You'll be able to fill out gggoverment form a771irs effortlessly by using our PDFinity® editor. FormsPal professional team is continuously endeavoring to improve the tool and insure that it is much better for clients with its many features. Bring your experience one stage further with constantly growing and great options we offer! Should you be looking to get going, here's what it requires:

Step 1: Hit the orange "Get Form" button above. It will open up our tool so that you can begin completing your form.

Step 2: Once you start the online editor, you'll notice the document prepared to be completed. Besides filling in various blanks, you can also do some other actions with the PDF, particularly putting on custom words, modifying the original textual content, adding illustrations or photos, signing the form, and a lot more.

It will be easy to fill out the form using out practical guide! Here's what you have to do:

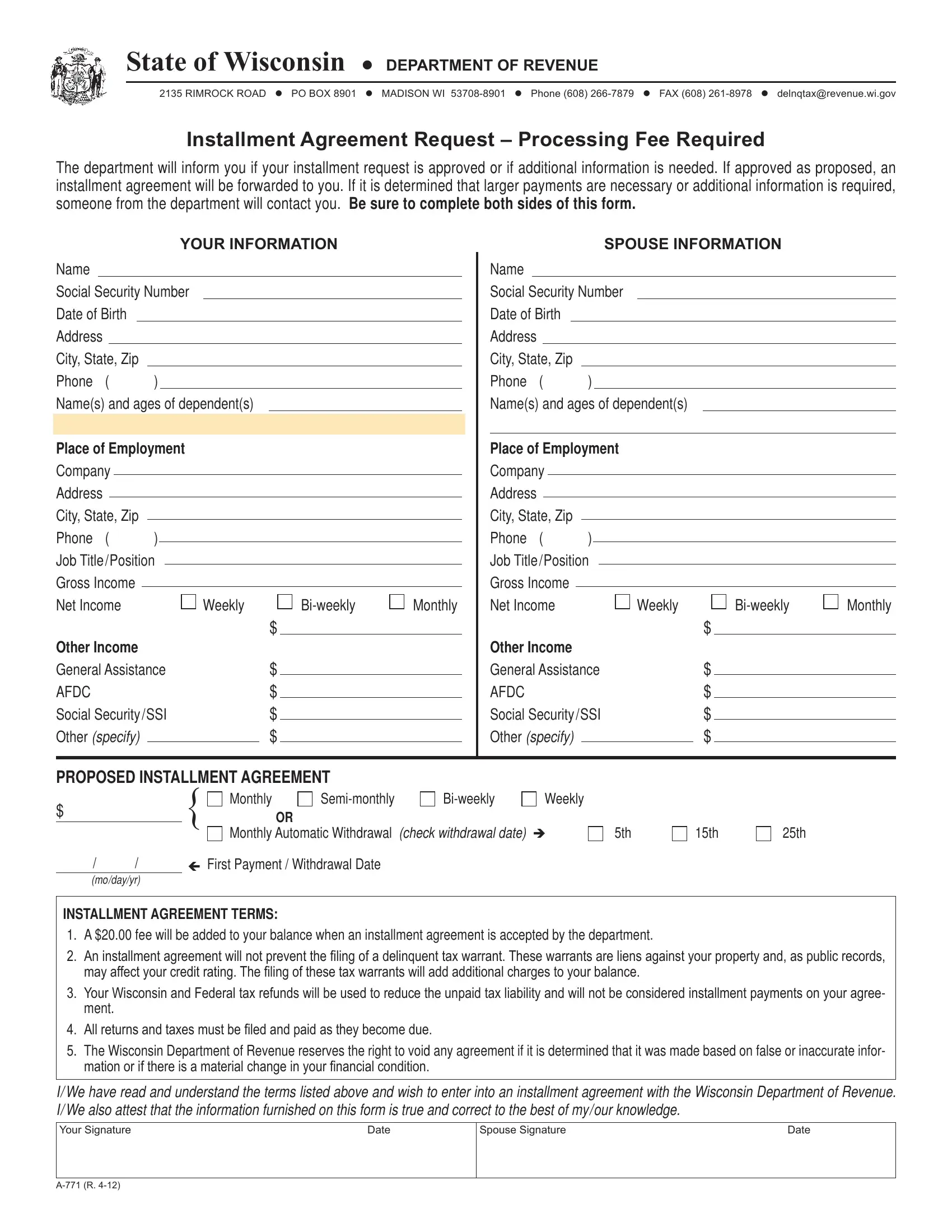

1. Complete your gggoverment form a771irs with a selection of necessary blanks. Consider all of the necessary information and be sure nothing is neglected!

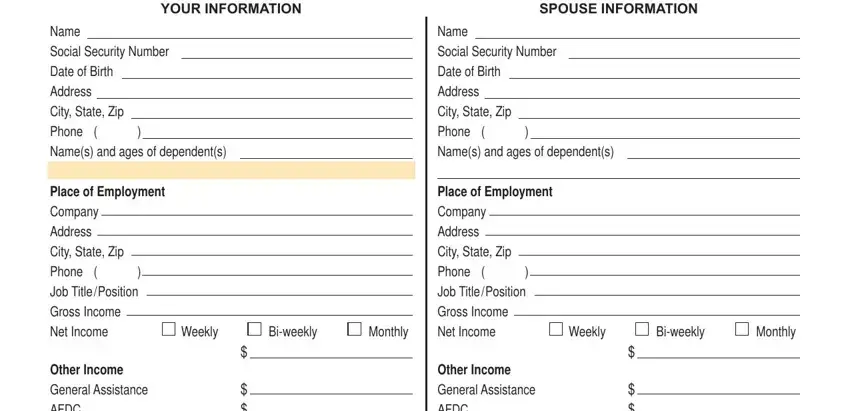

2. Now that this array of fields is completed, you're ready add the essential particulars in Other Income General Assistance, Other Income General Assistance, PROPOSED INSTALLMENT AGREEMENT, modayyr, Monthly, Semimonthly, Biweekly, Weekly, Monthly Automatic Withdrawal check, First Payment Withdrawal Date, INSTALLMENT AGREEMENT TERMS A, may affect your credit rating The, Your Wisconsin and Federal tax, ment, and All returns and taxes must be so you can proceed further.

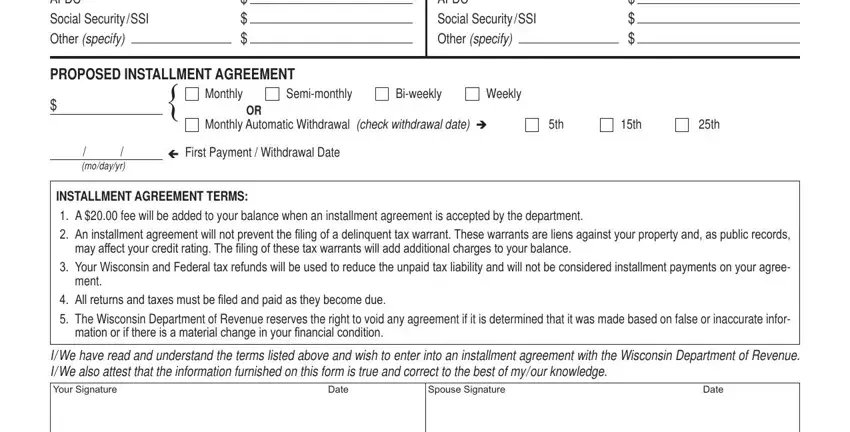

3. The following segment is mostly about Financial Institutions, Balance, Name and address of institution, Checking Account Savings Account, Beneiciary, Amount, Cash Value, Balance Due, on Loan, Yes, Have premiums been paid to date, Motor Vehicles, Make License Plate, Make License Plate, and Model - type in all these blank fields.

You can easily make a mistake when filling out your Yes, for that reason ensure that you take a second look prior to deciding to finalize the form.

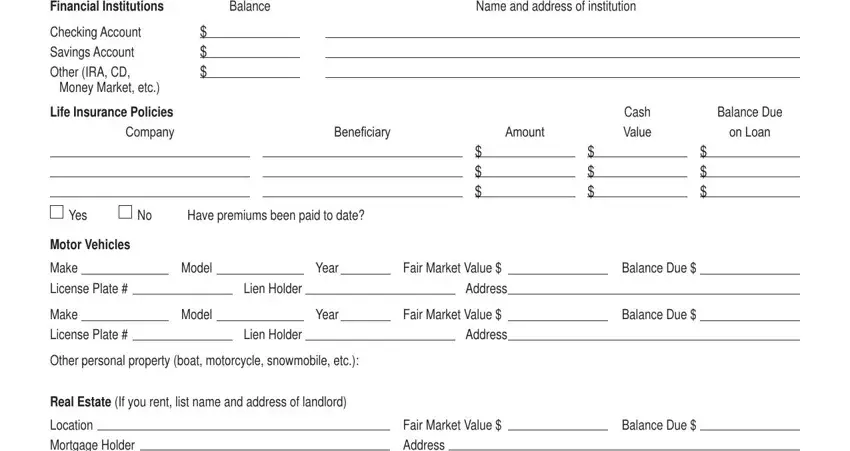

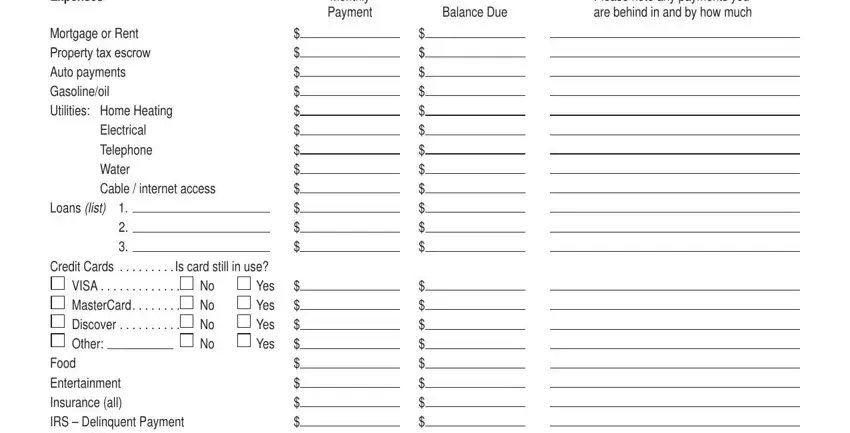

4. This next section requires some additional information. Ensure you complete all the necessary fields - Expenses, Monthly Payment, Balance Due, Please note any payments you are, Yes Yes Yes Yes, Electrical Telephone Water Cable, and Mortgage or Rent Property tax - to proceed further in your process!

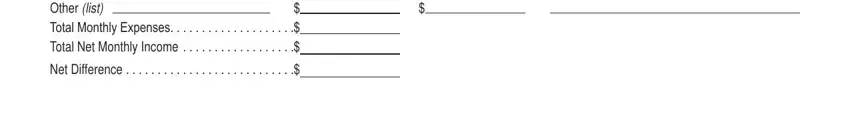

5. Lastly, the following last segment is what you'll have to complete prior to submitting the PDF. The blanks in this case are the next: Mortgage or Rent Property tax, and Net Difference.

Step 3: When you've reviewed the details you given, click on "Done" to complete your form. Right after setting up afree trial account at FormsPal, it will be possible to download gggoverment form a771irs or email it without delay. The form will also be readily accessible from your personal account menu with your each and every edit. At FormsPal.com, we do everything we can to be sure that all your information is maintained private.