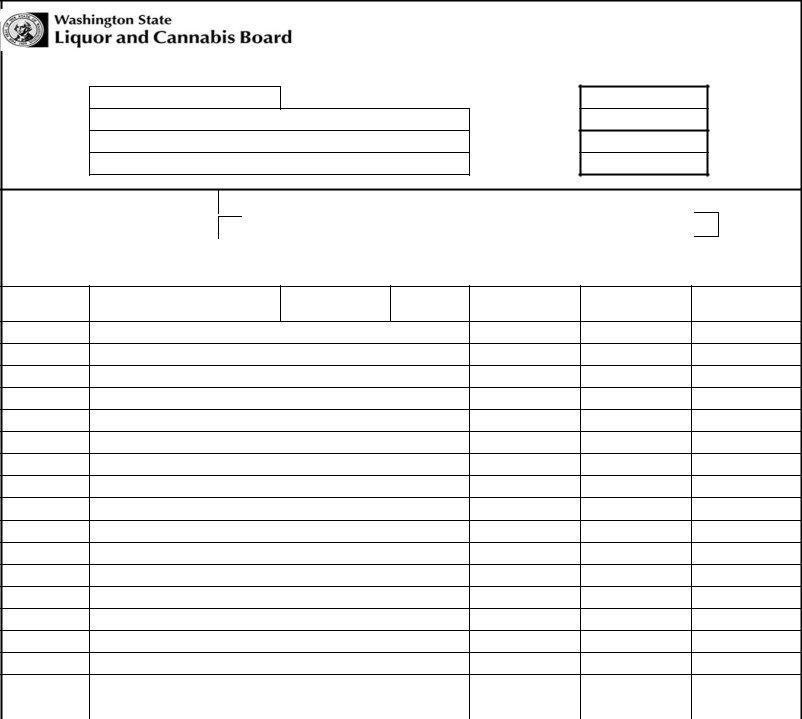

Licensee Number

Licensee Name

Location Address

City, State & Zip

PO BOX 43085

OLYMPIA WA

WINE AUTHORIZED REPRESENTATIVE CERTIFICATE OF APPROVAL HOLDER SUMMARY TAX REPORT FORM

(Revised 03/19)

REPORTING MONTH

YEAR

Check if applicable: |

NO DOMESTIC SHIPMENTS |

If Correction Report |

|

NO FOREIGN SHIPMENTS |

(check box) |

PART 1: |

(List by Washington Distributor and/or Importer) |

|

Current licensee lists are available at WSLCB website: |

REPORT IN LITERS |

|

(1) WSLCB LICENSE NO.

(2)

SOLD TO DISTRIBUTOR OR IMPORTERS NAME

(3)

CITY

(4)

(F)Foreign

(D)Domestic

(5)

Cider

LITERS

(6)

LITERS

(7)

Fortified

LITERS

|

Total Liters from all other pages (If multiple pages used) |

(8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LITERS THIS PAGE PLUS TOTAL FROM Line (8) |

(9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

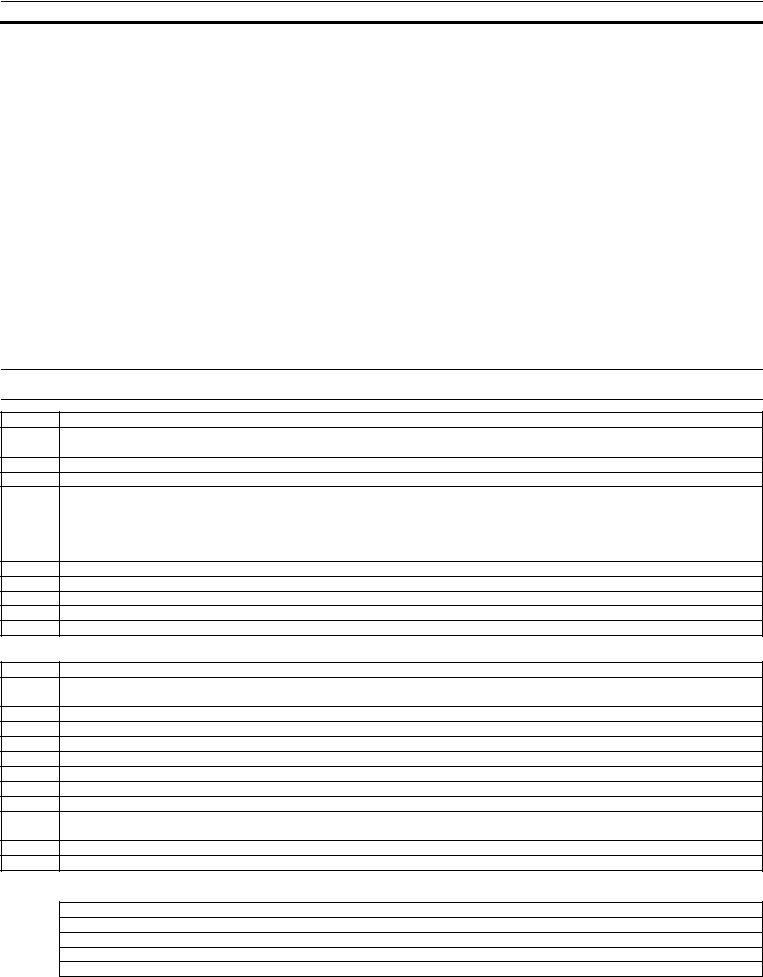

PART 2: |

TAXABLE (SAMPLES SHIPPED TO RETAILERS AND DONATIONS TO NON- |

|

Cider |

|

|

Fortified |

||

|

PROFIT) |

|

|

IN LITERS |

|

IN LITERS |

|

IN LITERS |

|

|

|

|

|

|

|

|

|

|

Certified True and Correct Under Penalty of Perjury |

|

(10) |

|

(11) |

|

(12) |

|

|

|

|

|

|

|

|

|

|

|

|

Box (10) X $0.0814 = (13) |

Box (11) X $0.2292 = (14) |

Box (12) X $0.4536 = (15) |

||||

|

|

|

||||||

|

|

|

|

|

|

|

|

|

Signature of Person Completing Form: |

|

(13) |

|

(14) |

|

(15) |

|

|

|

|

|

|

|

|

|

|

|

Printed Name: |

|

|

|

Taxes Due Current Month |

(16) |

|

||

Telephone Number: |

|

|

PENALTIES for late reporting are 2% per month of |

(17) |

|

|||

|

|

amount due on line 16 |

|

|

|

|

||

|

|

|

Balance or Refund Due (if any) |

(18) |

|

|||

|

|

|

|

|

|

|

||

Date: |

|

|

|

TOTAL DUE |

(19) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

WSLCB USE ONLY |

|

|

|

WSCLB USE ONLY |

|||

Payee Number |

|

|

|

Amount Received |

|

|

|

|

|

|

|

|

|

|

|

|

|

Refund Amount |

|

|

|

Postmark Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructions for Completing

This report must be completed by all Wine Authorized Representative Certificate of Approval Holders each month and postmarked on or before the 20th of the following month. When the 20th falls on a Saturday, Sunday, or a legal holiday, the filing must be postmarked by the U.S.Postal Service no later than the next postal business day. A report must be filed EVERY MONTH, including months when there is no activity. Report all shipments in the month regardless of invoice date.

DO NOT REPORT SALES DELIVERED TO: Military Installations, Commercial Carriers, or Ships Chandlers.

Correction report (check box): Include changes only (additions or subtractions) that need to be made to the original report.

Licensee Number: |

Enter your Washington State Liquor and Cannabis Board (WSLCB) 6 digit licensee number. |

Licensee Name: |

Trade Name per license number entered. |

Location Address: |

Location address per license number entered. |

City, State, Zip: |

City, State and Zip Code per license number entered. |

MONTH: |

Enter report month (month when the beer was shipped into WA). |

YEAR: |

Enter report year. |

NOTE: DO NOT DUPLICATE REPORTING OF THE REPRESENTED PRODUCT ON ANY OTHER FORMS; example Form

NO DIRECT SHIPMENTS TO EITHER A WASHINGTON CONSUMER OR RETAILER ARE ALLOWED WITH THIS PRIVILEGE

Please complete the numbered fields as follows: (round to two decimal places)

If you are licensed for domestic and/or foreign shipments and you have no shipments for the month, make sure you check the appropriate box for no shipments.

Part 1

(1)Enter the

Licensee Lists and Forms may be found on the WSLCB website at: http://lcb.wa.gov/taxreporting/main

(2)Enter the trade name of receiving distributor or importer in Washington State.

(3)Enter the city location of the distributor / importer.

(4)For product shipped to the distributor or importer enter:

•D or Domestic for wine produced in the United States.

•F or Foreign for product produced outside of the country.

•Use ONE line per distributor or importer for Domestic product shipped.

•Use ONE line per distributor or importer for Foreign product shipped.

(5)Enter the total liters of cider shipped.

(6)Enter the total liters of

(7)Enter total liters of Fortified wine shipped.

(8)Enter total liters from all other pages (If multiple pages used).

(9)Enter total liters from this page plus total from line 8.

Samples shipped to Washington Wine Distributors or Wine Importers for their use include in PART 1.

Part 2 TAXABLE SHIPMENTS

Part 2 report wine samples that are shipped to Washington Retailers, donations to

(10)Enter the total liters of cider samples shipped into the state for the month.

(11)Enter the total liters of

(12)Enter the total liters of Fortified wine samples shipped into the state for the month.

(13)Calculate line 10 multiplied by $0.0814

(14)Calculate line 11 multiplied by $0.2292

(15)Calculate line 12 multiplied by $0.4536

(16)Enter the total of lines 13, 14, and 15.

(17)Enter the amount of penalties if reporting late. (Reports are due the 20th of the following month and penalties accumulate at 2% PER month of the total due on line 16.

(18)Enter the amount of an exisiting credit as a negative number. Indicate a balance due as a positive number.

(19)Enter the total due from entries in box 16, 17, and 18.

Certified True and Correct Under Penalty of Perjury

Signature of person completing the form.

Entered printed name of person who completed the form.

Enter the date that form is completed.

Enter the telephone number of person who completed the form.

Enter the