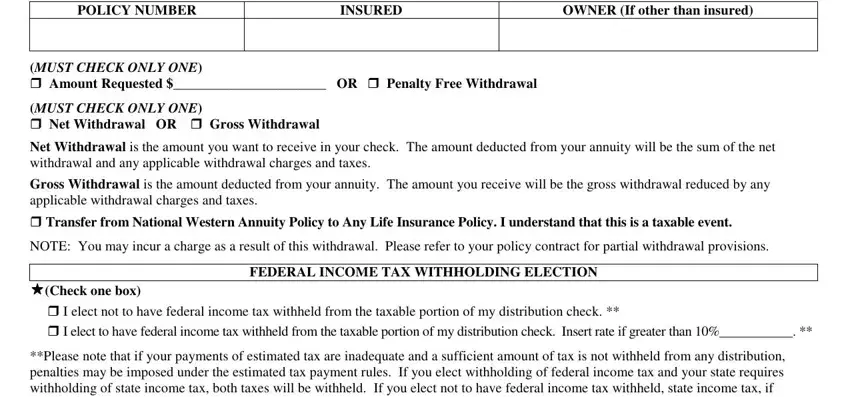

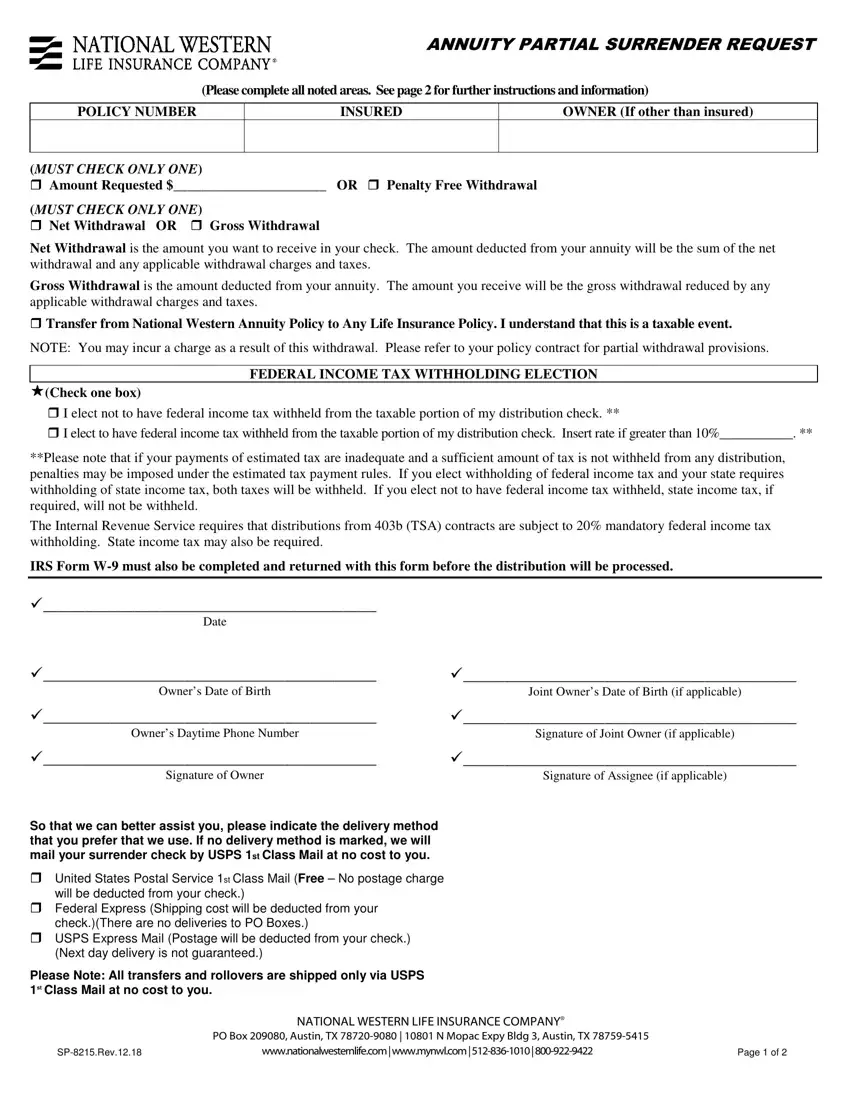

ANNUITY PARTIAL SURRENDER REQUEST

(Please complete all noted areas. See page 2 for further instructions and information)

OWNER (If other than insured)

(MUST CHECK ONLY ONE)

Amount Requested $______________________ OR Penalty Free Withdrawal

(MUST CHECK ONLY ONE)

Net Withdrawal OR Gross Withdrawal

Net Withdrawal is the amount you want to receive in your check. The amount deducted from your annuity will be the sum of the net withdrawal and any applicable withdrawal charges and taxes.

Gross Withdrawal is the amount deducted from your annuity. The amount you receive will be the gross withdrawal reduced by any applicable withdrawal charges and taxes.

Transfer from National Western Annuity Policy to Any Life Insurance Policy. I understand that this is a taxable event.

NOTE: You may incur a charge as a result of this withdrawal. Please refer to your policy contract for partial withdrawal provisions.

FEDERAL INCOME TAX WITHHOLDING ELECTION

(Check one box)

I elect not to have federal income tax withheld from the taxable portion of my distribution check. **

I elect to have federal income tax withheld from the taxable portion of my distribution check. Insert rate if greater than 10%___________. **

**Please note that if your payments of estimated tax are inadequate and a sufficient amount of tax is not withheld from any distribution, penalties may be imposed under the estimated tax payment rules. If you elect withholding of federal income tax and your state requires withholding of state income tax, both taxes will be withheld. If you elect not to have federal income tax withheld, state income tax, if required, will not be withheld.

The Internal Revenue Service requires that distributions from 403b (TSA) contracts are subject to 20% mandatory federal income tax withholding. State income tax may also be required.

IRS Form W-9 must also be completed and returned with this form before the distribution will be processed.

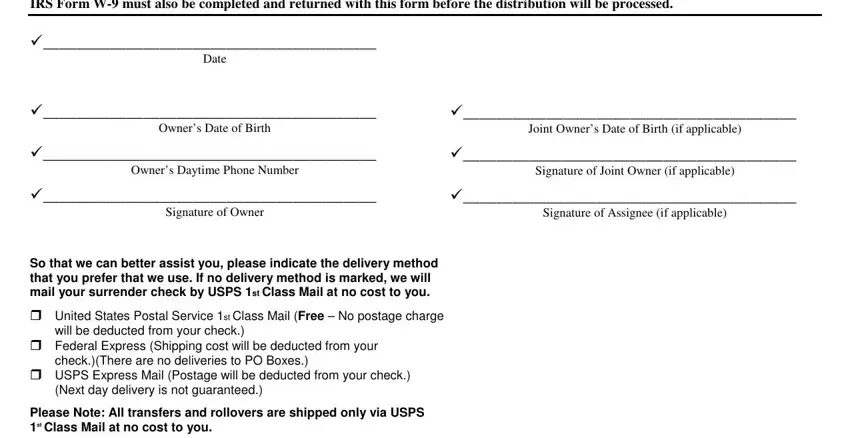

________________________________________

Date

________________________________________ |

________________________________________ |

Owner’s Date of Birth |

Joint Owner’s Date of Birth (if applicable) |

________________________________________ |

________________________________________ |

Owner’s Daytime Phone Number |

Signature of Joint Owner (if applicable) |

________________________________________ |

________________________________________ |

Signature of Owner |

Signature of Assignee (if applicable) |

So that we can better assist you, please indicate the delivery method that you prefer that we use. If no delivery method is marked, we will mail your surrender check by USPS 1st Class Mail at no cost to you.

United States Postal Service 1st Class Mail (Free – No postage charge will be deducted from your check.)

Federal Express (Shipping cost will be deducted from your check.)(There are no deliveries to PO Boxes.)

USPS Express Mail (Postage will be deducted from your check.) (Next day delivery is not guaranteed.)

Please Note: All transfers and rollovers are shipped only via USPS 1st Class Mail at no cost to you.

NATIONAL WESTERN LIFE INSURANCE COMPANY®

PO Box 209080, Austin, TX 78720-9080 | 10801 N Mopac Expy Bldg 3, Austin, TX 78759-5415

SP-8215.Rev.12.18 |

www.nationalwesternlife.com|www.mynwl.com |512-836-1010|800-922-9422 |

Page 1 of 2 |

ANNUITY PARTIAL SURRENDER REQUEST

INSTRUCTIONS AND INFORMATION

The cash value is payable at the Home Office of the Company at Austin, Texas.

HOW TO SIGN – The request must be dated. All signatures must be written in full exactly as they appear in the policy and must be in ink.

WHO MUST SIGN – This request must be signed by (1) the person or persons who, under the terms of the policy, have the rights of ownership, (2) by an assignee, and (3) by any other party who, by legal proceedings or statutes, may have an interest in the policy.

If signed for: (1) A corporation, the corporate name should be written followed by the signature and title of an authorized officer; (2) A partnership, the full name of the partnership should be written followed by the signature of any partner other than the insured.

FEDERAL INCOME TAX WITHHOLDING INSTRUCTIONS AND INFORMATION

As a result of the Tax Equity and Fiscal Responsibility Act of 1982, we are required to inform you of and give you an opportunity to make a tax withholding election. The new provisions apply to distributions from qualified and non-qualified life insurance policies and annuities to include deferred compensation plans, pension plans and IRA distributions. Partial surrenders of these contracts are to be treated as distributions. Withholding will only apply to the portion of your distribution that is included in your income subject to federal income tax. Thus, there would be no withholding on the return of your own nondeductible contribution. If an election is not made or if withholding is elected, the Company is required to withhold as follows:

If your check is a nonperiodic payment, the rate of withholding will be either: (a) determined according to computational procedures or tables provided in the Treasury Regulations accompanying Internal Revenue Code Section 3405 if the distribution is either a qualified total distribution or a total distribution by reason of death of the participant; or (b) 10% for any other nonperiodic payment, unless a higher rate is requested.

Please note: If you elect not to have withholding apply to your payment, or if you do not have enough federal income tax withheld, you may be responsible for payment of estimated tax. You may incur penalties under the estimated tax rules if your withholding and estimated tax payment are not sufficient.

NATIONAL WESTERN LIFE INSURANCE COMPANY®

PO Box 209080, Austin, TX 78720-9080 | 10801 N Mopac Expy Bldg 3, Austin, TX 78759-5415

SP-8215.Rev.12.18 |

www.nationalwesternlife.com | www.mynwl.com | 512-836-1010 | 800-922-9422 |

Page 2 of 2 |