employer garnishment form can be filled in online with ease. Just try FormsPal PDF editor to finish the job without delay. We at FormsPal are committed to making sure you have the absolute best experience with our editor by constantly releasing new functions and upgrades. With all of these updates, using our tool becomes better than ever before! To get the process started, take these basic steps:

Step 1: Open the form in our editor by clicking on the "Get Form Button" above on this webpage.

Step 2: This editor offers you the opportunity to customize PDF documents in a range of ways. Enhance it by adding any text, correct existing content, and place in a signature - all when you need it!

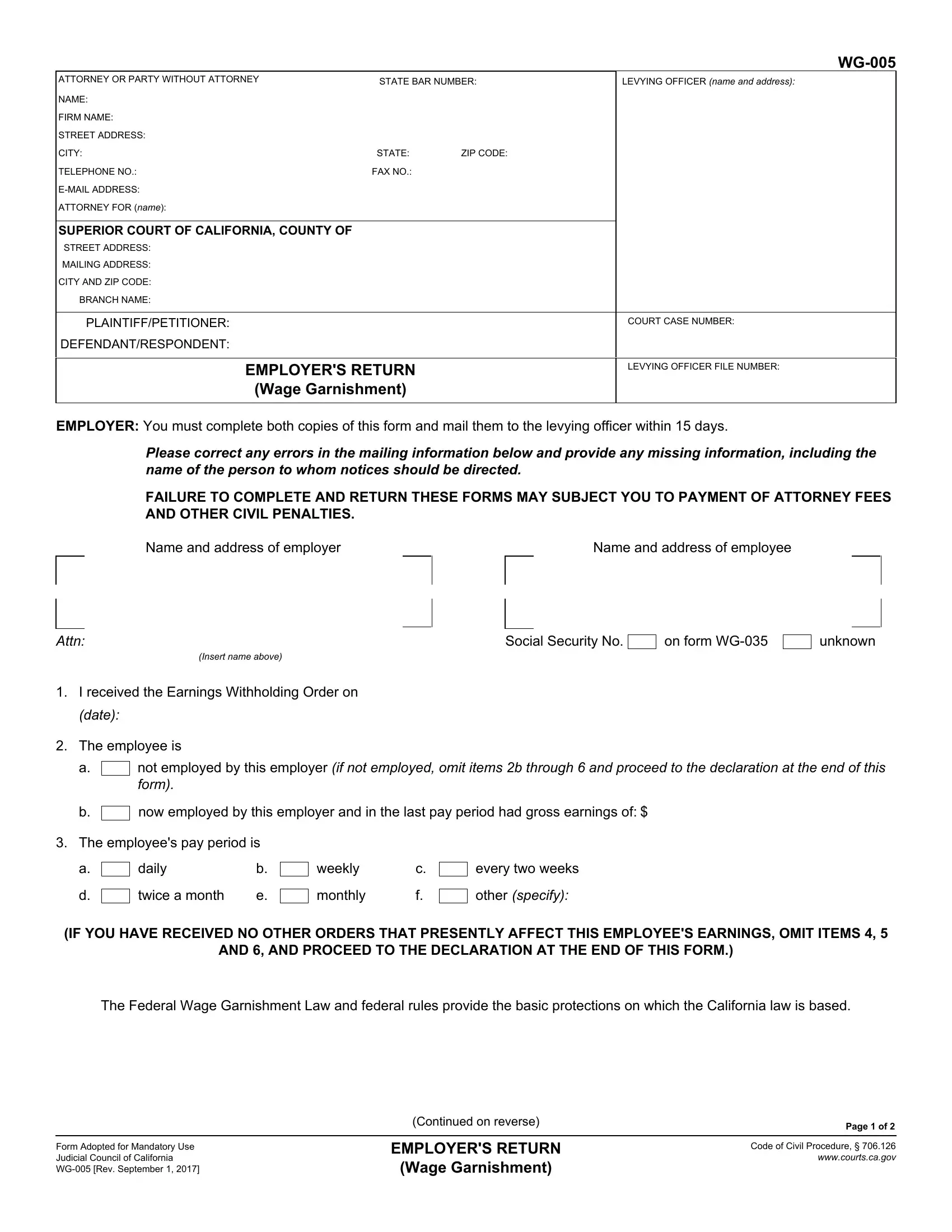

When it comes to blank fields of this precise form, this is what you should consider:

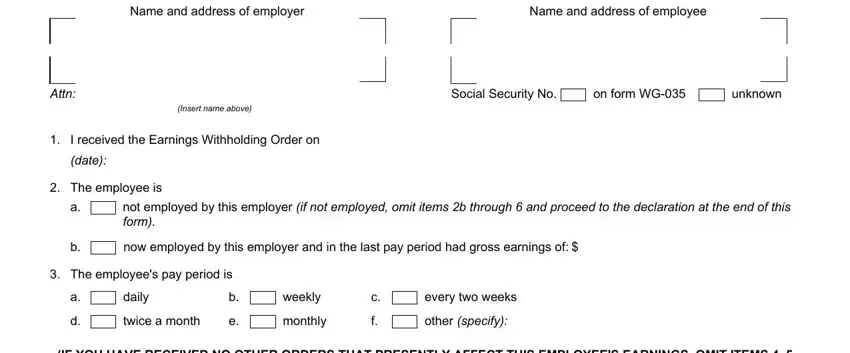

1. Start completing your employer garnishment form with a selection of necessary blanks. Collect all of the important information and be sure not a single thing forgotten!

2. Once the last segment is done, you're ready to include the required details in Name and address of employer, Name and address of employee, Attn, Insert name above, I received the Earnings, date, The employee is, Social Security No, on form WG, unknown, not employed by this employer if, now employed by this employer and, The employees pay period is, daily, and twice a month allowing you to go further.

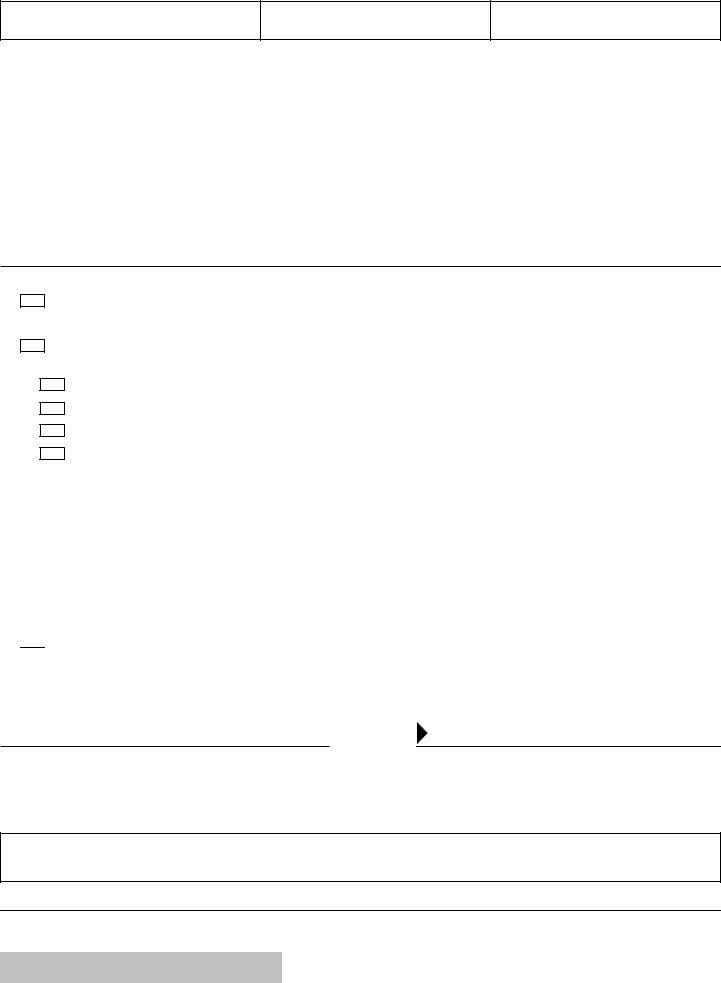

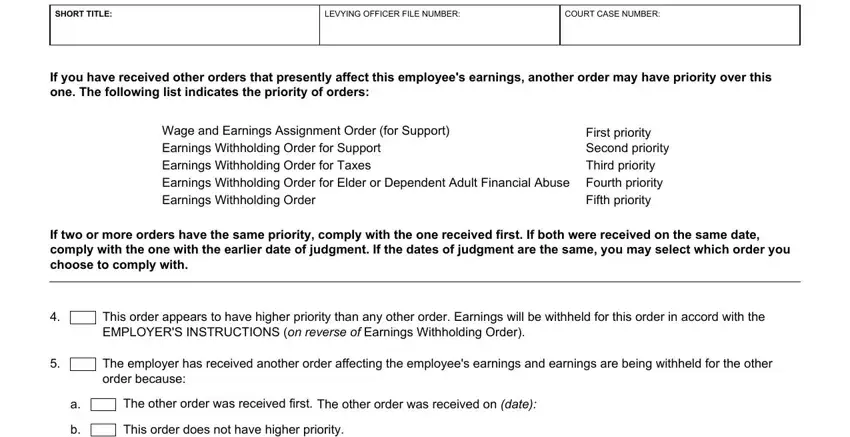

3. The following portion is all about SHORT TITLE, LEVYING OFFICER FILE NUMBER, COURT CASE NUMBER, If you have received other orders, Wage and Earnings Assignment Order, First priority Second priority, If two or more orders have the, This order appears to have higher, The employer has received another, The other order was received first, The other order was received on, and This order does not have higher - fill out every one of these blanks.

It is easy to get it wrong while filling in the If you have received other orders, so ensure that you reread it before you submit it.

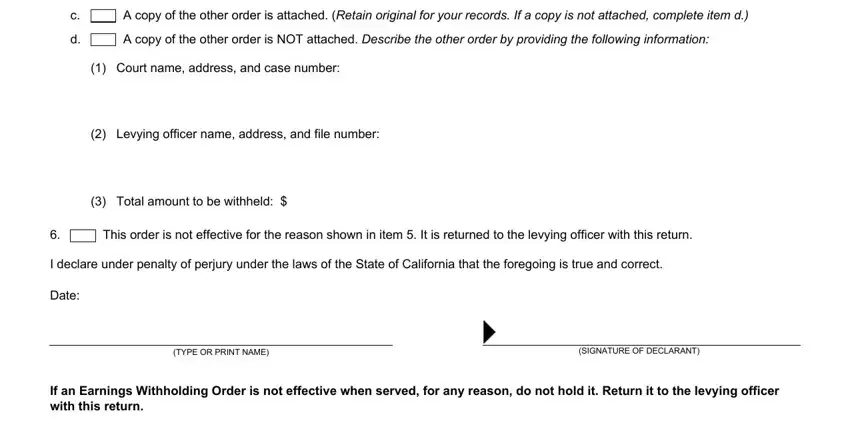

4. The following paragraph comes next with these blank fields to focus on: A copy of the other order is, A copy of the other order is NOT, Court name address and case number, Levying officer name address and, Total amount to be withheld, This order is not effective for, I declare under penalty of perjury, Date, TYPE OR PRINT NAME, SIGNATURE OF DECLARANT, and If an Earnings Withholding Order.

Step 3: Prior to getting to the next step, check that all blank fields were filled in correctly. Once you verify that it's fine, press “Done." Join us right now and immediately access employer garnishment form, available for downloading. Every change made is conveniently kept , which enables you to edit the file further if required. Here at FormsPal.com, we do our utmost to make sure that all your information is stored protected.