Dealing with PDF files online is definitely quite easy using our PDF editor. Anyone can fill out wsib annual reconciliation form here and try out many other functions we provide. Our team is devoted to giving you the best possible experience with our editor by consistently introducing new functions and improvements. With these updates, using our tool becomes better than ever! If you're seeking to get started, this is what it takes:

Step 1: Access the PDF doc inside our tool by hitting the "Get Form Button" at the top of this page.

Step 2: After you access the online editor, you will notice the form all set to be completed. Besides filling out different fields, you may also perform other actions with the PDF, particularly writing custom words, editing the initial textual content, adding images, signing the document, and a lot more.

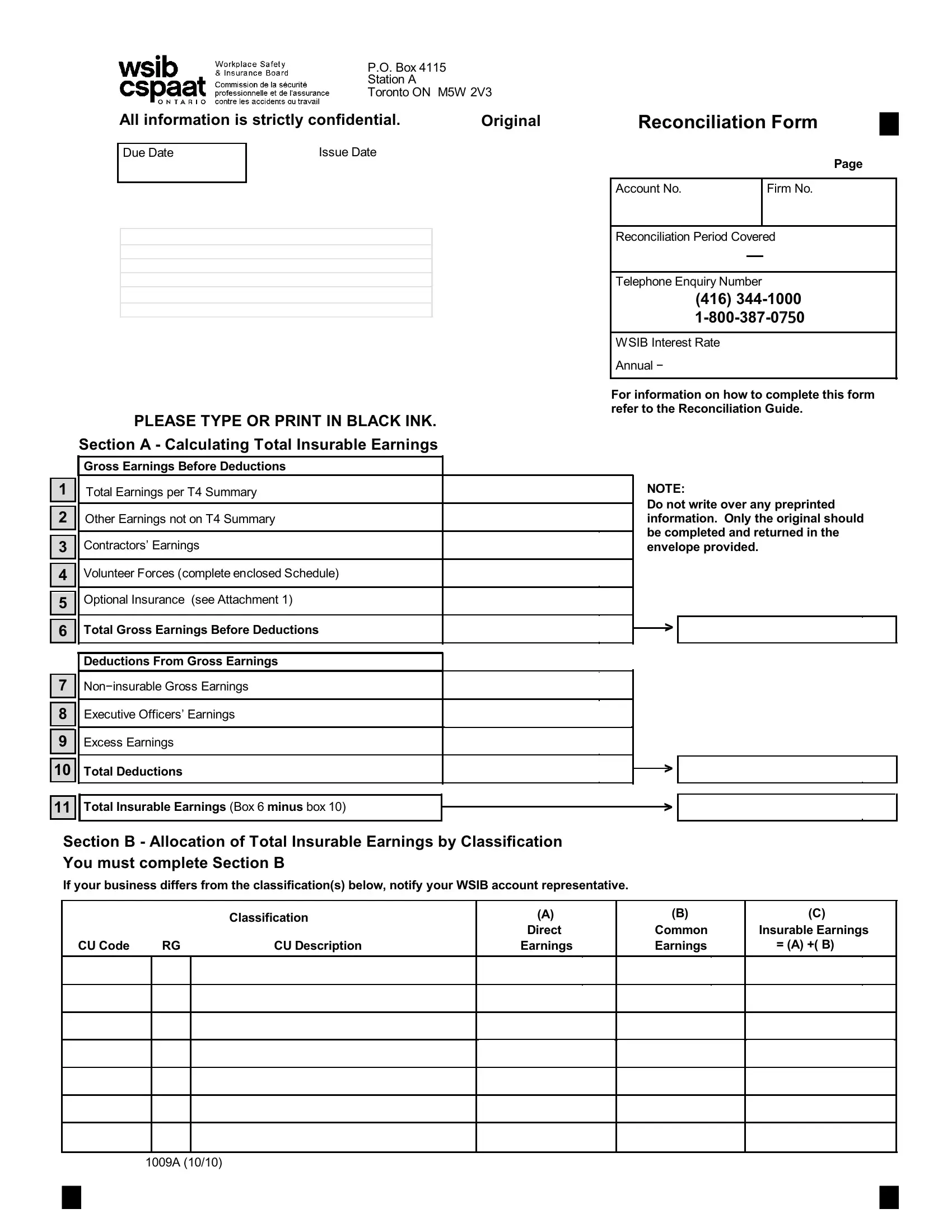

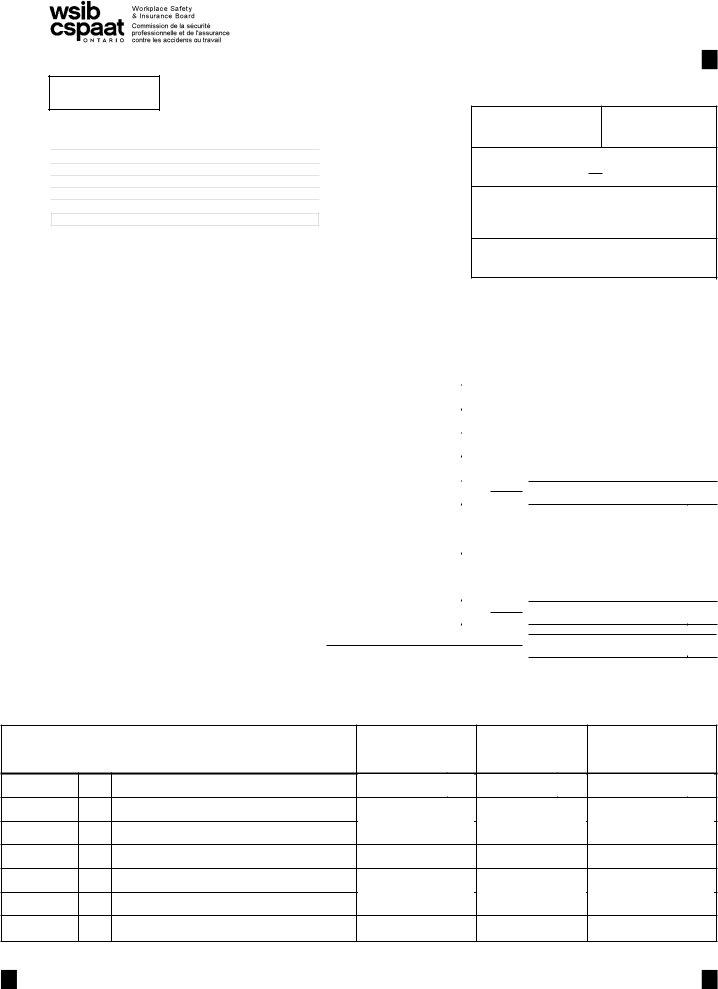

For you to finalize this document, make certain you type in the necessary details in each and every field:

1. It's essential to complete the wsib annual reconciliation form properly, hence be attentive when working with the sections comprising these blanks:

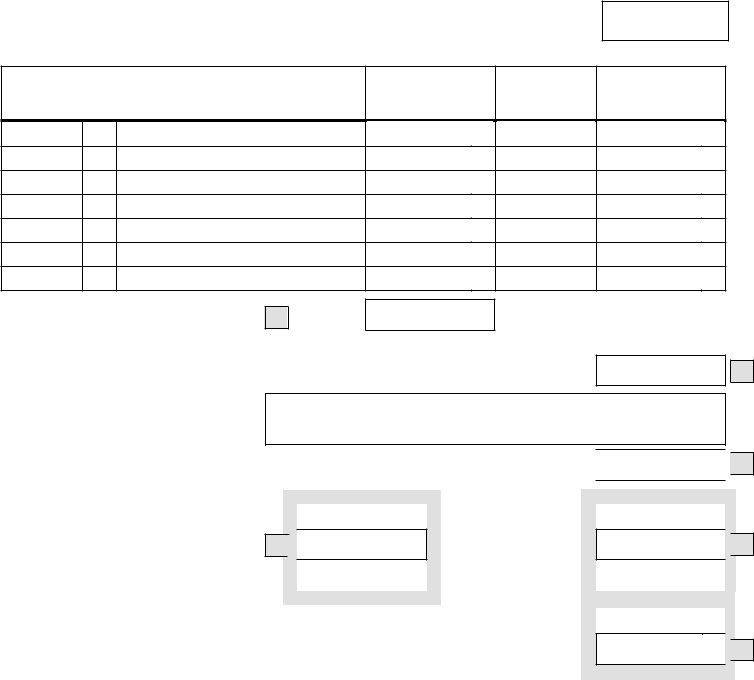

2. The subsequent step is usually to submit the next few blank fields: Failure to keep proper records or.

Those who use this form often make errors while filling out Failure to keep proper records or in this part. Ensure you go over what you enter right here.

Step 3: Right after looking through the filled out blanks, click "Done" and you're good to go! Sign up with us right now and easily get access to wsib annual reconciliation form, ready for downloading. Each modification made is handily saved , making it possible to change the pdf further when necessary. FormsPal is committed to the confidentiality of all our users; we make sure all personal data put into our system is kept confidential.