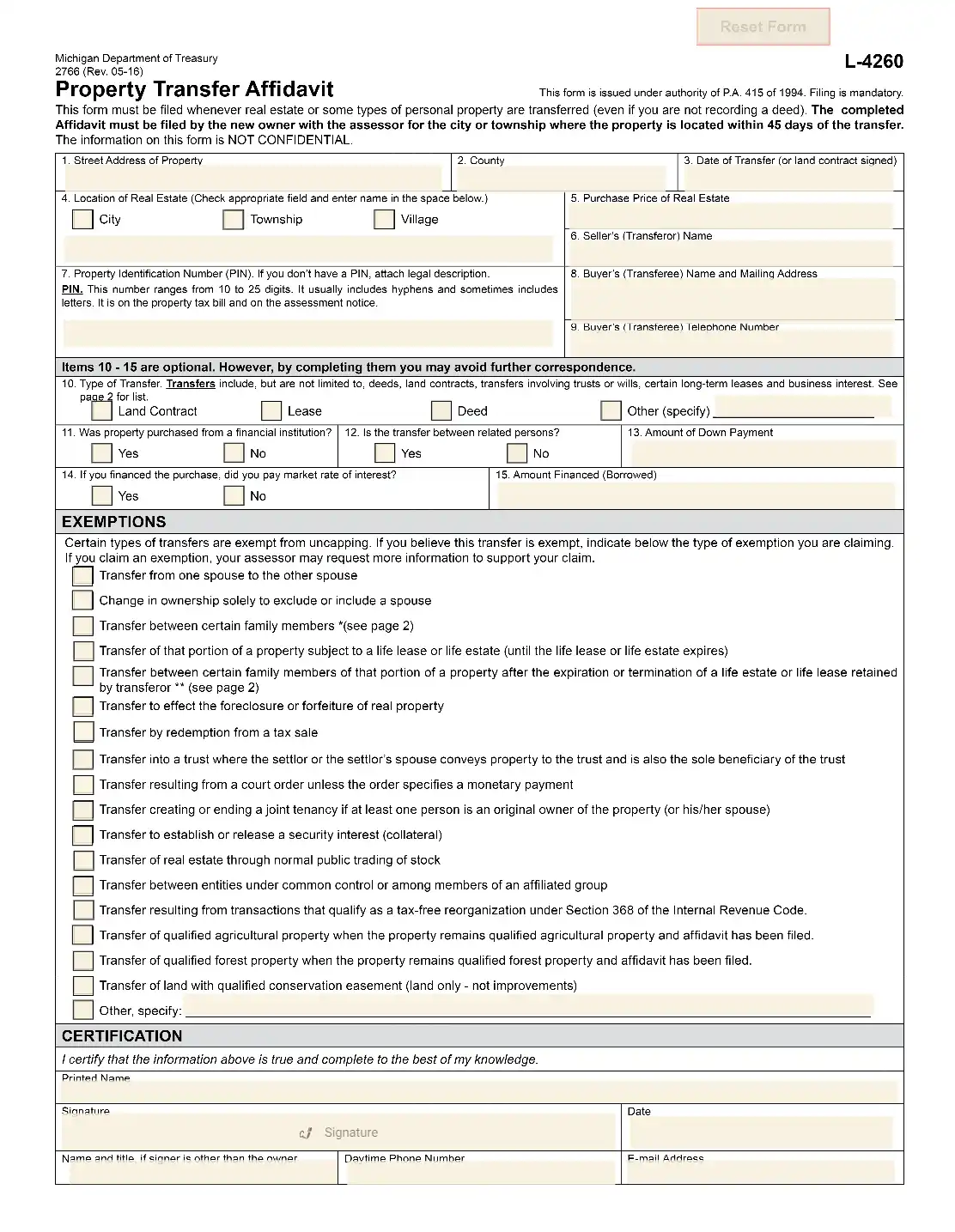

If you have real property in Michigan or anywhere in the United States and decide to sell or pass it to another individual, such a deal should be accompanied by several legal documents. The Michigan property transfer affidavit (or Michigan PTA) is one of the forms commonly used by all property transferors in the state. Without it, you cannot legally complete the property transfer procedure.

In this review, we will outline the essential details you should know about the form. We will also tell you about the local laws that regulate the document compilation and estate transfer deals in Michigan and provide you with helpful instructions explaining how to complete the Michigan PTA template properly.

What Is the Michigan Property Transfer Affidavit?

It is a one-page document created by the deal parties where they outline some info about the deal. In Michigan, it is mandatory to prepare such a record for every single real property transfer that occurs. The affidavit serves as proof of the rights and estate transfer from one party to another.

In each such form, one may discover:

- The parties’ full legal names

- The real property’s full address

- The property’s price in US dollars

- The type of transfer

- The property ID number

- The purchaser’s (of transferee’s) contact info

- The transferee’s signature

- The date of the form’s signing

And other vital details that are required by the local norms and rules.

It is worth mentioning that the Michigan property transfer affidavit is a compulsory record that has to be prepared any time an estate transfer occurs in the state, and this transfer also involves the ownership change. So, if the property is given to someone else and a former owner declines any rights to use it, remember that the parties must make their own affidavit and register it.

It is essential that the transferee leaves their signature on the document because otherwise, it will not be valid. Also, if you wish, you may ask a notary to verify the form and sign it; however, you are not obliged to do so by law when preparing such an affidavit in the state of Michigan.

You can also see other names of the Michigan PTA: others can call it a “property change of ownership form,” or form I-4260, or form 2766. It occurs because the official template has changed its name over time. So “I-4260” and “2766” in Michigan are essentially the same thing.

If you need to create the Michigan PTA, you must know that your form should be performed in compliance with the local and federal laws. To find out what chapter and section of Michigan Compiled Laws you have to check, proceed to our review’s following part.

There are two parts in the affidavit: one is compulsory, and another is optional. In the first part, you will give the basics about your deal; without the required data, it is not possible to register your form. The second part can be omitted; however, it is strongly recommended to fill it out because the assessing officer in Michigan may have various questions that can vanish if the section is complete with data.

Applicable Laws

The property transfer form is regulated by the Michigan Compiled Laws. People who are interested in the regulation and legal peculiarities may check Chapter 211 (Sections 211.27, 211.764, and 211.8 specifically). There, you can check all the requirements that the form, the transferor, and the transferee should meet and find out about all the fines one may get for not obeying the laws.

For instance, if the transferee fails to submit their record to the assessor who should register it, the fine can go up to $200 USD. For each day of delay, the transferee will most likely get a fine of five dollars. Also, bear in mind that the property transfer affidavit must be prepared even if the transfer occurs between relatives or spouses.

The rule, however, concerns the property that is not used for commercial purposes but for living. For those who operate commercial estate, rules may vary. Do not forget to check the relevant laws and regulations before you decide to sign any Michigan PTA (regardless of whether it is for commercial estate or an apartment where you plan to live).

Section 211.27a of the Michigan Compiled Laws obliges each transferee to register their form in a certain term: you should turn to the local assessor within 45 days from the date when your deal was completed. In this case, “local assessor” means that the assessor is located in the same area as the property in question.

Even if there are penalties and fines assigned to someone for not signing and submitting the Michigan property change of ownership form, none of such penalties will ever be a lien on the estate.

As it is written in the ownership transfer guidelines offered by the Michigan public authorities, you cannot submit any other document in place of the Michigan property transfer affidavit. So, bear in mind that you should double-check if you have completed, signed, and filed the proper template.

Lastly, in most cases, the affidavit should be filed by the one who receives the property, not the one who passes it.

How to Fill Out the Template

Sometimes the creation of legal forms in the United States might be a little tricky, and people seek help and advice on filling out various templates. We have developed thorough guidance that goes through every form’s point step by step. You can use it to speed up the form completion process.

However, we should warn you that if you have any questions or concerns regarding the record, do not hesitate to ask for assistance from professional lawyers or other specialists who regularly deal with legal forms. You must not insert anything in the form or file it if you have doubts about the template’s content.

The form consists of two sheets, and you should fill out only one of them because another is for official instructions. If you feel that everything is quite clear and you are ready to create your record, remember that you are welcome to try our user-friendly form-building software.

It allows you to generate many legal forms, including the Michigan property transfer affidavit, in a blink of an eye. So, obtain your template, and let’s get started. The official form is also available on the Michigan State Tax Commission website. However, it might take a while to find the necessary template.

Read the Warning

The first thing you can read on the page is a warning to all people who plan to fill out this form. Go through the sentences attentively. These sentences remind you that anytime you pass your property to someone else in Michigan, this document has to be created. Even if you do not plan to record a deed, you still need this affidavit to conclude the deal.

Another requirement is that you have to pass this document to the local assessor no later than 45 days from the deal day. Lastly, the notice warns you that any info you add to this template is not confidential.

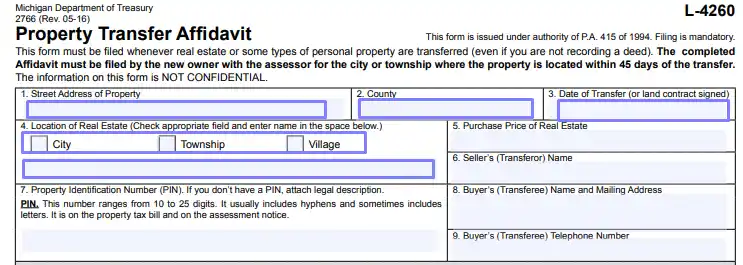

Proceed to the Filling Out Process

You have to start by stating the transferred property’s address. Enter the street address and county in the first and second line, respectively. Indicate the deal date (either the date when the contract for the land was signed or the transfer date). Then, define the property’s location (whether it is a city, village, or township) by marking the relevant box and insert the location’s name below.

Add Details about the Property and Parties

You should incorporate some basic info on the passed property and both deal parties in the form. It includes the property’s purchase price, the transferor and transferee’s names, the transferee’s valid phone number and email address, and the property identification number (or PIN).

Some properties do not have that number. In this case, you can use a legal description instead.

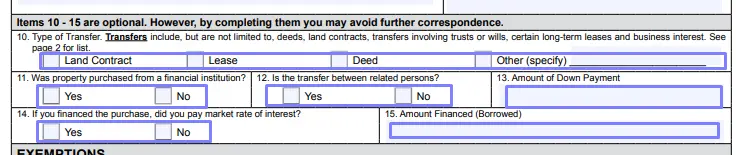

Complete Optional Sections (If Needed)

The form’s second part is optional: precisely, lines from 10 to 15 are not mandatory, and you can skip them if you like. Although some people prefer not to spend time on completing lines that they are allowed to omit, we strongly recommend you to spend a couple of minutes and go through each line. It may make your life much easier in the future because the one who will register your document may have questions; they will be able to find the answers in this section without contacting you.

On line 10, you shall determine the transfer type. The form offers the following options here:

- Deed

- Lease

- Land contract

- Other

Choose one of them that suits your case and mark it with a tick or cross. If you select “other,” enter the type in the line nearby.

After that, answer if the estate in question was bought from any financial institution (line 11). Reply to the question about the parties in line 12 (if the parties are relatives or not). If there was a down payment during the deal, enter its sum in line 13. In the following line, respond about the interest rate. Lastly, define the amount financed (borrowed) in line 15.

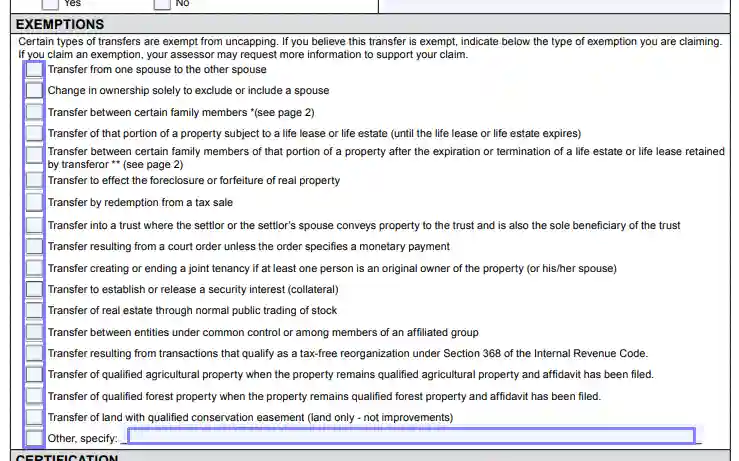

Check the “Exemptions” Section

In Michigan, some transfer types can be exempt from uncapping; there is a large table showing various conditions that allow you to consider your deal an exemption.

Among such exemptions are, for example, transfers between one spouse and another, transfers into a trust on certain conditions, transfer of qualified forest or agricultural property on specific terms, and so on. In total, there are 18 conditions, and you should check all of them carefully. If any of them applies to your situation, check the box that fits with a tick or cross.

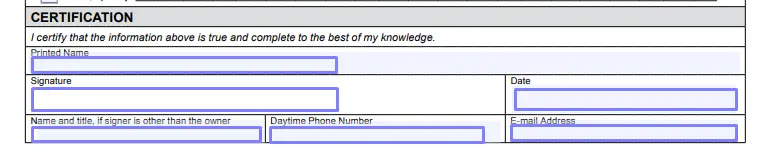

Sign the Document

The first page’s last section requires you to sign the form and leave some additional data about you.

Write your full legal name, the date of signing, your email address, and phone number. If the property’s owner and the document’s signer are different people, you have to leave the signer’s full name in the relevant field. Lastly, place your signature on the designated line.

Read the Official Instructions

As you already know, there are two pages in the Michigan PTA form. The template’s first page is to fill out. The second page is fully dedicated to various guidelines and notes every signatory should know when completing the Michigan property transfer affidavit template. Also, you can see a set of phrases from the current laws that are enforceable in the state of Michigan. Check all of the written notes carefully and ensure that your form’s content fits the requirements.

Filing the Michigan PTA

As you already know, state law prescribes that you should submit your signed affidavit to the local assessor. The assessor will register your affidavit and make your deal legitimate. Please keep in mind that you have 45 days from the day when the form is signed. If you fail to file your record within this term, a fine will follow.

The complete list of available assessing officers in Michigan may be found on the Michigan Department of Treasury official webpage. You will also find other contact details there and learn to whom you should apply if you have questions and doubts regarding the form and the estate transfer deal in Michigan in general.

In some cases, the assessor may request additional documentation related to your Michigan PTA. So, be ready to provide all the needed records to the authorities.