Discovering the right tool for managing purchases and facilitating credit access is paramount in navigating today’s financial landscapes, and the Yard Card Application form presents such an avenue with its carefully structured credit offerings. Originating from Mahwah, NJ, this form introduces consumers to a revolving line of credit, designed to enhance purchasing power with quick credit decisions, special financing offers, and the esteemed status of being a preferred customer. A noteworthy aspect is its inclusivity, accommodating married applicants from California with the option for separate accounts, whereas married Wisconsin residents are guided on combining financial information. It’s not just about accessing credit; it’s about doing so responsibly and under favorable terms—echoing through the form's emphasis on understanding the annual percentage rates (APR), potential penalty APRs for late payments, and minimum interest charges, ensuring consumers are well-informed. Moreover, the application extends beyond providing credit facilities; it’s safeguarded by procedures to prevent money laundering and terrorism funding, asserting the rigor in identity verification. With APRs tied closely to the market's prime rate and a detailed breakdown of fees, from transaction to penalty fees, applicants get a clear picture of their financial commitments. The associated cardholder agreement underscores a promise to adhere to the terms of credit utilization, showcasing a mutual commitment between the credit issuer and the consumer. In essence, the Yard Card Application is more than a form; it's a gateway to financial flexibility with an emphasis on transparency, consumer rights, and tailored credit solutions, thereby encapsulating an essential financial instrument in today's dynamic market.

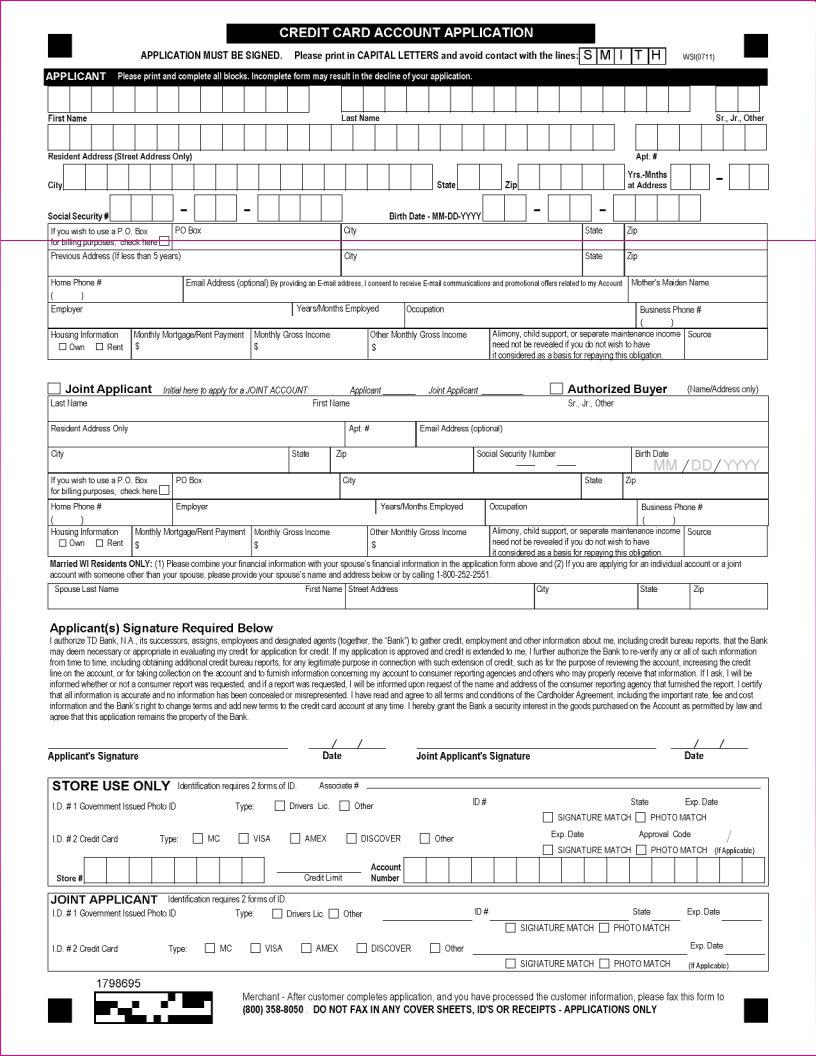

| Question | Answer |

|---|---|

| Form Name | Yard Card Application Form |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | yard card consumer, yard card consumer application, yard card credit application, yard card online application |

MAHWAH, NJ |

PO BOX 731 |

07430 |

|

904(0114) |

CITY |

STREET |

FROM |

STATEZIP CODE

consumer credit card application

Revolving

Line of Credit

Quick

Credit Decisions

Preferred

Customer Status

Special

Financing Offers

PLACE

STAMP

HERE

*Subject to credit approval. See attached cardholder agreement for additional details.

APP•904•RMI(0114)

CA Residents: Married applicants may apply for separate accounts in their own names. After credit approval, each applicant shall have the right to use this account to the extent of any credit limit set by the creditor and each applicant may be liable for all amounts of credit extended under this account to each joint applicant.

OH Residents: The Ohio laws against discrimination require that all creditors make credit equally available to all creditworthy customers, and that credit reporting agencies maintain separate credit histories on each individual upon request. The Ohio Civil Rights Commission administers compliance with this law.

Married WI Residents: All credit card obligations will be incurred in the interest of your marriage and your family. No provision of a marital property agreement, unilateral statement under section 766.59 or court decree under section 766.70 of the Wisconsin statutes adversely affects the interest of the creditor unless the creditor, prior to the time the credit is granted or an

APP•904•RMI (0114)

Important Information about Procedures for Opening a New Account. To help the government fight the funding of terrorism and money laundering activities, federal law requires all Financial Institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.

INTEREST RATES AND FEES |

|

||

Annual Percentage Rate (APR) for |

28.99% |

||

Standard Purchases |

|||

This APR will vary with the market based on the Prime Rate. |

|||

|

|

||

|

|

||

Penalty APR and When It Applies |

29.99% |

||

|

|

This APR will vary with the market based on the Prime Rate. |

|

|

|

This APR may be applied to your Account if a minimum payment is more |

|

|

|

than 60 days past due. |

|

|

|

How Long Will the Penalty APR apply? If your APR is increased for |

|

|

|

this reason, the Penalty APR will apply until you make six consecutive |

|

|

|

monthly minimum payments when due. |

|

Paying Interest |

Your due date is at least 25 days after the close of each billing cycle. We |

||

|

|

will not charge you interest on purchases if you pay your entire balance by |

|

|

|

the due date each month. We will begin charging interest on Convenience |

|

|

|

Checks on the transaction date. |

|

Minimum Interest Charge |

If you are charged interest, the charge will be no less than $2.00. |

||

For Credit Card Tips from the Consumer |

To learn more about factors to consider when applying for or using a credit |

||

Financial Protection Bureau |

card, visit the website of the Consumer Financial Protection Bureau at |

||

|

|

http://www.consumerfinance.gov/learnmore |

|

|

|

||

Fees |

|

||

Transaction Fees |

|

||

• |

Convenience Check Fee |

Either $10 or 3%, whichever is greater, of the amount of each check used. |

|

• |

Promotional Fee |

Up to $175 |

|

Penalty Fees |

|

||

• |

Late Fee |

Up to $35 |

|

• Returned Payment Fee |

Up to $35 |

||

|

|

|

|

The information about the costs of the credit card described in this Application is accurate as of January 2014 when it was printed. This information may have changed after that date. To find out what may have changed, call us at

How We Will Calculate Your Balance: We will use a method called “Average Daily Balance (including new transactions)”. See section 3 of your Cardholder Agreement for more detail.

Billing Rights: Information on your rights to dispute transactions and how to exercise those rights is provided in your Cardholder Agreement.

Margins: 25.74 % will be added to the Index for the APR for Purchases 25.74% will be added to the Index for the APR for Convenience Checks 26.74% will be added to the Index for the Penalty APR

Index: The Index (US Prime Rate) is currently 3.25% as of January 2014

The corresponding DAILY PERIODIC RATES (“DAILY PERIODIC RATES”) ARE:

.079424% for APR for Standard Purchases

.079424% for APR for Convenience Checks

.082164% for Penalty APR

CARDHOLDER AGREEMENT

“I”, “me” and “my” mean the borrower(s). My credit card (“Card”) is issued by TD Bank, N.A. (“you,” “your” or the “Bank”). I understand that the Bank may change my credit limit from time to time, subject to applicable law, either at my request (if the Bank approves my request) or at the Bank’s initiative. The Bank has the right to cancel or limit the credit to be extended to me at any time without prior notice. I may use my

Card to obtain advances under this Cardholder Agreement (this “Agreement”), in an amount up to my available credit (the difference between my credit limit and my outstanding balance), as long as the Bank has not terminated my right to obtain additional advances. I agree to pay for all advances made by the Bank to me and/or others as authorized by me.

I authorize the Bank to obtain credit reports in connection with this agreement and from time to time in connection with the review of my Card account (“Account”), or any update, extension or renewals of my Account, and for the purposes of collection of my Account. I authorize the Bank to verify with others any information and to provide information about its transactions with me to third parties (including consumer reporting agencies) for lawful purposes.

I agree to use the Card and the Account only for my own lawful personal, family or household purposes. I agree that I and each other user (each an “Authorized User”) whom I have notified the Bank is authorized to obtain advances using my Card will not use the Card or the Account for any business or commercial purposes, and also will not use the Card or the Account for any unlawful or illegal purposes. Such transactions include, but are not limited to, online gambling transactions, and any betting transactions that are illegal under applicable law including the purchase of lottery tickets or casino chips, or

I UNDERSTAND YOU MAY REPORT INFORMATION ABOUT MY ACCOUNT TO CREDIT BUREAUS. SUBJECT TO APPLICABLE LAW, LATE PAYMENTS, MISSED PAYMENTS, OR OTHER DEFAULTS ON MY ACCOUNT MAY BE REFLECTED IN MY CREDIT REPORT.

1.Promise to Pay: I (and any Authorized User) must activate and sign the Card to use it. I will be liable for all use of the Card or the Account by me or by any person with actual, implied, or apparent authority to act for me or to use the Card or the Account, including any Authorized User. Any such use will constitute acceptance of all the terms and conditions of this Agreement, even though this Agreement is not signed.

I authorize the Bank to pay and charge my Account for all purchases and Convenience Checks resulting from the use of my Card or the Account. I promise to pay the Bank (in U.S. Dollars drawn on U.S. banks) as required by this Agreement for all of these Purchases and Convenience Checks, plus Interest Charges and all other fees and charges owed under this Agreement (including without limitation all Purchases and Convenience Checks made or used by an Authorized User).

2. Credit Limit:

General: My initial credit limit for the Account is shown in the materials that accompany the Card(s) the Bank sends me when my Account is opened. My current credit limit for the Account will be shown on my Statement. I also may telephone Customer Service at

Changes to Credit Limit: In the Bank’s discretion, at any time, subject to applicable law, the Bank may change the credit limit that applies to my Account. The Bank will provide notification of any such change by mail and my credit limit will be listed on the periodic billing statement provided by Bank (“Statement”).

Exceeding the Credit Limit. I agree to not go over my credit limit. I also agree that the Bank may permit me to go over my limit, but is not required to do so. If the Bank permits me to go over my credit limit, the Bank will not charge me an overlimit fee. If my Account goes over my credit limit, I agree to pay the overlimit amount when it is billed to me, or sooner upon the Bank’s request. I understand that if the Bank permits me to exceed my credit limit, the Bank will not have waived any of its rights under this Agreement, and the Bank does not have to allow me to exceed my credit limit at a later date.

3. Interest Charges:

a. General; Minimum Interest Charges: Each billing cycle, you separately determine the interest charges on standard Purchases, standard Convenience Checks and each separate kind of promotional Purchase or Convenience Check (each, a “Type of Balance”). For each Type of Balance, you determine interest charges each billing cycle by multiplying the Balance Subject to Interest Rate for such Type of Balance by the Daily Periodic Rate for such Type of Balance (see Paragraph 4 for rate information) and by then multiplying the result by the number of days in the billing cycle. For each Type of Balance, the Balance Subject to Interest Rate is the average daily balance (including new Transactions), as calculated pursuant to Section 3b below. To get the total interest charges each billing cycle, you add together the interest charges for all Type of Balances. However, if there are any interest charges in a billing cycle, the minimum interest charge equals $2.00.

b. Balance Subject to Interest Rate; Grace Period on Purchases: For each Type of Balance, the Balance Subject to Interest Rate, also known as the “Average Daily Balance,” is the total of the closing daily balances for such Type of Balance for all the days in the billing cycle (treating any negative balance as $0), divided by the number of days in such cycle. Normally, the closing daily balance for each Type of Balance equals the balance at the beginning of the day, plus any new Transactions of the same Type of Balance and less any payments applied to such Transactions. However, this is subject to certain adjustments: (i) At the beginning of each billing cycle, you add to the balance for each Type of Balance any interest charges and transaction fees from the immediately preceding billing cycle relating to such Type of Balance. (ii) When a promotional period for a particular promotion ends, as of the beginning of the next billing cycle you will transfer the remaining promotional balance to a Standard Purchase balance. (iii) If my Account balance is $0 at the beginning of a billing cycle or I pay the entire Account balance as of the beginning of the billing cycle by the payment due date that falls in such billing cycle, the billing cycle is a “grace period” and each Balance Subject to Interest Rate and my interest charge for the billing cycle are all $0. (iv) If the billing cycle is not a grace period but immediately follows a grace period, all payments that are made by the payment due date will first be applied to Purchases from prior billing cycles as of the first day of the billing cycle and will then be applied to Purchases in the current billing cycle

as of the day of such Purchases (and will not be applied as of the day such payments were actually made or posted).

c. Interest Accrual Periods: On each Convenience Check, you start charging Interest Charges from the date the Convenience Check is posted to my Account. On each standard Purchase: (i) If I get a grace period for the billing cycle in which the Purchase is posted to the Account (the “Purchase Cycle”) and for the next billing cycle (the “Next Cycle”), you charge no Interest Charges at all. (ii) If I get a grace period for the Purchase Cycle but not for the Next Cycle, you start charging Interest Charges from the first day of the Next Cycle. (iii) If I do not get a grace period for the Purchase Cycle, you charge Interest Charges from the later of the date of the Purchase or the first day of the billing cycle in which it is posted to my Account.

d. Treatment of Late Fees and Returned Payment Fees: The Bank does not charge interest on Late Fees or Returned Payment Fees.

4. Interest Rates.

a. General: The “Annual Percentage Rate” or “APR” is the annual rate of Interest Charge on Account balances. In connection with a special promotion, you may charge a fixed rate of interest (which could be as low as a 0% APR). Otherwise, all interest rates may vary based on the “Prime Rate,” as defined below, plus a margin. The Daily Periodic Rate will equal the APR divided by 365 (366 in a leap year).

b. Prime Rate Index: For each billing cycle, the “Prime Rate” is based on the “Prime Rate” in effect on the last day of the immediately preceding billing cycle (the “Determination Date”). The “Prime Rate” is the highest U.S. Prime Rate published in the “Money Rates” section of THE WALL STREET JOURNAL on the Determination Date (or if THE WALL STREET JOURNAL does not publish such rate on such day, the previous day it did publish such rate). (If THE WALL STREET JOURNAL stops publishing the U.S. Prime Rate in its “Money Rates” section, then you may substitute another index and margin, in your sole discretion, subject to any notice and other requirements of applicable law.) Each billing cycle, the APR for each Type of Balance will equal the Prime Rate as of the most recent Determination Date plus the applicable margin. The margin on a Transaction under a special promotion may be lower than the margin on standard Transactions.

c. Effect of APR Changes: If and when the APR for a Type of Balance increases, more interest charges will accrue and more of each payment will be applied to interest charges and less to principal. This will result in higher and/or more payments if I make the minimum payment due each month. If and when the APR decreases, less interest charges will accrue and less of each payment will be applied to interest charges and more to principal. This will result in lower and/or fewer payments if I pay the minimum payment due each month.

d. Penalty APR: If any required minimum payment is more than 60 days past due, you may, in your discretion, send notice that you will increase the APR on all new and existing balances on the Account, up to the maximum penalty APR stated in the table of Interest Rates and Interest Charges. The Penalty APR will apply until I make six consecutive monthly minimum payments when due. The Penalty APR will be adjusted each billing cycle by adding a margin to the Prime Rate. Please see the table of Interest Rates and Interest Charges for more information about margins. If the Prime Rate changes, my Penalty APR will change and may increase. You may impose the Penalty APR under the circumstances described above, without losing any of your rights under this Agreement or under applicable law.

5.Minimum Payment Due: I agree to pay at least the minimum payment due by the payment due date shown on my monthly statement, which will be the same day of each month and at least 25 days after my statement date. Generally, the minimum payment due will be computed separately for each Type of Balance and will equal the sum of (a) 3.5% of the outstanding balance, (b) any applicable fees and charges (except Interest Charges) and (c) any past due amount, rounded to the nearest dollar. However, the Bank may adjust the rules for computing the minimum payment due in connection with any promotional transaction, as disclosed in the Promotional Offers section of this Agreement (Section 15). Also, notwithstanding any language to the contrary in this Agreement or any promotional offer, the minimum payment due with respect to any Type of Balance will never be less than $25, or if the outstanding balance on the statement date of a particular Type of Balance is less than $25, such outstanding balance. This means, for example, that if there are outstanding balances on the statement date of $100 for standard Purchases, $200 for one promotion and $500 for a second promotion, the minimum payment due will always be at least $75 ($25 for each Type of Balance).

Credits, adjustments, refunds and similar Account transactions may not be used in place of payment of any portion of a required minimum payment. If I pay more than the minimum payment due in one billing cycle, I will not be excused from paying the minimum payment due in subsequent billing cycles.

6.Late Fee: The first time the minimum payment due is not received by the payment due date on the Statement, the Bank will charge me a late fee of the minimum payment due or $25, whichever is less. If over the next six billing cycles, the minimum payment due is not received by the payment due date on the Statement, the Bank will charge me a late fee equal to the minimum payment due or $35, whichever is less. I understand and agree that at the Bank’s option, such late fee will be immediately due and payable.

7.Returned Payment Fee: The first time I pay with a check and my check is returned to the Bank by my financial institution unpaid or dishonored, the Bank may charge me a returned payment fee of the minimum payment due or $25, whichever is less. If over the next six billing cycles, I pay with a check and my check is returned to the Bank by my financial institution unpaid or dishonored, the Bank will charge me a returned payment fee equal to the minimum payment due or $35, whichever is less. I understand and agree that at the Bank’s option, such late fee will be immediately due and payable.

8.Administrative Fees: If I request a copy of a Statement or sales draft, payment check, or Convenience Check, I will pay a fee. I understand that the amount of the fee will be disclosed at the time I request this optional service. However, I will not be charged for copies of billing Statements, sales drafts, or other documents that I request for a billing error/inquiry I may assert against the Bank under applicable law.

9.Convenience Checks: The Bank may agree to provide me with Convenience Checks for my use from time to time, in the Bank’s sole discretion, after the Account is opened. Each Convenience Check must be in the form the Bank issues, and must be used according to the instructions the Bank gives me. I may use a Convenience Check, which is a special check that the Bank may provide me from time to time, in its sole discretion, to access my Account. The Bank may refuse to process Convenience Checks received after any applicable expiration date printed on them. The Bank will not return paid Convenience Checks to me. Convenience Checks may not be used to pay any amount owed to the Bank under this Agreement or any other agreement I or any Authorized User may have with the Bank, now or in the future. The Bank will not certify any Convenience Checks. I may not

Convenience Check Transaction Fee: There is a fee equal to 3% of the check amount for each check used with a minimum of $10, whichever is greater. This fee is effective upon the use of any Convenience Check. I understand and agree that at the Bank’s option, this fee will be immediately due and payable.

10.Application of Payments: The Bank will send a Statement to my address on the Bank’s records each month if required by applicable law. Each minimum payment is due on the payment due date shown on the Statement (which will be at least 25 days after the “Statement Closing Date”).

a. The Bank will generally apply my minimum payment in the following order:

(i)to interest charges and other fees;

(ii)to transactions (purchases, Convenience Checks) with the lowest Daily Periodic Rates and corresponding APRs.

b. Application of Payments in Excess of Minimum Payment. The Bank will generally apply my payments in excess of the minimum payment in the following order:

(i)to transactions (purchases, cash advances) with the highest Daily Periodic Rates and corresponding APRs;

(ii)to transactions with the lowest Daily Periodic Rates and corresponding APRs;

(iii)to interest charges and other fees.

During the last two billing cycles before the expiration of a promotional plan, the Bank will apply any payments in excess of the minimum payment to the promotional plan balance. If more than one promotional period is expiring when a payment in excess of the minimum payment is received, the Bank may apply the payment in any manner permitted by applicable law. Subject to the foregoing and applicable law, payments will generally be applied first to the oldest Purchases.

11.Payments: Payments are to be sent to the address designated on the Statement. Payments received at such address with the return portion of the Statement by 5:00 PM Eastern Time Monday through Saturday (excluding bank holidays) will be credited on the day of receipt. However, if the payment due date falls on a day when the Bank does not accept payments, the Bank will not treat any payment as late if the Bank receives it by 5:00 PM Eastern Time on the following business day. Payments received after 5:00 PM Eastern Time Monday through Saturday (excluding bank holidays) will be credited on the next business day. There may be a five (5) day delay of crediting if payments are not received in U.S. dollars, not made in the envelope provided with the Statement and accompanied

by the payment stub which is part of the Statement, and/or not received at the address for payments designated on the Statement. Payments must be made by check or money order payable in U.S. funds and drawn on a financial institution located within the United States. If the Bank changes the payment address or makes a material change in its procedures for handling payments and such change causes a material delay in crediting a payment, the Bank will waive or rebate Late Fees and Interest Charges to the extent required by applicable law. If I want to pay with a check that has “payment in full” or some other special notation or instruction on it or with it, I agree to send the payment (including the special notations or instructions) to the Bank at P.O. Box 731 Mahwah, New Jersey 07430 or any substitute address the Bank provides to me. In any event, the Bank may ignore the special notations or instructions, and the Bank’s crediting any such check or other instrument to amounts I owe under this Agreement does not mean that the Bank has agreed to the special notations or instructions. The Bank does not accept payments at its branches. I MAY AT ANY TIME PAY MORE THAN THE MINIMUM

PAYMENT DUE OR THE FULL UNPAID BALANCE OF MY ACCOUNT WITHOUT INCURRING ADDITIONAL CHARGES OR ANY PENALTY.

12.Automated

This is a secure system, and my financial institution information will not be shared for any reason other than for automated payments.

13.Same Day Telephone Payments: I may also call the Bank and arrange for an expedited payment through a customer service representative. By doing so, I will authorize the Bank or its agent to automatically initiate a single entry ACH debit to my checking account and will authorize my financial institution to accept these debits and charge them to my checking account. Payments arranged by 5:00 PM Eastern Time on business days will be credited on a

14.Credit Balance: The Bank will make a good faith effort to return to me any credit balance on my Account over $1.00 if the credit balance has been on my Account longer than six (6) months (or, in the Bank’s discretion, for a shorter time period). I may also request a refund of a credit balance on my Account at any time, by sending my request to Customer Service at P.O. Box 731 Mahwah, New Jersey 07430, by first class mail, postage prepaid. The Bank may reduce the amount of any credit balance on my Account by applying the credit balance towards new fees and charges posted to my Account.

15.Promotional Offers: Notwithstanding any other provisions of this Agreement, the Bank may occasionally, at its option, make certain promotional offers (“Promotional Offers”). Information about Promotional Offers will be shown separately on my statement. However, balances under any Promotional Offer will be combined with balances under my standard terms upon the expiration of any deferred or specified time period applicable to a Promotional Offer. The Bank may charge a Promotional Fee of up to $175, disclosed to me in advance, if I take advantage of any Promotional Offer. The Promotional Fee will be treated as part of the promotional Purchase for all purposes, including computation of interest charges and the minimum payment. Features of Promotional Offers may include, among other things, interest forgiveness;

compliance with specified requirements and may revoke any Promotional Offer if any required minimum payment is 60 days past due. Specific terms of certain Promotional Offers we make from time to time are as follows, provided that such terms may be modified or supplemented by the terms set forth on or with my sales slip at the time of my purchase:

Promotional Transaction Fee: For each promotional transaction, I may be charged a Promotional Transaction Fee up to the amount listed on the Interest Rates and Fees table. The amount of the Promotional Transaction Fee will vary based on the promotion offered and will be disclosed prior to each purchase under such promotion. The Bank adds the fee to the balance for the related category as of the promotion transaction date.

16.Entire Agreement: I agree that this Agreement (as amended and supplemented from time to time) and the application constitute the final expression of the agreement between me and the Bank and that this agreement may not be contradicted by evidence of any prior, contemporaneous or subsequent oral agreement between me and the Bank regarding my Account. The retail store and its employees have no authority to change, add to or explain the terms of this Agreement except to provide me with the Bank’s Promotional Offers. For more information or questions, call

17.Default: I agree that I will be in default, and the Bank will not be obligated to honor any attempted use of my Account (even if the Bank does not give me advance notice) if any of the following events occurs:

•The Bank does not receive a required minimum payment by 5 p.m., Eastern Time, on the payment due date, accompanied by my statement’s payment stub (if mailed), or the Bank does not receive any other payment required by this Agreement when such payment is due.

•I exceed the credit limit

•I die or I am declared legally incompetent or incapable of managing my affairs, become insolvent, file for bankruptcy, or otherwise become the subject of a bankruptcy petition or filing.

•I give you false or misleading information at any time in connection with my Account.

•I send the Bank a check or similar instrument that is returned to me unpaid, or any automatic, electronic or other payment on my Account cannot be processed or is returned unpaid, for any reason, within the last six (6) billing cycles.

•I breach or otherwise fail to comply with any term or condition of this Agreement.

•The Bank has reason to suspect that I or any Authorized User may have engaged or participated in any unusual, suspicious, fraudulent, or illegal activity on my Account.

•I do not give the Bank any updated information about my finances, employment, or any other information the Bank may reasonably request, promptly after its request.

Upon default: (a) the Bank will not be obligated to honor any attempted use of my Account (even if the Bank does not give me advance notice); (b) the Bank may require me to pay at once all or any portion of the balance outstanding under the Account; and (c) the Bank may exercise any right provided by this Agreement or applicable law.

18.Security Interest: I hereby give the Bank a first priority

19.Liability for Unauthorized Use: If my Card is lost or stolen or if I believe someone may have used my Account without my permission, I must notify the Bank at once. I may be liable for the unauthorized use of my Account. I will not be liable for unauthorized use that occurs after I notify the Bank by writing to P.O. Box 731 Mahwah, New Jersey 07430 or verbally by calling

20. Closing My Account:

a. The Bank May Close My Account: Except where prohibited by applicable law and without prior notice, the Bank may close my Account to new transactions at any time, for any reason. If the Bank closes my Account to new transactions, I agree to pay the Bank all amounts I owe under this Agreement, under the terms and conditions of this Agreement, and I agree that the Bank is not liable to me for any consequences resulting from closing my Account.

If I am in default, the Bank may close my Account and require me to pay the Bank immediately the entire amount I owe under this Agreement, in full. The Bank may also increase the dollar amount of my minimum payment, subject to applicable law.

If the Bank closes my Account to new transactions, I must return all Cards, unused Convenience Checks and other Account access devices to the Bank (cut, torn, or otherwise deliberately damaged to prevent unauthorized use by third parties).

b. I May Ask the Bank to Close my Account: I may ask the Bank to close my Account to new transactions at any time, by notifying Customer Service at P.O. Box 731 Mahwah, New Jersey 07430, by first class mail, postage prepaid, and returning all Cards, unused Convenience Checks and other Account access devices to us (cut, torn, or otherwise deliberately damaged to prevent unauthorized use by third parties) with my written notice or contacting the Bank at

21.Changing This Agreement: Subject to applicable law, you may change this Agreement at any time or from time to time. For example, you may change the addresses and telephone numbers I should use to contact you, change fees, add new fees, change the interest rates or rate formulas that apply to my Account, increase my minimum payment due or add, delete or modify

22.Authorization: Telephone calls may be made to me using an automatic dialing- announcing device. My telephone conversations with employees or agents of the Bank may be monitored and/or recorded. Use of my Account will signify my consent to such use of an automatic dialing announcing device, monitoring, and/or recording.

23.Telephone Numbers: If you give a cell number directly to us, you consent to and agree to accept collection calls to your cell phone from us and our agents. For any telephone or cell phone calls placed to you by us or our agents, you consent and agree that those calls may be automatically dialed and/or use recorded messages.

24.Governing Law: Applicable federal law and the substantive laws of the State of Delaware (to the extent not preempted by federal law) without regard to principles of conflict of law or choice of law, shall govern this Agreement including the rate of interest and fees.

25.How to Dispute Credit Reports Regarding Your Account: If I think the information you furnished to consumer reporting agencies on the Account is not accurate, I will write you at the Notice Address, Attn: Credit Report Dispute. A delay may be experienced if I do not write to this address. In order for you to investigate my dispute, I will need to provide you with my name, address, and telephone number; the Account number I am disputing; and why I believe there is an inaccuracy. You will complete any investigation and notify me of your findings and, if necessary, corrections. I understand that calling you will not preserve my rights.

NOTICE

A. I MAY AT ANY TIME PAY MY TOTAL INDEBTEDNESS UNDER THIS AGREEMENT. B. I WILL KEEP A COPY OF THIS AGREEMENT TO PROTECT MY LEGAL RIGHTS.

C.SUBJECT TO APPLICABLE LAW, THE BANK CAN CHANGE THE TERMS OF, ADD NEW TERMS TO, OR DELETE TERMS FROM THIS AGREEMENT. THE BANK WILL GIVE ME ADVANCE NOTICE OF THE CHANGE, ADDITION OR DELETION WHEN REQUIRED BY APPLICABLE LAW. ANY CHANGE, ADDITION, OR DELETION TO THIS AGREEMENT WILL BECOME EFFECTIVE AT THE TIME STATED IN THE NOTICE.

NOTICE: ANY HOLDER OF THIS CONSUMER CREDIT CONTRACT IS SUBJECT TO ALL CLAIMS AND DEFENSES WHICH THE DEBTOR COULD ASSERT AGAINST THE SELLER OF GOODS OR SERVICES OBTAINED WITH THE PROCEEDS HEREOF. RECOVERY HEREUNDER BY THE DEBTOR SHALL NOT EXCEED AMOUNTS PAID BY THE DEBTOR HEREUNDER.

YOUR BILLING RIGHTS; KEEP THIS DOCUMENT FOR FUTURE USE

(In this description of billing rights, “you” and “your” mean the borrower. “We”, “us” or “our” mean the Bank.)

This notice contains important information about your rights and our responsibilities under the Federal Credit Billing Act.

What To Do If You Find a Mistake on Your Statement

If you think there is an error on your statement, write to us at: Customer Service at P.O. Box 731 Mahwah, New Jersey 07430 In your letter, give us the following information:

•Account Information: Your Name and Account number.

•Dollar Amount: The dollar amount of the suspected error.

•Description of the problem: If you think there is an error on your bill, describe what you believe is wrong and why you believe it is a mistake.

You must contact us:

•Within 60 days after the error appeared on your statement.

•At least 3 business days before an automated payment is scheduled, if you want to stop payment on the amount you think is wrong.

You must notify us of any potential errors in writing. You may call us, but if you do we are not required to investigate any potential errors and you may have to pay the amount in question.

What Will Happen After We Receive Your Letter

When we receive your letter, we must do two things:

1.Within 30 days of receiving your letter, we must tell you that we received your letter. We will also tell you if we have already corrected the error.

2.Within 90 days of receiving your letter, we must either correct the error or explain why we believe the statement was correct.

While we investigate whether or not there has been an error:

•We cannot try to collect the amount in question, or report you as delinquent on that amount.

•The charge in question may remain on your statement, and we may continue to charge you interest on that amount.

•While you do not have to pay the amount in question, you are responsible for the remainder of your balance.

•We can apply any unpaid amount against your credit limit.

After we finish our investigation, one of two things will happen:

•If we made a mistake: You will not have to pay the amount in question or any interest or other fees related to that amount.

•If we do not believe there was a mistake: You will have to pay the amount in question, along with applicable interest and fees. We will send you a statement of the amount you owe and the date payment is due. We may then report you as delinquent if you do not pay the amount we think you owe.

If you receive our explanation but still believe your bill is wrong, you must write to us within 10 days telling us that you still refuse to pay. If you do so, we cannot report you as delinquent without also reporting that you are questioning your bill. We must tell you the name of anyone to whom we reported you as delinquent, and we must let those organizations know when the matter has been settled between us.

If we don’t follow all of the rules above, you do not have to pay the first $50.00 of the amount you question even if your statement was correct.

Your Rights If You Are Dissatisfied With Your Credit Card Purchases

If you are dissatisfied with the goods or services that you have purchased with a credit card and you have tried in good faith to correct the problem with the merchant, you may have the right not to pay the remaining amount due on the purchase.

To use this right, all of the following must be true:

1.The purchase must have been made in your home state or within 100 miles of your current mailing address, and the purchase price must have been more than $50.00. (Note: Neither of these are necessary if your purchase was based on an advertisement we mailed to you, or if we own the company that sold you the goods or services.)

2.You must have used your credit card for the purchase. Purchases made with cash advances from an ATM or with a check that accesses your credit card account do not qualify.

3.You must not yet have fully paid for the purchase.

If all of the criteria above are met and you are still dissatisfied with the purchase, contact us in writing at:

Customer Service at P.O. Box 731 Mahwah, New Jersey 07430

While we investigate, the same rules apply to the disputed amount as discussed above. After we finish our investigation, we will tell you our decision. At that point, if we think you owe an amount and you do not pay, we may report you as delinquent.