Affidavit of Heirship

An affidavit of heirship is a legal document that helps identify the heirs of the intestate decedent, that is, the one who died without leaving a will. If the deceased person does not leave the last will, the assets will be divided among the family members through a probate court. However, the heirs can avoid these court expenses by completing the affidavit of heirship.

Affidavits of heirship will save time and money and help arrange the inherited real estate. If you want to avoid expensive probate proceedings, feel free to complete the affidavit using our template. The affidavit form must be signed in the presence of a notary public and then recorded with the county recorder’s office. Our guidelines below will provide you with more detailed information. You may also address your family attorney during the preparation process.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Here are some definitions that may be useful to know:

Affidavit – a document used to make a written statement, which is sworn under oath to be true.

Decedent – a deceased person.

Heir – a person legally entitled to inherit some assets from a decedent.

Intestate – refers to someone who dies without the last will.

Probate – a legal process in which the real estate is administered and divided among the legal heirs. This term also refers to a process of the last will validation.

When an Affidavit of Heirship Should Be Used

Nowadays, it’s common to make the last will to distribute the real estate after a person’s death. Still, a lot of people die without leaving this legal document. It happens due to different reasons, for example, sudden death or lack of resources to make a will. If the decedent has neither the last will nor legal heirs, all of the assets will go to the state. However, when the decedent has, for example, a spouse and children, the estate should be divided among them.

An affidavit of heirship is a good way to transfer the decedent’s interest in the real property to the beneficiaries. The affidavit could be used not only if the last will is lacking but also if the decedent’s will was not probated within four years of the death. No matter the case, an affidavit of heirship is a time and cost-effective way out of the estate division issue. It’s essential to use the affidavit correctly following the next requirements:

- The identity of heirs is confirmed. There should be official documents proving that an individual is related to the decedent (family book, marriage, or birth certificates). The heirs under intestacy are, as a general rule, surviving spouses, children, and blood relatives. The unrelated people cannot claim the decedent’s estate in this case.

- The property is well-described. The document should have a legal description of the real property, identifying all of the boundaries of a specific parcel of land. Generally, the affidavit of heirship forms are limited precisely to the real property distribution. However, some states, such as Texas or Tennessee, allow using the document to establish personal property ownership. Make sure to check the state and county requirements on the issue.

- The heirs operate collectively. All family members, including a surviving spouse, children, and siblings, should agree on the property division and its future use. You can file an affidavit of heirship only if every beneficiary has signed the document. If someone does not agree to any issue, the property administration will go to probate court.

- The affidavit is prepared by a disinterested affiant. The affiant, that is, the person preparing the affidavit, should not be the decedent family member and should not benefit from signing the document. But the affiant must know well the family history and be able to confirm the heirs’ identity.

- The affidavit is notarized. To avoid any malpractice, a notary public should acknowledge the affidavit of heirship. A notary analyzes the documents connected with the family history and confirms the information along with the affiant.

How to Prepare an Affidavit of Heirship

Losing a relative is a hard experience. You may want not to rush and wait a certain period after the death before preparing the affidavit of heirship. It’s okay, particularly since the state law contributes to this. Some states have a waiting period after a relative passing before the affidavit may be filed. When the time comes, it will help to follow the next steps when preparing your document.

Step 1. Collect all the necessary documents

First, you need to collect all the documents confirming that you are related to the deceased person, such as birth or marriage certificates. You may also need the death certificate with the date and place where the decedent died.

Step 2. Communicate with other heirs

If you are not the only heir left, you are expected to communicate with other related members and siblings and contribute to the affidavit together. The affidavit of heirship forms work only if each heir agrees on the terms and signs the documents. Otherwise, the property will be distributed by a probate court.

Step 3. Create the document

When every heir is identified and ready to cooperate, you can find someone who will prepare the affidavit of heirship. It should be an unrelated person who will not gain financially from signing the document. This person is expected to have first-hand knowledge about the decedent’s family history and be able to name the potential beneficiaries.

Step 4. File the affidavit with deed records

The affidavit must be notarized and then filed with the county’s deed records where the decedent’s property is located. After that, the law allows you to manage the estate as agreed. However, the heirship affidavit is presumed to be a fact only after being filed for five years.

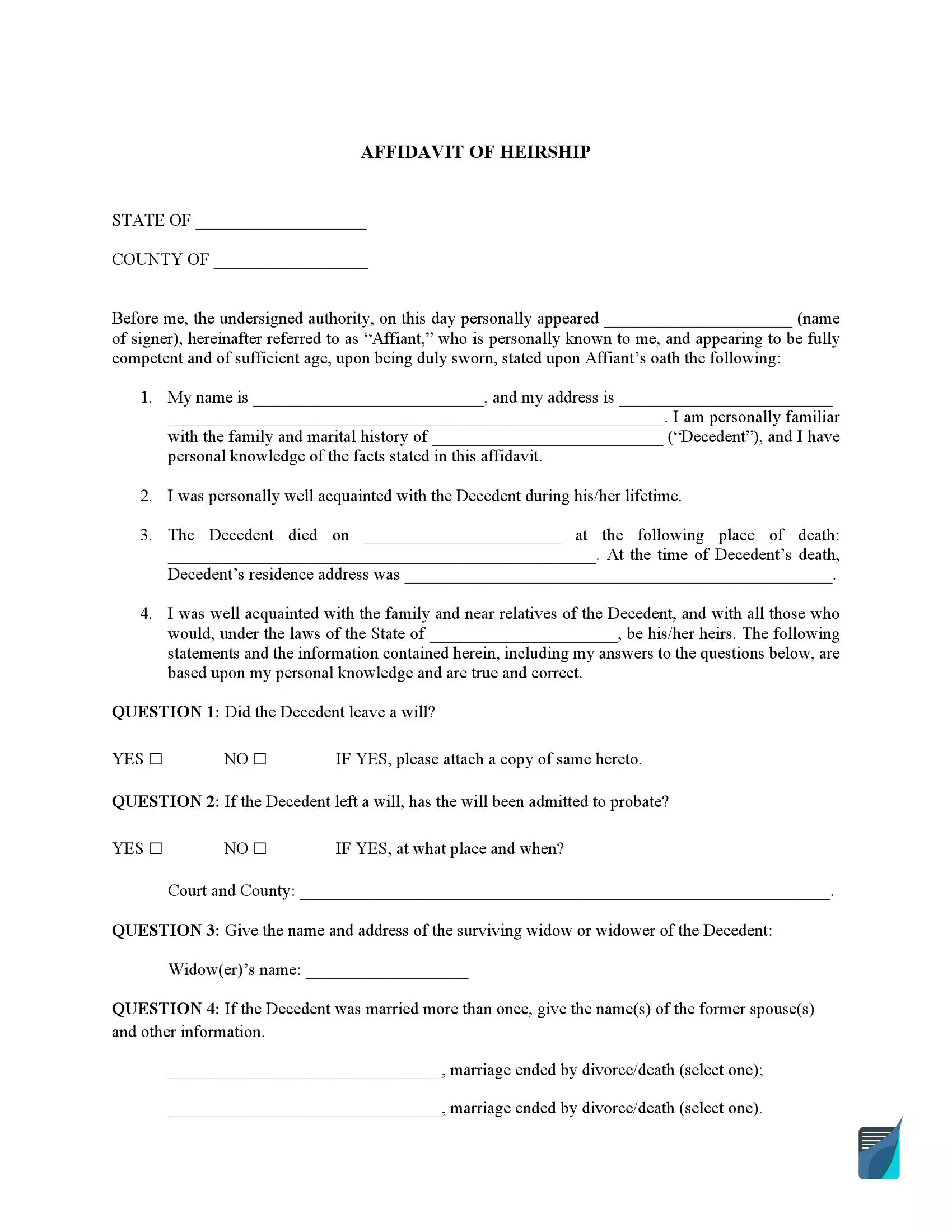

Filling Out the Affidavit of Heirship Form

To create a comprehensive document, you are expected to complete various sections and answer specific questions. It’s possible to address the attorney and obtain legal advice while working on the document. Nonetheless, our free template includes all the necessary questions, and you will have to only fill in the relevant information. Please follow the next steps.

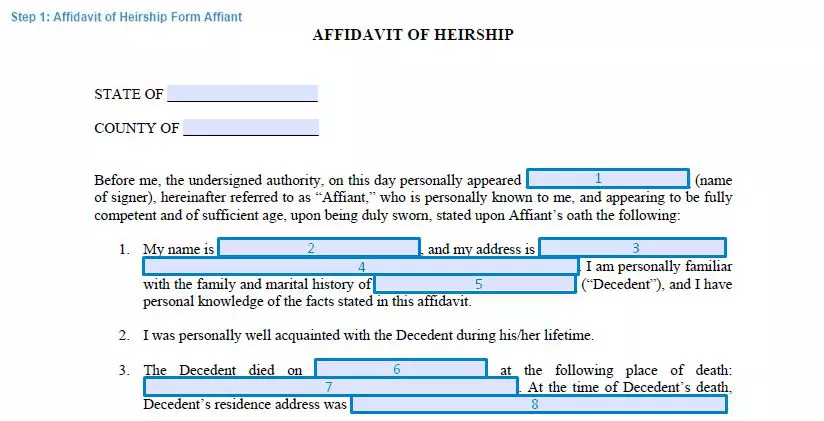

Step 1. Identify the affiant

As the affiant filing the affidavit of heirship, you need to provide the information about yourself, including your name and address, details on how you know the decedent, and for how long. These questions are aimed at confirming your competence to complete the document. Note that the affiant cannot be the family member or somehow related to the decedent.

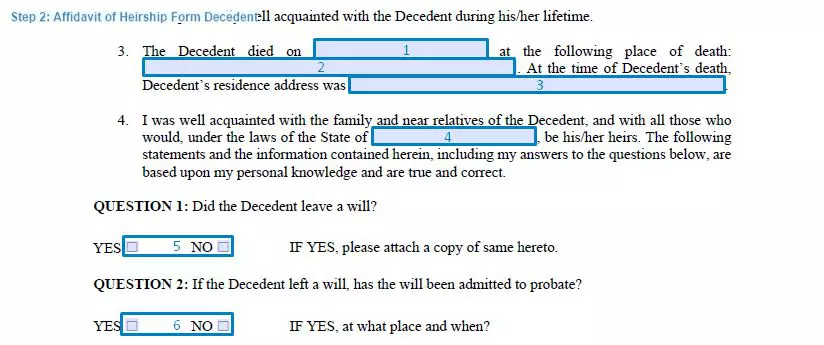

Step 2. Define the decedent

You are expected to answer the questions about the family history of the decedent, as well as the date of death and whether the deceased died with or without a will. You have to also provide information about the marital status, name the surviving spouse, and, if applicable, indicate the spouse’s date of death.

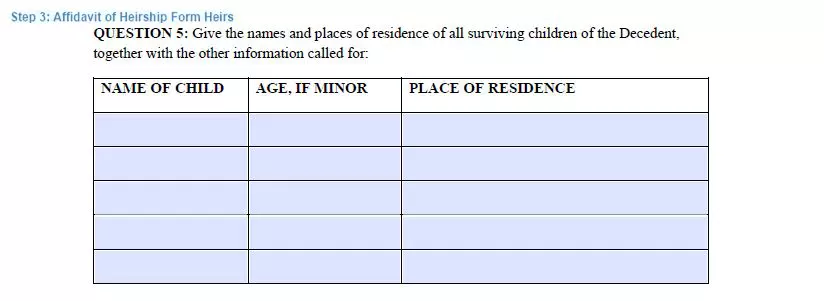

Step 3. Indicate the heirs

You must fill in the information about all the heirs, including their names and addresses. If one of them is minor or incapacitated, their parents or legal guardians should sign the document. In some states, a spouse of the decedent is not considered an heir since they are entitled to properties following marital and community property laws.

Step 4. Describe the property

This section describes information about the real and personal property left after the decedent. You have to provide a legal description specifying the county where the property is located and the boundaries of specific land. In the case of personal property, it’s necessary to list all the belongings. Also, you need to state whether the decedent has any debts. If the decedent isn’t transferring any assets, and the document is only necessary to establish the heirs, this section is omitted.

Step 5. Sign the affidavit

After completing the form, you must indicate the date, sign, and notarize it. Before filing the document in the county recorder’s office, please make sure that it’s free of any mistakes. It’s also necessary to check the state laws since some jurisdictions may require additional witnesses to sign the form. It’s possible to attach other documents to the affidavit. For example, a copy of the last will (if any) or the papers proving the guardian’s competence to sign the form (if there is a minor).