You may fill in wv it 1406 form easily in our PDF editor online. Our tool is consistently evolving to present the best user experience achievable, and that is because of our commitment to constant enhancement and listening closely to user feedback. Getting underway is effortless! Everything you need to do is stick to the next easy steps down below:

Step 1: Press the "Get Form" button in the top part of this page to access our tool.

Step 2: The tool provides the capability to work with PDF documents in a range of ways. Enhance it by adding personalized text, adjust what is already in the file, and add a signature - all at your convenience!

Filling out this form needs attentiveness. Ensure that all required blank fields are filled out accurately.

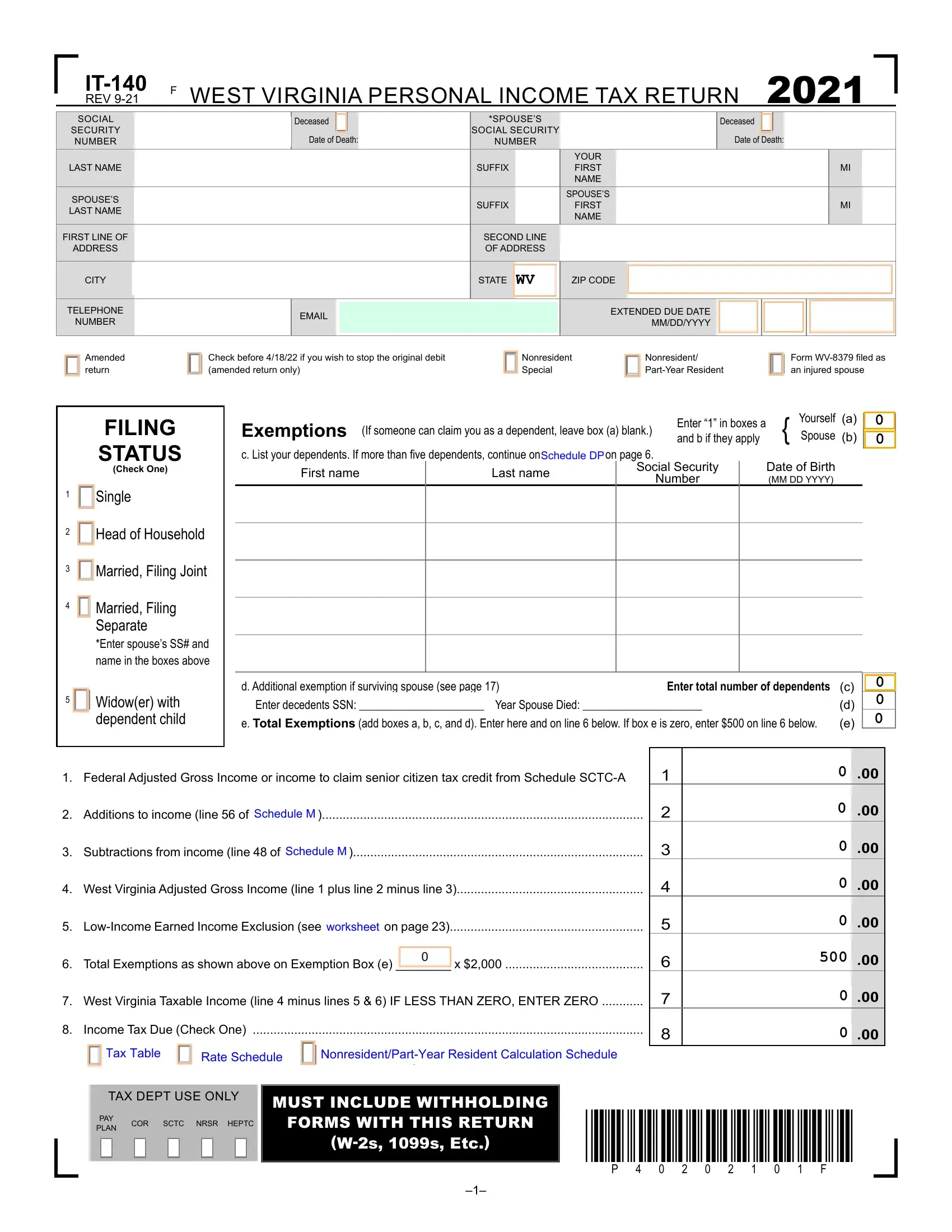

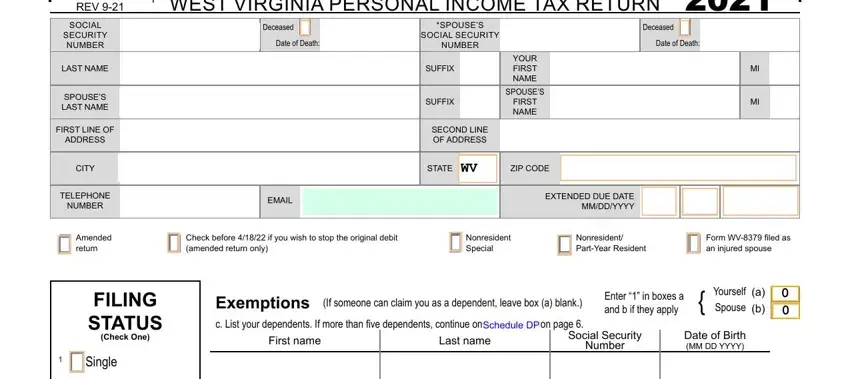

1. You need to fill out the wv it 1406 form correctly, therefore be attentive while filling out the segments including these blank fields:

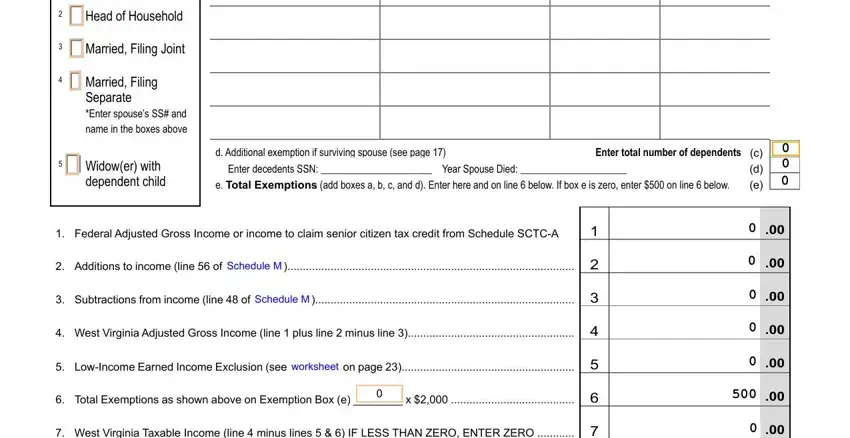

2. Right after this part is completed, proceed to enter the applicable details in these: Head of Household, Married Filing Joint, Married Filing Separate Enter, Widower with dependent child, d Additional exemption if, Enter total number of dependents, Enter decedents SSN Year Spouse, e Total Exemptions add boxes a b c, Federal Adjusted Gross Income or, Additions to income line of, Schedule M, Subtractions from income line of, Schedule M, West Virginia Adjusted Gross, and LowIncome Earned Income Exclusion.

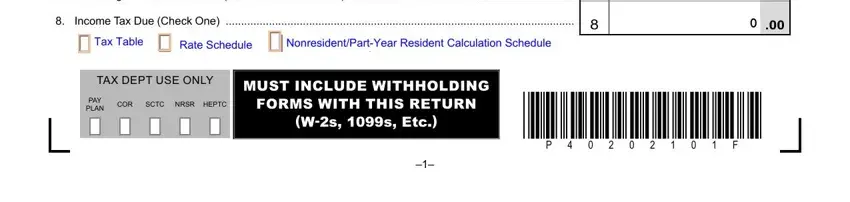

3. Within this stage, look at West Virginia Taxable Income line, Income Tax Due Check One, Tax Table Tax Table, Rate Schedule Rate Schedule, NonresidentPartYear Resident, TAX DEPT USE ONLY, MUST INCLUDE WITHHOLDING, PAY PLAN, COR, SCTC, NRSR HEPTC, FORMS WITH THIS RETURN, and Ws s Etc. Every one of these must be filled out with greatest focus on detail.

It is possible to make a mistake when filling out the TAX DEPT USE ONLY, therefore you'll want to reread it before you finalize the form.

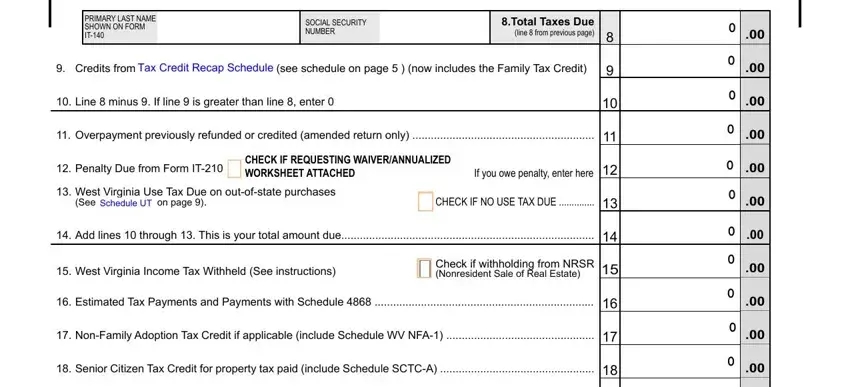

4. This specific part comes next with the next few form blanks to fill out: PRIMARY LAST NAME SHOWN ON FORM IT, SOCIAL SECURITY NUMBER, Total Taxes Due, line from previous page, Credits from Tax Credit Recap, Tax Credit Recap Schedule, Line minus If line is greater, Overpayment previously refunded, Penalty Due from Form IT, CHECK IF REQUESTING, If you owe penalty enter here, West Virginia Use Tax Due on, See Schedule UT on page, Schedule UT, and CHECK IF NO USE TAX DUE.

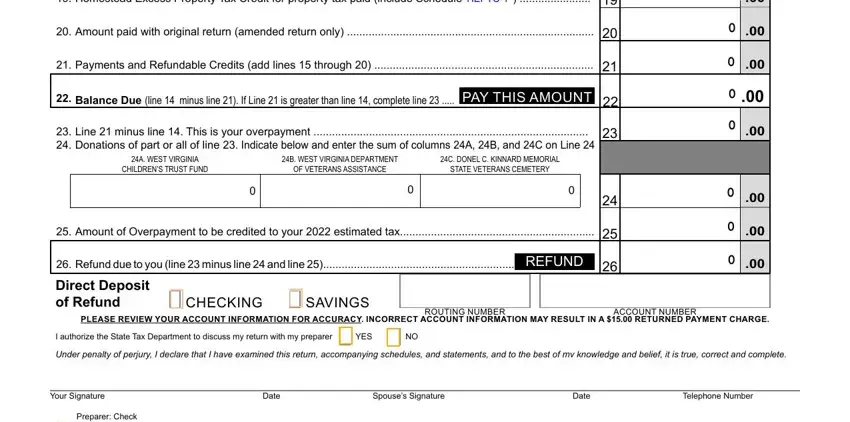

5. To conclude your form, this particular part requires some additional blanks. Filling out Homestead Excess Property Tax, HEPTC, Amount paid with original return, Payments and Refundable Credits, Balance Due line minus line If, Line minus line This is your, A WEST VIRGINIA, CHILDRENS TRUST FUND, B WEST VIRGINIA DEPARTMENT, OF VETERANS ASSISTANCE, C DONEL C KINNARD MEMORIAL, STATE VETERANS CEMETERY, Amount of Overpayment to be, Refund due to you line minus, and CHECKING is going to conclude the process and you will be done in no time!

Step 3: When you have reread the details provided, simply click "Done" to conclude your document generation. Make a 7-day free trial account with us and gain immediate access to wv it 1406 form - accessible inside your FormsPal account. FormsPal is focused on the privacy of all our users; we always make sure that all personal information put into our system remains confidential.