Wi S 211 Form can be filled in without difficulty. Simply try FormsPal PDF tool to complete the task quickly. To make our tool better and simpler to use, we continuously implement new features, bearing in mind feedback from our users. Starting is effortless! All that you should do is take these basic steps directly below:

Step 1: Click the "Get Form" button above. It's going to open our pdf tool so you could start completing your form.

Step 2: With this handy PDF editing tool, it's possible to accomplish more than just fill in forms. Express yourself and make your docs seem great with customized textual content incorporated, or fine-tune the original input to excellence - all accompanied by an ability to add your own pictures and sign the PDF off.

Pay attention when filling in this document. Make sure that all necessary blank fields are completed correctly.

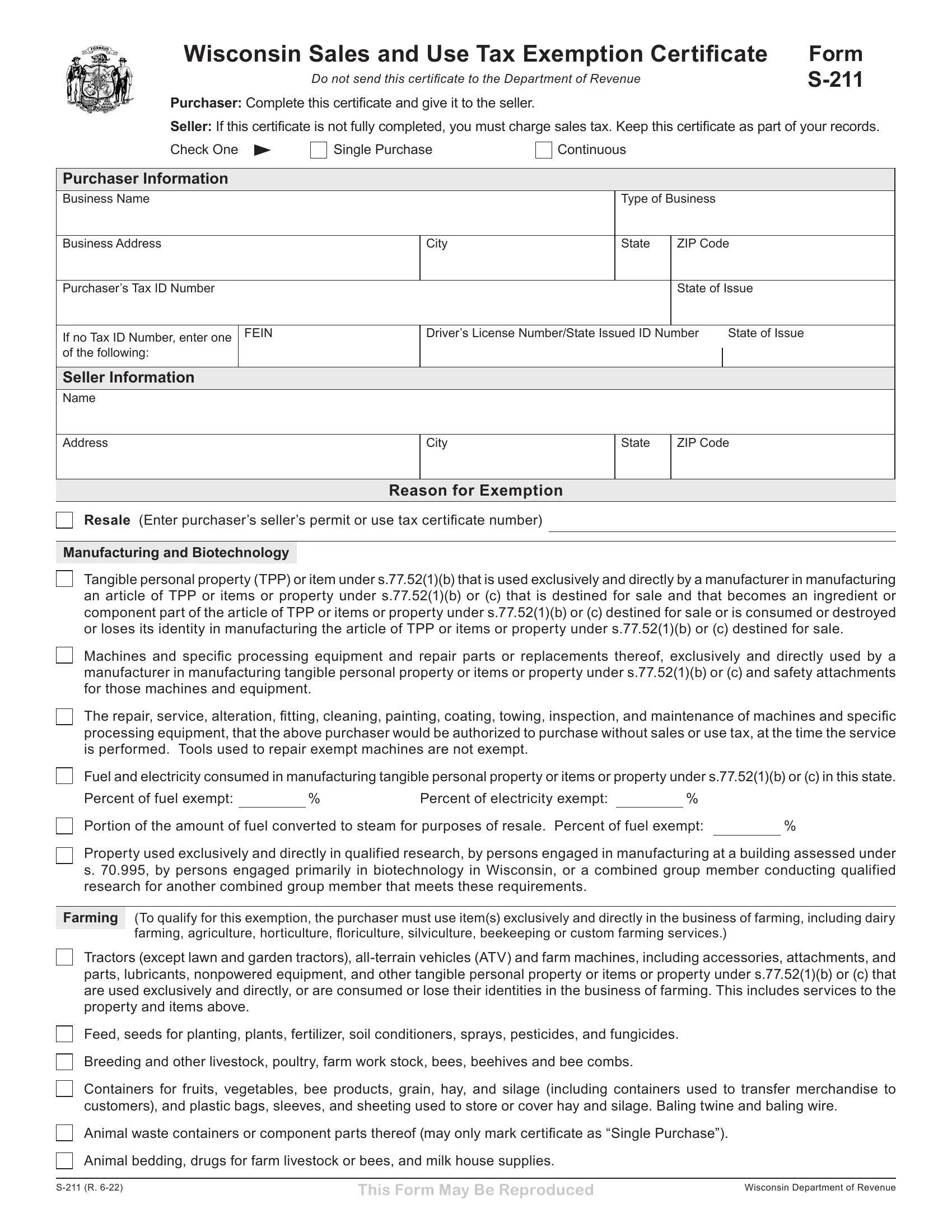

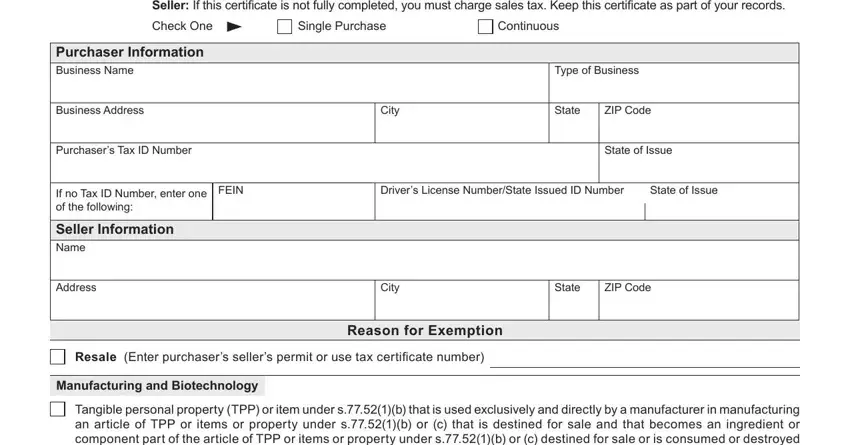

1. Fill out your Wi S 211 Form with a selection of essential fields. Gather all the information you need and be sure nothing is overlooked!

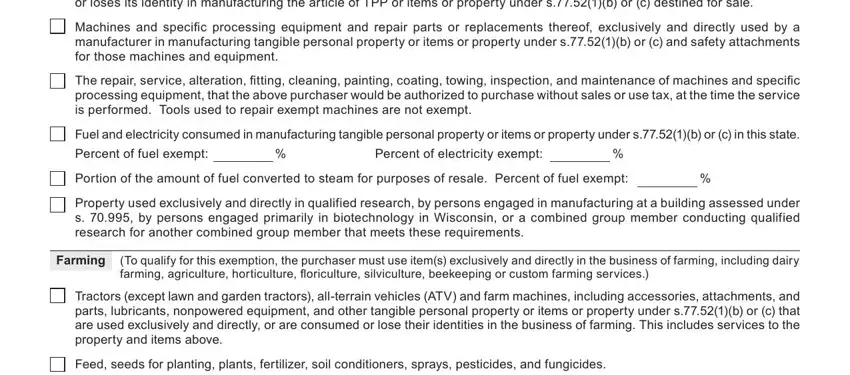

2. Once your current task is complete, take the next step – fill out all of these fields - Tangible personal property TPP or, Machines and specific processing, Portion of the amount of fuel, Property used exclusively and, Percent of electricity exempt, Farming, To qualify for this exemption the, Tractors except lawn and garden, and Containers for fruits vegetables with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

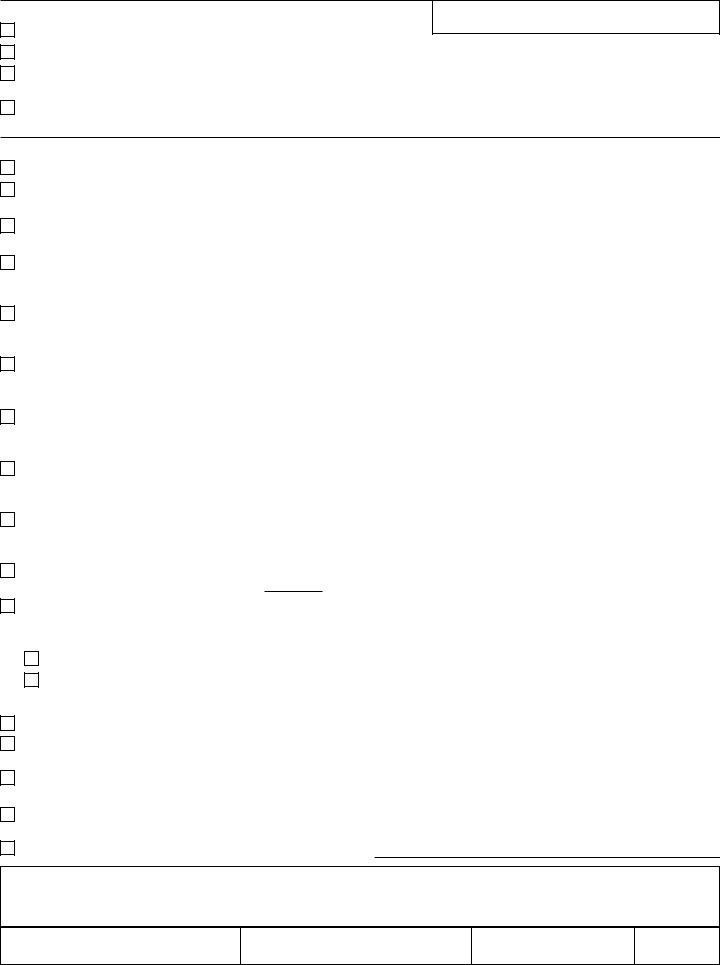

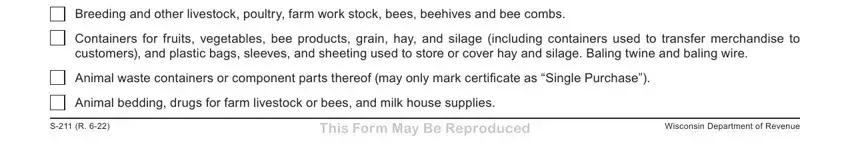

3. In this stage, have a look at Tractors except lawn and garden, Containers for fruits vegetables, customers and plastic bags sleeves, S R, This Form May Be Reproduced, and Wisconsin Department of Revenue. All of these must be filled out with utmost accuracy.

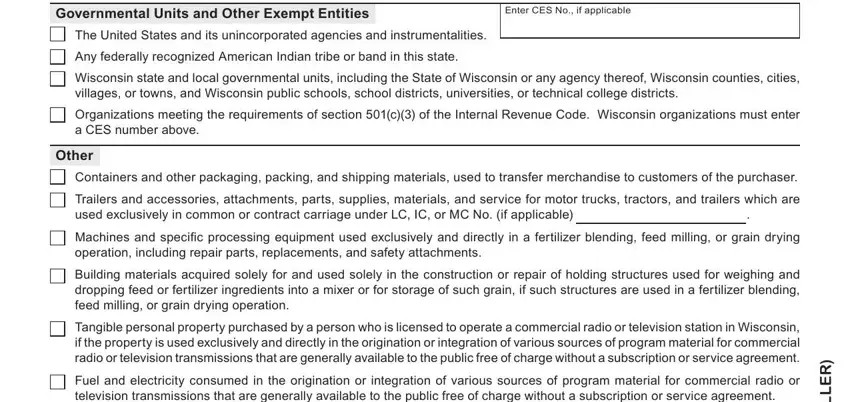

4. To move forward, your next section requires filling out a couple of form blanks. These comprise of Governmental Units and Other, The United States and its, villages or towns and Wisconsin, Enter CES No if applicable, Organizations meeting the, a CES number above, Other, Containers and other packaging, and R E L L E S O T T N E S E R P D N, which you'll find essential to going forward with this particular document.

Be extremely attentive while filling in R E L L E S O T T N E S E R P D N and villages or towns and Wisconsin, since this is where many people make a few mistakes.

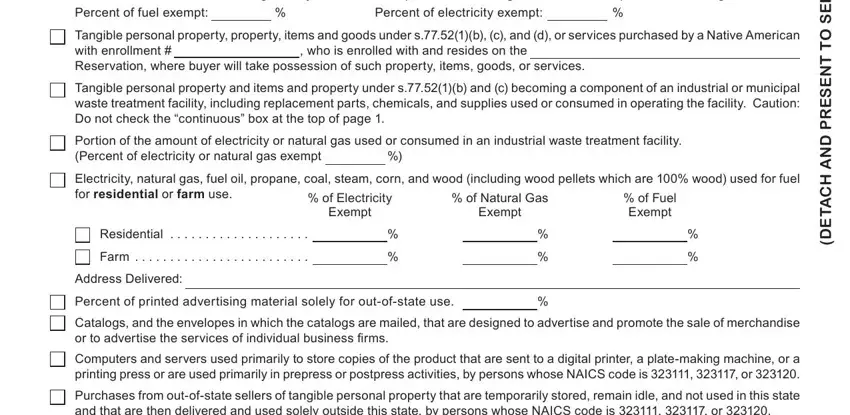

5. To finish your document, the final area requires a few extra blank fields. Filling out Containers and other packaging, who is enrolled with and resides, Percent of electricity exempt, of Electricity, of Natural Gas, Residential, Address Delivered Percent of, Exempt, Exempt, of Fuel Exempt, and R E L L E S O T T N E S E R P D N will certainly conclude the process and you can be done in a short time!

Step 3: Glance through all the information you've entered into the blank fields and then click on the "Done" button. Sign up with FormsPal today and instantly access Wi S 211 Form, all set for downloading. All adjustments you make are preserved , which enables you to edit the file at a later stage anytime. FormsPal guarantees your information privacy with a protected system that never saves or distributes any sort of private information typed in. Feel safe knowing your paperwork are kept protected whenever you work with our service!