You can complete washington child support financial declaration instantly with the help of our PDFinity® editor. To keep our tool on the forefront of efficiency, we work to put into action user-driven features and enhancements on a regular basis. We are always pleased to get suggestions - assist us with remolding how you work with PDF files. Getting underway is simple! All that you should do is follow the next simple steps directly below:

Step 1: Simply hit the "Get Form Button" above on this webpage to get into our form editor. This way, you'll find all that is required to work with your document.

Step 2: The tool helps you modify PDF documents in many different ways. Improve it by adding any text, correct existing content, and place in a signature - all within several clicks!

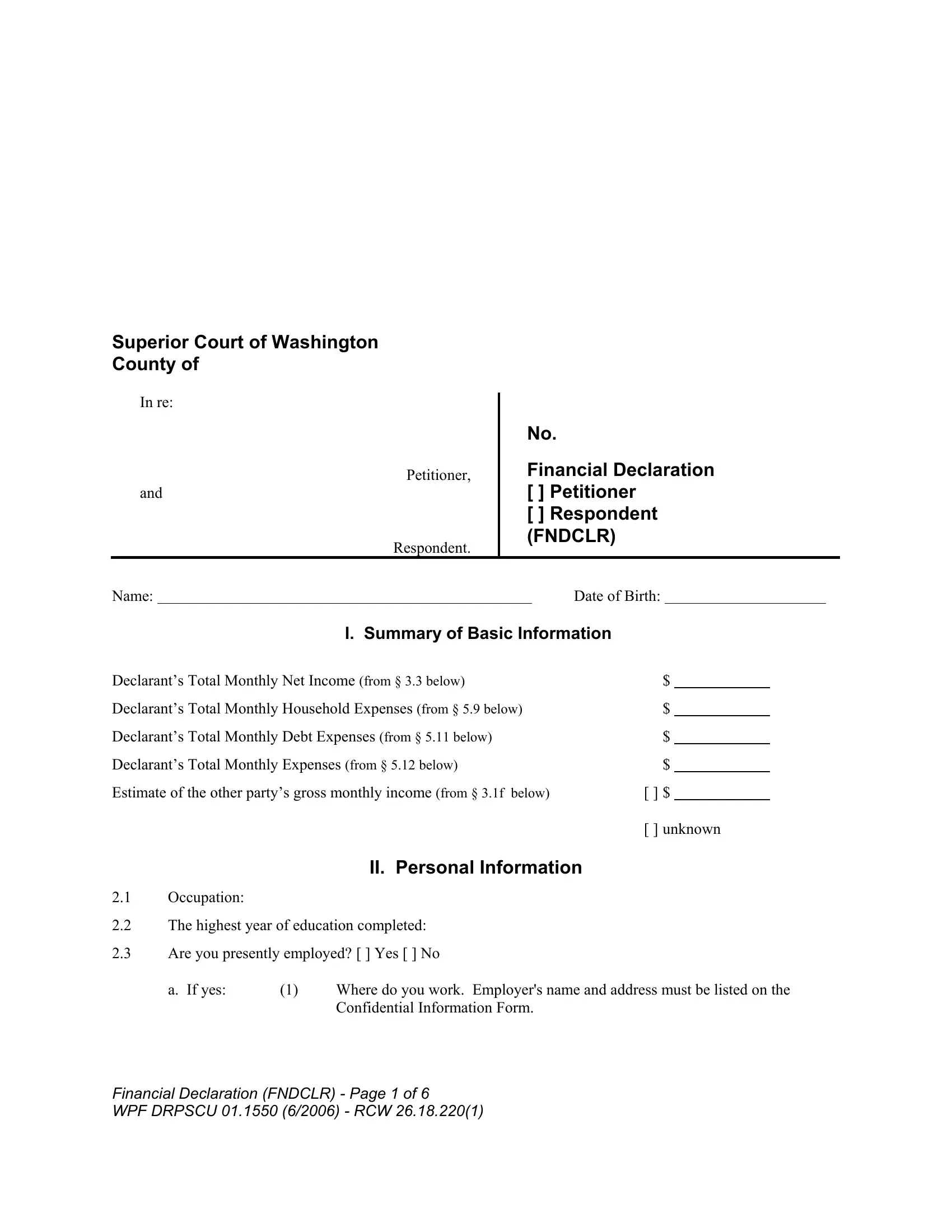

When it comes to blanks of this particular document, here is what you should know:

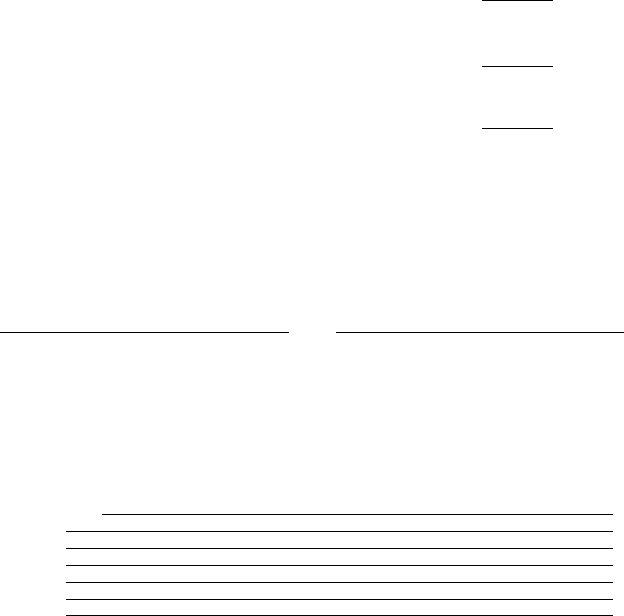

1. Start filling out your washington child support financial declaration with a group of major blanks. Gather all of the necessary information and ensure there is nothing left out!

2. Given that this segment is finished, it is time to include the necessary specifics in The highest year of education, Are you presently employed Yes, a If yes, Where do you work Employers name, and Financial Declaration FNDCLR Page in order to go to the next stage.

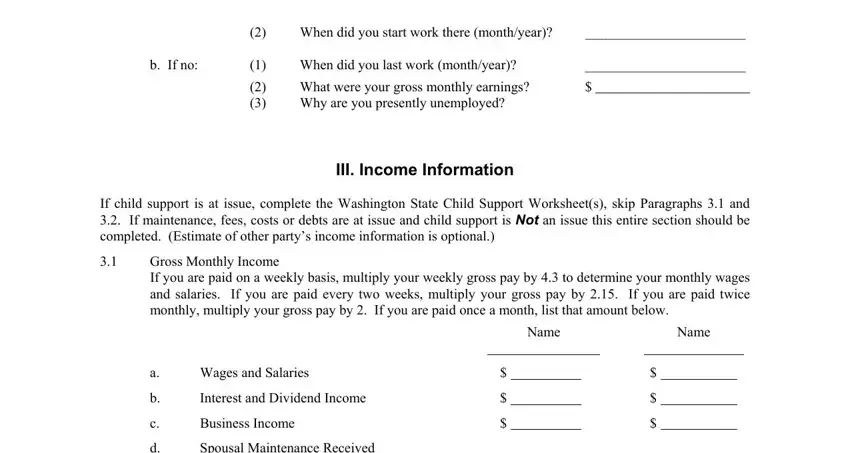

3. In this specific part, check out b If no, When did you start work there, When did you last work monthyear, What were your gross monthly, III Income Information, If child support is at issue, Gross Monthly Income If you are, Name, Name, Wages and Salaries, Interest and Dividend Income, Business Income, and Spousal Maintenance Received. Each one of these will need to be filled in with utmost precision.

Many people often get some things wrong when filling out Business Income in this section. Be sure to revise everything you enter right here.

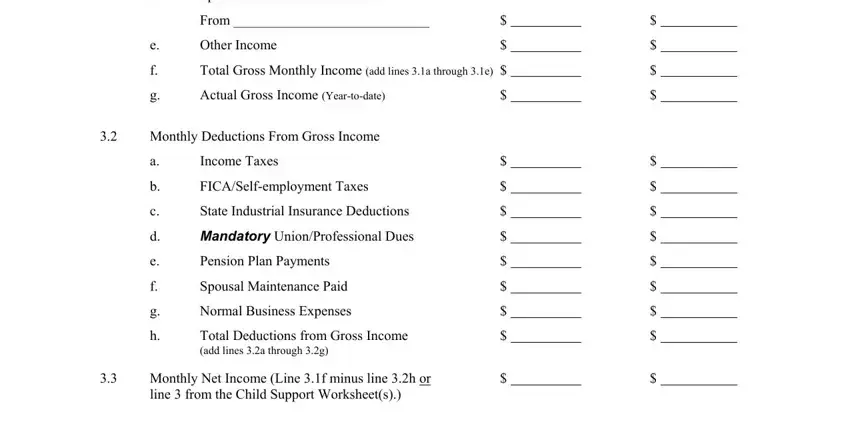

4. This next section requires some additional information. Ensure you complete all the necessary fields - Spousal Maintenance Received, From, Other Income, Total Gross Monthly Income add, Actual Gross Income Yeartodate, Monthly Deductions From Gross, Income Taxes, FICASelfemployment Taxes, State Industrial Insurance, Mandatory UnionProfessional Dues, Pension Plan Payments, Spousal Maintenance Paid, Normal Business Expenses, Total Deductions from Gross Income, and Monthly Net Income Line f minus - to proceed further in your process!

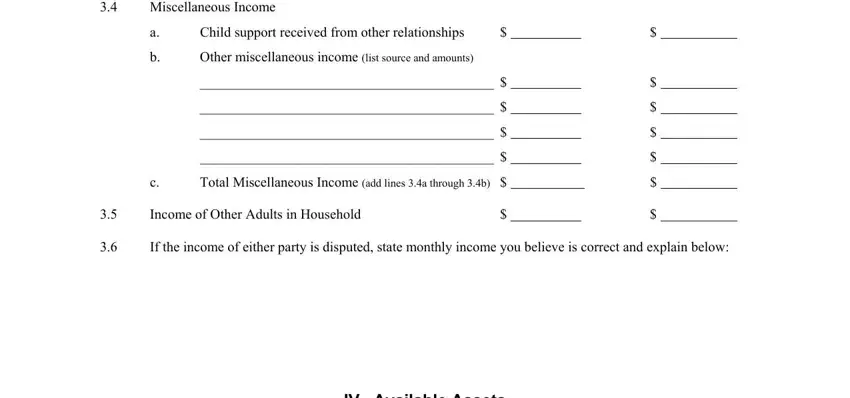

5. And finally, the following final section is precisely what you will need to finish before finalizing the PDF. The blank fields at issue are the next: Miscellaneous Income, Child support received from other, Other miscellaneous income list, Total Miscellaneous Income add, Income of Other Adults in Household, If the income of either party is, and IV Available Assets.

Step 3: After double-checking the fields you have filled in, press "Done" and you're good to go! After registering a7-day free trial account with us, you'll be able to download washington child support financial declaration or email it immediately. The document will also be easily accessible via your personal account menu with your every edit. At FormsPal, we do our utmost to ensure that your information is stored private.