Using PDF forms online is actually surprisingly easy using our PDF editor. You can fill out pdffiller wi tax exempt form here effortlessly. To make our editor better and simpler to use, we continuously develop new features, with our users' suggestions in mind. Here's what you will want to do to get going:

Step 1: Firstly, open the pdf editor by pressing the "Get Form Button" at the top of this webpage.

Step 2: With our state-of-the-art PDF file editor, you could accomplish more than just fill out forms. Try all the features and make your documents look perfect with customized textual content added in, or adjust the original input to excellence - all that comes with an ability to incorporate your own images and sign the PDF off.

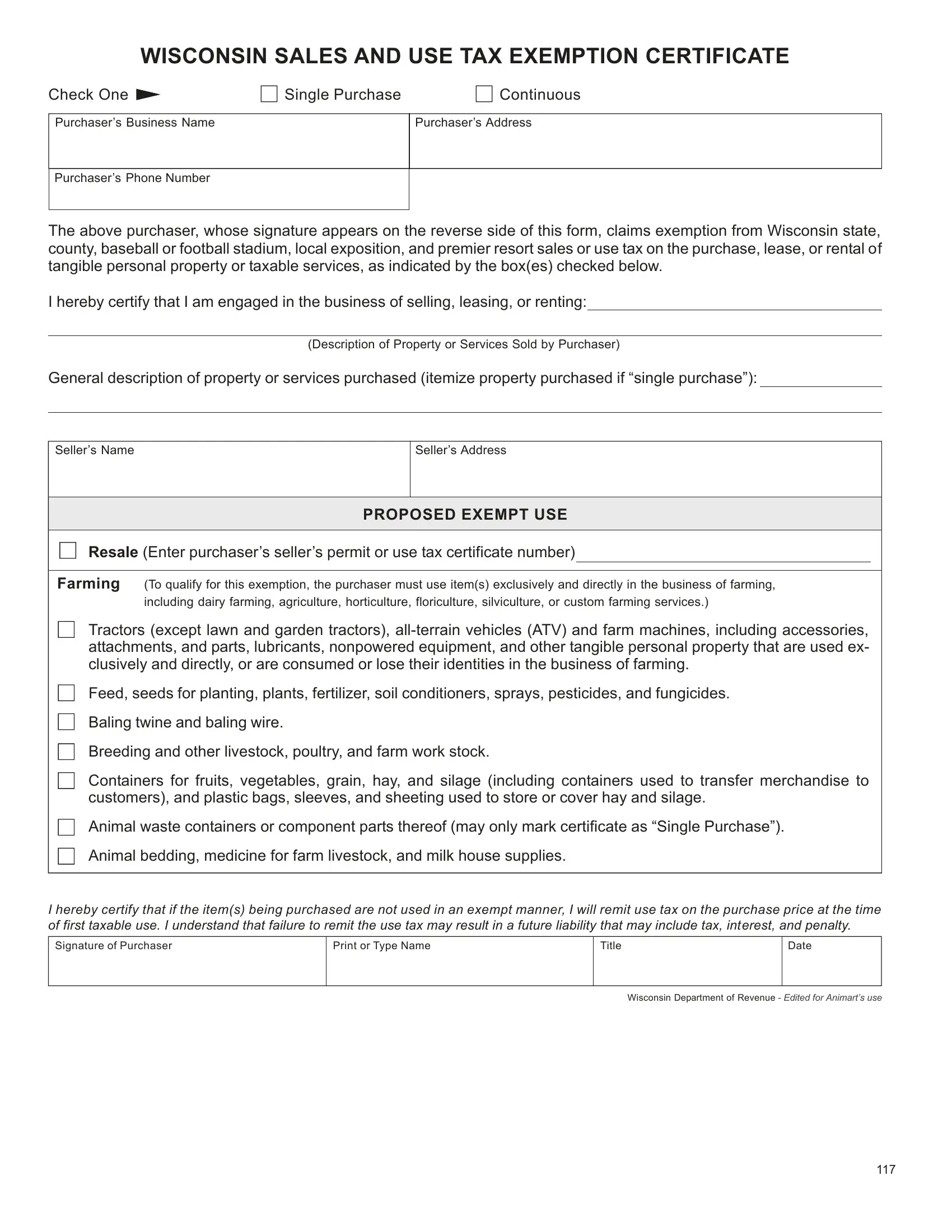

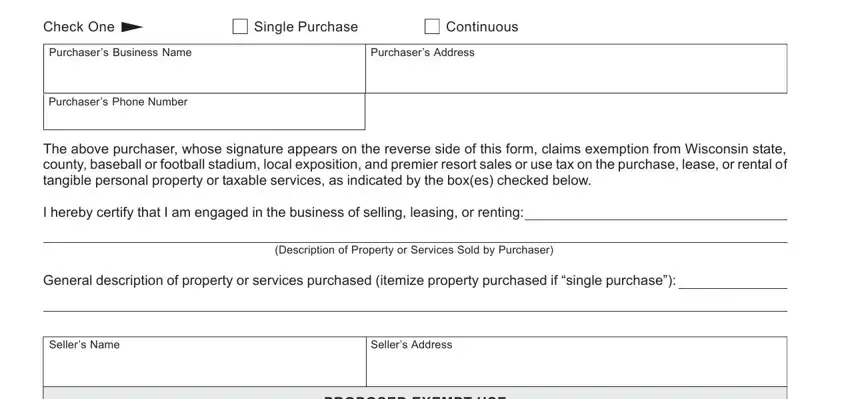

To be able to complete this PDF form, be certain to enter the right information in each blank:

1. To begin with, when completing the pdffiller wi tax exempt form, beging with the area that includes the next fields:

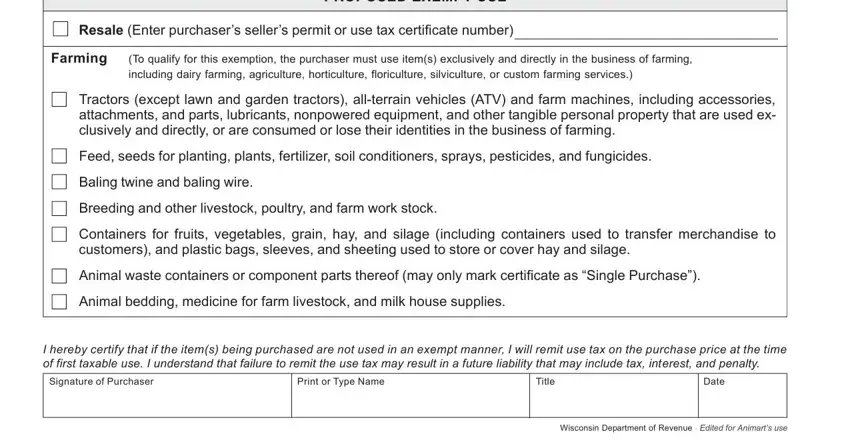

2. The next stage would be to fill in the next few blank fields: Resale Enter purchasercids, PROPOSED EXEMPT USE, Farming, To qualify for this exemption the, Tractors except lawn and garden, Feed seeds for planting plants, Baling twine and baling wire, Breeding and other livestock, Containers for fruits vegetables, Animal waste containers or, Animal bedding medicine for farm, I hereby certify that if the items, Signature of Purchaser, Print or Type Name, and Title.

It is possible to get it wrong when filling out the Breeding and other livestock, so ensure that you look again before you send it in.

Step 3: Immediately after taking one more look at the fields and details, click "Done" and you are all set! Try a free trial plan at FormsPal and gain instant access to pdffiller wi tax exempt form - download or modify inside your personal account. FormsPal guarantees your information privacy with a secure method that in no way records or distributes any personal data involved in the process. You can relax knowing your docs are kept protected when you work with our editor!