California affidavit of death of a joint tenant is a lawful document establishing the death of either a husband or wife and states that the surviving spouse as the new owner of the premises. It allows the signatory to inform various financial and business organizations, including insurance companies, of the recently deceased. The printable affidavit form must contain the description of the premises, be acknowledged by the surviving spouse, and certified by a notary public.

What Is a California Affidavit of Death of a Joint Tenant?

The focal purpose of any affidavit of death is the statement that the affiant declares the deceased’s death, knows about the matter personally, has the legal capacity to acknowledge it, and possesses the right to apply for a change of ownership. An affidavit of death of a joint tenant is created if the dwellers, often the couples, owned the premises in joint tenancy.

Joint tenancy ownership ensures two or more individuals share equal rights for the property and management, including the sale. Therefore, all authorized owners must provide their consent to handle the estate. In case the joint tenant dies, the rest individuals cannot manage the property in full unless an affidavit of death of a joint tenant is registered to influence the ownership changes legally.

A California affidavit of death of a joint tenant allows the surviving spouse or another authorized surviving joint tenant to inform the financial institutions, title organizations, and the assessor’s office of one of the joint tenant’s death and apply for the change of the title. Unless the affidavit of death is recorded, authorized individuals cannot sell and transfer the premises or manage any banking accounts.

Affidavit of Death of a Joint Tenant Components

Though one can find various templates of the respected form, the document must contain particular parameters mandatory for verification. Consider the list below and ensure that all aspects are included and in line with the requirement of the state of California:

- Affiant

As in most cases, the affiant appears to be the surviving spouse. They should provide the related info and identify themselves, indicating the affiant’s legal capacity to prepare the affidavit.

- Deceased

The document should include the decedent’s legal name as indicated both in the death certificate and the current deed for premises.

- Deceased’s date of death

These data must correlate with the info disclosed on the death certificate.

- Operating area

It indicates the state or region where the affidavit is prepared and signed. Often counties within one state offer diverging data. Thus, for example, Sacramento County does not provide Instrument Numbers metrics needed to define the premises. In this event, the preparer should enter all parameters available.

- Legal description and record info of the premises

Use the accurate description provided in the deed for premises. You are also empowered to photocopy the unit and attach it to the affidavit form. Ensure to specify that the description is included in the Exhibit.

- Acknowledgment by the affiant

The preparer must date and sign the affidavit proving all submitted info is authentic and correct. This condition ensures the affiant is aware of penalties for knowingly false statements.

- Notary public certification

Under California statutes, the affidavit should be obligatory signed in the presence of and verified by a notary public.

We offer our website visitors ready-to-use templates constructed by our specialists. Our PDF files comply with the state laws, which guarantees that you won’t miss any critical components. Any additional information can be found on the Superior Court of California website in the Simplified Probate Procedures section.

Steps to File the Affidavit of Death

Once you have completed the affidavit of death of a joint tenant and notarized the document, you should follow a particular algorithm to file and record the application.

- Generate and complete the referenced affidavit.

- Download and prepare a Preliminary Change of Ownership Report, often recognized as PCOR. Each California county advances specific requirements for the form. You need to consult the area assessor’s office to learn the details.

- Attach the PCOR, other necessary certified copies or originals, and apply for the Affidavit registration at the local Recorder’s Office where the premises is situated.

- If not exempt, fulfill the fee program and request the property reassessment tax exclusion (if applicable).

How to Fill Out California Death of a Joint Tenant Affidavit Form

Generate and print out the needed affidavit of death form via our advanced software. We offer high-resolution PDF file templates and advice on completing the selected documents. Follow the guidelines below to minimize the effort.

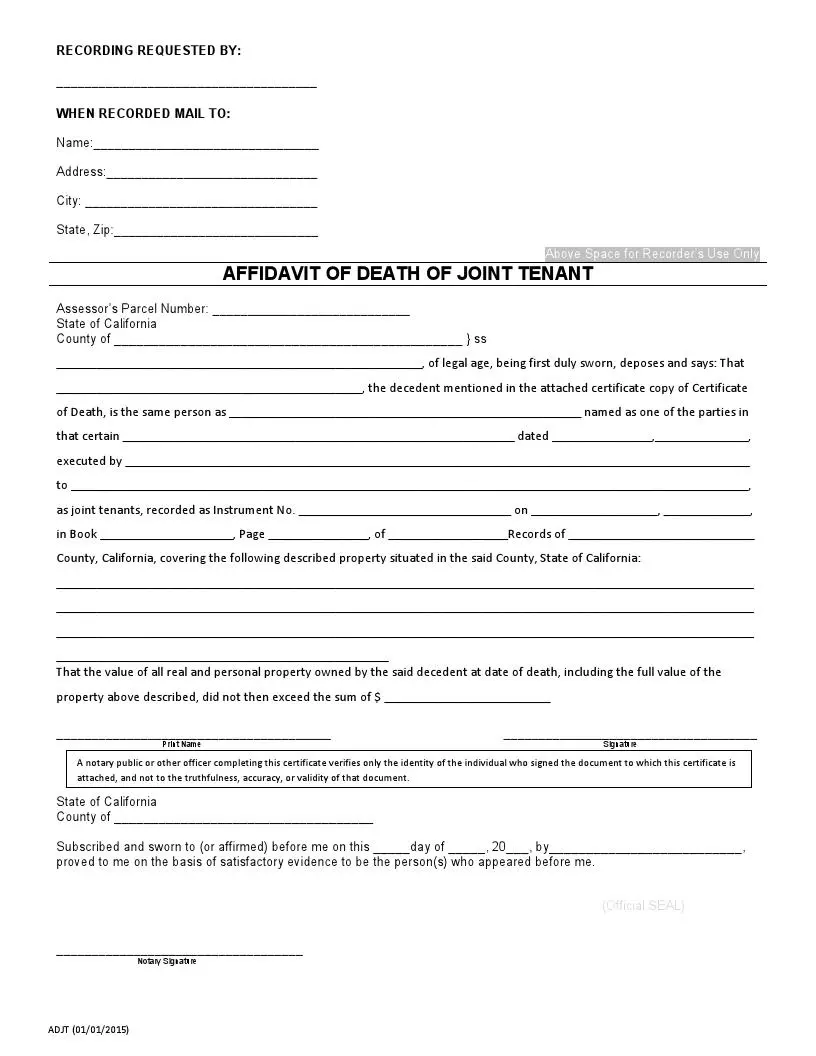

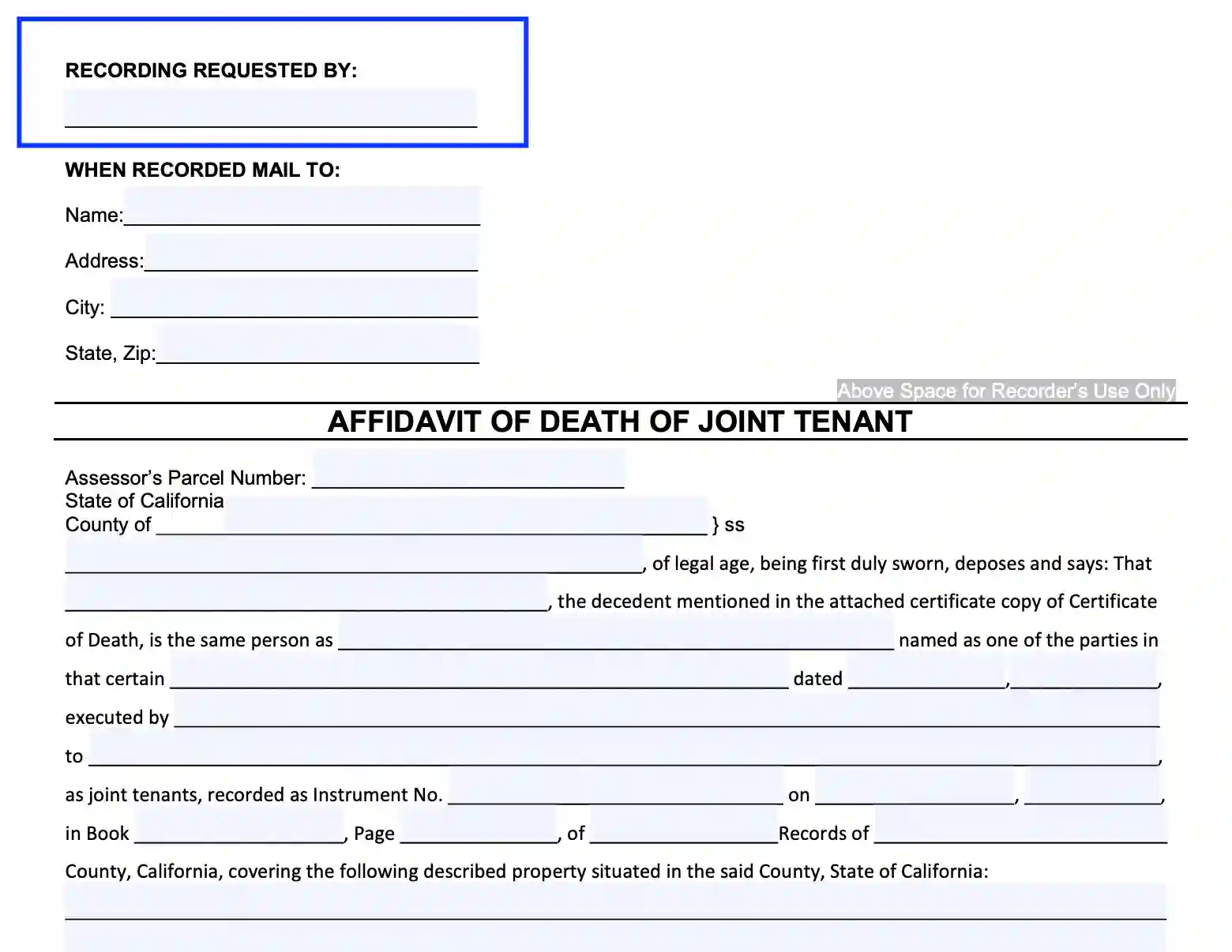

Identify the New Owner(s)

Enter the legal name of the individual who completes the affidavit request. After the application is accepted, the indicated person becomes the new owner of the premises.

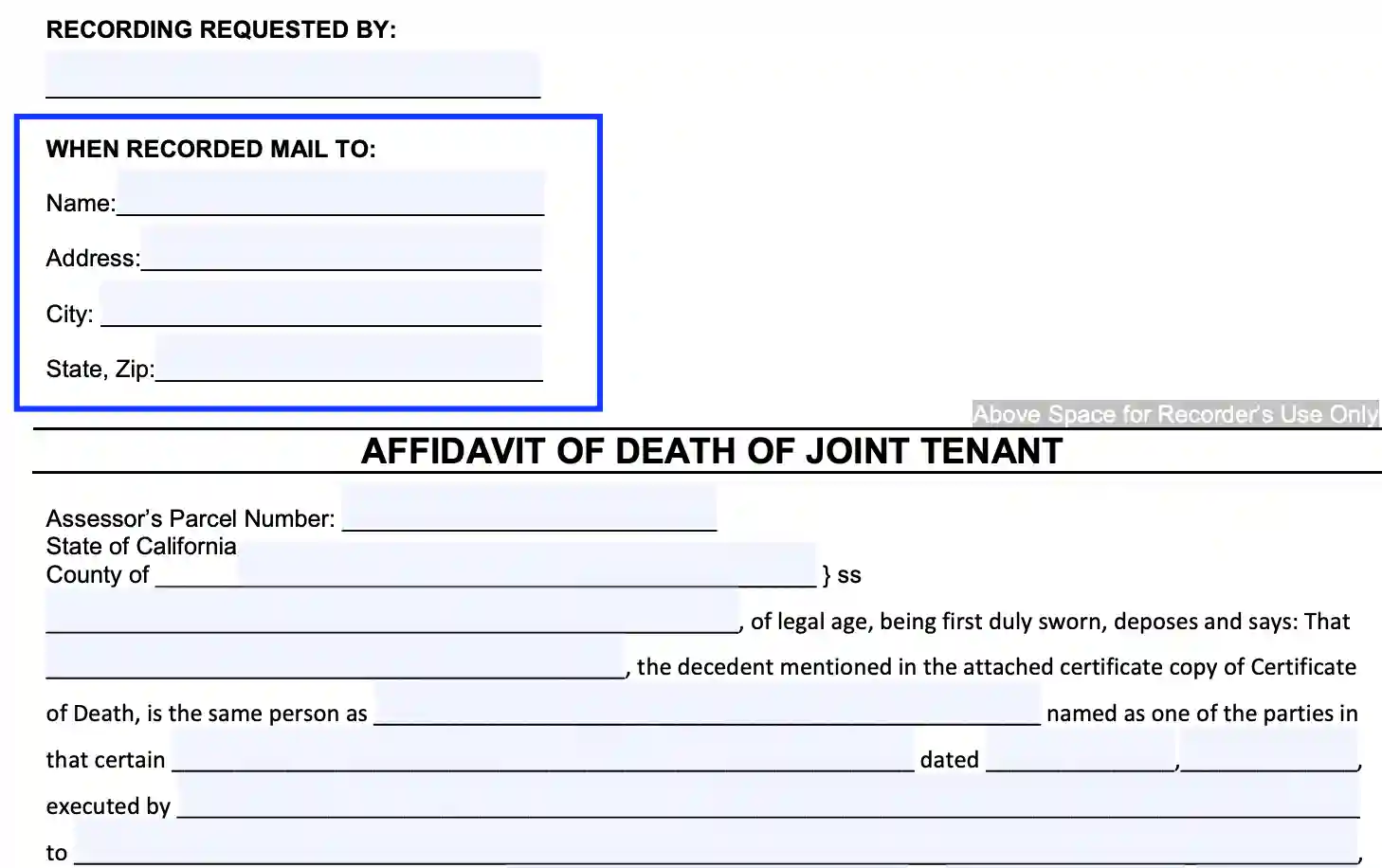

Determine the Return Address

Submit the receiver’s data where the certified copy of the affidavit should be sent. This individual also becomes liable to receive and fulfill tax returns. Enter the following info:

- Person’s legal name

- The physical address, including the apartment (unit) number, street, city, state, and ZIP details

Skip the “Recorder’s Use Only” Section

The applicants do not complete this part of the document. The unit defines if the claimant is fee-exempt for submitting the form.

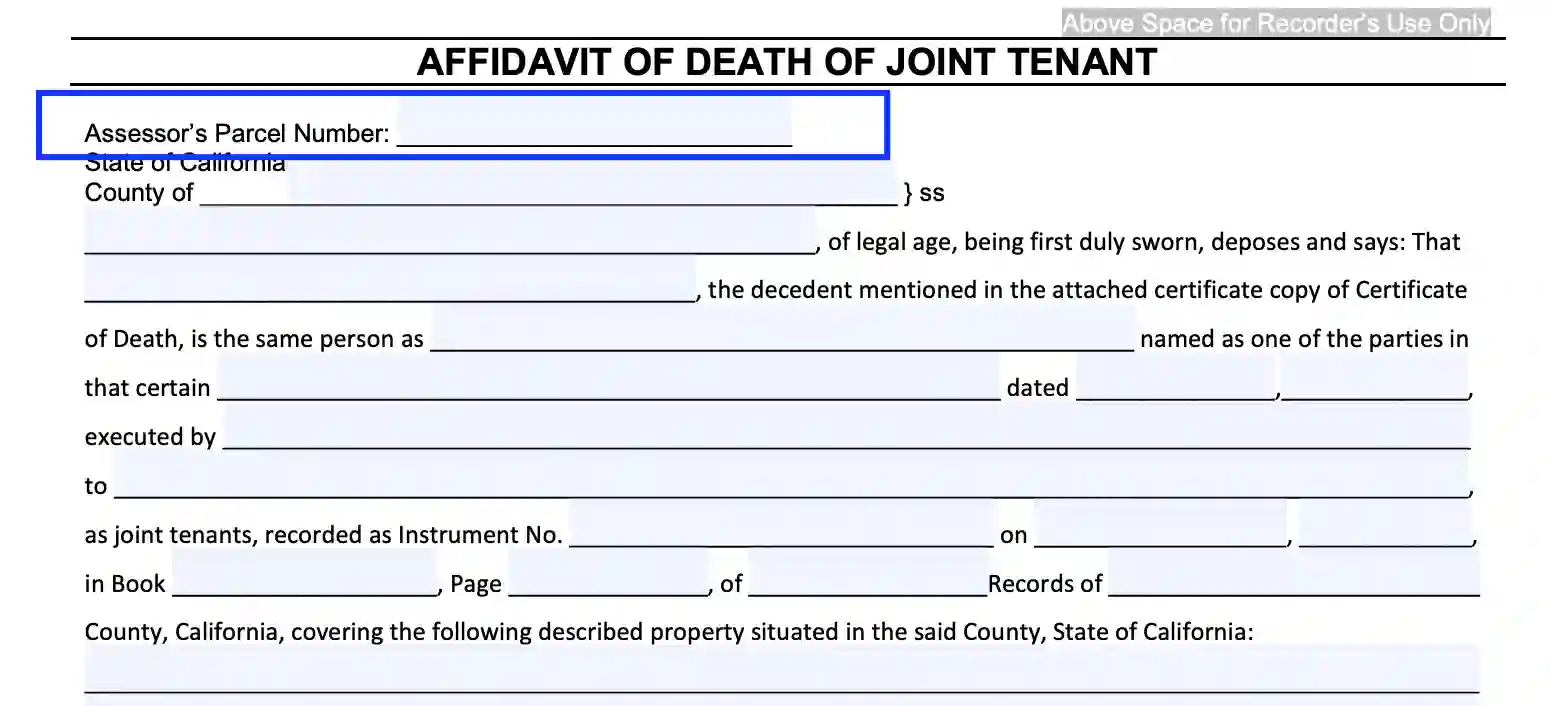

Submit the APN

Here, you need to enter the assessor’s parcel number indicated on the tax statements or the current agreement.

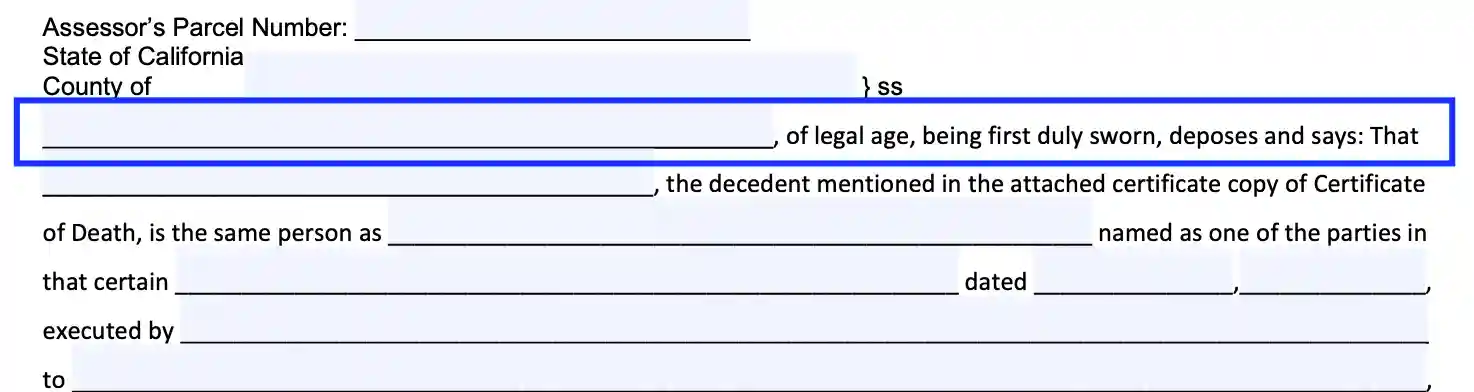

Define the Signatory

Enter the name of the individual who is preparing the affidavit of death.

Enter the Decedent’s Data

Use the line to enter the deceased’s name as indicated on the death certificate.

Identify the Decedent Tenant

Fill in the decedent’s name as written in the agreement.

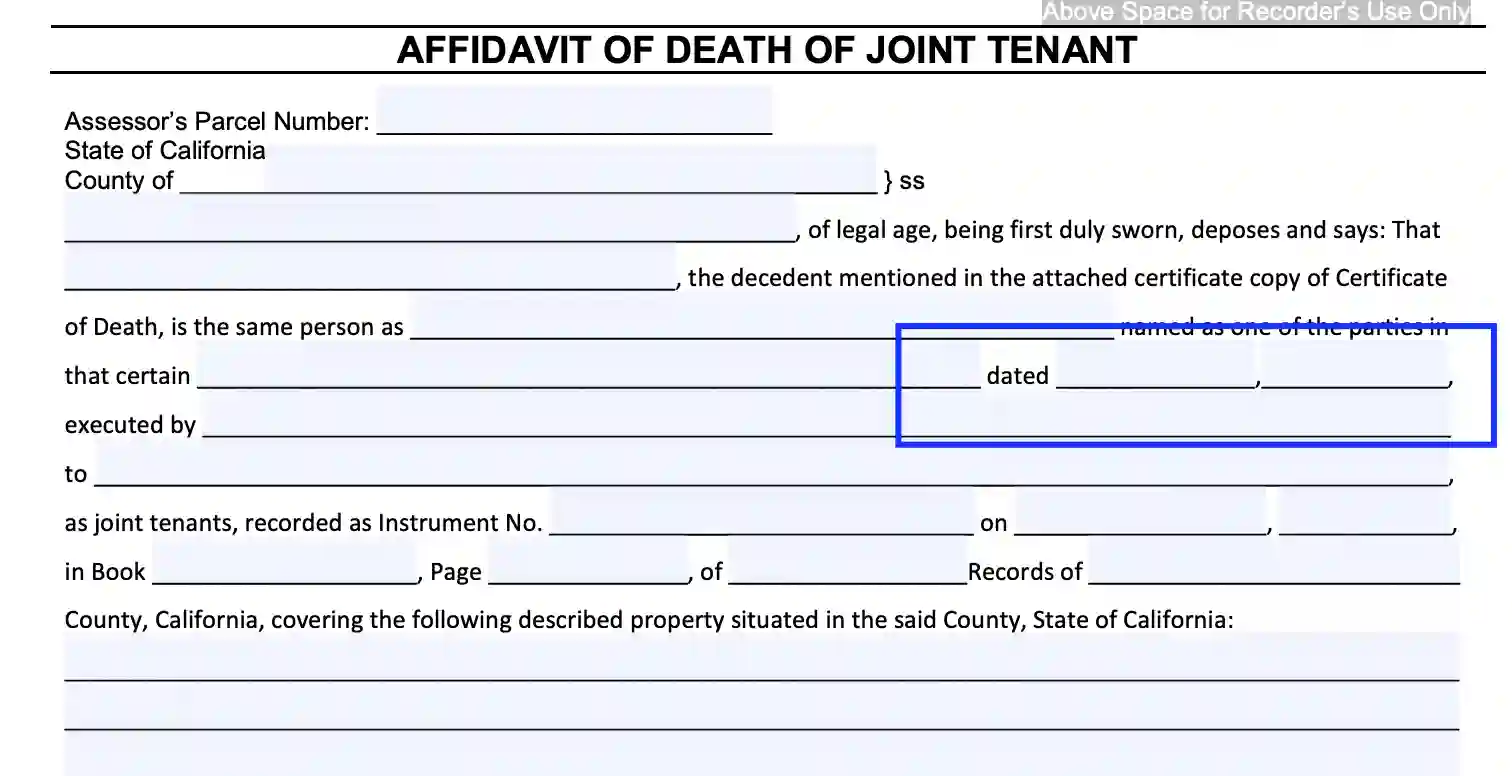

Specify the Date

Submit the calendar date when the agreement for the premises was acknowledged.

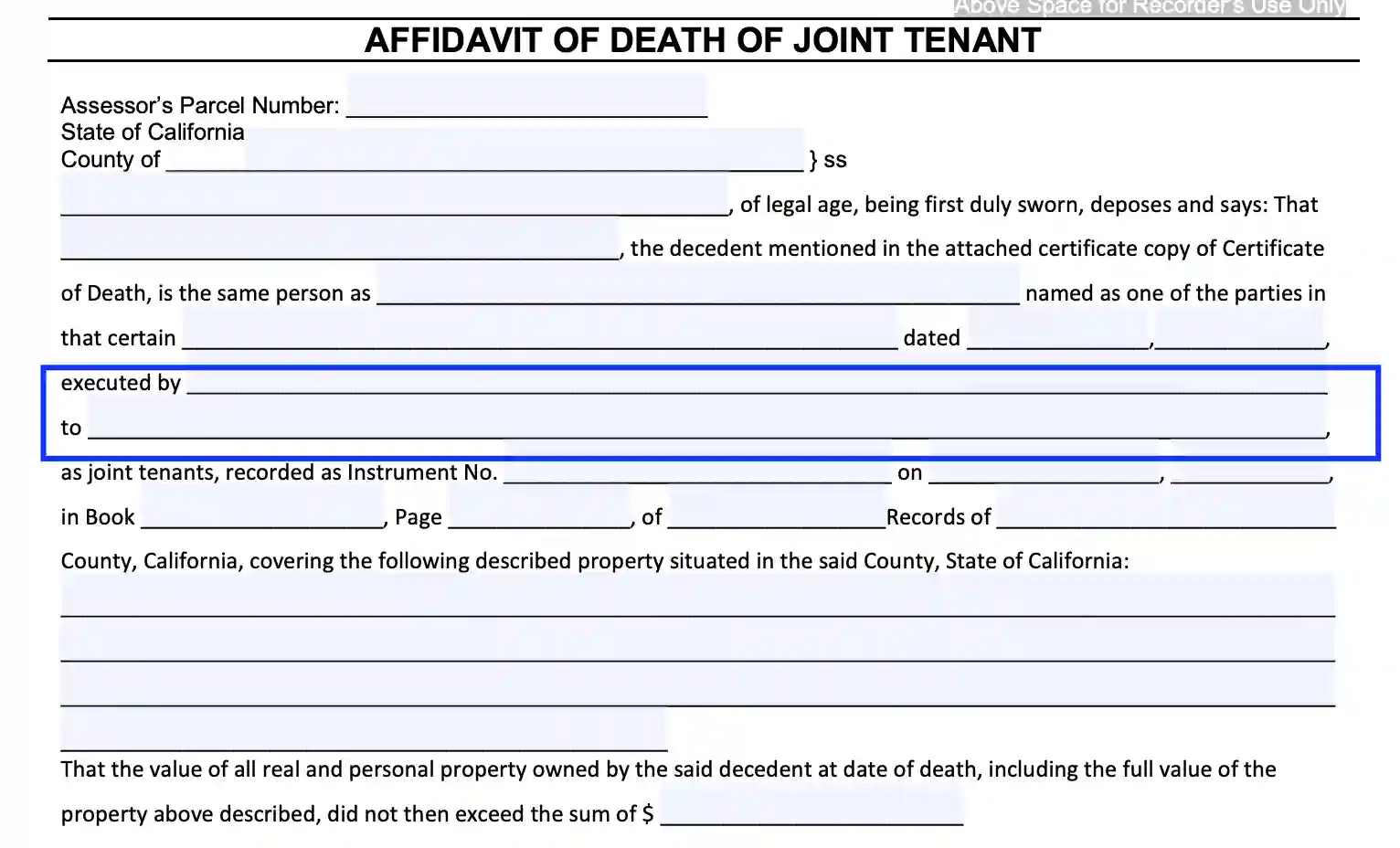

Identify the Deed Parties

First, enter the grantor’s legal name. Use the subsequent line to disclose the grantees’ info, identified as the “tenents.”

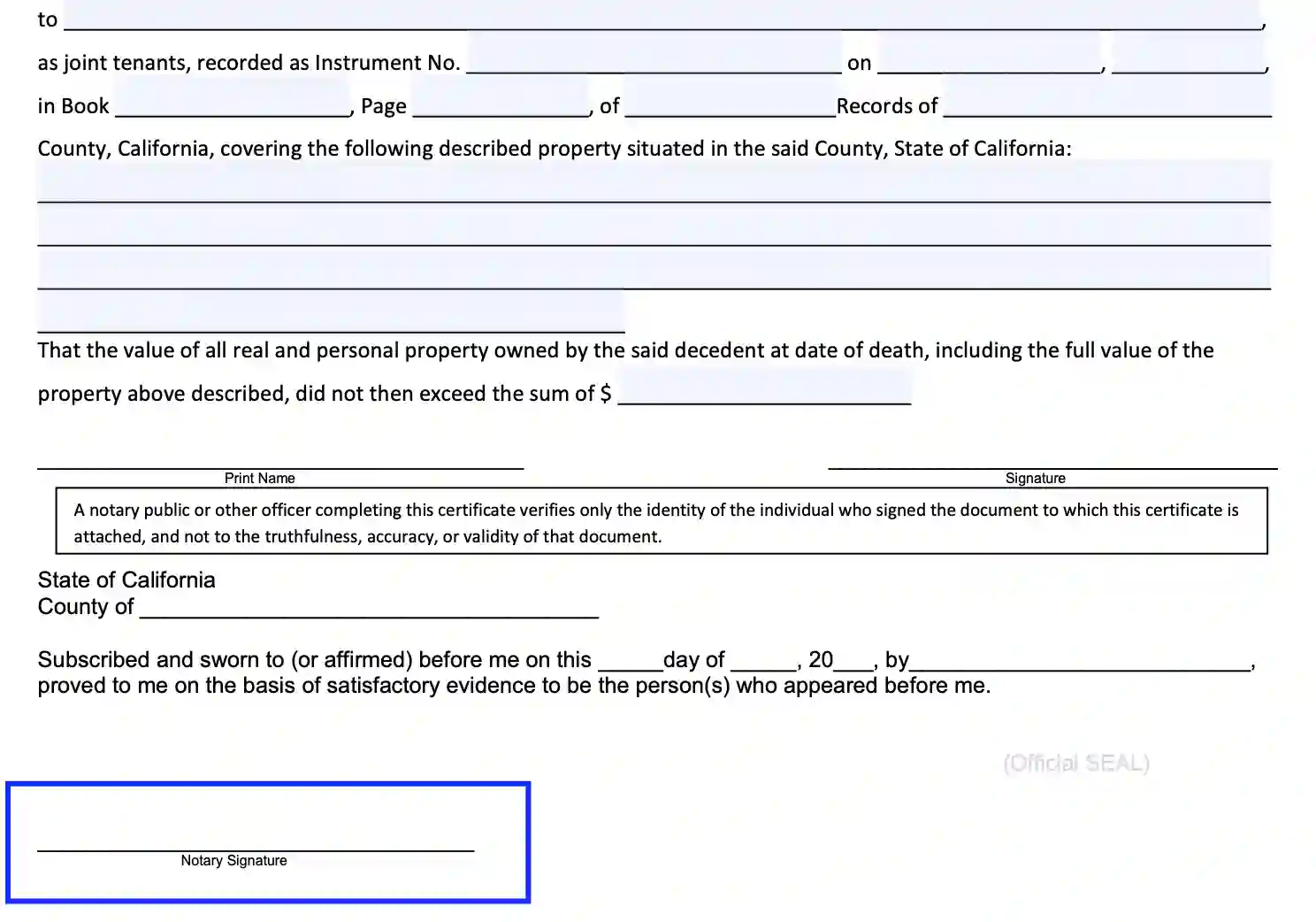

Disclose the Registration Data

Specify the official records regarding the premises. Submit the below-listed parameters:

- Date the agreement was recorded

- Instrument number

- Book

- Page

- County

If the residence region does not provide the required info, the signatory is empowered to enter only the data present in the deed for premises.

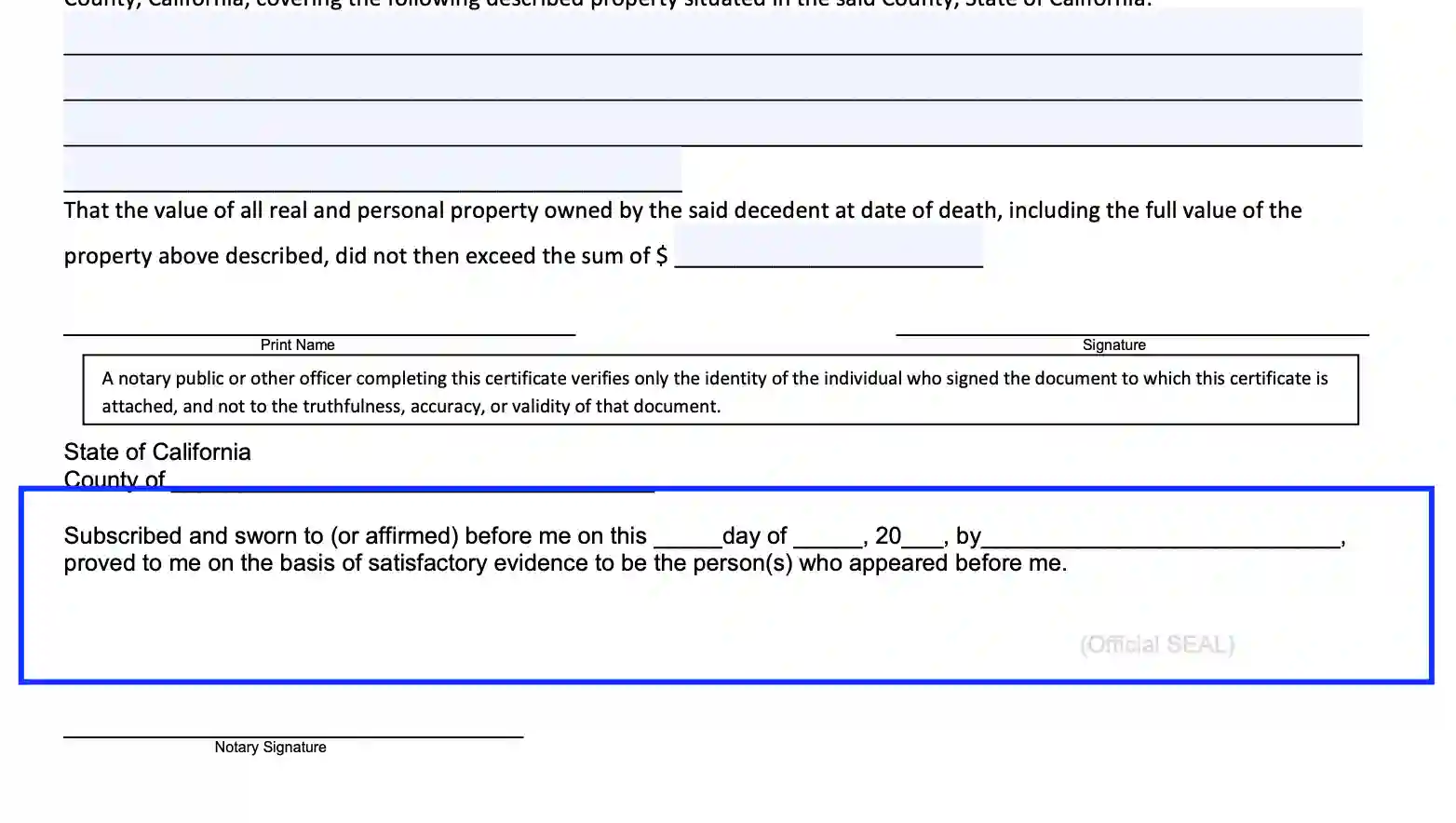

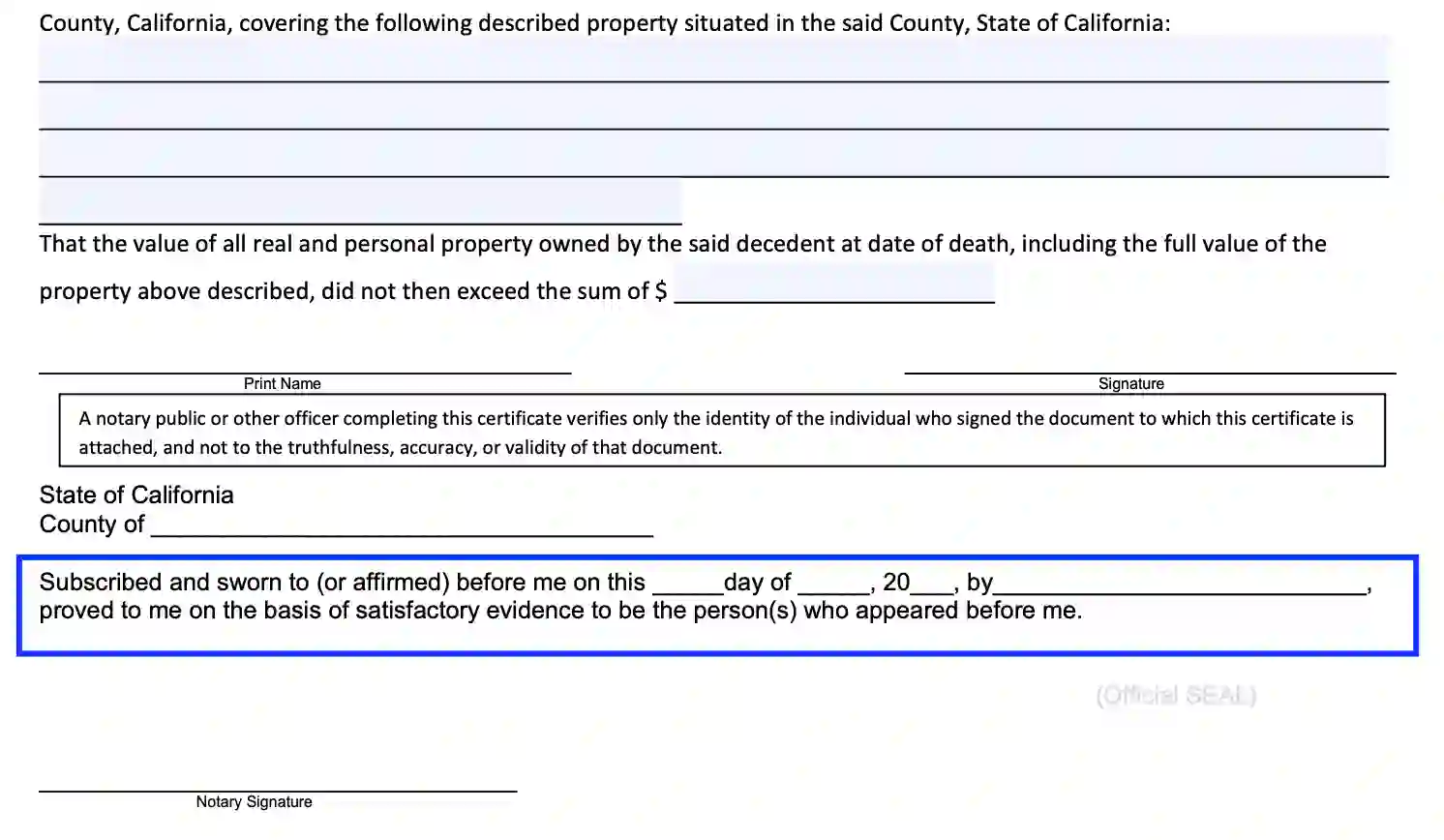

Describe the Premises

Provide the legal description precisely as entered on the deed. You are empowered to make a copy of the description and attach it to the referenced affidavit. In this case, the signatory should enter “Consider the Exhibit A” in this unit.

Acknowledge the Affidavit

The applicant should enter the current date, signature, and legal name (typed or printed). Make sure you, as the declarant, provide the signature in the presence of a notary public.

Notarize the Affidavit

Certify the authenticity of the affidavit by collecting the notary’s signature, date, state seal, and other inherent elements.