Affidavit of Domicile

An affidavit of domicile is a document identifying the legal residence of a deceased person at the time of death. Legal residence, or legal domicile, refers to a deceased person’s permanent home, where they lived most of the time, paid taxes, and voted.

In most cases, this affidavit form can help during the probate process when someone dies and leaves behind the securities to transfer, such as stocks and bonds. In this case, the legal representative or surviving owner of the assets uses the affidavit to certify the decedent’s domicile and transfer ownership to the heirs or other beneficiaries. It’s necessary to prepare a separate affidavit for each additional security account.

To easily make your document, please download and use our free affidavit of domicile template. The guidelines below will help you to walk through the preparation process. You are free to address your lawyer and obtain legal advice while preparing the documents. Note that the affidavit of domicile should be notarized.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Here are some definitions that may be useful to know:

Affidavit – a document used to make a written statement, which is sworn under oath to be true.

Domicile – the permanent home of a person; the residence where the person plans to live indefinitely.

Decedent – a deceased person.

Securities – tradable financial assets, for example, equity or interest in a company or business.

Probate court – a judicial system segment that handles a legal process in which the estate is administered and divided among the heirs and beneficiaries.

The executor of the estate – a person coordinating the estate distribution after the decedent’s death under the last will.

When You Need an Affidavit of Domicile

An affidavit of domicile is used whenever you need to identify the deceased person’s legal residence. It’s usually used for but not limited to transferring the decedent’s financial property or securities ownership. It’s essential to use these documents to ensure that there are no claims against the decedent’s estate in the jurisdiction of domicile or determine the applicability of inheritance taxes.

The affidavit form includes a sworn statement of the affiant declaring where the decedent legally resided at the time of the death. Depending on circumstances, the affiant can be the executor of the estate, administrator, legal representative, or surviving owner. As a general rule, the affiant’s role goes to the executor of the estate named by the deceased in the last will. If the individual dies without the will, the court will appoint an administrator to coordinate the assets’ distribution and, as a result, create the form. Personal representatives come into play if the decedent has specifically nominated them, for example with a power of attorney.

What Information an Affidavit of Domicile Should Include

The affidavit of domicile should include components according to a specific state. Such documents consist of the following contents.

Affiant. This section includes information about the individual filing the document, such as the name, address, and legal identification. It’s usually an executor of the estate or legal representative.

Decedent. The affidavit should contain the deceased person’s name and the statement of when and where this person died. You may also be required to provide the death certificate.

Legal domicile. This section describes the decedent’s domicile, the legal residence, including street address, city, county, and state. Please do not confuse the residence where the deceased might temporarily live before death and the place where they usually lived (the domicile).

Securities. You may also use the affidavit forms to describe the decedent’s securities or other property to transfer, including account number and registration details.

Notary. A notary public should sign an affidavit of domicile to avoid any possible validation issues.

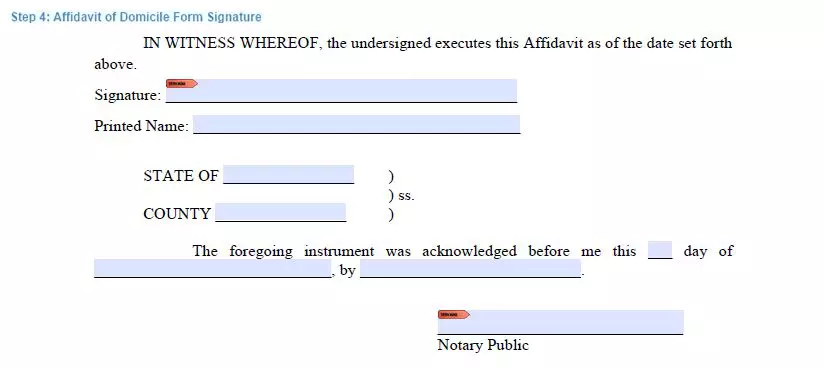

Filling Out the Affidavit of Domicile Form

The affidavit of domicile is not long to prepare, but you have to be very careful regarding the information you fill in. You may need to check the state and county requirements and obtain legal advice during the process. In any case, please use our free affidavit of domicile template to create the legal document as complete as possible, following the next steps.

Step 1. Identify the affiant

The affidavit usually begins with the information about the individual filing the document. As the affiant, you should provide your name and address and state your legal identification, such as executor, administrator, personal representative, beneficiary, survivor, or trustee.

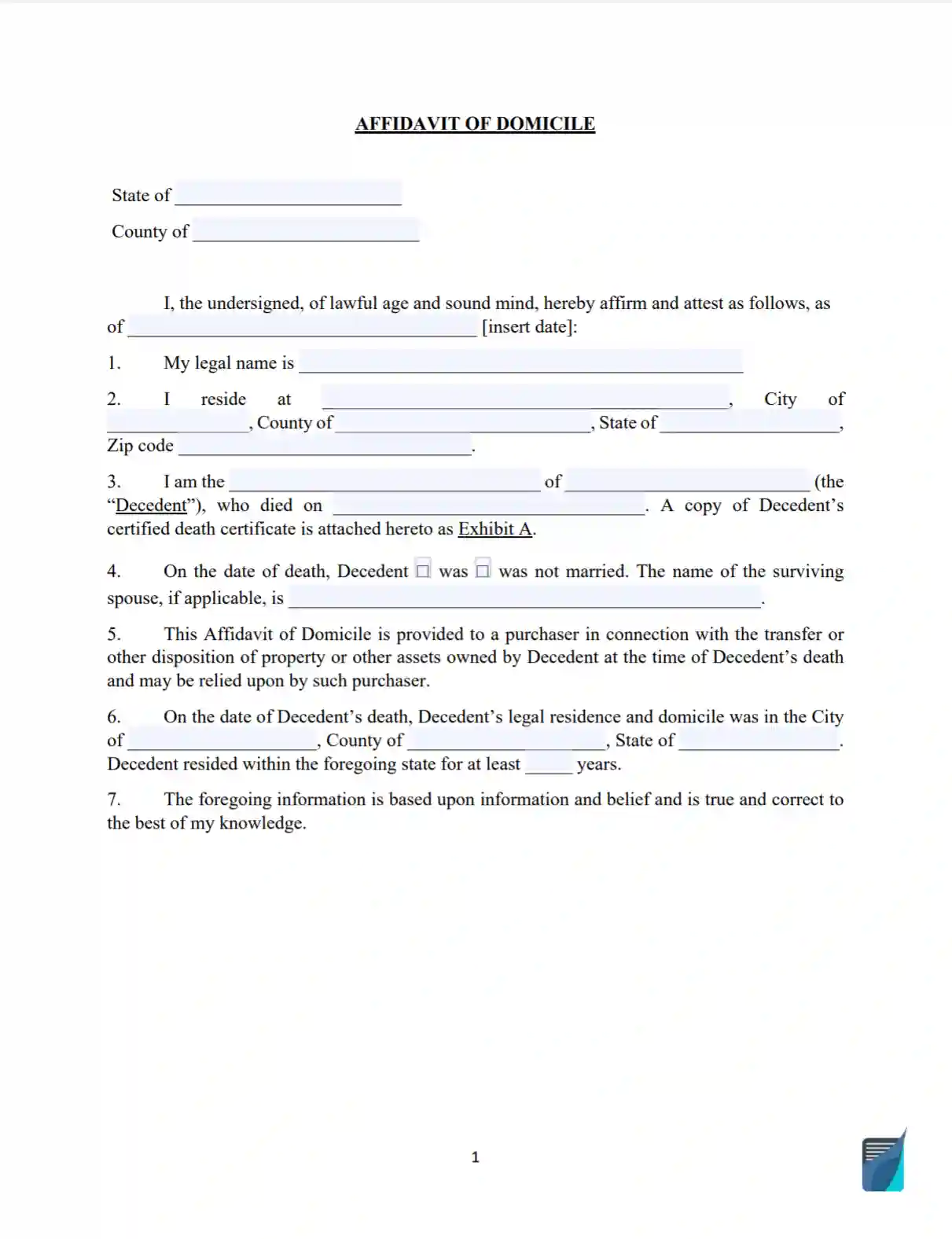

Step 2. Define the decedent

The next move is to indicate the deceased, including the name and date of death. Sometimes, the affidavit forms also require to state the decedent’s stocks and bonds details, such as business or company name, account number, registration, and instructions on how to transfer them.

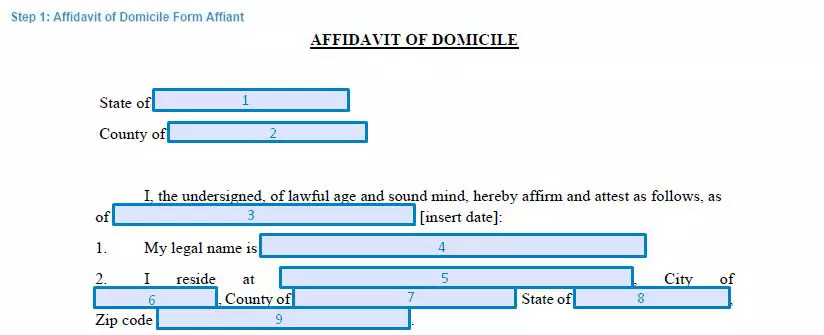

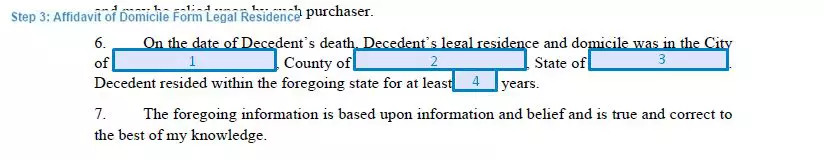

Step 3. Indicate the legal residence

The next important part is to state the facts proving the legal domicile of the decedent. These facts include the city, county, and state where the decedent resided at the time of death and for how many years. This section also contains the statement that the decedent was not a resident of another U.S. state. If the decedent died in Michigan but usually lived in Ohio, the latter will apply. In order to define the correct domicile, consider the address on the federal income tax return or where the decedent voted.

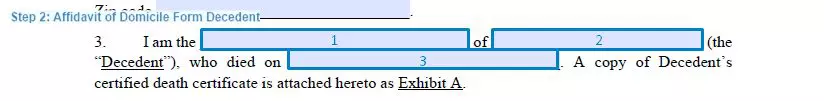

Step 4. Sign the affidavit

After creating the affidavit form, you are required to sign the document before a notary public. You must be sure that all the information provided in the affidavit is complete and accurate. Please also make sure that the document is free from grammatical mistakes. It’s never redundant to obtain help from your attorney.